Author: Sima Cong

People hate risk, and at the same time hate the warning signs that reveal the risk.

Any selling activity itself will exacerbate the price decline. But people choose to ignore the "inherent risk", now, Michael Saylor and its micro-strategy itself is the biggest time bomb or irregular, depending on the following:

Although the possibility is smaller than during President Trump's term, if the SEC decides to investigate MicroStrategy's "unique" strategy;

According to the Investment Company Act of 1940, if the company's main business is to hold investment assets rather than actual operations, it should register as an investment company and be subject to stricter regulation. If MicroStrategy's main asset is Bit, should it be registered as an investment company?

Whether MicroStrategy actually holds the amount of Bit it claims, and whether these assets have verifiable on-chain proof, its holdings are not fully transparent;

According to the most optimistic valuation, the fair price of micro-strategy is between $202.45 and $214.67, while the conversion price of its convertible bonds due in 2031 and 2032 is $232.72 and $204.33, which objectively requires micro-strategy to raise the stock price;

According to my valuation model, with an EV/EBITDA of 18x and an Implied EV/REV of 3x, the stock price of micro-strategy needs to return to $188.9 to eliminate the premium, which is equivalent to buying Bit spot at par, but this price cannot achieve the conversion price of its convertible bonds in 2031 and 2032;

And don't forget that in March 2024, micro-strategy's stock price was still in the $200 range (considering the stock split), and the Bit price at that time was $70,078.

Madness is unfolding

Trump quickly filled in his regrets and blanks, at least, also provided the material.

I mean the tweet material of the founder of micro-strategy.

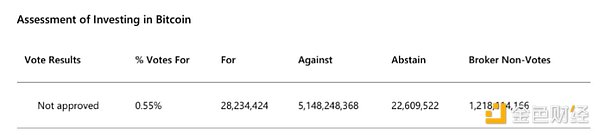

According to public reports, the vast majority of Microsoft shareholders rejected its proposal to establish a Bit reserve.

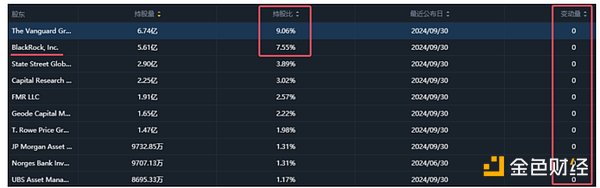

The Microsoft board had earlier urged shareholders to reject a proposal from the National Center for Public Policy Research to invest 1% of the company's total assets in Bit to hedge against inflation. At the annual meeting, MicroStrategy Chairman Michael Saylor gave a three-minute speech trying to convince Microsoft shareholders to support this proposal. His company has invested billions of dollars in Bit. Data shows that Microsoft's largest shareholders are institutional investors, including Vanguard and BlackRock.

At the meeting, "Bit whale" MicroStrategy Chairman Michael Saylor cited the sharp rise in MicroStrategy's stock price since adopting the Bit strategy as a case to try to convince Microsoft shareholders to support the NCPPR proposal.

Saylor emphasized that public and political support for Bit is growing, citing comments from incoming U.S. President Donald Trump supporting crypto and Wall Street firms launching Bit investment products. He described this trend as part of a broader "crypto renaissance".

The Microsoft board opposed the proposal, calling it "unnecessary" and citing existing processes for managing and diversifying the company's financial assets.

This is not only Microsoft's choice, legendary investor and Bridgewater Associates founder Ray Dalio still chooses gold. Because he believes crypto still faces unique challenges.

"The reason I'm worried about crypto is first of all privacy," Dalio said. "The government knows exactly what you have, where it is, and that's an effective way for them to tax it."

Dalio said that while Bit has "merits," the top crypto has not yet "proven itself" fully. He also does not believe Bit is a well-tested hedge against inflation.

"The reliability of crypto, like, 'Is it related to inflation? Is it related to those things?' No, not really, not very good," he said. "It's largely speculative in nature."

He added that, unlike gold, Bit is unlikely to become a major reserve currency anytime soon.

"It's unlikely to become a reserve currency, it won't work," Dalio said.

