2024 is a turbulent year for Web3 crypto enthusiasts, as the entire Web3 market slowly awakens from its slumber. BTC's fourth halving event marks the beginning of a four-year bull market cycle; global crypto policies are becoming clearer and more compliant; the Trump election dust has settled; CZ goes to prison and is then released; the Federal Reserve initiates rate cuts; various asset ETFs, etc. Each of these events is driving the forward momentum of the Web3 industry.

BTC has also doubled in value from the $40,000 level to a new high of $108,365. So where are we now in the bull market cycle? How can we capture the top to escape?

Exploring the Peak of This Bull Market Cycle Through BTC's Historical Trends

History is remarkably similar

Common points in BTC's previous three bull market cycles:

1. Halving events occur at the midpoint of the bull market cycle

2. Consolidation and retracement to the low point occur after each halving

3. Bull market peaks typically occur around the 70th week after the halving

BTC's First Bull Market Cycle (2011-2013)

During the bull market from 2011 to 2013, the BTC halving event occurred on November 28, 2022 (the midpoint of the year), which was the 54th week after the low point on November 14, 2011, and the bull market peak also occurred in the 54th week after the halving.

BTC's Second Bull Market Cycle (2015-2017)

During the bull market from 2015 to 2017, the BTC halving event occurred on July 9, 2016 (the midpoint of the year), which was the 77th week after the low point on January 12, 2015, and the bull market peak also occurred in the 77th week after the halving.

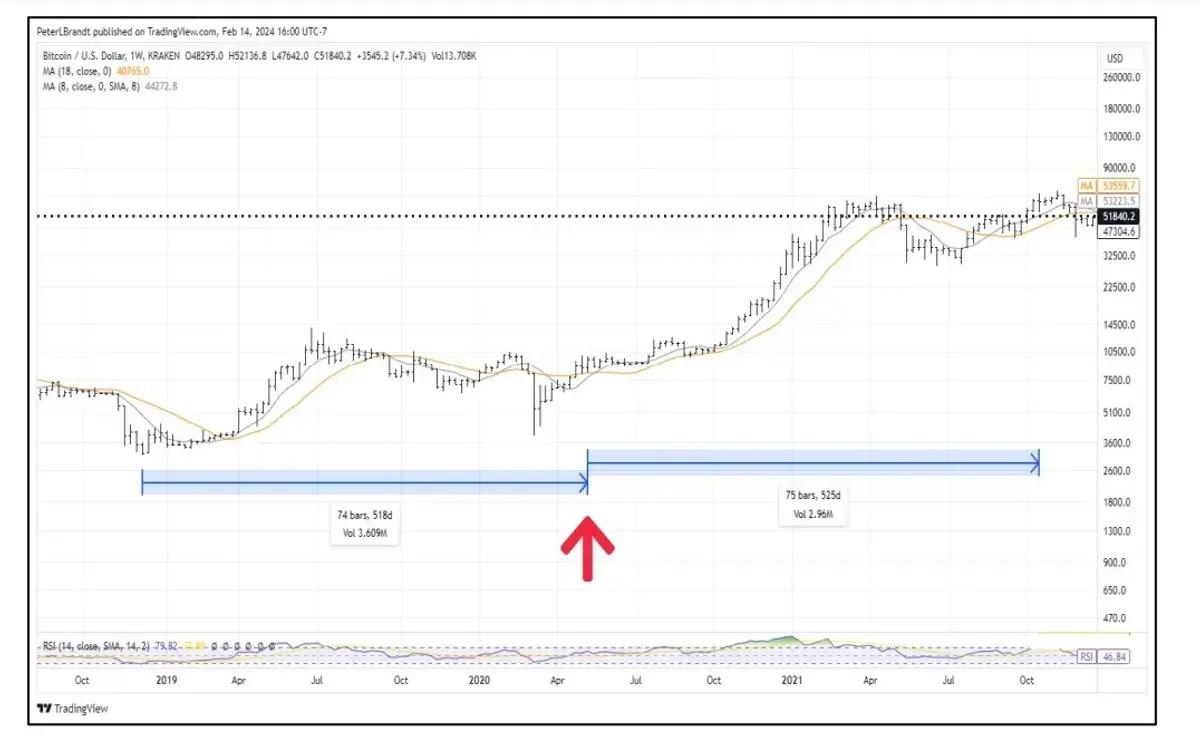

BTC's Third Bull Market Cycle (2018-2021)

During the bull market from 2018 to 2021, the BTC halving event occurred on May 11, 2020 (the midpoint of the year), which was the 74th week after the low point in December 2018, and the bull market peak occurred in the 75th week after the halving.

Prediction of BTC's Fourth Bull Market Cycle (2022-2025)

Based on the above experiences and the fact that BTC's next halving will occur on April 20, 2024, the bull market is expected to start by the end of this year. The peak of this bull market is estimated to be reached around the 75th week after the halving, which is in early October 2025. This timeline also coincides with the end of the Federal Reserve's rate cut cycle, and BTC has the potential to reach the $150,000-$200,000 range.

Retail Investors Indifferent to the Bull Market? The Market Sees a Significant Correction - Are We Back in a Bear Market?

