Author: Lostin, Helius

Compiled by: Glendon, Techub News

If you hold SOL tokens and want to stake them, but don't understand the staking mechanism of Solana? Don't worry, this guide will provide you with a comprehensive overview of SOL staking, covering the most common questions and all key areas. Let's get started!

Why stake SOL?

Staking SOL is not just about earning rewards - it is also crucial for the decentralization and security of Solana. By staking, SOL token holders can contribute to the network's stability and governance. In this process, choosing the right validator (Validator) to stake with is very important. Delegating tokens to a validator is like voting in a representative democracy, reflecting trust in the validator's ability to maintain high uptime, process blocks quickly and accurately. Other considerations include the validator's ethical conduct, response to hard forks, and contribution to the Solana ecosystem.

Reasonably distributing staking power among reputable validators can further promote network decentralization and effectively prevent any single well-funded entity from manipulating consensus decisions for personal gain.

What happens when you stake?

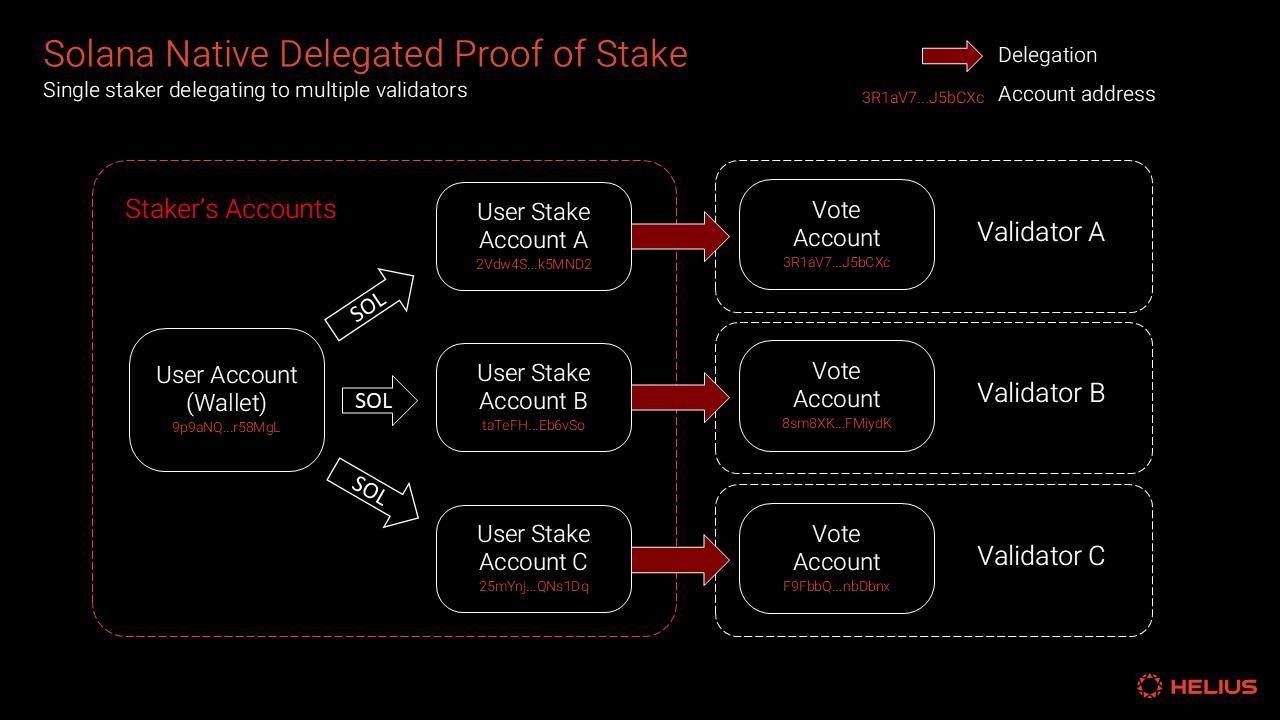

There are two forms of staking on Solana: native staking and liquid staking. Currently, 94% of staked SOL uses native staking, so this article will focus on this form and briefly introduce liquid staking later. For native staking, users can operate through various platforms, including multi-signature fund management tools (such as Squads), popular wallets, and dedicated staking websites. The process of native staking is relatively simple: users only need to deposit their tokens into a staking account and then delegate them to a validator's voting account. A single user can create multiple staking accounts, each of which can flexibly choose to delegate to the same or different validators.

