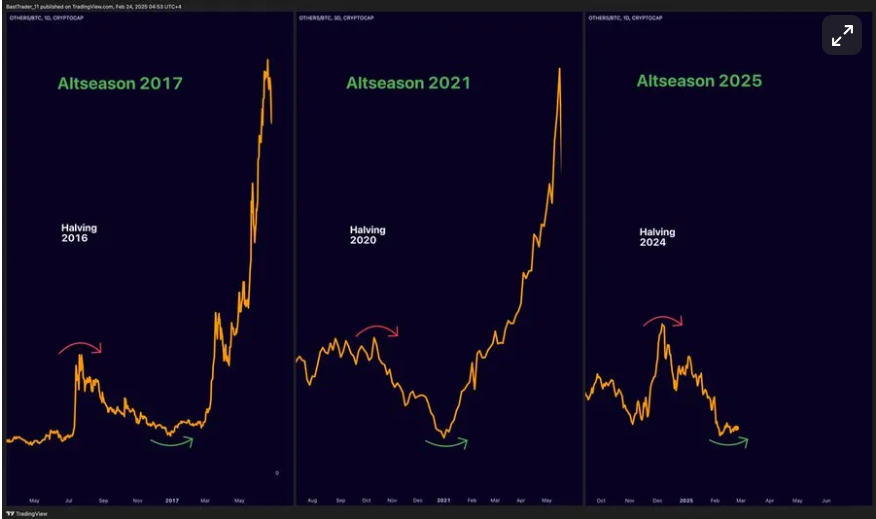

Is the Altcoin season coming?

Bit is in the mid-cycle, while Ethereum is lagging behind.

But Altcoins are ready to embrace their moment.

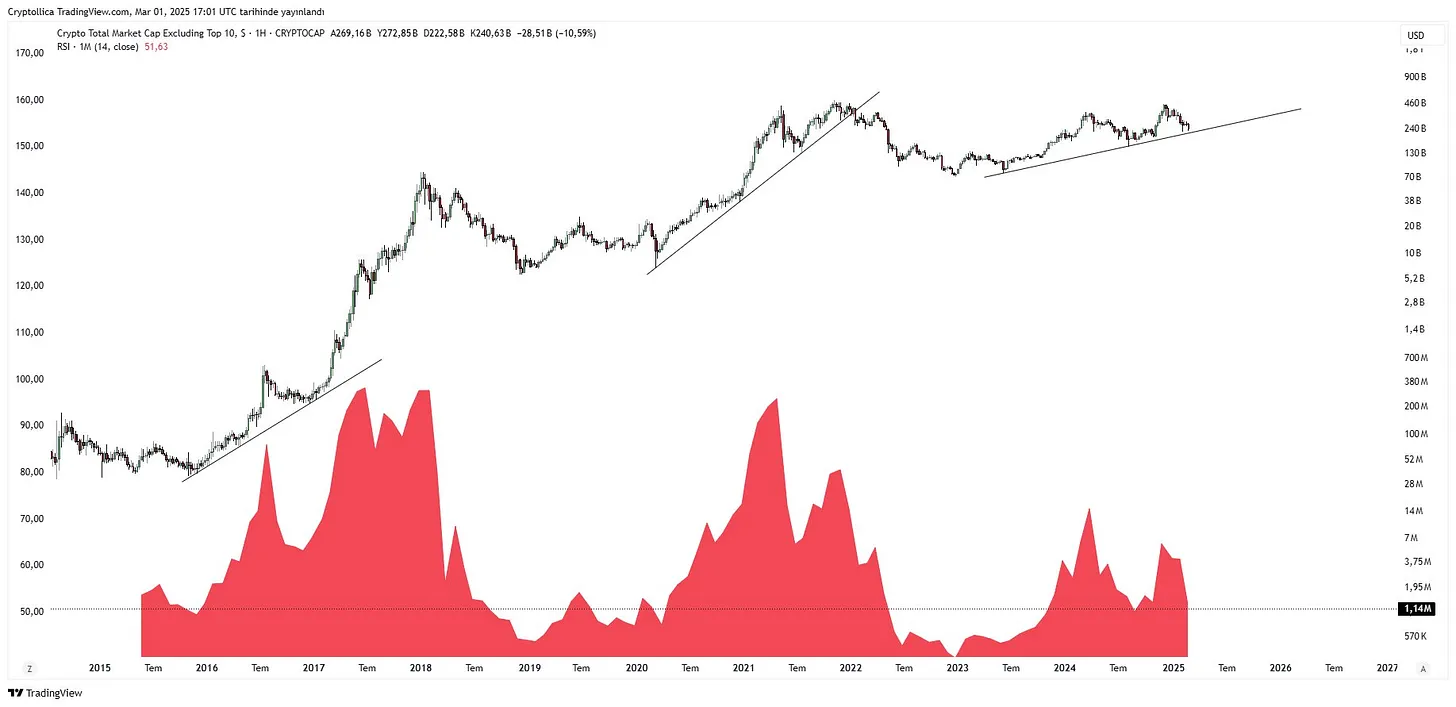

The Altcoin "golden cross" has just appeared - this signal has often driven a significant rebound.

