Author: Francisco Rodrigues, CoinTelegraph; Translated by: Tong Deng, Jinse Finance

The ongoing meme coin trading frenzy during the cryptocurrency bull market has taken traders on a dizzying ride of highs and lows, but it seems that the beneficiaries of the "gold rush" are the providers of crypto infrastructure.

The popularity of memes has resulted in record-breaking revenues for Solana-based decentralized applications (DApps), with the automated market maker Raydium setting a record $11 million in 24-hour fees earlier this month.

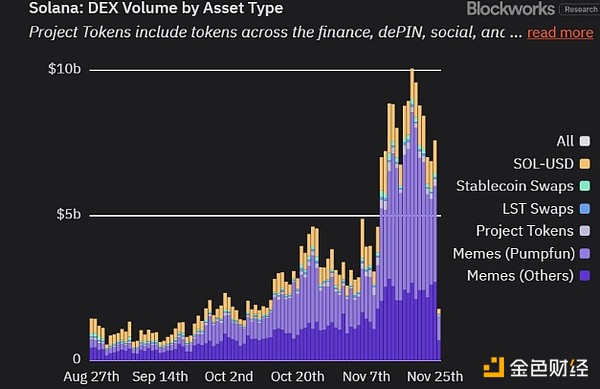

According to Blockworks data, on-chain activity on Solana has seen an explosive growth in recent weeks, with decentralized exchange (DEX) daily trading volume soaring from around $1.6 billion to a peak of $10 billion.

DEX trading volume on Solana. Source: Blockworks

Cryptocurrency bull markets (including the current one) are often compared to the California Gold Rush, which occurred between 1848 and 1855 when gold was discovered at a construction site, prompting a massive influx of miners to the region.

By 1853, around 250,000 gold miners had moved to the area, and gold production skyrocketed. However, it is widely believed that the majority of the wealth did not flow to the miners, but rather to the entrepreneurs who provided them with goods and services.

In other words, those who sold the picks and shovels made the real money, not those who used them to search for gold.

In the cryptocurrency realm, the "picks and shovels" are the infrastructure providers, including trading platforms, blockchain networks, wallet providers, payment systems, and other decentralized applications.

Gracy Chen, CEO of cryptocurrency exchange Bitget, stated in an interview that the "picks and shovels" analogy is still relevant in the context of the cryptocurrency market, "because it represents the fundamental infrastructure required for the cryptocurrency and the broader ecosystem to function."

When comparing the industry to the California Gold Rush, Chen pointed out that the 2017-18 Initial Coin Offering (ICO) frenzy ended with various investors suffering losses, while "ICO founders profited handsomely, often on luxury purchases like Lamborghinis and mansions."

A Binance spokesperson noted that the "picks and shovels" analogy "does not fully capture the multidimensional nature of the cryptocurrency market," but agreed that it "describes the entities providing the basic infrastructure and services," including "stablecoin issuers, blockchain networks, mining companies, and ETF [Exchange Traded Fund] providers, among others."

Benefiting from the Cryptocurrency Gold Rush

As shown in the image, the decentralized exchanges on Solana are benefiting, as the meme coin trading frenzy has led to a surge in trading volume (and the resulting fees).

David Gogel, Vice President of Strategy at the dYdX Foundation, stated that historically, exchanges "have been the biggest beneficiaries of bull markets, as the surge in trading volume drives massive fee revenue."

Gogel added that while he believes this trend is continuing, in the current market cycle, new "sophisticated non-custodial wallets" like Phantom are "capturing significant activity" through their mobile applications, integrating seamlessly with the ecosystem that is experiencing the trading frenzy.

Vijay Chetty, CEO of Eclipse, the first Layer 2 network to combine Ethereum and Solana, stated that cryptocurrency gateways and asset issuers like Circle and Tether are benefiting from the growth in stablecoin supply, serving as an entry point for users.

Chetty said that token and meme coin launchpads like Pump.fun are also performing well. He added that aggregators like Jupiter, which facilitate exchange activity, as well as liquid staking platforms like Solana MEV and Jito, are also generating "significant fees."

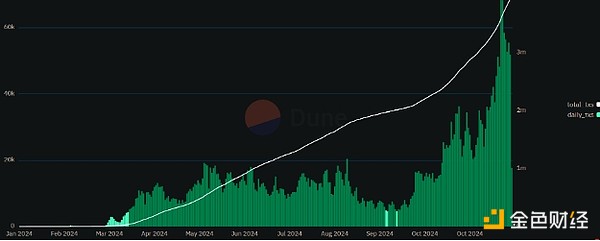

In fact, Dune Analytics data shows that the platform for token launches, Pump.fun, has seen an explosive growth in daily trading volume in recent weeks. The platform became so popular that it had to disable its live streaming function due to strong opposition to the explicit content it hosted.

Pump.fun daily trading and total trading. Source: dune analytics

Illia Otychenko, Chief Analyst at the cryptocurrency exchange CEX.IO, noted that infrastructure providers, including oracle and software development kit providers, are also "in a favorable position to thrive," but added that each market cycle introduces a new "gold."

Otychenko stated that in 2021, around 71% of the total value locked in decentralized finance was concentrated in decentralized exchanges and lending platforms, but in the current cycle, this has shifted, with "liquid staking and re-staking becoming the primary beneficiaries."

However, a Binance spokesperson pointed out that cryptocurrency users may also benefit from this frenzy due to the "unique dynamics of the cryptocurrency market."

"In the gold rush, miners were chasing gold with limited predictability and strategic foresight. In the cryptocurrency market, participants - including traders, speculators, and investors - can use sophisticated tools, data, and strategies to make more informed and well-considered decisions," they added.

Therefore, they stated that while infrastructure providers remain crucial to the growth of the ecosystem, "the winners in the cryptocurrency market may include traders, speculators, and venture capitalists."

Bitget's Chen also expressed a similar view, stating that "anyone who is adept at leveraging advanced technology can profit from digital assets, not just the developers or providers of that technology."

Is the Current Cryptocurrency Bull Market Sustainable?

The current cryptocurrency market rally may benefit both traders and infrastructure providers, but observers are uncertain how long the bull market will last.

Otychenko of CEX.IO stated that the surge in trading volume "appears unsustainable" after the spike, but added that it "may establish a new benchmark for Solana fees." He pointed out that Solana's daily fees spiked from $200,000-$400,000 to $2-3 million in March 2024, before stabilizing in the $1-2 million range.

The Binance spokesperson stated that while the frenzy indicates increased user engagement and activity, its "sustainability remains uncertain." Fee spikes "are typically intermittent and closely tied to broader market cycles and specific events."

The long-term outlook will depend on "how the market narrative and user behavior evolve." They added:

"To maintain such fee levels and potential demand, Solana may need to diversify use cases and cultivate consistent user engagement across a broader cryptocurrency sub-sectors, rather than relying on concentrated DApp activity."

This may include expanding into areas like gaming, decentralized finance, and "other high-growth domains that could foster long-term utility and participation." As the market adapts, business models may also change, potentially implementing dynamic fee structures if fees reach prohibitive levels.

Bitget's Chen stated that we are seeing a "stress test of existing blockchain infrastructure," and added that addressing high transaction fees and improving throughput "has become pressing once again."