Introduction

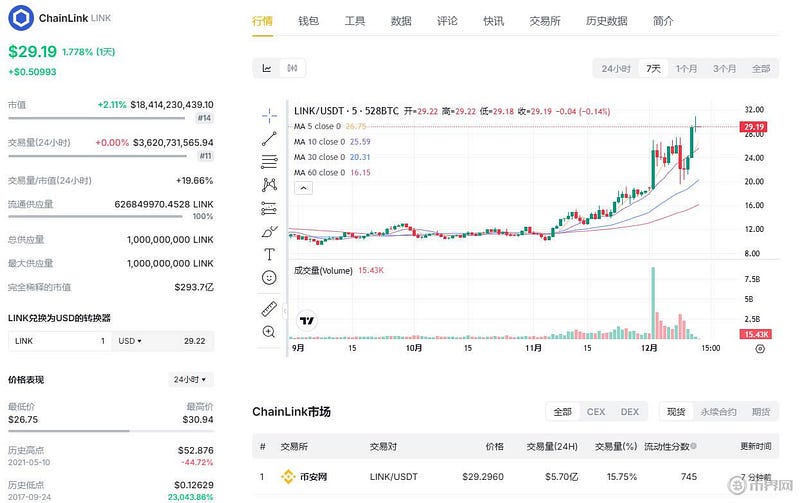

The price of Chainlink (LINK) has recently seen a strong upswing, breaking through its highest level since January 2022. On Thursday, the price of LINK reached $29.45, this surge is mainly due to the sustained demand from mature investors and the strong push by whales. According to data from Coin World, LINK has risen by 20% in the past week and 119% in the past month, making it one of the best performing Altcoins recently.

Latest price trends of Chainlink (LINK), Toncoin (TON), TRON (TRX), and Aave (AAVE)

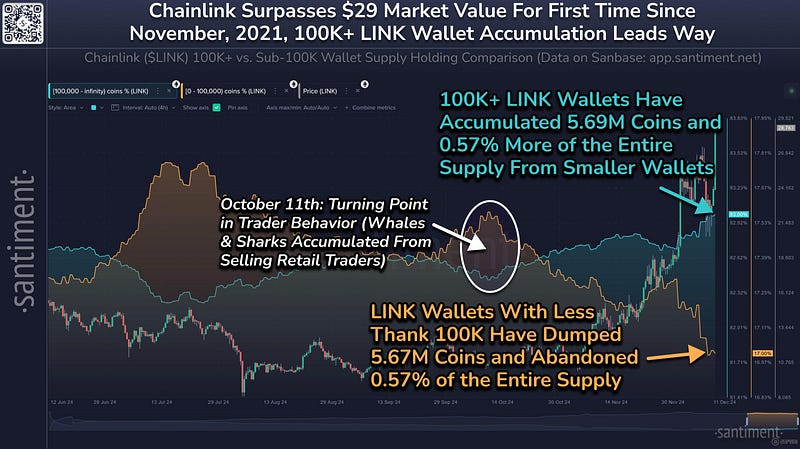

Whale activity drives LINK price increase

According to Glassnode data, LINK's futures open interest (OI) has recently hit a record high of $770.27 million, significantly higher than Toncoin's (TON) $259 million and TRON's (TRX) $356 million. The surge in this figure reflects the strong bullish sentiment in the market for LINK, particularly the increasing demand from large investors and institutions.

LINK's futures open interest (OI) data - Coin World

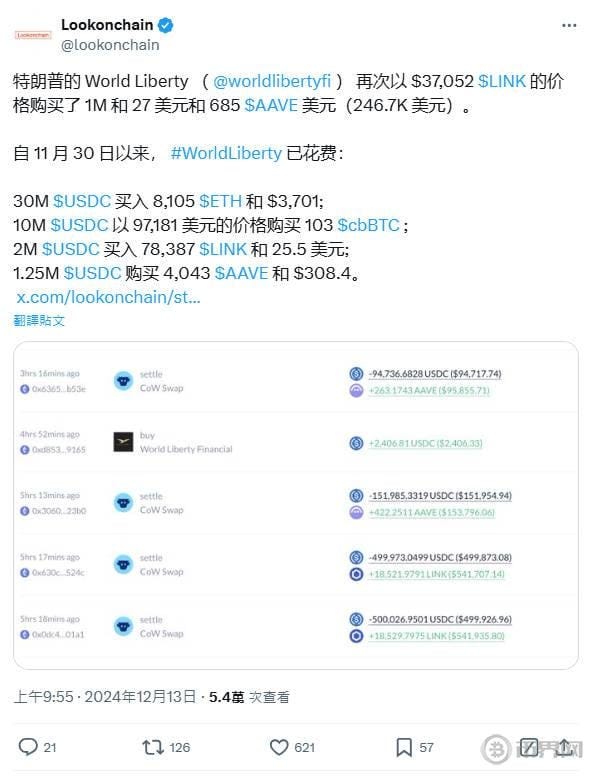

Meanwhile, whale activity has been a key factor driving the rise in LINK's price. On-chain data shows that World Liberty Financial, supported by former President Trump, purchased 41,335 LINK tokens at a price of $24.19 per token, a $1 million transaction that significantly impacted market sentiment and further pushed up LINK's price.

