The Ethereum Foundation smiled slightly and sold another 100 ETH...

- Original: Odaily ([@OdailyChina])

- Author: Azuma ([@azuma_eth])

The world has long been suffering from the Ethereum Foundation (EF).

As the community's disappointment with ETH's weak performance this cycle gradually accumulates and finally erupts, the call for reforming the EF is also growing louder.

Over the past few days, the entire Ethereum community has been discussing the EF's leadership structure, personnel composition, operating model, and financial plans. The current EF Executive Director, Aya Miyaguchi, has been heavily criticized by the community, and Vitalik himself has had to publicly state that he is "undertaking a major overhaul of the EF's leadership structure" under pressure.

Time has come to this Monday, and the discussion has further deepened. The founders and executives of several leading Ethereum ecosystem projects have come forward to condemn the EF's many sins, and the intensity of their words shows that the major projects have long been resentful of Ethereum's performance.

The following is a collection of views compiled by Odaily.

Table of Contents

ToggleSynthetix, Infinex Founders: EF Should Require L2 to Use Revenue to Buyback ETH

Synthetix and Infinex founder Kain Warwick was the first to attack.

On Monday afternoon, Kain posted on X saying: "If I were to run the EF, I would definitely put pressure on Layer 2 to use their sequencer revenue to burn ETH. Ethereum has a lot of leverage in this negotiation..."

Curve Founder: EF Should Immediately Abandon L2 Strategy

Following Kain, Curve Finance founder Michael Egorov also jumped out to attack Layer 2, but his wording was more aggressive.

On Monday afternoon, Egorov posted on X saying that the EF's top priority should be to abandon the Layer 2-centric roadmap and instead focus all efforts on expanding Layer 1.

In subsequent discussions with community members, Egorov also directly stated: "Layer 2 is not a moat, but a bandaid."

Aave Founder: 12 Measures to Save the EF

In the evening, Aave founder Stani Kulechov posted a long article on X stating that he had read the EF's annual budget report and believed that the EF needed to undergo a thorough reform in 12 aspects to achieve better sustainability:

- Immediately reduce the burn rate from $130 million to $30 million;

- Reduce the number of employees to 80;

- Carefully review who can stay. Remove senior positions, consultants, any part-time roles, interns, freeloaders, cockroaches and parasites;

- Prohibit consultants or any conflicts of interest;

- Ensure 80% of employees are technical;

- Split all technical teams into small 5-person teams, each focused on a specific area and specialty;

- The leadership should be a 5-person committee, selected based on performance, with one as the chairman responsible for VB;

- Part of the non-technical team should focus on financial management (done internally);

- Diversify financial investments into various long-term sustainable assets (LRSTs) and well-fundamentaled and profitable DeFi and non-DeFi projects built on Ethereum;

- Diversify staking rewards into stablecoins and invest the funds into DeFi;

- Borrow from Aave to manage finances and sell periodically when ETH outperforms other assets;

- Create a sustainable revenue model from transaction or staking fees to fund a reasonable EF budget.

Ethena Former Growth Lead: EF Should Focus on DeFi

Seraphim, the former Growth Lead of Ethena and also the former Expansion Lead of Lido, also posted his views on reforming the EF.

Seraphim mentioned that Ethereum needs two paths to save itself, one is that the EF should focus on DeFi, and the other is that ConsenSys, led by Ethereum co-founder Joseph Lubin, should emulate Microstrategy's approach to BTC. As long as these two points can be achieved, ETH will soon break through $6,000.

Wintermute founder: The potential death spiral of Ethereum

Although the top-tier market maker Wintermute is not exclusive to the Ethereum ecosystem, the institution is directly involved in market making for a large number of Ethereum ecosystem projects, so its stance is also of great significance to Ethereum.

In the evening, founder and CEO Evgeny Gaevoy posted about the potential for a death spiral in Ethereum.

Evgeny said that the biggest internal contradiction in Ethereum right now is: the more ETH is used for "gambling", the more Dapps related to finance are running on Ethereum, the higher the price of ETH, the higher the security; conversely, if there is no gambling behavior, and ETH is only used for transfers on Zazulu, then the price of ETH will be very low and the security will also be very low. As the price of ETH declines, fewer and fewer Dapps that still believe Ethereum is secure will flee to other chains, further reducing the price of ETH, which could be a very large death spiral.

Therefore, any blockchain must incorporate gambling, speculation, and broader financial applications as part of its product, otherwise it will be seen as insecure.

In the midst of public outrage, the EF chooses to sell again...

In the face of collective condemnation and unabated public outrage, the EF has once again chosen an unexpected move.