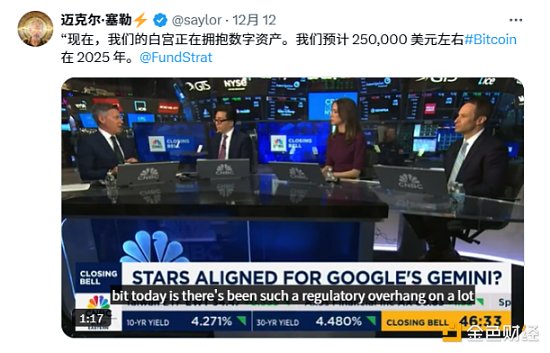

But the crypto has Trump, the so-called "crypto-friendly policy" of Trump, which not only helped Bit reach a historic high of $100,000, but also brought endless imagination, the latest scene is like this:

If you check the Twitter account of MicroStrategy Chairman Michael Saylor, you will find: the style of pictures and text like the one below is an endless loop.

Intended to promote the "broader vision" of Bit tirelessly.

But this is just an episode in Michael Saylor's long-term vision, his long-term vision is this: In 2045, the price will be $13 million per Bit, accounting for 7% of the world's wealth.

This is his near-term vision, that is, next year's vision:

Let's talk about reality.

Proposals from large companies like Microsoft to promote the establishment of Bit reserves may not only be part of the "crypto renaissance" that Michael Saylor talks about, and his tireless tweeting and promotion, but also a real consideration, even an imminent one.

And this risk is obscured by the following picture:

The charismatic leader like a savior, the stock price performance that is once-in-a-lifetime, even surpassing Nvidia, and the historical high of Bit!

So-called establishing Bit reserves, the essence and the first step is to purchase, which is crucial to Michael Saylor and his MicroStrategy, a matter of life and death.

Michael Saylor's "debt/equity, Bit, stock price" game is a double Ponzi scheme, which has become the biggest time bomb in the current crypto field.

Inherent risk

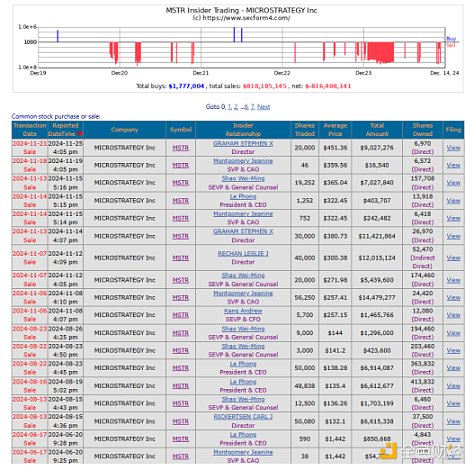

First, we need to note that although Michael Saylor has been tirelessly promoting Bit as the grand vision of the future, he and the management team of MicroStrategy have been selling stocks (https://www.secform4.com/insider-trading/1050446.htm), which is an obvious contradiction and warning signal, of course, you can think that they sell stocks to raise funds to buy Bit.

According to its website, MicroStrategy "provides software solutions and expert services to deliver actionable intelligence to every enterprise". Since 2000, the company has accumulated a net loss of $1.4 billion. In addition, its revenue has deteriorated over the past decade.

As a software solutions company, it has already gone bankrupt. However, its CEO Michael Saylor has transformed a shaky tech company into a leveraged Bit holding company.

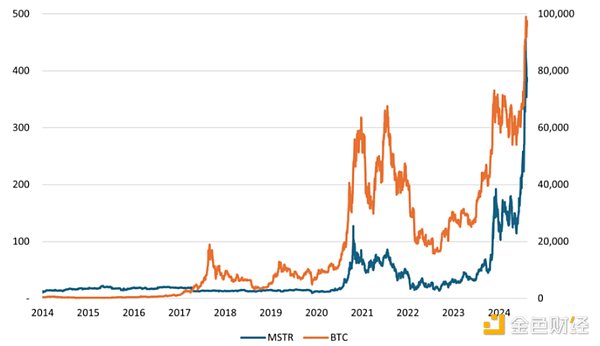

The chart shows that once they started buying Bit in 2020, its price has been closely correlated with Bit. The company is essentially a leveraged Bit holding company, so as it buys more Bit, this relationship may further strengthen.

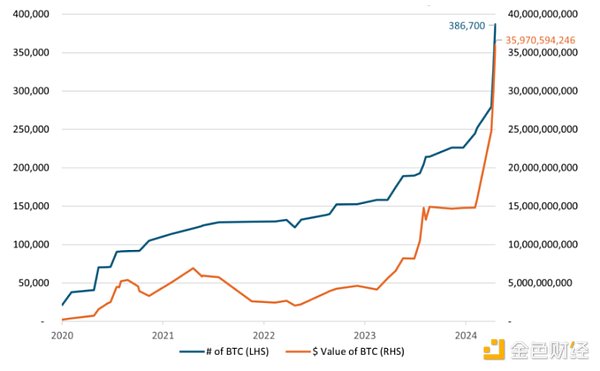

According to its public disclosure, as of 2024-12-8, it holds 423,650 BTC.

