Yetta, are you anxious about the current market? This was a serious question asked by someone at a dinner, and I was initially taken aback, not understanding why they thought we should be anxious. "Because many people think Meme is rampant and VC coins are going to die haha."

The biggest discussion at this DevCon was indeed about Meme, and industry peers joked that talking about it would distract from pumping Meme. Some also asked if we had included Meme in our asset allocation.

To be honest, we are not very anxious, or rather, we had already anticipated this situation at the beginning of the year. Primitive is a self-sustaining fund without external capital, which allows us to take a longer-term view of the industry. We also don't have the pressure of capital deployment, so we don't need to explain to LPs who don't understand our industry why we invest in any track (which is often a huge pressure).

In the Crypto market, which is becoming more polarized between the primary and secondary markets, the definition of VC is actually closer to its essence: Bet on Things with Venture Return. Following any ideology or participating in any political struggle is meaningless, the key is to learn from the market.

First, let me talk about our understanding of the structural changes in the industry

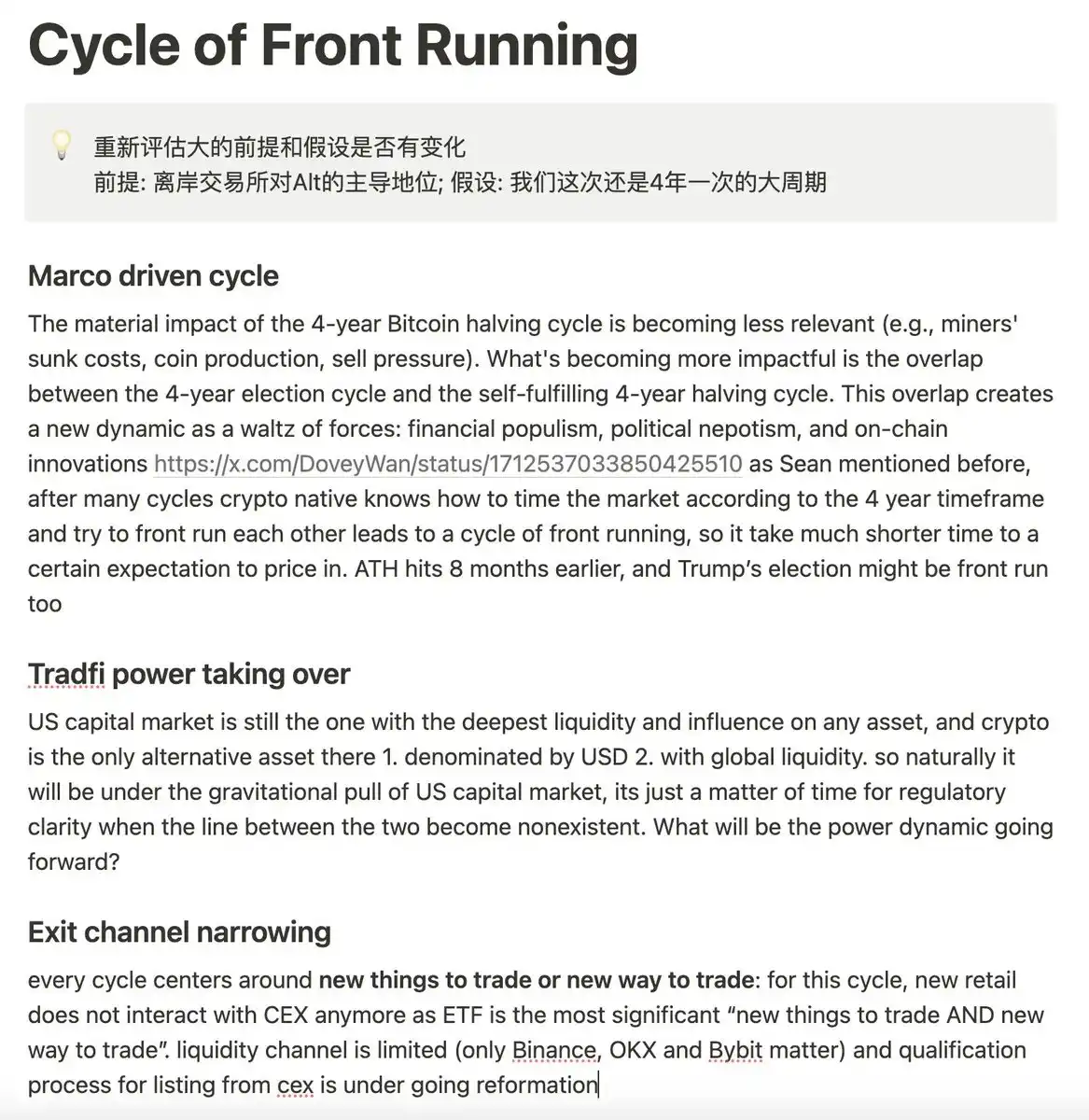

At the beginning of this year, we conducted a comprehensive review of the industry's structural changes and wrote an internal report called "Cycle of Front Running". TLDR: The polarization in our industry is becoming more and more serious.

On the one hand, the industry has grown in scale, and TradFi has integrated a large amount of Crypto assets into Wall Street through compliant means such as ETFs, and this part of liquidity has been snatched away and is difficult to be converted back into our on-site capital;