Expansion of the Chainlink ecosystem drives market demand

The rise in Chainlink's price is not just the result of capital inflows, but also the strong ecosystem and the growing network of partnerships. Chainlink recently launched the Cross-Chain Interoperability Protocol (CCIP) on the Ronin network, enabling the flow and interoperability of tokens between Ethereum, Ronin, and the Coinbase-incubated Base blockchain, further enhancing Chainlink's position in the blockchain industry.

Furthermore, Chainlink has partnered with Emirates NBD, one of the largest banks in the UAE, to jointly promote the tokenization of digital assets. This collaboration has further validated Chainlink's application scenarios in the traditional finance industry. Additionally, Coinbase's Project Diamond has integrated Chainlink, providing infrastructure for tokenized asset management. Chainlink's collaboration with global payment giant SWIFT to launch an institutional payment solution has also solidified its market-leading position as a decentralized oracle.

LINK price breaks through key resistance, bullish technicals

Chainlink's price movement is also supported by technical factors. Santiment data shows that LINK's price has recently broken through the $29 mark, the first time in three years, exciting market participants. Technical analysis indicates that LINK's price has successfully broken through the key resistance zone between $27.32 and $28.26, and the Relative Strength Index (RSI) has soared to the upper limit, suggesting that buying pressure is still increasing. Meanwhile, the Moving Average Convergence Divergence (MACD) also shows a bullish trend, further confirming the strong market demand.

The appearance of a 'golden cross' suggests that LINK's uptrend may continue. The next key resistance level is around $34.39, and if this is breached, LINK's price may continue to rise to $40. If this level is broken, with the sustained bullish sentiment, LINK has the potential to challenge the $50 mark, or even surpass its historical high.

Market recovery drives LINK's rally, can it break $50?

Chainlink's price surge is not a coincidence. As the broader crypto market gradually recovers, the rebound of Bitcoin (BTC) and Ethereum (ETH) has had a positive impact on the Altcoin market. As the leading decentralized oracle, LINK has attracted a significant amount of capital inflows due to its unique technological advantages and wide range of applications, making it one of the best-performing crypto assets.

Furthermore, the speculation about a potential collaboration between Chainlink and global investment giant BlackRock has also brought more optimistic expectations to the market. Although this partnership has not been officially confirmed, the meeting between the two parties at the Abu Dhabi Finance Week has sparked widespread discussions about the possibility of cooperation. If this collaboration materializes, it may further enhance Chainlink's visibility and application depth among institutional investors, providing additional momentum for its price increase.

According to CoinCodex's forecast, Chainlink is expected to break through $66.77 in February 2025, setting a new historical high. The realization of this prediction depends on the strong demand for LINK and the overall positive trend in the crypto market. If the government under former President Donald Trump can introduce policies supporting digital assets, LINK may have even greater upside potential in 2025. Some analysts even believe that with policy support, LINK's price could break into the triple-digit range and exceed $100.

Aave (AAVE) also shows strong momentum

In addition to Chainlink, Aave (AAVE) has also exhibited strong growth momentum recently. World Liberty Financial's $1 million investment in Aave has driven the token's price up by nearly 15%. Technical analysis suggests that Aave's price is approaching the key resistance zone between $516 and $566, and once this range is broken, Aave may trigger a new round of upswing, challenging its historical high of $668. Meanwhile, the approaching Altseason also brings more upside potential for Aave, and some analysts expect Aave to break through $1,000 during this process.

The strong momentum of LINK and AAVE may lead the crypto bull market

In summary, the recent strong performance of Chainlink (LINK) and Aave (AAVE) has injected new vitality into the crypto currency market. On-chain data shows that LINK's whale activity and market demand are driving its price to continue rising, and its constantly expanding ecosystem and partnership network have laid a solid foundation for LINK's future growth. If LINK can break through $40 and further push towards $50, it may have even greater upside potential in 2025, potentially surpassing its historical high.

At the same time, Aave's strong performance also demonstrates its potential in the crypto market, and with the arrival of Altseason, Aave may experience greater price fluctuations. Driven by factors such as the investment by Trump's company, Chainlink and Aave may become the leaders in the crypto market in the coming months.

Therefore, for investors, Chainlink and Aave are two crypto assets worth paying attention to, as they may bring significant growth potential in the coming years and become key participants in the crypto market.