Author: Spirit, Jinse Finance

introduction

The once significant "listing wealth-creating effect" in the crypto industry is weakening. The phenomenon of skyrocketing prices of new coins after listing is no longer common, but has been replaced by violent price fluctuations and subsequent declines, especially in the case of meme coins. Market liquidity has also declined, and investors have gradually lost patience with short-term hype projects. The core reasons for this shift are multifaceted, including the high degree of control of token issuance by venture capital and insiders, which has led to retail investors taking over at high prices; there are loopholes in the arbitrage mechanism between DEX and CEX, and the on-chain whale have made profits in advance, causing CEX retail investors to suffer losses; and the lack of value support for meme coins themselves, which are easily manipulated by market sentiment, and their inherent fragility makes it difficult for the wealth effect to continue.

Faced with this trend, the cryptocurrency industry is in urgent need of transformation. Although exchanges such as Binance benefit from listing and trading in the short term, in the long run, user trust and regulatory pressure will increase. The industry should shift from excessive speculation to value investment, promote project parties to build a more practical and sustainable token economic model, and establish a fairer and more transparent token issuance and trading mechanism, in order to rebuild market confidence and achieve healthy development.

Chapter 1 Binance Coin Listing Mechanism: Seeking the Optimal Solution Between Prudent Supervision and Market Vitality

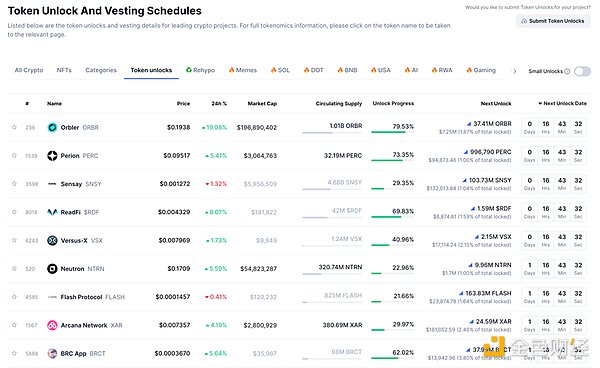

Looking at the development history of the cryptocurrency market, the rapid expansion and irrational prosperity in the early stage have gradually become a thing of the past, and the industry is entering a new stage of standardized and mature development. The following factors have jointly led to the fading of the wealth-creating effect of listing coins. First, the early high control of token issuance and prices by venture capital institutions and project parties made it difficult for ordinary investors to benefit in the medium and long term.

The entire market is facing severe selling pressure caused by the unlocking of VC coins

Secondly, the time difference and liquidity difference between DEX and CEX are used by market participants for arbitrage, further damaging the interests of CEX users. The deeper reason is that the market is full of speculative sentiment, and MEME coins that lack actual value support account for most of the newly listed projects. Their inherent fragility makes it difficult for the wealth effect to continue.

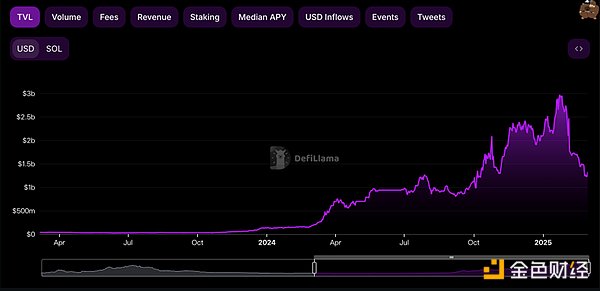

Since the beginning of 2024, new MEME token issuance platforms represented by Pumpfun have quickly gathered considerable market liquidity with convenient token creation and issuance mechanisms, injecting new vitality into the Solana ecosystem. However, as some celebrity-driven token issuance platforms have exposed problems such as uneven project quality and lack of long-term value support, market speculation has suffered a serious blow. In addition, some celebrity token projects have run away or made a sharp correction, resulting in a cliff-like drop in overall market trading volume and capital inflows. The market has begun to re-examine whether this type of asset issuance model has truly brought innovation and value.

1. Common challenges in the industry and Binance’s radical innovation: Market performance of new coins diverges after listing

Faced with the increasingly diversified and complex cryptocurrency issuance model and the continuously evolving market environment, Binance has continuously adjusted and optimized its coin listing mechanism, striving to find the best balance between effectively protecting user rights and interests, prudently controlling market risks, and fully stimulating market innovation vitality.

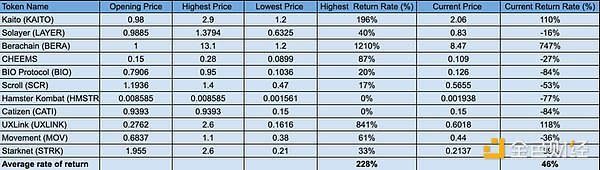

Despite the widespread poor performance of new coin listings in the current crypto industry, the return performance of Binance's newly launched projects is still leading the market. Data shows that the median return rate of Binance's listed tokens in 2024 reached 126.64%, far exceeding the 60% average of the other six major exchanges, and Coinbase is only 30%. Even if we observe the latest price return rate, the median retracement of Binance's listed projects is controlled at -52.49%, which is 10 percentage points better than the industry average. But Binance still needs to face the gap in investors' perceived return on investment.