Where does the money come from?

Convertible debt financing

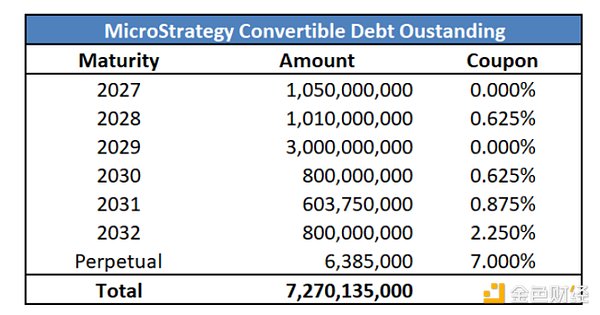

MicroStrategy has borrowed $7.27 billion using convertible bonds alone. The proceeds were used to purchase Bit.

Secrets and Risks Are Here

Convertible bonds are unique because they provide investors with the benefits of bonds as well as the upside of stock exposure. Assuming the convertible bond issuer does not default, the bond holder will receive their initial investment back at maturity, earn interest, and have a call option that allows them to purchase the company's stock at a specific conversion rate.

On November 21, 2024, MicroStrategy issued $3 billion of 0% convertible notes due December 1, 2029.

The stock was trading at $430 at issuance, with a conversion price of $672. Investors were willing to forgo interest payments in exchange for the call option. If MicroStrategy's stock rises more than 50% over the next five years, the stock option has value. If the stock does not exceed $672, the investor will earn a 0% return on their investment.

The opportunity cost also needs to be considered. MicroStrategy's S&P credit rating is junk (B-). According to the ICE BofA index, the yield on similar bonds is 6.75%. A 6.75% five-year compounded investment return provides a 47% total return.

Therefore, investors are forfeiting a 47% five-year total return, hoping that MicroStrategy's stock can double in five years to break even, rather than holding a similar-rated junk bond.

On paper, this looks genius. The plan is simple: borrow at zero interest using convertible bonds, buy Bit, and pay off the debt when the stock converts at a low price. As long as the stock price keeps rising - with Bit at least hovering around $100,000 - we're talking about one of the most successful financial engineering feats in history.

Bit miner Mara has also joined the fray, putting $8.5 million into convertible bonds to refinance its debt, naturally buying more Bit. The terms are quite sweet: zero interest and a 40% conversion premium.

The real attraction lies in MicroStrategy's stock - or more accurately, its volatility.

How can this stock, trading at $433, raise $3 billion with a zero-coupon bond and a $672.40 conversion price? The answer lies in the stock's explosive volatility, driven and amplified by its Bit holdings. This volatility significantly increases the value of the embedded call option in the bond, which in turn offsets the cost of the bond itself. As a result, the company is able to borrow at a much lower rate than traditional debt.

MicroStrategy's stock is unstable. Its 252-day historical volatility is currently (2024-12-7) 106% (meaning an average daily swing of 6.6%! Its 30-day stock options have an implied volatility 2.5 times that of similar-duration Bit options.

MicroStrategy is not embarrassed by this: in its Q3 earnings report, management loudly proclaimed that MicroStrategy's option trading implied volatility is higher than any S&P 500 stock.

Option prices are derived from the current stock price, strike price, time to expiration, implied volatility, interest rates, and dividends. Aside from implied volatility, all of these factors are known.

Implied volatility measures how much investors think the underlying stock will fluctuate.

Convertible debt is priced based on the company's credit risk, the bond's interest rate, and the value of the call option. The higher the redemption value, the more the issuing company can extract.

In this case, MicroStrategy's stock's incredibly high implied volatility has boosted the option value, allowing the company to raise more funds.

Data from The Block shows MSTR's implied volatility is about twice that of Bit.

Once MicroStrategy has recast itself as a Bit megabull, volatility has soared, first over 70% and then breaking 100%. This dynamic is self-reinforcing: getting more Bit amplifies stock price swings, allowing MicroStrategy to issue convertible debt on ever more favorable terms, which it then uses to buy more Bit - further exacerbating the volatility. So the cycle continues.