The image above: A single staker delegating to multiple validators

Each staking account has two key permissions: staking permission and withdrawal permission. These two permissions are automatically set by the system at the time of account creation and are default-allocated to the user's wallet address. Each permission has its own clear responsibilities. The withdrawal permission has higher control over the account, as it can remove tokens from the staking account and allow the user to update the distribution of staking permissions.

The most important time unit in staking is the epoch. Each epoch on Solana lasts 432,000 slots, which is approximately two days. When a new epoch begins, the system will automatically distribute staking rewards to the corresponding stakers. This process requires no manual operation from the stakers, as they will see their account balances increase at the end of each epoch. Additionally, users can directly earn MEV rewards through the Jito website (more on this later).

When you stake SOL natively, your tokens will be locked for the duration of the current epoch. If users cancel their staking at the beginning of an epoch, they may have to go through a cooling-off period of up to two days before they can withdraw. If they withdraw at the end of an epoch, the process will be almost instant, with no additional waiting.

Similarly, initiating staking also requires a warm-up period, which can last up to two days or be almost immediate, depending on when the user starts their staking account. During this process, users can check the Solana block explorer to track the progress of the current epoch.

How do operators profit?

Validator operators primarily profit in three ways:

- Issuance/Inflation: Issuing new tokens

- Priority Fees: Users pay SOL to validators to prioritize their transactions

- MEV Rewards: Users pay Jito tips to validators to include transaction bundles

Validator revenue is entirely denominated in SOL, and the scale of their revenue is directly linked to their staked amount. Operating costs are mostly fixed and priced in a mix of SOL and fiat currency.