On the other hand, the strong expansion of populist capitalism, the further compression of the attention economy, and the increasingly simple and brutal financialization process have made the most Crypto Native way to directly pump Meme, which is an area that TradFi cannot reach.

Against this macroeconomic and social background, the liquidity in the market is constantly shrinking. In the past, we said that the Barbell Strategy was hoping for integration at both ends, but the opposite has happened, and our polarization has become more and more intense. As a result, the middle ground in our industry is becoming increasingly difficult.

Who are these middle ground players? They include all the institutions that have emerged from the wild era. Offshore CEXs, Trading Firms, Crypto financial service providers, and VCs - none of them can avoid it.

This structural change will make Offshore CEXs anxious, as CME's Future OI has already surpassed Binance. If mainstream coins are traded more and more on compliant trading venues due to TradFi's entry, and Meme can also pump out projects over $1B on-chain, is Binance's space being squeezed?

In addition to Offshore CEXs, those Market Makers who have risen with Crypto are seeing Wall Street's high-frequency quantitative teams bringing their own Infra and capital, so how can they break through? Accompanying their decline, the presence of the third-party financial institutions that served them is also becoming increasingly weak, not to mention the VCs who cannot actively trade.

This polarization and liquidity squeeze is the fundamental change in our industry. Whoever finds the breakthrough point will be the winner.

Next, what exactly is the problem with VC Tokens?

I fully understand the market's emotions towards VC Tokens. Projects with extremely high FDV at launch, followed by constant unlocking and dumping to realize profits - since it's all just a casino, why not go to a relatively fairer casino and play Meme PVP, where you can only blame your own slow hands if you lose, rather than helping dozens of billions of dollars of VC coins to find the bottom.

