Author: Tanay Ved, Cooper Duschang Source: Coin Metrics Translator: Shan Eoba, Jinse Finance

Introduction

2024 is a landmark year for the digital asset industry, from the long-awaited approval of a spot Bitcoin ETF to the end of the US presidential election. Institutional capital entering the market has driven Bitcoin prices to new highs and fueled the development of the entire ecosystem. Stablecoins have surged to over $200 billion, tokenization of risk assets is gaining momentum, and corporate demand for Bitcoin is accelerating at an unprecedented pace. Bitcoin has undergone its quadrennial halving, Ethereum has expanded in blob form, and the Solana ecosystem has also rapidly expanded. At the same time, old narratives are fading, making way for emerging themes.

Until recently, the cryptocurrency industry faced strict scrutiny from the US Securities and Exchange Commission and an uncertain interest rate hike cycle. Now, the optimistic sentiment is back. Supported by a US government that is favorable to cryptocurrencies and the renewed enthusiasm of the entire ecosystem, Bitcoin has surged to over $100,000 after the election. These developments have positioned the industry on firm footing as it moves towards 2025, ready to explore future transformative trends and opportunities.

Market Outlook

Assets, Themes, and Sectors

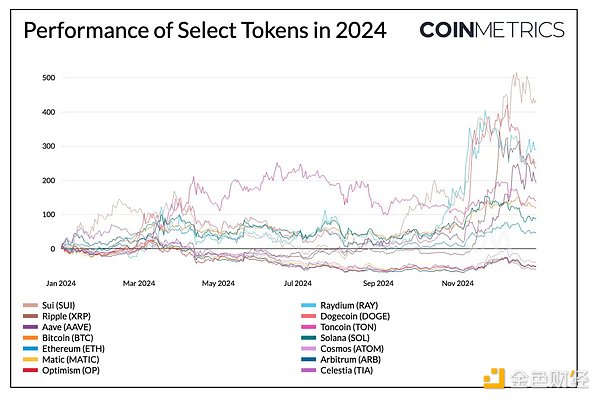

Outlook: By 2025, we expect selective outperformance of emerging and mature categories, such as Layer 1 blockchains, Ethereum, Solana, and DeFi on Base, as well as the evolving intersection of cryptocurrencies and artificial intelligence.

Bitcoin (BTC)

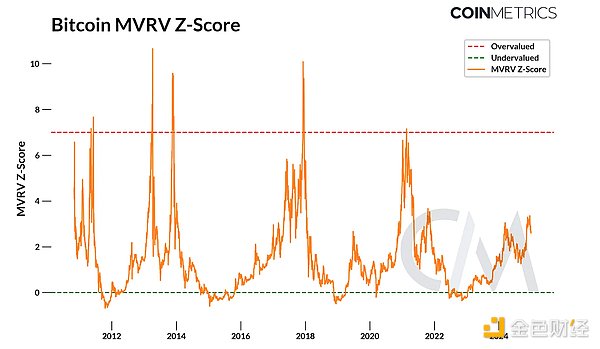

Outlook: Supported by cyclical growth trends and accelerating structural adoption, Bitcoin (BTC) will test the $140,000 to $170,000 price range by 2025. Against a backdrop of reduced supply, continued ETF inflows, corporate capital adoption, and potential nation-state adoption will drive demand for BTC.

Ethereum (ETH)

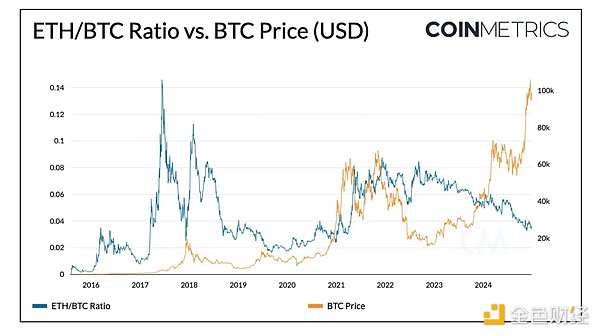

Outlook: With the ETH/BTC ratio reversing to 0.055, Ethereum's lackluster performance will disappear. We expect Ethereum (ETH) to reach a price range of $7,500-$10,000, driven by increased institutional demand, the maturation of the Layer 2 ecosystem, and Ethereum's continued dominance in stablecoins, RWA tokenization, and DeFi.