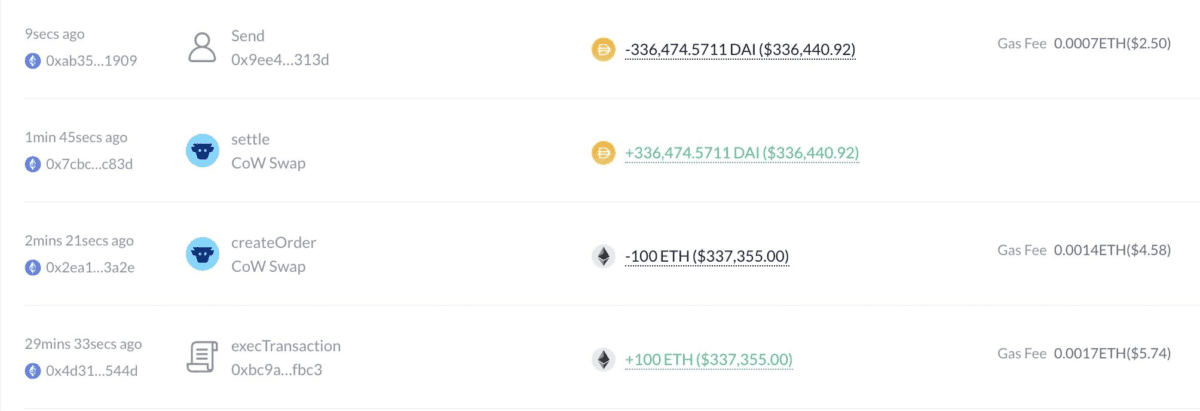

Around 6:20 pm, the EF's address 0xd77...1f4 used for small-scale high-frequency ETH sales sold another 100 ETH, with an average selling price of $3,364.

As a long-term ETH holder, I find it hard to imagine why the EF would make such a "low total value but extremely symbolic" move at such a sensitive time, especially when the community has actively suggested that the EF use staking rewards to replace direct sales, and this proposal has also been acknowledged by Vitalik to be further explored.

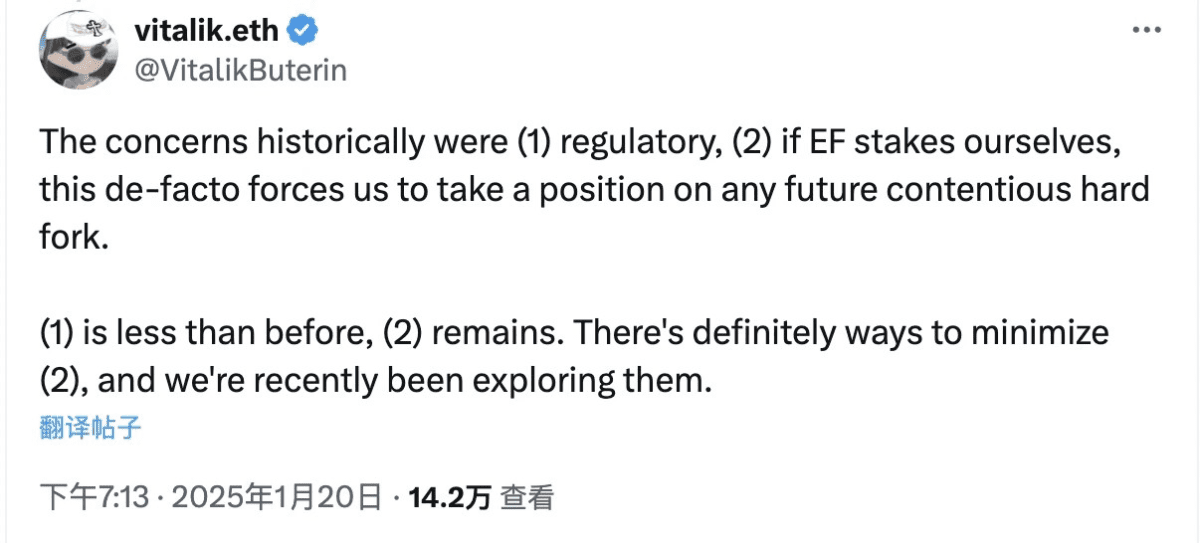

You didn't read it wrong, as the top-level organization in the Ethereum ecosystem architecture, the EF hasn't even put its ETH holdings into staking. Vitalik's explanation for this is, first, concerns about regulatory issues; second, the neutrality issue of the EF, if the EF stakes on its own, it will force them to take a stance on any future controversial hard forks.

I won't say much about the regulatory issue for now, as the overall regulatory environment has gradually become less of a problem.

As for the second point, does this explanation really hold water? When Solana is pressing hard, and the competition has reached the stage of life and death, the EF is still "avoiding embarrassment" for hypothetical future situations.

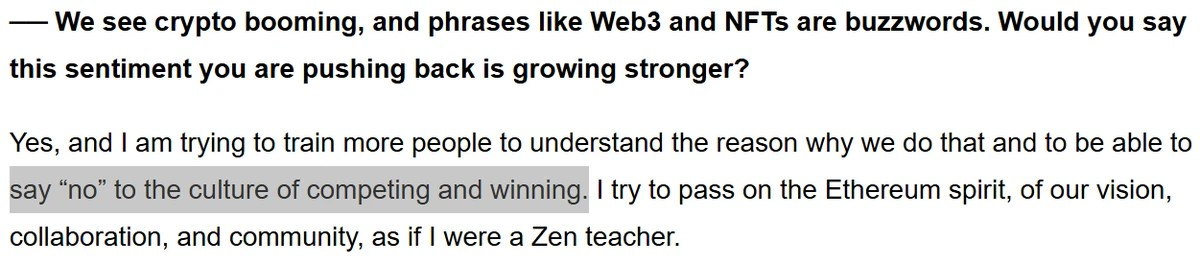

Oh yes, the EF also doesn't seem to care about competition - today the Ethereum community has dug up what Aya Miyaguchi said in a previous interview: "I'm training people to say no to the culture of competition and winning."

At a loss for words, I hope the day of real change will come soon.