Michael Saylor is touting Bit to drive up his stock's implied volatility, allowing him to issue debt as cheaply as possible.

He is both the driver and the accomplice of this mechanism.

Because fixed-income investors now have a way to get Bit exposure. However, for others who want to own Bit, there are better options. MicroStrategy's stock valuation is at least double the value of the Bit it holds. And, let's not forget, its software business is worth virtually nothing. It could even be said to have negative value. Therefore, investors looking to purchase Bit should simply buy Bit or one of the many available Bit ETFs.

As of 2024-12-12, the premium to the current Bit price is 2.2x.

How It Works

Historically, convertible bond trades in the energy sector have been the "juiciest", with implied volatilities reaching 35-40%, while recent tech company convertible bond issues have reached 40-45% levels. According to IFR, MicroStrategy's convertible bond has an implied volatility of 60% in the market, which is unprecedented in the stock-linked market.

Investors in these bonds employ various trading strategies to capture volatility gains, one classic method being the so-called gamma trade. This strategy involves buying the bond and short-selling the stock, dynamically adjusting the short position size to maintain a market-neutral portfolio position. The net effect is to buy low and sell high on the stock, while maintaining a long position in the convertible bond.

The specific mechanics are as follows:

Investors first sell short a proportion of MicroStrategy stock based on the bond's "delta" (a measure of the bond's price sensitivity to stock price changes). As the stock price rises, the bond approaches "par", and the bond's delta increases, requiring the investor to sell more stock to maintain neutrality. When delta reaches 1, the investor's short position will equal the expected number of shares to be received from converting the bond. Conversely, when the stock price falls and the bond is deeply "out of the money", the delta decreases, and the investor needs to buy back stock to reduce the short position. Constant position adjustments can generate profits from stock volatility, regardless of the overall trend.

It can be likened to harnessing wind power: as long as there is wind, no matter which way it blows, the turbine can spin and generate electricity. For the traders, volatility is the "wind" that drives their strategy. For MicroStrategy, its stock is highly suitable for this trade: high volatility, good liquidity, and easy to borrow for short-selling.

The gamma trading strategy is not suitable for retail investors. It is highly complex and requires constant position adjustments.

If the stock volatility calms down, these volatility-based arbitrage opportunities may disappear, leaving the gamma traders' "windmills" idle. (This could happen, for example, if convertible bond investors sell stock on price rises and buy on declines, dampening volatility.)

MicroStrategy's stock price volatility has cooled somewhat in recent weeks, which may have resulted in some losses for investors, though these losses are negligible compared to the lucrative gains from the convertible bond previously.

What Could Go Wrong?

The potential upside for convertible bond holders is if MicroStrategy's stock price rises above the conversion price.

The risks of holding the debt are twofold.

First, assuming the company does not default, if the stock price remains below the conversion price, the bond investors will get their money back. But they will have nothing to show for it over the five-year period.

Here is the English translation:The worst-case scenario arises when people consider how MicroStrategy will repay its $7.2 billion in convertible debt when it matures. Unlike most companies, the answer does not lie in the revenue it generates. Since 2000, their cumulative net income after tax has been negative $1.5 billion. The average quarterly loss for the past eight quarters was $316 million. The last time they achieved quarterly profitability was in 2021. Even at MicroStrategy's peak earning capacity, its cumulative net income is only around $650 million.

The company can issue more stock to pay off its bondholders. This will dilute existing shareholders and may reduce the stock price and the value of convertible options.

Alternatively, MicroStrategy can issue more debt to pay off its old debt. However, if the Bit price falls, bondholders may not accept convertible debt and instead demand higher interest rates.

Finally, they can sell Bit to pay off their bondholders. If Bit trades at a high price, this plan may work. However, if the price is much lower, it could be very problematic. Of course, if one of the world's three largest Bit holders sells a large amount, it could seriously damage the Bit price.

MicroStrategy's 5 previously issued convertible bonds - currently deeply "in-the-money", with conversion prices ranging from $143.25 to $232.72.

What if the Bit price (and MicroStrategy's stock price) crashes? If the situation reverses, how will MicroStrategy repay up to $6.2 billion in bond principal?

Being in-the-money means the conversion value is higher than the bond's face value.

Formula: Conversion value > Bond face value

Investor Tendency:

In an in-the-money state, investors tend to convert the bond into stock, as this can yield higher returns.