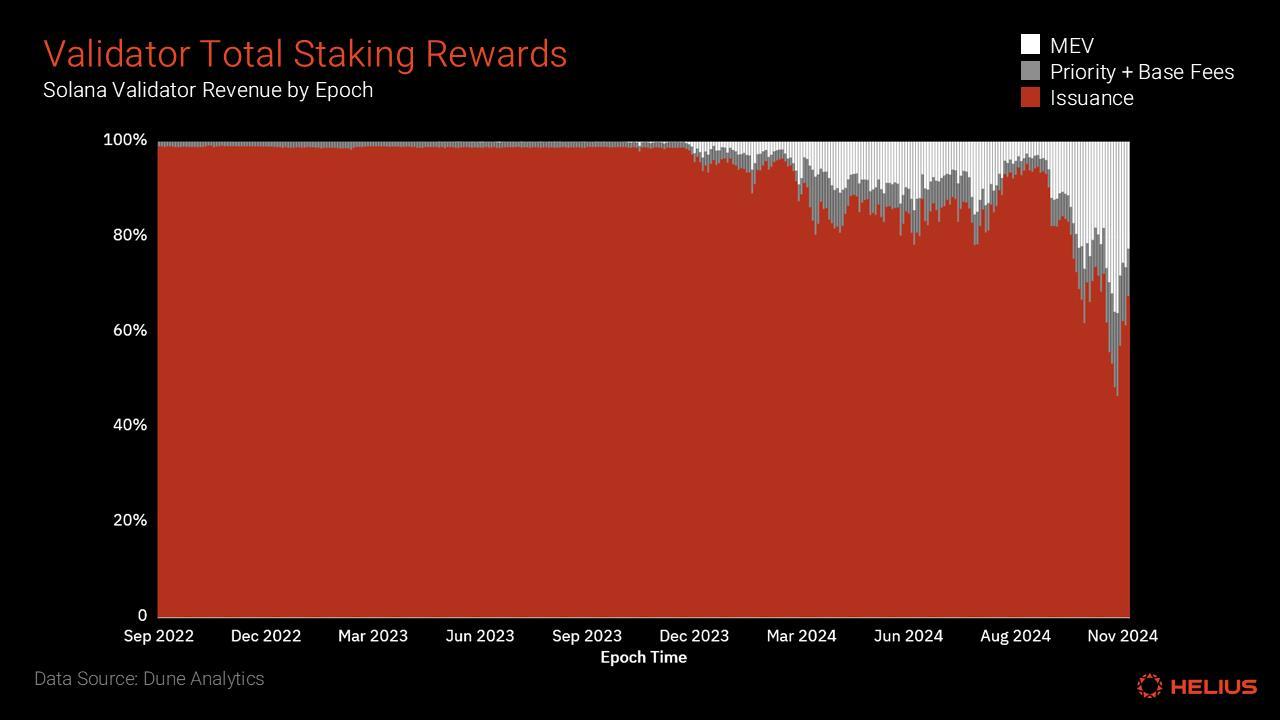

The image above: Total staking rewards for Solana validators (Source: Dune Analytics, 21.co)

Token Issuance

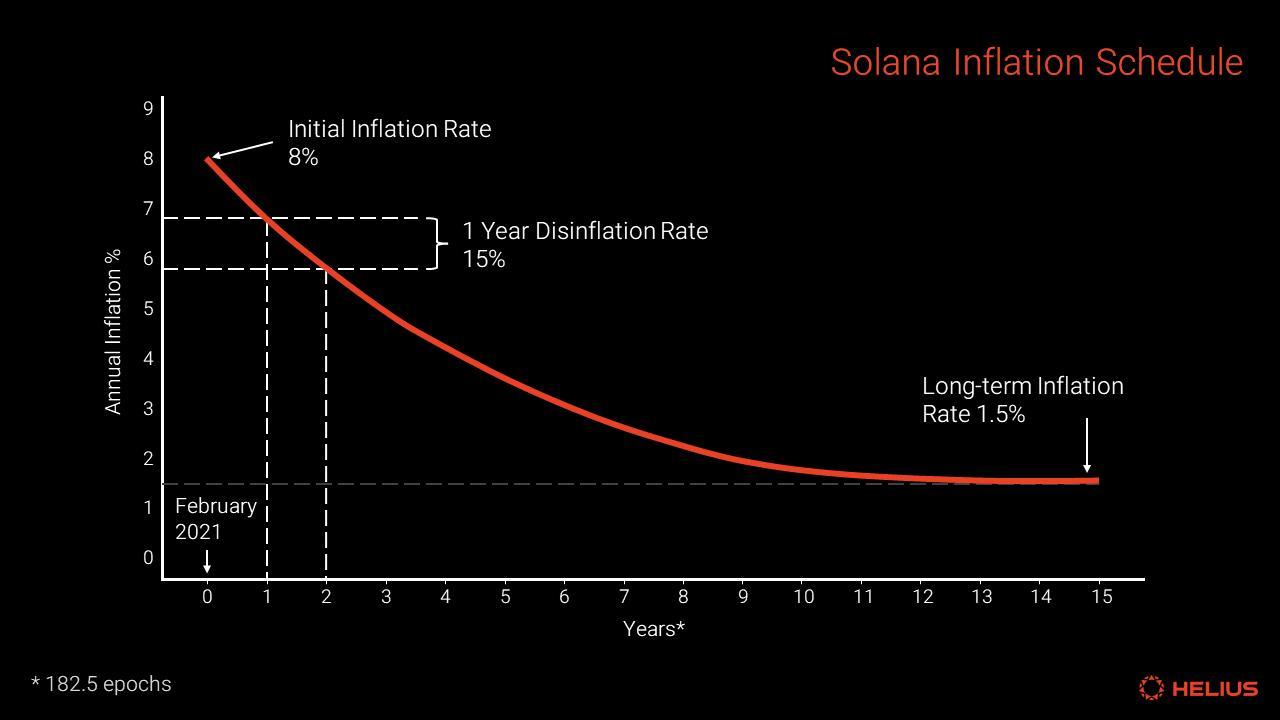

Solana regularly issues new SOL tokens according to its inflation plan and distributes these tokens as staking rewards to validators at the end of each epoch. Currently, Solana's inflation rate is 4.9%, and this rate will gradually decrease by 15% per year until it stabilizes at a long-term rate of 1.5%.