From the second half of 2024 to the beginning of 2025, Binance actively embraced market changes and combined with the advantages of BNBChian's technical ecology to provide users with diversified asset allocation options. Market data shows that the return performance of its newly listed tokens has begun to pick up. Recently, a number of high-quality projects including KAITO and BERA have emerged, which have outstanding market performance and created considerable wealth effects for users.

Note: The above are K-line statistical data, not the start and end data of listing, and are for reference only.

The positive transformation of the above data is inseparable from Binance's long-term strategy of adhering to the concept of value investment, implementing the review standards for listing crypto assets, and continuously building a strong platform ecosystem. In particular, the recent attempt to use the circuit breaker mechanism. Although it may reduce liquidity and limit price discovery in the short term, its positive significance is more significant. This mechanism can effectively curb excessive market volatility, provide investors with a safety buffer, reduce the risks of small and medium-sized investors, and reduce the space for market manipulation, thereby enhancing users' sense of transaction security and platform trust. In the long run, the circuit breaker mechanism board will help the cryptocurrency market move closer to more mature and standardized traditional financial markets, attract institutional investors, promote rational value investment in the market, and ultimately achieve the long-term healthy development of the Binance platform and the cryptocurrency market.

The distribution of token types listed on Binance is also more balanced, and we keep an eye on high-quality projects in each sector.

Binance is clearly aware that industry development is accompanied by opportunities and challenges. Faced with the common problem of poor performance of new coins in the crypto industry after listing, Binance not only did not choose to lower the listing standards to cater to short-term market speculation, but chose to stick to the long-term orientation of value investment and continuously optimize and improve the listing process, which not only improved the professionalism and transparency of project review, but also actively guided users to establish a rational investment concept, and worked with all parties in the industry to jointly promote the long-term healthy development of the industry ecology. At the same time, Binance is also actively exploring innovative models such as LaunchPool and BNB staking voting for listing, aiming to provide a fairer and more efficient value discovery and issuance platform for truly potential high-quality projects, and to create more opportunities for users to participate in early high-quality projects and share the long-term value growth of projects.

2. Paradigm shift in coin listing mechanism: from “strict platform selection” to “community governance”

Binance is actively promoting profound changes in the coin listing mechanism, striving to gradually transition from the traditional "centralized platform strict selection" model to a more open, transparent and decentralized "community governance" new paradigm.

- Significantly reduce project listing fees: Binance has significantly reduced project listing fees to near zero, and will return all the platform revenue generated to community users and project developers through innovative forms such as Launchpool. In 2023 alone, the Binance platform has distributed a total of US$180 million worth of newly listed tokens.

- Continuously improve the transparency of the coin listing process: Binance is committed to continuously improving the transparency of the coin listing process, gradually making relevant information on key links such as project due diligence, technical security audits, and internal IC (coin listing committee) reviews public to the community, and accepting wider market supervision.

- Proactively explore community participation in governance: Binance plans to officially launch the "BNB Staking Voting for Listing" mechanism in the second quarter of 2024, aiming to delegate part of the decision-making power of project launches to community users. By introducing a community voting mechanism, it will achieve innovative upgrades in the platform governance model and build a more open listing ecosystem.

Binance executive He Yi publicly stated at a recent community event, "We are not pursuing perfection, but we will never stop evolving." At the same time, Binance also proactively disclosed relevant data on anti-corruption within the platform over the past two years at the event, including a total of 120 internal violation investigations, the dismissal of 60 employees who violated the rules, and the recovery of more than US$30 million in illegal gains. Binance hopes to effectively respond to market suspicions through "sunshine" operations and "data-based" disclosures, and to rebuild user trust with practical actions.

Chapter 2: Adhering to the concept of decentralization: Binance seeks a balance between value discovery and protection

The inherent cyclical fluctuations in the cryptocurrency market are a severe test for all market participants. In a complex environment where market sentiment is easily affected by external factors and user confidence is challenged, the Binance team has always adhered to the concept of decentralization and is committed to maintaining market order and promoting the healthy development of the industry.

1. Respond to cyclical market fluctuations and maintain the foundation of user trust

The cryptocurrency market is characterized by significant high volatility, and irrational market behavior and user panic can be easily amplified. Looking back at 2023, the Binance coin listing team conducted a comprehensive and rigorous review of more than 2,000 crypto projects, and the final coin listing pass rate was less than 4%. All successfully launched projects must pass multiple strict screenings including code security audits, economic model stress tests, and community consensus assessments to maximize project quality and user asset security.

