As Bitcoin plunged 10% in a single day and Ethereum fell below the critical support of $2,500, the Altcoin index hit a new low in just 3 months, and the crypto market has officially entered a technical bear market.

This liquidity withdrawal that began at the end of 2024 finally evolved into extreme panic across the entire market on February 26, 2025.

This article will start from the current market signals, extrapolate the evolution path of the bear market, and construct a systematic framework for buying the dips based on the characteristics of crypto assets.

Bear Market Projection - The Darkest Hour and Structural Changes in the Crypto Market

I. Collapse and Reconstruction of the Industry Ecosystem

The current "scapegoat war" in the Solana ecosystem has kicked off the first stage of the bear market. The developer community blames the capital side for cashing out too early, while the VCs point the finger at the technical defects of the protocol layer, and the community directly faces the fact that meme has damaged the Solana ecosystem - a classic case of "success leads to failure". This "project-capital-community" triangular game will permeate the entire bear market cycle.

From a historical perspective, exchanges will implement a "2:1 layoff rule" in the middle of the bear market: for every 1 compliance expert hired, 2 market operations personnel will be laid off. This structural adjustment reflects the industry's shift from expansion to compliance-driven survival.

It is worth noting that leading exchanges may take the opportunity to complete a "generational change". Just as Binance overtook the market through its futures business during the 2018 bear market, the breakthrough point in 2025 may lie in the RWA (Tokenization of Real-World Assets) custody and cross-chain derivatives track, which requires exchange teams to have compound capabilities in traditional finance and blockchain, and a reshuffle of talents is inevitable.

II. Vicious Cycle of Capital Flows and Market Sentiment

Web3 KOLs may collectively return to Web2, which is essentially the collapse of the industry's capital funnel. According to on-chain data monitoring, the average price of KOL commercial orders has dropped from $50 per post in December 2024 to the current $15 per post, a 70% drop. This "content winter" will trigger three chain reactions:

1. The efficiency of market information transmission will decline, forcing project parties to turn to institutional roadshows;

2. Community governance will stall, and the DAO proposal pass rate may fall below 20%;

3. The cost of acquiring new users will soar, and DApp daily active users will experience a 30%-50% decline.

III. The Ebb and Flow of Regulatory Policies

Bear markets are often accompanied by the release of regulatory headwinds. Referring to the legislative acceleration after the LUNA collapse in 2022, this crash may drive the implementation of three policy aspects:

1. Stablecoin reserve fund audit system: an on-chain real-time monitoring system for algorithmic stablecoins;

2. Cross-chain bridge licensing: requiring cross-chain asset transfer service providers to hold specific financial licenses;

3. DeFi protocol "circuit breaker mechanism": mandatory implementation of automatic suspension function when TVL fluctuates more than 30%.

These policies will suppress market sentiment in the short term, but in the long run, they will clear the way for institutional capital inflows, forming a "policy bottom - market bottom" transmission effect.

IV. The Return of Value in Technical Narratives

The volatility of ZK-based projects has already revealed a unique pattern in the bear market: projects that missed the bull market peak tend to launch a "desperate pump" during the liquidity vacuum period.

This operation essentially leverages the scarcity of market attention to create local hotspots, such as StarkWare's 300% surge in the 2023 bear market through mainnet launch. But investors need to beware of the "good news is bad news" trap, and truly technologically breakthrough projects should meet the following criteria:

· Testnet running for more than 6 months and no major vulnerabilities

· Quarterly growth in the number of developer community contributors > 15%

· Non-VC address holdings account for more than 40%

Part II: Bear Market Buying the Dips Guide - Finding Diamonds in the Ruins

I. Cognitive Reshaping: Establishing a Value Coordinate System for the Crypto Market

The traditional financial PE/PB valuation system is not suitable for the crypto world, and a four-dimensional evaluation model needs to be established:

Under this framework, the current targets worth watching include:

· Infrastructure layer: L1 public chains with daily transaction fee revenue > $500,000 (such as Sonic Chain)

· Middleware layer: Decentralized oracles with API call volume growing for 3 consecutive quarters

· Application layer: DeFi protocols with TVL/market cap < 0.5 and real yield

II. Strategy Toolbox: A Multi-Dimensional Buying the Dips Methodology

1. "Pyramid" Position-Building

Divide the capital into 3-4 batches, and add positions when Bitcoin drops 15%, but must meet the following conditions:

· Fear and Greed Index < 20

· Stablecoin exchange balance ratio > 35%

· Exchange BTC net outflow for 5 consecutive days

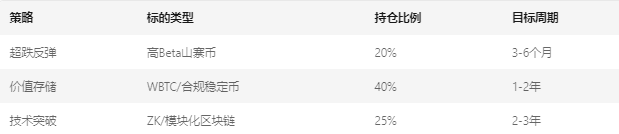

2. Cross-Cycle Arbitrage Portfolio

3. On-Chain Data Alert System

Deploy customized monitoring dashboards, focusing on:

· MVRV-Z Score: < -1.5 enters the historical bottom range

· Exchange net position: 3 consecutive weeks of net outflows as an accumulation signal

· Whale wallet activity: Top 100 address holdings increase by more than 200%

Bear Market Buying the Dips Strategies for Bitcoin, Ethereum, and Solana: Point Estimation and Position-Building Guide

Bitcoin (BTC): Finding the "Golden Pit" and Multi-Dimensional Verification

As the bellwether of the crypto market, the buying the dips logic for Bitcoin needs to consider technical analysis, on-chain data, and macroeconomic variables. According to the consensus of analysts and historical cycle patterns, the following key areas are worth watching:

1. Technical Support Levels

- First Support: $85,000-$88,000

According to the "fair value gap" ($81,700-$85,100) formed by Bitcoin in November 2024 that has not been fully filled, combined with the daily MA120 (around $85,000), this area is the focus of the short-term bull-bear tug-of-war. If the price stabilizes and on-chain selling pressure eases, you can try the first position-building.