The amount of staking rewards a validator receives depends primarily on the number of points they earn by correctly voting to become an on-chain block node. If a validator experiences downtime or fails to vote in a timely manner, their point earnings will be reduced. On average, a validator with 1% of the total staked amount is expected to receive around 1% of the total inflation rewards.

Furthermore, a validator's staking rewards are further divided and distributed among their stakers based on the delegation size. In this process, the validator can charge a commission fee on the total inflation rewards earned by their stakers. This commission rate is typically in the single-digit percentage range, but can be any number between 0% and 100%.

The image above: Solana inflation schedule

Priority Fees

On the Solana network, the validator selected as the current block producer can collect fees from each transaction they process, which are divided into two types: base fees and priority fees. These fees are immediately credited to the validator's identity account. Prior to this, validators could earn 50% of both the base fees and priority fees, with the remaining portion being burned. However, with the passing of SIMD-96, this fee structure is about to change, allowing block producers to retain 100% of the priority fees.

By paying priority fees, users can ensure their transactions are prioritized for inclusion in the block. This mechanism is particularly important in various scenarios, including arbitrage, liquidations, and NFT minting, which often require high transaction speed. Since complex transactions consume more computational resources, they typically require higher priority fees. Generally, hot token accounts with high demand need to pay higher priority fees.

Compared to priority fees, base fees, although contributing relatively less revenue, play an indispensable role in preventing spam. To maintain the network's security and stability, the Solana system has fixed the base fee at 0.000005 SOL (5000 lampors) per signature, in order to reduce the risk of malicious transactions and network congestion.