The market price of a convertible bond reflects its dual attributes:

Bond value (debt attribute);

Conversion value (equity attribute).

When MicroStrategy's stock price is far above the conversion price, the price of the convertible bond is mainly determined by the stock's conversion value. At the current stock price, the "debt value" of the bond has been completely covered, and even exceeded, by the conversion value of the stock.

Each bond has a unique identifier, such as CUSIP (commonly used in the US bond market) or ISIN (international standard).

Currently, the prices of MicroStrategy's five previous convertible bonds have fully reflected their conversion value, similar to a "par" state.

If the Bit price (and MicroStrategy's stock price) crashes, MicroStrategy will face a catastrophic situation:

First, MicroStrategy's free cash flow cannot cover its debt, and its software business is losing money;

Selling Bit to raise cash may be the last resort, but can you imagine one of the world's three largest Bit holders, who has tirelessly promoted the grand revival of Bit, shill to sell even 10,000 Bit?

And the person who stands up is none other than Michael Saylor?

In this case, the rigid redemption demanded by creditors combined with a sharp drop in the Bit price could create an even bigger shock than the FTX incident.

Numerical Demonstration

The essence of MicroStrategy is a dual Ponzi scheme:

First, the essence of MicroStrategy's convertible bond model is a Ponzi scheme of stock price, using high volatility to earn profits (the gamma trade mentioned above), regardless of whether the stock goes up or down, as long as the volatility is there, there is profit, because this strategy is highly risky, and once the volatility decreases, the convertible bond investors must rely on the stock price to find a buyer, otherwise they will have nothing.

This is a Ponzi scheme of stock price;

Second, the conversion prices of the convertible bonds previously issued by MicroStrategy are roughly $143 to $232, and the current stock price is far above the conversion price, but if Bit drops significantly, and the recent convertible bond conversion price is $672, this means that objectively there needs to be a buyer to immediately take over, but note that even with the most optimistic valuation model, MicroStrategy's stock price is only around $203 to $215 (including its Bit price), so once it cannot be converted, MicroStrategy needs to repay the debt, but MicroStrategy's free cash flow is only around $10 million (2023 financial report); it can only borrow new debt to pay off old debt, which is the second part of the Ponzi scheme, the debt Ponzi.

First, let's evaluate the company's valuation

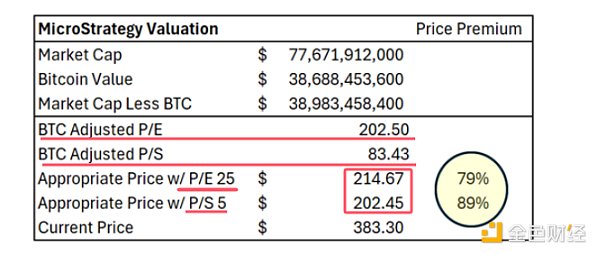

Adopting the most optimistic valuation assumptions as follows: the company's market value minus the market value of its held BTC, combining this metric with the TTM recurring earnings per share, the base business trading multiple is 202.5. Assuming the appropriate P/E and P/S ratios for the base business are 25 and 5 respectively. These are very broad assumptions, as the revenue and earnings per share growth of the relevant businesses are very small in the long run. Under these conditions, the calculated fair value price of MSTR (including its BTC position) is between $202.45 and $214.67.

Please note that according to the most optimistic valuation and my personal valuation model:

MicroStrategy's fair price is between $202.45 and $214.67, while its convertible bonds maturing in 2031 and 2032 have conversion prices of $232.72 and $204.33, which objectively requires MicroStrategy to raise its stock price;

According to the valuation model, MicroStrategy's stock price needs to return to $188.9 to eliminate the premium, and this price is extremely fatal, because this price cannot achieve the conversion price of its 2031 and 2032 convertible bonds.

At the same time, based on the current Bit price ($100,924) and MicroStrategy's stock price ($411), when the Bit price drops 21% (assuming a beta of 3.14 between the stock price and Bit price, this data is calculated based on historical data), the Bit price will be $79,730, and MicroStrategy's stock price will drop to a fatal price, immediately triggering the conversion of all convertible bonds. The entire principal of the rigid debt needs to be redeemed.

Even if the beta is adjusted to 2, the Bit price only needs to drop 33%, to around $67,619;

And don't forget that in March of this year, MicroStrategy's stock price was still running at $200 (considering the stock split), and at that time the Bit price was $70,078.

MicroStrategy cannot stop, because the trigger price behind it exceeds $672.