Airdrop Trends

Outlook: While airdrops may continue to disappoint speculators in 2025, new rounds of airdrops and adjusted allocation structures and processes may result in more satisfied users being rewarded for their participation.

Sectors

Exchange Traded Funds (ETFs)

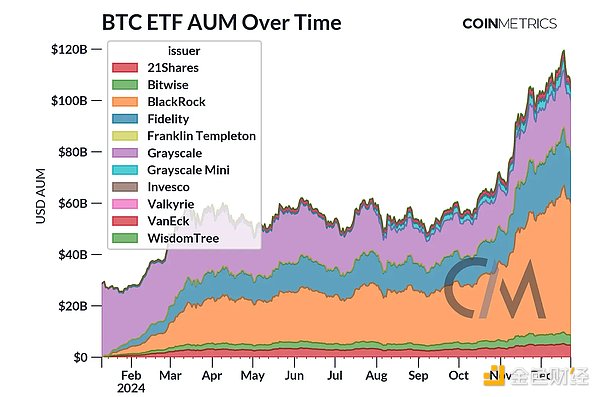

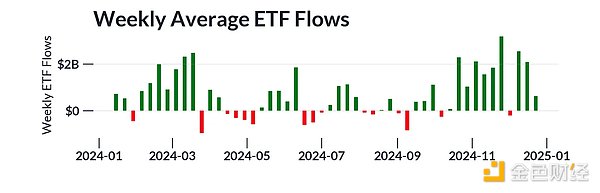

Outlook: With a more relaxed regulatory environment under the new administration, the digital asset space will become clearer, and we expect broader institutional participation to sustain significant inflows into the US spot Bitcoin ETF. AUM is expected to more than double, with Bitcoin holdings exceeding 2.5 million BTC by 2025.

Infrastructure

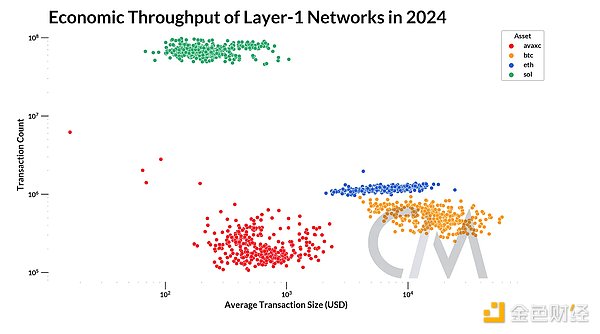

Layer 1

2025 Outlook: The Layer 1 technology landscape will transcend EVM, with demand for block space coalescing around the EVM, Ethereum, and Solana ecosystems as the base layer and scaling solutions continue to advance. The "Layer 1 premium" will remain strong.

Layer 2

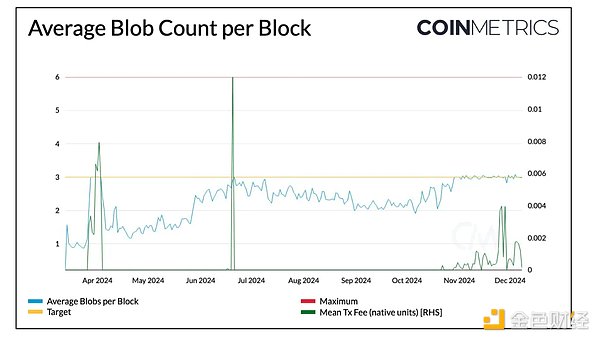

Outlook: Blob space will play an increasingly important role in Ethereum's scalability. As more institutional (Ink Chain, Soneium) and custom (Unichain) Layer 2s are built on Ethereum, blob fees are expected to make up a larger share of Ethereum's total fee spend.