MEV (Jito) Rewards

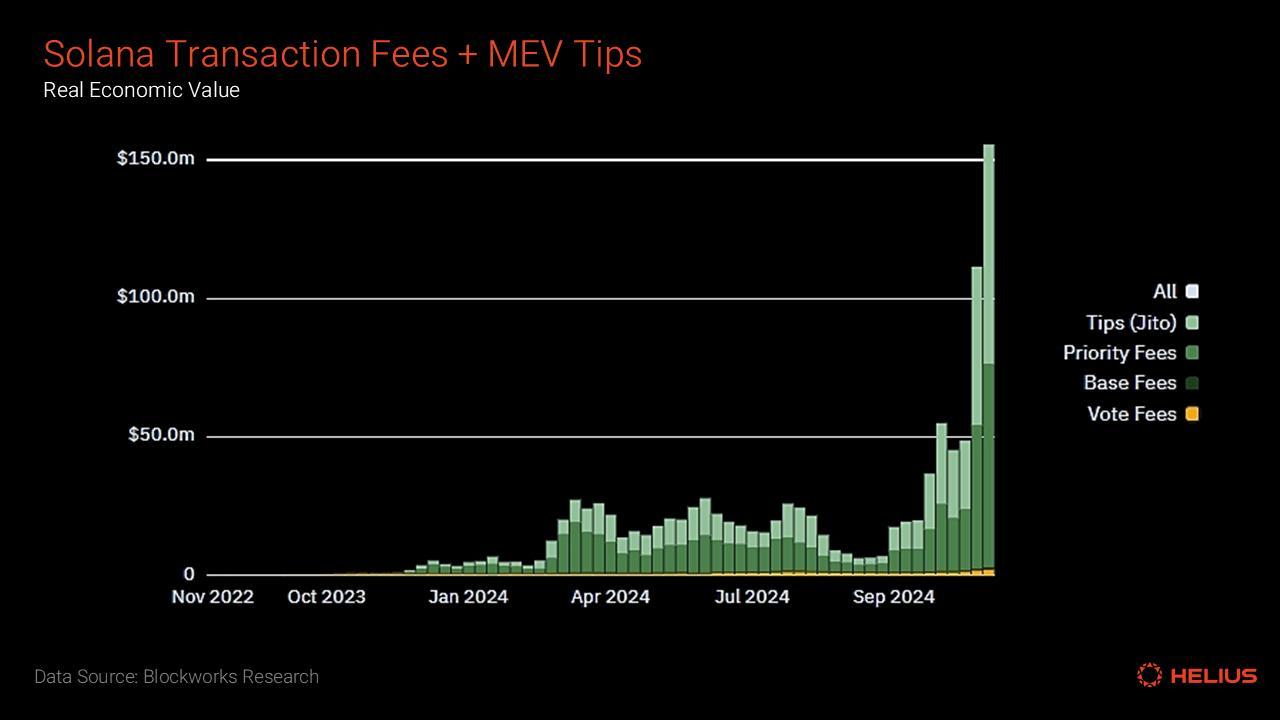

Currently, validators running the Jito validator client account for over 90% of the total SOL staked. Jito has introduced an off-chain block space auction mechanism, where searchers and applications can submit transaction bundles called "bundles". These bundles often contain time-sensitive transactions, such as arbitrage or liquidations. To incentivize block builders to prioritize these transactions, each bundle comes with a "tip". This provides validators with an additional revenue source beyond priority fees and base fees.

By 2024, Jito's MEV revenue has grown from negligible to become a validator's primary source of income. Similar to the mechanism for inflation rewards, validators can set and collect their MEV commissions. Stakers also receive a share of the remaining fees based on the relative size of their delegation to the block builder.

The image: Data on the growth of quantitative priority fees and Jito tips. Data source: Blockworks Research

Where does the APY come from?

The Annual Percentage Yield (APY) is an important metric that measures the annualized compounded percentage yield that a staker can earn by staking at the current rate for a full year. This yield is influenced by a combination of complex factors, including but not limited to the network's current issuance rate, the performance and uptime of validators, the tips received by validators from users, and the current staking rate (the proportion of SOL staked to the total supply). Currently, many websites provide ranked lists of validators by APY, with StakeWiz being one of the most comprehensive.

Specifically, the APY is derived from two main sources: issuance rewards and MEV (Jito) rewards.

Issuance Rewards

On the Solana network, validators distribute staking rewards based on the size of their delegated stake. Validators charge a service fee when distributing rewards, with the fee ranging from 0% to 100%. Additionally, the rewards received by validators depend not only on the size of their delegated stake, but also on their voting performance. Each successful vote earns the validator points, which are a key factor in determining their rewards.

Well-managed validators can generate higher rewards based on the following factors:

- Minimal downtime: Validators do not earn points during downtime, as they cannot participate in voting.

- Timely voting: If validators consistently lag in consensus participation, they may earn fewer points.

- Accurate voting: Points are only earned for voting on blocks that are subsequently confirmed.

MEV (Jito) Rewards

MEV rewards are playing an increasingly important role in the composition of staking rewards. The growing on-chain transaction volume and the resulting arbitrage opportunities are driving this growth. Recently, Jito MEV tips have accounted for 20-30% of the total rewards, significantly boosting the returns for stakers. Similar to issuance rewards, validators charge a commission on MEV tips, ranging from 0% to 100%. Additionally, Jito charges a 5% platform fee on all MEV-related revenue.

Other Considerations

However, when choosing validators, stakers do not solely focus on the commission rate. While low-commission validators may offer higher direct returns, many still prefer high-commission validators like Coinbase, driven by factors such as custodian lock-ups and regulatory arbitrage. For example, funds using Coinbase Custody often must be staked specifically on Coinbase's validators. On the other hand, centralized exchanges also benefit from the convenience-over-optimization behavior of retail users. For off-chain users, they may be less sensitive to sub-standard returns, giving exchanges more flexibility in the rewards they offer.

Finally, new protocol mechanisms (such as SIMD-123) aim to allow validators to share block rewards directly with stakers. If successfully implemented, this would provide an additional income source for stakers.

