How did $TRUMP become the top influencer in the crypto circle overnight?On January 17, 2025 at 10 PM (Taiwan time), $TRUMP started minting on the Solana chain, and the official liquidity address injected 10% of the total tokens. By 9 AM on January 18, the full 20% liquidity injection was completed. On the same day at 10:44 AM, following a social media post by the incoming US President Trump confirming the $TRUMP, the token price surged significantly. Between 7 PM and 11 PM that day, the first wave of exchanges listed the perpetual contracts, and the next day the second wave of exchanges listed the spot trading, with the price rising from 10u to 80u, and the total circulating market cap (FDV) reaching a peak of around 800 billion u. This report will deeply analyze the key events driving this token release and the on-chain transaction flow data.

1. Project Fundamentals Analysis

1.1 Basic Information

Token Name: OFFICIAL TRUMP (TRUMP)

Issuance Chain: Solana

Token Address: 6p6xgHyF7AeE6TZkSmFsko444wqoP15icUSqi2jfGiPN

Issuance Method: Multi-signature wallet minting

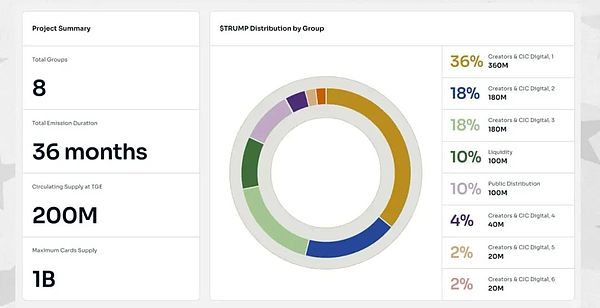

1.2 Token Economic Model

Maximum Supply: 1B (1 billion)

Circulating Supply: 200M (200 million)

Issuance Cycle: 36 months

TGE Unlock Ratio: 20% (Liquidity Pool + Public Distribution)

2. Token Allocation Structure Analysis

2.1 Allocation Percentage Breakdown

Core Allocation (72%)

Creators & CIC Digital 1: 36% (360M)

Creators & CIC Digital 2: 18% (180M)

Creators & CIC Digital 3: 18% (180M)

Market Operations (20%)

Liquidity Pool: 10% (100M)

Public Distribution: 10% (100M)

Other Allocations (8%)

Creators & CIC Digital 4: 4% (40M)

Creators & CIC Digital 5: 2% (20M)

Creators & CIC Digital 6: 2% (20M)

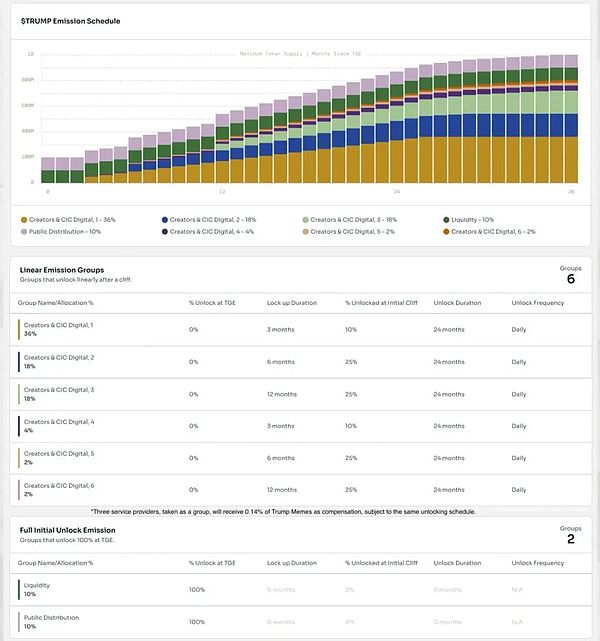

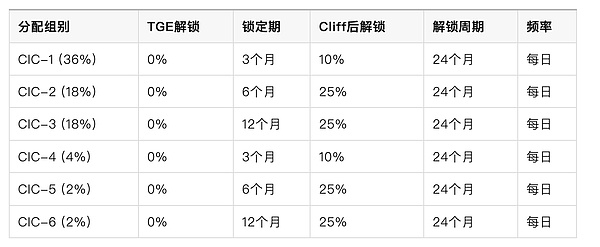

2.2 Unlock Mechanism Analysis

2.2.1 Linear Unlock Group (80% of Total)

Liquidity Pool (10%): Unlocked at TGE

Public Distribution (10%): Unlocked at TGE

TRUMP/USDC Pool: 100,000,000 TRUMP / 0 USDC

TRUMP/SOL Pool: 0 TRUMP / 50 SOL

2.2.2 Instant Unlock Group (20% of Total)

3. Market Behavior Analysis

3.1 Key Timeline Analysis

Key Event Summary:

January 17, Taiwan Time

22:01 - Trump token minted on Solana network

22:27 - Official liquidity address started injecting liquidity, injecting 100,000,000 TRUMP (10% of total tokens)

22:58:36 - https://gettrumpmemes.com/ official website launched (reference)

January 18, Taiwan Time

09:01 - Liquidity injection completed

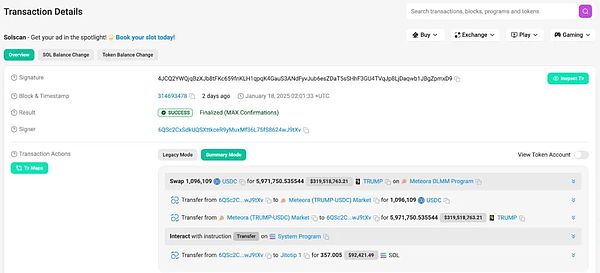

10:01 - First large transaction ($1,096,109) appeared

10:44 - Trump's social media post

19:00-23:00 - First wave of exchanges listed perpetual contracts (Gate.io, Hyperliquid, Bitget, HTX, Binance, Bybit)

