Author: DWF Ventures; Translator: Jinse Czxiaozou

2024 will be a pivotal year for the Bit world - whether it's from the perspective of institutional participation or the growth of on-chain activities.

Let's summarize the year through the following data.

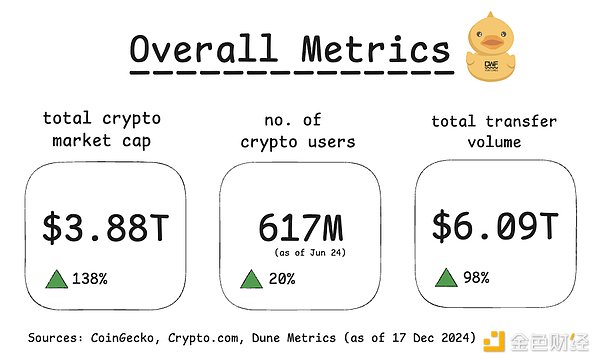

1. Healthy Growth

With the total Bit market Cap exceeding the historical high of 2021, the market has rebounded significantly, reaching $3.7 trillion. Not only is liquidity increasing, but the number of users and trading volume are also rising, indicating healthy growth and utilization.

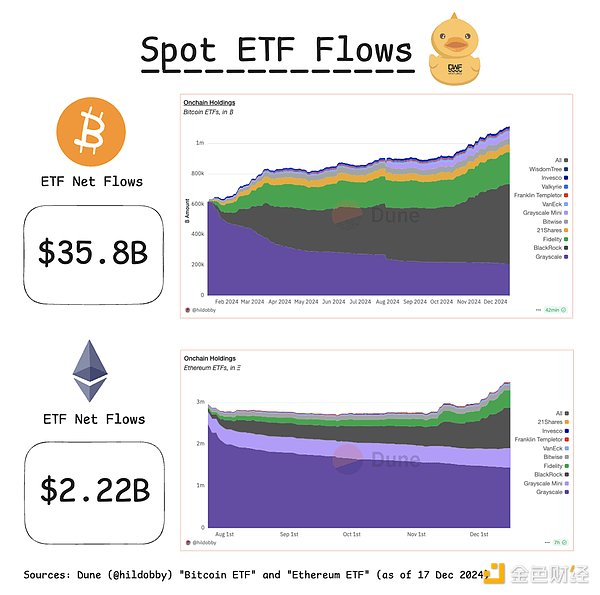

2. ETF & Institutional Capital Inflow

A major catalyst this year was the launch of the BTC ETF in January and the ETH ETF in July. In addition to a lower entry threshold, these capital inflows also indicate that traditional investors have a huge interest in Bit assets, and this interest is growing. The on-Chain total holdings of the BTC ETF have grown to 1.1 million BTC, doubling from the beginning of the year.

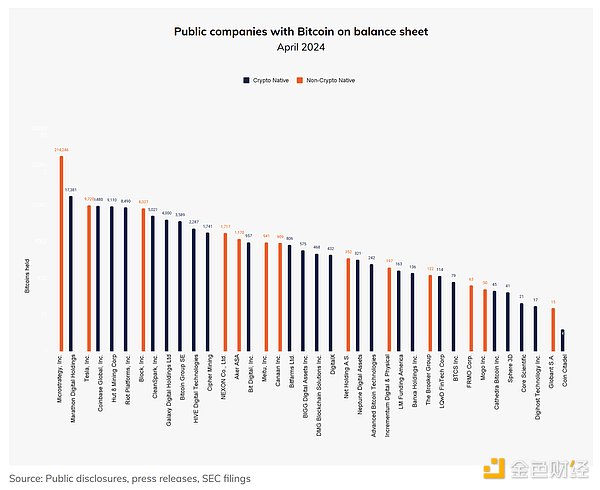

Many large companies (including non-Bit companies) are also increasing their exposure to BTC and other Bit assets. MicroStrategy's BTC holdings, led by Saylor, have continued to double, and the current holdings have increased to 439,000 BTC.

3. Stablecoin Opportunities

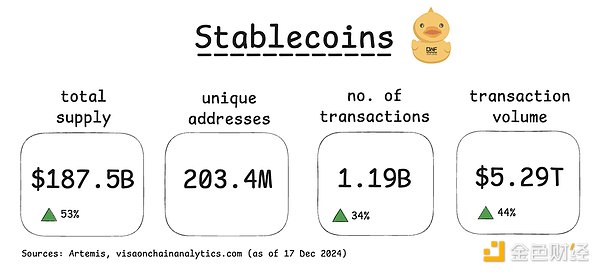

Stablecoins are crucial to the Bit ecosystem, as they enable seamless in-and-out of assets and are often seen as an indicator of new capital inflow. The total supply of stablecoins has reached a historic high of $187.5 billion. Trading frequency and trading volume have also grown by more than 30-40%. Notably, trading volume has remained stable even in a volatile market environment, indicating strong use cases beyond just trading.