- Second Support: $78,000-$76,000

The theoretical downside target of the double top pattern, coinciding with the October 2024 miner cost line ($78,000). If whales increase holdings (such as a single-day net inflow of over 10,000 BTC) or the stablecoin exchange balance ratio breaks through 40% in this area, it can be seen as a medium-term bottom signal.

- Extreme Risk Zone: $70,000-$72,000

Corresponding to Arthur Hayes' "black swan zone", which requires: the Fed delaying rate cuts, Trump policy obstacles, and contract open interest falling below $30 billion. At this time, you need to wait for the daily RSI < 25 and the funding rate to turn positive before entering in batches.

2. Position-Building Strategy

- Pyramid-style DCA: Divide the capital into 3-4 batches, invest 30%, 40%, and 30% at $85,000, $78,000, and $72,000 respectively. If the rebound breaks through the $92,000 neckline, you can add 10% to the position.

- Hedging Tools: Configure Bitcoin put options (strike price $70,000) or hold 20% of the position in compliant stablecoins (such as USDC) for extreme market top-up.

II. Ethereum (ETH): Dual Drivers of Technical Upgrades and Ecosystem Resurgence

Buying the dips in Ethereum needs to focus on the recent Pectra upgrade progress, Layer2 ecosystem traffic, and staking yield changes, combined with technical analysis and on-chain indicators to formulate a strategy:

1. Key Support Levels

- Short-term defensive position: $2,300-$2,400

The 200-day MA ($2,350) overlaps with the Q4 2024 institutional accumulation cost line, if the ETH/BTC rate holds above 0.03 and the staking APR rises above 4%, a small position can be established.

- Medium-term value zone: $1,900-$2,000

Corresponding to the dense accumulation area before the 2023 bull market, requirements are: Layer2 TVL breaks through $60 billion, DEX weekly trading volume recovers to $50 billion.

- Extreme drawdown level: $1,600-$1,700

Historical cycle bottom model estimate, triggered by: macro liquidity crisis, ETF staking proposal rejection. Wait for whale address accumulation (net inflow of over 500,000 ETH per week) as a signal.

2. Portfolio construction

- "Core + Satellite" allocation: 70% in ETH spot, 30% diversified into Layer2 leaders (e.g. Arbitrum, zkSync, Starknet) and RWA protocols (e.g. Chainlink).

- Yield enhancement: Stake 50% of holdings on compliant platforms like Lido, Coinbase for 4%-6% APY, and participate in EigenLayer for yield amplification.

III. Solana (SOL): "Adversity Reversal" Opportunity After Ecosystem Reshuffle

Solana bottom-fishing should be cautious about FTX liquidation pressure and technical stability risks, but the long-term value of the high-performance public chain still has room for imagination:

1. Bull/Bear Battleground Levels

- Short-term battleground: $130-$140

Current price is close to the 2024 institutional accumulation cost line ($130), if the daily active addresses recover to 1 million and DEX volume exceeds $3 billion, a long position can be attempted.

- Medium-term safety margin: $100-$110

Theoretical bottom after FTX liquidation pressure is fully released, requires: 1) Solana network downtime ≤1 per quarter; 2) AI+DeFi ecosystem TVL exceeds $5 billion.

- Oversold rebound signal: Below $100

"Panic-driven bottom-fishing" zone in extreme scenarios, requires: Bitcoin dominance >60%, stablecoin market cap shrinks 20%. Can allocate 10%-15% for rebound trading.

2. Strategy Toolbox

- Event-driven entry: After March 1 FTX unlock, if price stays above $120 and whales accumulate (daily net inflow >500,000 SOL), can enter in batches.

- Ecosystem hedge portfolio: 50% SOL spot + 30% Solana ecosystem AI protocols (e.g. Render Network) + 20% short hedge.

Historical Lessons and Future Projections

From the "mining rig fire sale" in 2018 to the LUNA collapse in 2022, bear market bottoms often coincide with "extreme panic + fundamental capitulation". The uniqueness of 2025 lies in:

- Higher institutional involvement: MicroStrategy and others hold over 12%, potentially shortening the bear cycle.

- Technical revolution inflection point: Breakthroughs in ZK-Rollups, AI agent networks, etc. may catalyze a structural bull market.

Investors need to balance "probability" and "payoff": When Bitcoin falls below $80,000, Ethereum below $2,000, and Solana below $120, the market payoff is better than 90% of the past three years, with a probability of 35%-40% (based on implied volatility).