Author: Liu Jielian

On the weekend, BTC still hovered below the $100k mark. The past week was the week when the $100,000 BTC became a reality, and "12.8 Jielian Internal Reference: Week 49 The Big Cake Breaks the Six-digit Barrier, the New Supervisor Unfolds a Grand Plan in the White House" reviewed this.

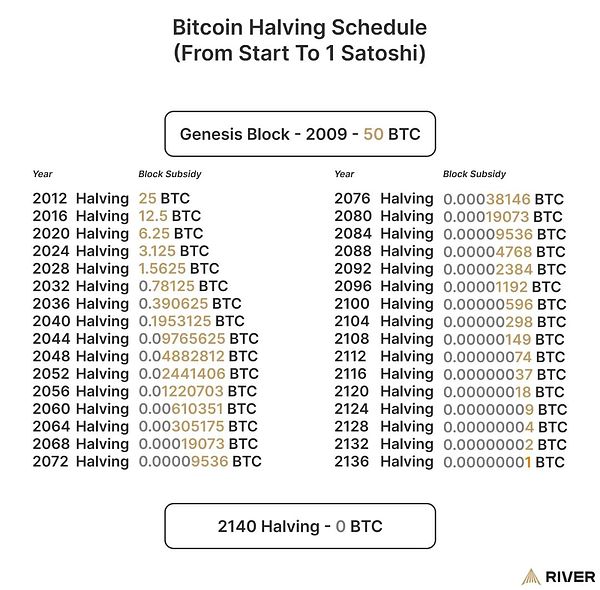

A BTC worth $100,000 does indeed make ordinary retail investors feel that it is not cheap. But do you know that according to the halving algorithm specified in the BTC system code, the last BTC out of the total 21 million BTC will take about 35 years to be mined before the issuance is completely stopped.

The above image is the timeline of BTC halving. After each halving, 210,000 blocks will be mined, which takes about 4 years. Simple calculation shows that from the halving in 2104 until the complete cessation of output in 2140, the total amount of BTC that can be produced is:

(298+149+74+37+18+9+4+2+1) * 210000 / 10^8 = 1.2432

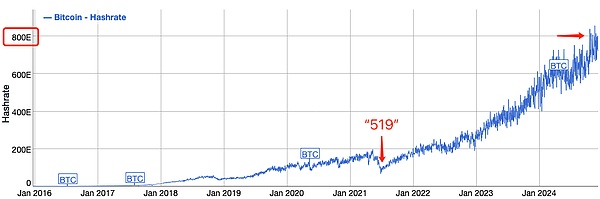

Now, the global BTC network has a computing power of up to about 800EHash/s. 800EHash/s means that 800 x 10^18 hashes can be calculated per second, that is, 800,000,000,000,000,000,000 hashes.

According to the information, the world's current top supercomputer is the US's El Capitan, which has a performance of over 1.7 EFlops (1.7 × 10^18 floating-point operations per second).

According to the record in the "History of Bitcoin" Chapter 11 Episode 53 by Jielian, "The unit of supercomputer computing power is FLOP/s, and according to the rough estimates of CPU computing power data previously measured by Satoshi Nakamoto and netizens, the floating-point computing power of general-purpose computers needs to be reduced to one ten-thousandth of the original value to convert to hash power, that is, every 10,000 FLOP/s is equivalent to about 1 hash/s."

That is to say, the computing power of this top global supercomputer is approximately equivalent to 1.7 x 10^14 Hash/s.

800EHash/s is roughly equivalent to the computing power of 5 million such supercomputers.

When Jielian wrote the "History of Bitcoin" in 2020, the world's fastest supercomputer was Japan's Fugaku (about 442 PFlops/s), and at that time the BTC network computing power was only 100EH/s, equivalent to the computing power of about 3 million supercomputers. In the past four years, the performance of supercomputers has increased 3.8 times, while the BTC network computing power has grown 8 times.

Supercomputer technology is progressing. But BTC computing power technology is progressing even faster.

This is just from the perspective of computing power, without considering the energy consumption dimension.

When writing the "History of Bitcoin" in 2020, Jielian made an estimate of energy consumption, and wrote: "And if 3 million supercomputers were really used, not to mention whether there is enough capital to produce and manufacture them, just in terms of their power consumption, it would consume 30,000 times the electricity used for BTC mining today, which would not be very feasible."

In the past four years, the development of BTC computing power has further widened the gap with supercomputers. The gap in energy consumption is likely to have widened further as well.

Therefore, we say that the security of BTC is not just at the abstract, logical level, but is realized at the material and energy level that humans cannot exceed!

There is no other thing that can surpass the computing power used by the BTC network to protect the security of all BTCs at a lower cost. This statement has become an indisputable objective fact.

BTC may not be the largest asset in terms of market value among all current forms of human wealth, but it is already the safest asset.

Now, let's go back to the question at the beginning of the article, that is, with the BTC network computing power so huge and even greater in the future, it will take 35 years to forge the last BTC.

How much is such a BTC worth?

And the exact same BTC can be easily owned today for less than $100,000.

Is it worth it or not?