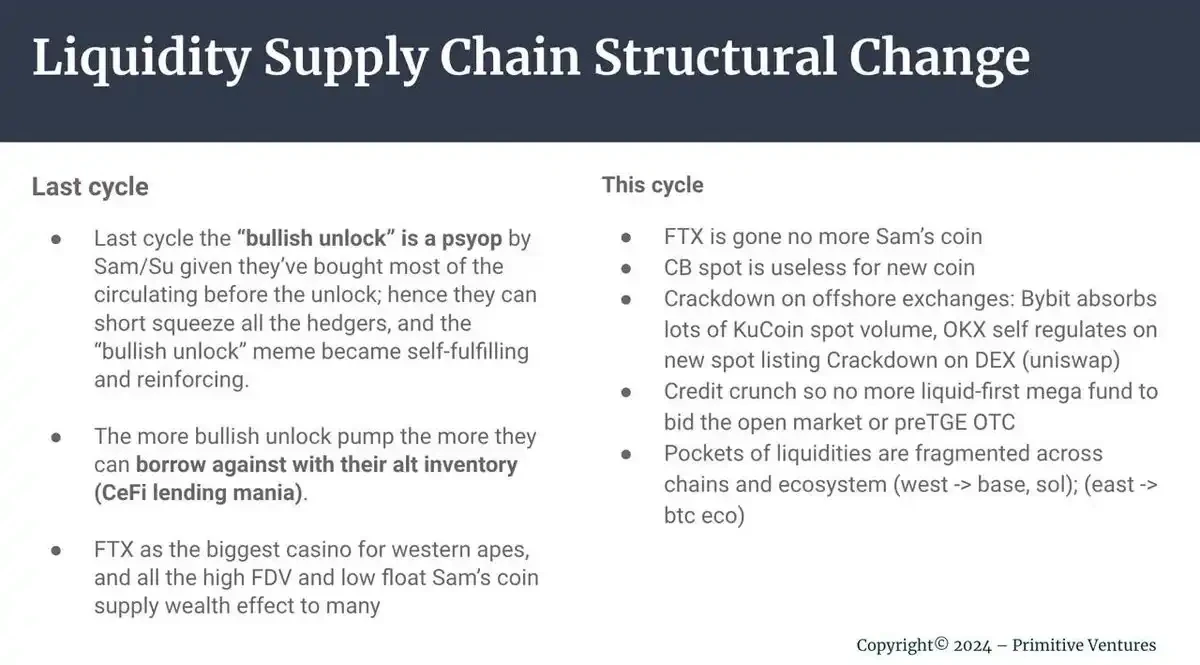

What is the essence of this problem? It is that there is a problem with the Liquidity Supply Chain in our industry.

Why can Solana keep hitting ATHs? Because they have real product implementation, and the product allows SOL holders to make money, so the user Community has transformed into a Trading Community, and the positive flywheel between the two has become a self-fulfilling prophecy, which is the key to forming Buy Pressure.

The DeFi of the last Cycle was also like this. The products had some micro-innovations and were fun to play with, the DEXs created liquidity and continuous price discovery, and once the product Community and the speculative Community reached a consensus, the CEX listing further released liquidity, and the project, community, and CEX achieved a three-way win-win.

A healthy ecosystem is one where everyone playing on-chain is willing to buy the coins, and even more willing to evangelize them - this is how the liquidity supply chain can form a positive feedback loop.

And now? The problem faced by VC Token is the division between these two Communities. The mainnet just went live with TGE, but the product has not yet been launched, and the Community is just here to grab the airdrops, bringing in selling pressure. In the previous cycle, we still had Sam/Su helping us leverage buy Alts, but this cycle the leverage has basically been cleared. At the same time, many VCs raised a large amount of funds in the previous bull market, and they have the pressure to deploy, so they have to keep pushing up the valuations of projects to show good paper returns to their LPs.

So this has led to the current situation of VC Tokens, with high valuations at launch but no buying pressure, so all they can do is drop.

This naturally explains the logic behind the emergence of MEME, since the projects invested by VCs cannot be launched, and they are just pumping hot air, why not pump a lower-valued and more fair MEME?

MEME has become one of the most undeniable and indispensable opportunities in our industry

Under the polarization analyzed at the beginning of the article, MEME has become one of the most undeniable tracks in our industry.

I always thought MEME was just a speculative play, but this time I realized I was wrong, it is a carrier of cultural trends, its value lies not in specific functions and technologies, but in its unique ability to carry collective consciousness, emotions and identity, which is no different from the logic of religion.

Beneath the absurd surface, it expresses deep-seated social psychological needs and values, it is tokenizing and capitalizing on trends and emotions.