I believe we are at a local bottom. Here's why.

Where are we in the cycle?

The biggest question remains: are we still in a bull market, or is an adjustment imminent?

Let's dive into key market indicators and insights to help you navigate the current market environment.

Bit's position in the market cycle

Bit is still in a confirmed bull market, but still some distance from the frenetic highs of the previous cycle. On-chain data suggests there is still room for upside, but signs of profit-taking have also emerged.

Key indicators:

- MVRV Z-Score: Indicates that Bit is neither overvalued nor undervalued, suggesting it is in the mid-cycle stage of the cycle.

- NUPL (Net Unrealized Profit/Loss): Shows the market is in the "optimism/denial" phase (around 0.48), with most holders still in profit.

- Long-term holder SOPR: At 1.5, meaning long-term holders are profiting from selling, but not aggressively.

- CryptoQuant Bull/Bear Cycle Indicator: Confirms Bit is in a strong uptrend, but not yet overheated.

What's next?

The past two months have been a rollercoaster, with unexpected market volatility and uncertainty. While January was a slow start, February - usually one of Bit's best performing months - brought chaos rather than a rebound. We witnessed new celebrity-backed meme coins, a $140 million exchange hack, rising tariffs, and widespread liquidations in the market.

Despite the turbulence, the key to crypto success is not in controlling the market, but in how we respond to it.

Short-term market outlook

The good news is? After the recent selloff, we may be approaching a local bottom. Multiple indicators suggest a potential turning point:

- Crypto Fear & Greed Index has dropped to its lowest level since 2022, a historic buy signal.

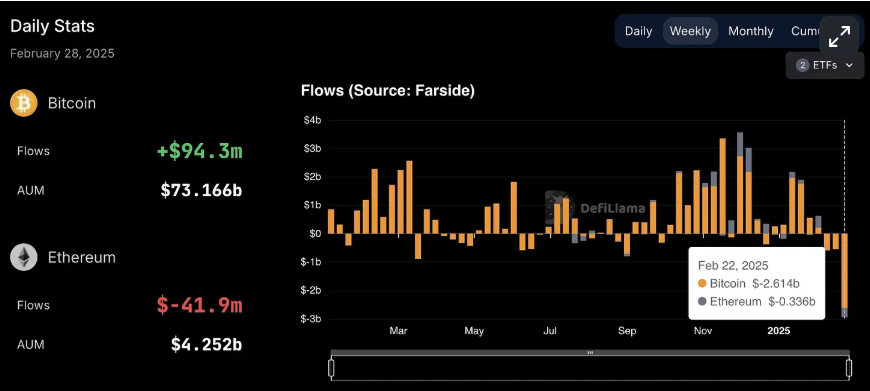

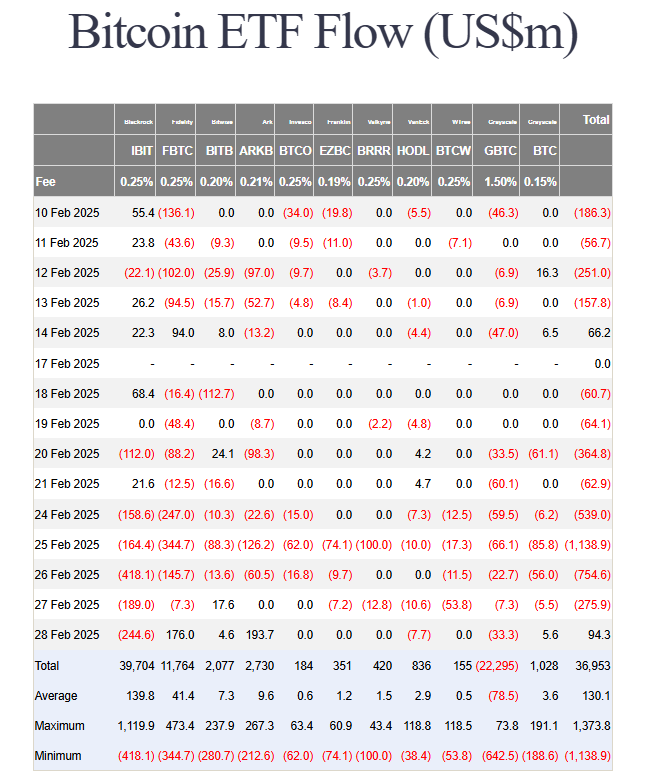

- Bit ETFs have seen significant outflows, which in past cycles has signaled the arrival of a local bottom.

- Altcoin liquidations have slowed, reducing downward pressure.

However, macroeconomic uncertainty remains a concern:

- Trump's trade tariffs are causing uncertainty in global markets.

- If tariffs continue to increase, it could exacerbate selling pressure.