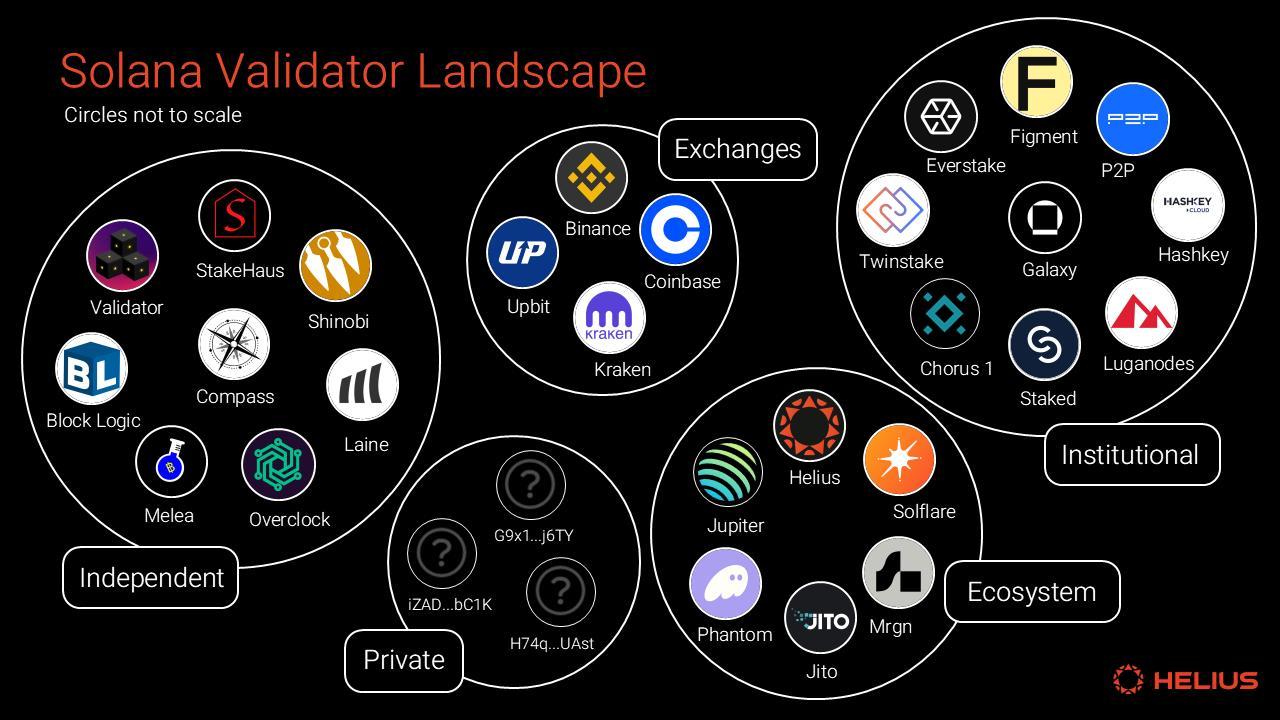

Key Participants in the Solana Staking Ecosystem

Solana validators can be categorized into several groups.

Ecosystem Teams

Many prominent Solana applications and infrastructure teams operate validators that complement their core businesses. For example, Helius runs a validator to support its RPC service.

Examples:

- Helius

- Mrgn

- Jupiter

- Drift

- Phantom

Centralized Exchanges

Centralized exchanges are among the highest-staked Solana validators, providing one-click staking solutions for their off-chain exchange customers.

Examples:

- Kraken

- Coinbase

- Binance

- Upbit

Institutional Solution Providers

These companies specialize in providing customized staking services for institutional clients. They support multiple blockchains to cater to a wider range of customer needs.

Examples:

- Figment

- Kiln

- Twinstake

- Chorus One

Independent Teams

The Solana validator ecosystem also includes many independently operated mid-sized and long-tail validators. Some have been active since the network's inception and contribute to the ecosystem through education, research, governance, and tool development.

Examples:

- Laine

- Overclock

- Solana Compass

- Shinobi

Private Validators

The network also has over 200 private validators. Their staking is self-delegated and may be controlled by operating entities. These validators are characterized by a 100% commission rate and a lack of publicly available identity information on block explorers and dashboards.

What is Liquid Staking?

Liquid staking allows users to diversify their staking exposure across multiple operators by staking through staking pools, which can issue Liquid Staking Tokens (LSTs) that represent the user's ownership share in the underlying staking account.

LSTs

LSTs are yield-bearing assets that accrue rewards based on the Annual Percentage Yield (APY) of the underlying staking account. In native staking, the epoch rewards directly increase the staked SOL balance. In contrast, with liquid staking, the number of LSTs remains constant, but their value relative to SOL tokens increases over time.