In other words, the core of its product is the trends and narratives it carries, and the size of these trends and narratives determines the ceiling of a MEME. Pioneering technology, idol worship, IP emotions, subculture trends, we analyze the potential behind them, just like how VCs analyze the prospects of the track a product is in and its position in the track.

For MEME, the Token is its product, so what it needs to do around the product is to promote the interaction between price and community, the price is in a sense the iteration of the product, building a solid community foundation in the ups and downs of the price, turning Paper Hands into Diamond Hands, and letting them do the propagation, ultimately fulfilling the self-fulfilling prophecy.

In this respect, MEME Tokens actually have a huge advantage that VC Tokens don't have. Because the Token is the product itself, the product Community and the speculative Community are one and the same, and they form a synergy.

MEME has a very low signal-to-noise ratio due to the low issuance of capital, and it cannot be analyzed from the form of tangible products, it requires an excellent understanding of trends and market sentiment, I am still learning, whether there is a structured methodology to study this track, so as to pick targets in the extremely low signal-to-noise ratio, and if so, what kind of targets are suitable for us to intervene and when to intervene.

But I firmly believe that MEME will become an opportunity that transcends cycles, because it is essentially a cultural phenomenon in the digital age, and as long as the trends are immortal and emotions are iterative, it will never be exhausted.

More importantly, I've always felt that giving the marginalized a chance to get rich is where the vitality of our industry lies. Before this wave of MEME, it was said that the requirements for entrepreneurs in this cycle are more than 10 times that of the past, and it seems that all the investments have been eaten up by VCs, and the emotions of the community and retail investors have been greatly suppressed. But through MEME, young people can still realize 100x opportunities through early deployment, anti-authority is one of the core spirits of Crypto, and I believe it will always be there.

How long can MEME go in this cycle

When everyone is enthusiastic and feels they can sacrifice themselves for the community and think they can make money forever, don't forget that the profit-taking side will definitely reap the harvest, this is an eternal truth in the financial industry. Remember how the NFT Community was like a few years ago: everyone was proud to use monkey avatars, helping them connect with brands, holding events and collaborations all over the world, NFT Parties were held everywhere, and then what?

When all kinds of inflated self-confidence and unrealistic expectations appear, when holding Major seems less attractive than holding MEME, when all kinds of hackers and rugs appear, we should start to be vigilant. Once our industry no longer has greater liquidity opportunities, and BTC starts to encounter resistance, all the enhanced Alphas will plummet faster.

By the way, is DeSci the same as the logic of PeopleDAO and the rescue of Assange in the previous cycle? Under the banner of "justice", do we have the ability to distinguish belief from speculation.

In fact, the turning point for MEME happened when Binance listed a small Neiro, at that time VC Tokens were in trouble, the breakthrough was the discovery of the listing on Binance, embracing the Community MEME allowed the project, community and CEX users to all make money, and that's how ACT came about.

But now, the blind liquidity of on-chain MEME, isn't it like the TVL competition after the high TVL projects on Binance, isn't it like the competition after the Ton ecosystem tokens with a huge user base on Binance.

CEXes will change their listing strategies based on market expectations, guiding the market direction, and our industry will inevitably fall into a homogenized competition chaos due to the low cost of asset issuance and liquidity premium, and this chaos will definitely numb and tire everyone.

This is the power of the cycle.

In the short term, don't do whatever just to bet on CEX support, the projects that are truly building for the industry will come out.

In the long run, the bear market will eventually clear out the pile of OverSupply that has done nothing, and put the market back on track.

The market is always swinging between long-term constructionism and short-term emotionalism, it is a spectrum, Main Character and MEME will become the two ends of the Barbell, waxing and waning with the market sentiment.

No need to be anxious, just find your own rhythm.

Investing is a game like this, we make bets based on our cognition, right we make money, wrong we lose, always curious, always in awe.