Medium-term market outlook

Bit's surge past $100,000 was primarily driven by two key catalysts:

- A spot Bit ETF

- Trump's pro-crypto policies

Now that these catalysts have played out, the crypto market lacks a major upcoming event to drive the next leg up. The market is forward-looking, and without a new narrative, Bit may struggle to set new all-time highs in the near term.

What could be a potential bullish narrative? A U.S. national Bit reserve. The White House's AI and crypto lead has mentioned they are "evaluating" this proposal. If this idea gains traction, it could become a huge catalyst for Bit.

For now, I believe Bit will consolidate unless a new strong narrative emerges.

Long-term bullish sentiment

Despite short-term uncertainties, the overall outlook for crypto is stronger than ever:

- Regulatory transparency is improving as new pro-crypto legislation is enacted.

- The CEO of Blackstone is publicly promoting Bit on mainstream media.

- U.S. banks are planning to launch their own stablecoins.

Infrastructure is being built, and institutional adoption is increasing. The long-term trend remains firmly bullish.

Ethereum's dilemma: time to accumulate?

Ethereum has significantly underperformed Bit over the past two years, declining 70%, and down 48% since December 2024. The lack of Ethereum ETF inflows has exacerbated the bearish sentiment.

However, there are some new catalysts emerging:

- Changes in Ethereum Foundation leadership and a shift towards Layer 1 scaling.

- The Pectra upgrade introducing EIP-7702 to improve user experience and launching a new open intent framework.

- The weakness in meme coins may drive users back to fundamental projects.

- Institutional interest in Ethereum as a tokenization platform, with key players like Blackstone actively participating.

While Ethereum faces challenges, these changes will take time. The risk is that Ethereum may miss this bull run, only becoming a strong buy opportunity in the next bear market.

Is the Sonic Network ($S) recovering?

Sonic Network ($S), formerly Fantom ($FTM), has surged 75% in two weeks after a violent post-migration selloff. The ecosystem's main decentralized exchange, $SHADOW, has risen 13x in the same period.

- Incentive programs are driving new activity.

- Despite the strong momentum, $S remains highly volatile - do not blindly chase the pump.

Bit price action: market indecision

- Bit's trading momentum is weak on lower time frames, leading to market uncertainty.

- Three possible scenarios:

Bullish scenario: Rapid recovery, late long liquidations, continuation of uptrend.

Neutral scenario: Bit enters a re-accumulation phase, finding balance before resuming the uptrend.

Bearish scenario: Price distribution continues, supply-driven, trend reversal occurs.

Conclusion: The volatile market environment makes trading more challenging, and staying on the sidelines may be the best approach.

Arbitrum dynamics: DAO updates, grants, and ecosystem growth

- Stylus Sprint grant highlights: 17 projects received grants to help JavaScript and TypeScript developers join the Arbitrum ecosystem.

- Arbitrum DAO treasury diversification (STEP 2.0): Allocating $35 million in ARB tokens to a tokenized money market fund.

- Arbitrum RWAs (Real-World Assets) adoption: Over $100 million in Assets Under Management (AUM), with growing institutional interest.

- Alchemy grants still have $3 million available for Arbitrum developers.

- Trading volume on Arbitrum-based decentralized exchanges (DEXs) has surged, exceeding $43 million in daily volume.

- Dolomite launches GMX strategies, expanding yield opportunities.

Altcoin market outlook: when will the rotation start?

Bit continues to outperform most Altcoins, based on a strong speculative index (around 0.0-0.2). Historically, this stage is often followed by an Altcoin rally.

Some promising Altcoins:

- $FLUID: A lending protocol that challenges the dominance of Uniswap DEX, with plans to implement a buyback program.

- $ENA: Despite recent hacking incidents, its fundamentals are strong and it has strong support.

- $SKY (formerly $MKR): Active buyback program and the adoption of stablecoins.

- $KMNO: Dominant in the Solana lending market, with a total locked value of $1.8 billion.

- PENDLE: A leading DeFi yield strategy platform.

- Sonic's $S: Powerful user experience and growing adoption.

Summary and Outlook: What's next?

- Bitcoin is currently in the mid-stage of a bull market and still has upside potential.

- Although there has been some profit-taking, the extreme euphoric sentiment has not yet arrived.

- The fate of Ethereum will depend on whether its ecosystem upgrades can gain momentum.

- If Bitcoin remains stable, Altcoin rotation may start soon.

- Macroeconomic conditions will affect market sentiment, but the long-term narrative for cryptocurrencies remains bullish.

Inside Alert: Just discovered Nomy - an AI agent that makes on-chain Alpha super simple.

Imagine ChatGPT for crypto, where it can analyze wallets, execute cross-chain swaps, find the best DeFi yields across 15+ chains, and track token performance - all through simple commands.

Developed by Biconomy (AA leader, already supported 50M+ transactions and 200+ dApps). Currently in closed Alpha with only 200 testers, but expected to be publicly released in April.

My guess? Based on their roadmap, the token will likely be released by the end of the year - getting in early could give you an advantage.