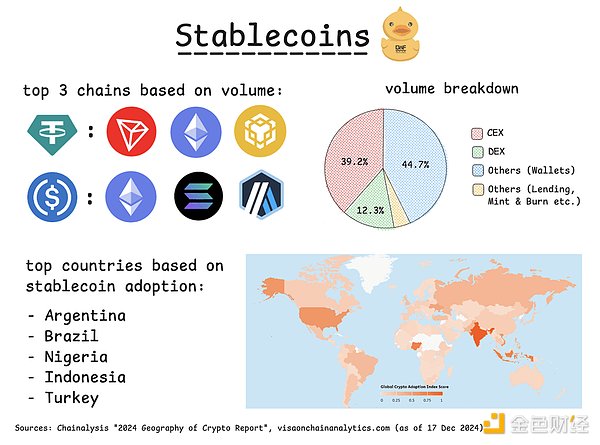

TRON DAO, Ethereum Foundation, BNB Chain, and Solana are processing the largest on-Chain stablecoin transactions. L2s like Arbitrum and Base have also experienced massive growth in USDC trading volume/user count. CEXs (Centralized Exchanges) have been more active than DEXs (Decentralized Exchanges), but this trend may be shifting.

The recently launched BlackRock and Ethena Labs USDtb allow traditional funds to easily access DeFi while maintaining fund security. As access becomes regulated, we can expect to see more capital flowing on-Chain.

Over the past year, the stablecoin market in Latin America and Africa has grown by over 40-50%. In these regions, the stablecoin market is thriving due to a strong demand for trustless currency hedging. More investments are flowing into these regions, such as Tether launching educational programs and Circle expanding its payments business to Latin America. Therefore, we expect significant growth in this area in the new year as well.

4. On-Chain Activity

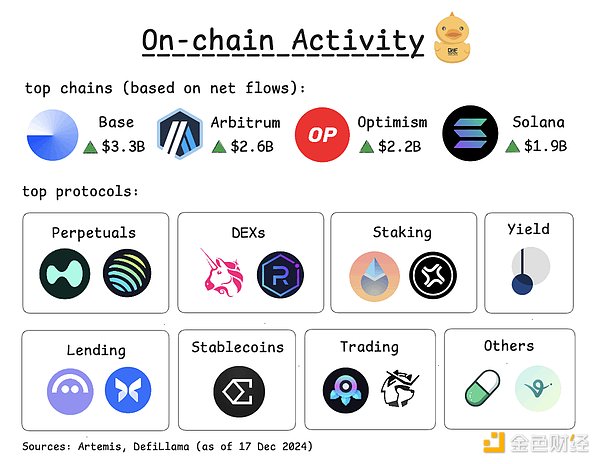

L2s like Base, Arbitrum, and Optimism, as well as non-EVM Chains like Solana, have seen the highest net inflows as users migrate to lower-cost, faster Chains. The fastest-growing areas are perpetual contracts and DEXs, with trading volumes up over 150% and TVL up 2-3x.

Pump.fun ignited the MEME Bit frenzy, driving a significant surge in trading volume, from which Raydium benefited, and had a ripple effect on other ecosystems. This also led to the growth of trading bots, with the usage of Photon and BONKbot continuing to increase, ranking among the highest fee-generating protocols in the Bit space.

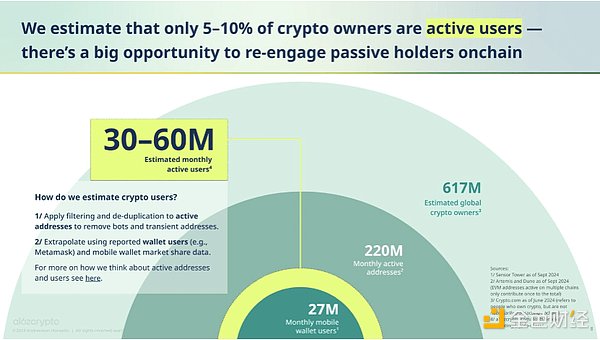

Considering that only 5-10% of Bit holders actively participate in on-Chain transactions, there is still significant room for growth in on-Chain activity.

Mobile-friendly interfaces, such as the TON mini app, have proven successful, attracting over 50 million users to the TON Chain. Therefore, user experience and user retention mechanisms will be key for protocols to move forward.

5. Conclusion

2024 has been an incredible year, and we believe that 2025 will see the Bit market gain strong tailwinds.