As the year-end approaches, BTC and other major and altcoin assets have seen significant pullbacks, causing many to panic and believe that the bear market has returned. For most retail investors, the experience of this bull market has been quite different from the previous three - there is a lack of FOMO frenzy, and even a sense of indifference, as BTC breaks through the $100,000 mark with little fanfare or internal excitement.

Why is this the case? The author believes:

1. The bullish sentiment around BTC's halving has been priced in advance, as everyone has already firmly believed that BTC will reach $100,000, and its current price is just the realization of this expectation.

2. The assets, circulation, management, and ecosystem of Web3 are undergoing transformations. New assets in the MEME sector are constantly emerging, diluting liquidity, and providing more investment choices, leading to a fragmentation of capital into BTC, MEME, NFT, and other factions, lacking the interaction that would drive a strong upward momentum.

3. The issuance of new assets lacks sustainability, as most community tokens are chasing hot spots without the composability and scalability seen in the previous DeFi bull market. As a result, the lifespan of new assets is short, the sense of a zero-sum game is stronger, and most people prefer to "bet big with small" on new asset types, relegating BTC to being the main trading chip for institutions and big players, further reducing retail participation and attention.

In fact, based on the author's observations over the years, the market usually experiences a significant correction around December, which is a healthy cyclical adjustment. This is due to overseas Christmas, when retail investors need to cash out for the holidays, and institutions need to perform various asset settlements and financial audits at the end of the year, optimizing their asset allocation. While this leads to a corrective market in the short term, the author believes that the overall market is still in the early stages of a bull market cycle. Bull markets require a rhythm of "inhaling and exhaling" - just like human breathing, constant inhalation or exhalation will ultimately lead to suffocation. As long as we maintain rationality, each correction in the turbulent market is an opportunity to increase our holdings. As long as we are clear that we are in a long-term bull market cycle, every pullback is a chance for us to accumulate more.

How to Escape the Top? What Indicators Can We Reference?

1. Market Sentiment Indicators

Greed and Fear Index: Extreme greed in the market often signals that prices may be approaching a top.

Social Media Hype: If relevant keywords (such as "Web3", "DeFi", "NFT", etc.) consistently top social media platforms, it may indicate overheated market sentiment.

KOLs and Media Trends: When a large number of opinion leaders are actively promoting, and mainstream media is extensively reporting, it may be a signal that the market is approaching a bubble stage.

2. Technical Analysis

RSI (Relative Strength Index): An RSI value above 70 may indicate that the market is overbought.

Volatility: Abnormally high price volatility may be a signal of a market top.

Key Moving Averages: If the price is significantly deviating from the 200-day moving average, it may suggest an overheated market.

3. On-Chain Data

Active Address Count: When the number of active addresses stops growing or even declines, it may signal a weakening of market momentum.

Transaction Volume: If the price is rising but on-chain transaction volume is decreasing, it may be a top signal.

Whale Activity: Observing the transfer and selling behavior of large holders. If whales start to sell, the market may be approaching a top.

4. Capital Flows

Stablecoin Supply: If a large amount of capital flows from crypto assets to stablecoins, it may indicate a decline in investor confidence in the market.

Exchange Net Inflow/Outflow: When a large amount of tokens flow into exchanges, it may suggest that investors are preparing to sell.

Institutional capital flows: If institutional capital inflows decrease or even withdraw, it may be a signal of a market top.

5. Macroeconomic and policy environment

Changes in macroeconomic interest rates: When the central bank raises interest rates or tightens liquidity, the cryptocurrency market may be affected.

Regulatory trends: If there are major regulatory adverse policies, it may trigger a market top pullback.

Global economic signals: For example, a strong US dollar and geopolitical events may put pressure on the market.

6. Market cycle characteristics

Historical patterns: Review the characteristics and time cycles of past bull market tops (such as 12-18 months after the Bitcoin halving).

Surge in overvalued projects: When the market is flooded with overvalued projects with low actual application value, it may be a top signal.

Proliferation of "100x coins" phenomenon: The frequent occurrence of new projects skyrocketing in a short period of time may be a sign of a market bubble.

7. Community and investor behavior

Excessive retail participation: When a large number of new investors unfamiliar with the industry rush in, the market may have overheated.

Spread of FOMO sentiment: The widespread fear of missing out (FOMO) mentality is a common feature of market tops.

Changes in holding structure: Long-term investors (HODLers) turn to short-term holding, or the proportion of retail holdings increases significantly.

8. Technology and product ecology

Stagnation of technological progress: When the project's technological progress and application implementation have not kept up with the increase in market value, the market overheating needs to be vigilant.

Decrease in the utilization rate of decentralized products: If the user count and total value locked (TVL) of on-chain protocols decrease, it may indicate a weakening of market interest.

In summary, the author believes that the safest method at this stage is to add positions to mainstream assets and top assets during each pullback, reduce the cost of holding, and increase the chip count. Combining the historical cycles of BTC to the top, the highest point of this bull market for BTC may appear around October 2025. However, escaping the top of BTC is basically a very dangerous operation, so it is more important to manage the position reasonably before the high point appears, and wait for the capital outflow from BTC to drive the altcoin catch-up rally.