January 19, Taiwan Time

3:30-15:20 - Second wave of exchanges listed spot trading (Kraken, OKX, Binance, Bybit, Coinbase)

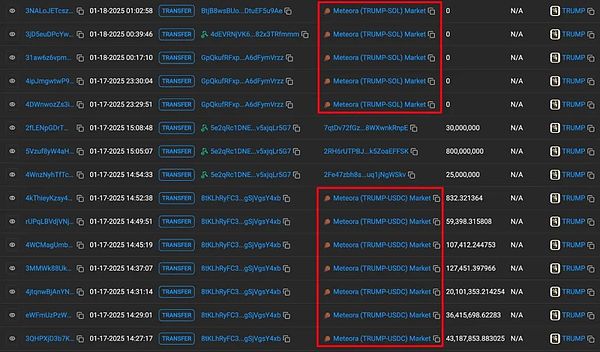

3.2 Liquidity Deployment Analysis (Initial Liquidity on Meteora)

Initial Liquidity Configuration (Meteora Pool):

Characteristics:

Dual pool strategy

Conservative initial pricing

Reserved price discovery space

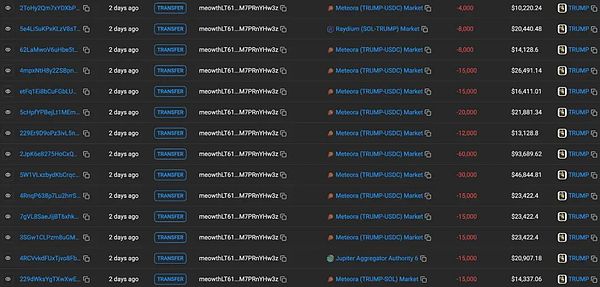

3.3 Suspicious Trading Behavior Analysis

Time Characteristics

Capital Deployment: 4 hours before opening

Entry Timing: First minute

Profit-taking: Batched

Operation Tactics

Initial Position: $1 million scale

Dispersed Strategy: Split into 10 sub-addresses

EPKrfFVt2CoaUnCo8eMauH3PEsK3rwyPQefxGd1zEi8m

2311zgVvwvWkGnG8ZjiKCzE9ASSpf4peoUxEsXuVEJ9A

H2ikJvq8or5MyjvFowD7CDY6fG3Sc2yi4mxTnfovXy3K

2RssnB7hcrnBEx55hXMKT1E7gN27g9ecQFbbCc5Zjajq

AETvgbNUjrjqQCr6TbDk8wNvvSDYmUUaJAu1vVXfsMSa

5YHnbqDfPonA7PbuY282kigRVBU4Db62DC62z3C61qXG

cGxeYN6F7T9aELwjLPeL3hnJNscGU7EHg5CEsP4B3Hz

8zgKeSDpjHmDtD666y6fSZMWekvA6rQTMGynTcUaQGdr

5QiXtr1GSJcadW9WoAXn9LtZ4Zx5W9BfSWgPKkN5grkh

meowthLT61GwsPZCfdRcNXwSDPp1p6bNRM7PRnYHw3z

Profit Scale: Over $20 million cashed out

3. Transaction Information

Transaction Record

Transaction Address: 6QSc2CxSdkUQSXttkceR9yMuxMf36L75fS8624wJ9tXv

4. Exchange Listing Strategy Analysis

4.1 Listing Time Distribution

January 18

(Listing time based on each exchange's announcement (Taiwan time))

Gate.io

Spot Listing January 1810:58:56

Hyperliquid Perpetual Contract January 18 13:25

Bybit Pre-Market Trading January 18, 14:51

BYBIT Spot Listing Listing AnnouncementJanuary 18, 17:24

Binance Perpetual Contract January 18, 18:43

Gate.io

Perpetual Contract ListingJanuary 18, 19:23

Bitget Perpetual Contract January 18, 20:05

Bybit Perpetual Contract January 18, 21:27

HTX Perpetual ContractListing Announcement (January 18)January 18, 22:56

Kraken Spot Listing January 19, 3:33

OKX Spot Trading January 19, 11:00

OKX Perpetual Contract January 19, 11:40

Coinbase Spot Listing January 19, 11:50

Binance Spot Listing January 19, 12:05 - Listing Announcement (January 19, 16:30)

Robinhood Spot Listing January 20, 13:16

Diversity of Choices:

Spot Trading

Perpetual Contracts

Leveraged Trading

Timing:

Rapid coverage of mainstream exchanges

Concentrated listing on all major exchanges within 48 hours

Perpetual contracts listed prior to spot

Concentration Risk

80% of tokens controlled by the core team

Long unlock period (36 months)

Large daily unlocking volume in the future

Liquidity Risk

Unbalanced initial liquidity allocation

Concentrated large holding addresses

Insider Trading Risk

Pre-deployment of capital

Large buy orders

Dispersed profit-taking

Price Volatility Risk

Concentrated exchange listings in the short term

Strong speculative sentiment

Ongoing unlocking pressure

January 19

January 20

4.2 Listing Characteristics

5. Risk Analysis