LSTs unlock DeFi opportunities to improve the capital efficiency of staking. A common use case is depositing LSTs as collateral in lending platforms, allowing users to borrow while maintaining their staking position and continuing to earn rewards.

The State of Liquid Staking

Although only 7.8% of SOL is currently staked through liquid staking, this segment is growing rapidly. Data shows that liquid staking has accumulated 32 million SOL, up from 17 million SOL at the start of 2024, a year-over-year growth rate of 88%. Among the liquid staking tokens, JitoSOL is the most popular, with a 36% market share, followed by Marinade (mSOL) and JupiterSOL (jupSOL) with 17.5% and 11% market share, respectively.

Tax Advantages

In fact, liquid staking also offers tax advantages for users. In many jurisdictions, staking rewards distributed in the form of tokens are considered a taxable event (similar to stock dividends) and are taxed as income upon receipt. However, due to the LST mechanism, where the user's wallet balance remains unchanged and only the value increases, users do not trigger a taxable event with each reward distribution.

Is SOL Staking Safe?

Native staking provides stakers with a direct and secure way to participate in the network validation process. In this model, stakers always maintain control and custody of their SOL. If a validator goes offline or underperforms, non-custodial stakers have the right to unstake at any time and freely switch to better-performing validators. In the event of network outages, the positions of native stakers remain unaffected, and their holdings will be intact once network activity resumes.

Similarly, liquid staking, as an alternative option, also provides security assurances in its unique way. Currently, five reputable companies have conducted nine audits on the staking pool programs to ensure their robustness. Nevertheless, investors using liquid staking should be mindful of market volatility and potential risks. During unfavorable market conditions or "black swan" events, the trading price of LSTs may temporarily fall below their underlying value. While these deviations are typically short-lived, investors should consider tail-end risks, especially when using LSTs as collateral.

Slashing Mechanism

Slashing is a penalty mechanism that curbs malicious or harmful behavior by reducing delegated Stake. Although Solana has not yet implemented a slashing mechanism, network developers are actively considering this option and may introduce it in the future.

Finally, Stakers should follow best practices and securely manage their private keys to prevent loss or theft.

How is Staking SOL different from Staking ETH?

Solana and Ethereum have some differences in their Staking approaches. Solana has integrated delegated Proof-of-Stake (dPoS) directly into its core protocol, allowing for Staking without relying on external solutions. This design has resulted in a Solana Staking participation rate of 67.7%, occupying a significant portion of the total supply, far exceeding Ethereum's 28%. In contrast, Ethereum's transition from Proof-of-Work to Proof-of-Stake has relied more on third-party platforms like Lido and Rocket Pool to provide Staking and liquid Staking services.

On the other hand, in Ethereum, solo Staking is the only native Staking option, requiring validators to have a high level of technical expertise and dedicated hardware. Validators must Stake at least 32 ETH and ensure their hardware is always online and well-maintained. This self-custodial approach has earned Ethereum a reputation for a highly decentralized blockchain, with thousands of solo Stakers forming the foundation of the network.

While solo Staking plays a crucial role in Ethereum, liquid Staking has also gained widespread adoption through some major platforms. Lido, in particular, holds a leading market position, controlling over 28% of the Staked ETH supply. Lido issues the yield-bearing token stETH, allowing investors to enjoy Staking rewards while maintaining their ETH holdings. However, like all liquid Staking tokens, stETH faces certain risks, including smart contract vulnerabilities and stETH price deviations from ETH. More importantly, Ethereum's inflation rewards are relatively low, resulting in a yield of only 2.9% for Staking ETH through Lido, significantly lower than the returns from Staking SOL. Additionally, Lido charges a 10% fee on Staking rewards, further reducing the actual returns for investors.

Finally, it is worth noting that Ethereum does have a Slashing mechanism to penalize validator misconduct, but Slashing events are rare.

Conclusion

This article has comprehensively explored the concept, mechanisms, and importance of Staking on Solana, which is crucial for both experienced participants and newcomers to the Solana ecosystem. Staking not only provides a competitive way for long-term SOL holders to earn rewards, but it is also a core element supporting the security and decentralization of the Solana network.