With plans to increase the target blob rate in Ethereum's Pectra upgrade, Layer 2s will need to continue monitoring their blob inclusion while ensuring cost minimization relative to alternative data availability solutions.

Applications

Stablecoins

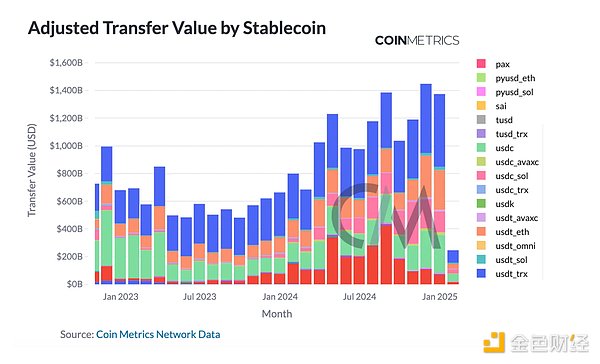

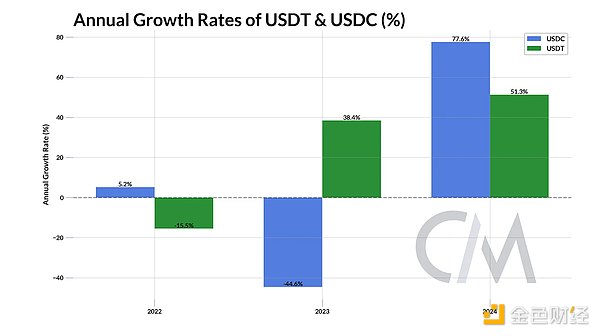

Outlook #1: Stablecoins grew by around 50% in 2024, surpassing $200 billion, with over $12 trillion in total transaction volume. We expect stablecoin supply to exceed $400 billion, with transaction volume growing over $20 trillion by 2025, driven by the bull market, issuer expansion and network growth, stablecoin legislation, and consumer and enterprise adoption of payments and financial services.

Outlook #2: USDT and USDC are likely to maintain their top two stablecoin positions in 2025, exceeding their 2024 growth rates and retaining market dominance. However, "other" stablecoins - driven by new issuances and growth in existing alternatives - are expected to narrow the gap in total supply and capture an increasingly larger share (around 30%) of the stablecoin market.

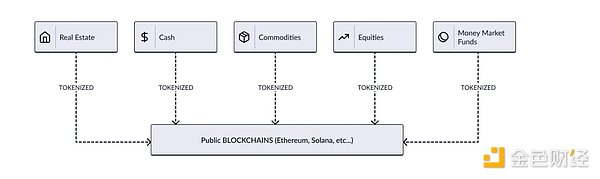

Real-World Asset (RWA) Tokenization

Outlook: With the evolving regulatory environment and institutions seeking more accessible capital and liquidity rails, we expect a surge of tokenized assets entering major blockchains. As a result, the RWA market assets entering public blockchain rails will double. We expect at least one company listed on the New York Stock Exchange or Nasdaq to tokenize its stock on a blockchain.

Conclusion

While there are many positive momentum entering 2025, it must be acknowledged that certain macroeconomic and crypto-specific risk factors still exist. Inflation, though better than before, remains difficult to eliminate, and a slowdown in the "Big Tech" revenue could have ripple effects on the cryptocurrency industry. Crypto-friendly regulations failing to materialize as expected, and the reversal of MicroStrategy's Bitcoin accumulation strategy, are some specific factors that may pose headwinds in 2025. Therefore, we maintain a cautiously optimistic outlook for the year ahead.