The core of Binance's listing mechanism is to seek a dynamic balance between innovative vitality and risk control, and to prioritize user interests. Since the beginning of 2024, Binance has launched more than 130 crypto tokens, covering Meme coins, AI protocols, DeFi and other cutting-edge fields. While actively capturing market hotspots, it also takes into account the diversified construction of the ecosystem. Judging from the market data performance, Binance has maintained a relatively stable operating situation among mainstream centralized exchanges, and has made positive contributions to maintaining market confidence.

Nevertheless, in the face of the rapid emergence of emerging asset issuance platforms such as Pumpfun, and the resulting market discussion on whether "low-threshold coin issuance" will eventually lead to asset bubbles, Binance sticks to its prudent coin listing strategy and continues to use a multi-dimensional KPI assessment framework (including token secondary market ROI performance, project's new contribution to the industry ecosystem, and market share, etc.) to evaluate the value of the projects to be launched, striving to identify and select high-quality assets with real long-term development potential in high-risk areas such as Meme coins. Binance adheres to a value-oriented coin listing strategy, which may face certain market understanding deviations and user growth pressure in the short term, but in the long run, it has positive significance for maintaining a healthy market order and guiding the rational development of the industry.

2. Binance: An important provider of “value discovery” in the crypto asset market

The value discovery mechanism of the cryptocurrency market has always been controversial, and there are different views in the industry on whether the market value should be freely adjusted or moderately guided by centralized platforms. The role of the Binance coin listing team can be compared to the concept of the "Federal Reserve" in the crypto market to some extent, hoping to maintain the health of the market ecology through a professional screening mechanism. Just as the Federal Reserve seeks a balance between the free market and prudent regulation to cope with economic cycle fluctuations, Binance also attempts to release the liquidity of high-quality assets through platforms such as LaunchPool, and use the KPI framework to improve the efficiency of value discovery and support Web3 innovation. However, the most important aspect is that just as the Federal Reserve often faces difficult choices and market shocks, Binance, as a "regulator" on the crypto asset side, its centralized concept is also facing the impact and test of market sentiment.

Value-oriented coin screening criteria

The Binance team positions itself as a "blockchain ecosystem builder" and has built a multi-dimensional and multi-level project evaluation system to ensure the quality and potential of listed assets:

- Technology maturity and innovation: Quantitative indicators such as the number of original code lines and the frequency of GitHub code repository updates are important references for measuring the technical strength and innovative vitality of the project.

- Community foundation and consensus: Indicators such as the number of active addresses on the chain and community participation reflect the user base and community recognition of the project.

- Long-term value and development potential: Whether a project has a clear long-term development strategy, a sustainable business model and continuous innovation capabilities is a key factor in determining whether it can survive market cycles.

Binance has always believed that adhering to strict project screening standards is an inevitable requirement for the platform to fulfill its market responsibilities and protect the interests of users. Just as the Federal Reserve may face short-term market pressure due to its adherence to a tight monetary policy when inflation pressure is high, Binance may also face misunderstandings from some market participants when it proactively removes some high-risk and highly speculative projects. However, Binance firmly believes that maintaining the long-term healthy development of the crypto market and protecting the overall interests of the user group are the primary responsibilities that the platform must bear.

The “counter-cyclical” nature of Binance’s listing strategy

In the context of the surge of speculation in the Meme coin market and the market sentiment being easily driven by irrational factors, Binance insists on relatively strict listing standards and continues to improve the transparency of the listing process. This is undoubtedly a "road less traveled". Behind this is the line-by-line review of smart contract codes by hundreds of professional auditors, international expert review meetings across multiple time zones, and the courage and responsibility to withstand the short-term profit-seeking pressure of the market and decisively remove potential risk projects.

When the on-chain data engineer detected a security backdoor in the code base of an AI project, and when the community voted to call on the platform to retain a Meme token project that was popular in the short-term market but lacked practical application scenarios, Binance's strategic choice was always clear and firm: the platform should not be a blind follower of short-term market hotspots, but should stick to the role of "value gatekeeper" and maintain the long-term healthy development of the market. This "counter-cyclical" strategy of staying calm and rational during market frenzy may not fully cater to the speculative preferences of some market participants in the short term, but in the long run, it precisely reflects the responsibility and strategic foresight that Binance should have as a leading trading platform.

Rethinking the concept of decentralization

Binance believes that true decentralization is by no means to allow the market to develop in an unorderly manner. Binance's coin screening mechanism also needs to fully absorb the opinions and suggestions of the community to achieve a benign interaction between platform governance and community participation. With the launch of the BNB staking voting coin listing mechanism, Binance looks forward to hearing more rational voices from the community and jointly discussing the following deep-seated issues in the development of the industry:

- When it comes to crypto asset project selection, should the market focus more on projects with disruptive technological innovation and a solid code base, or short-term market popularity and user attention?

- In terms of building an industry innovation ecosystem, should platform resources prioritize supporting early-stage grassroots developers and innovation teams, or should they focus more on mature projects with institutional endorsements and resource advantages?

There is no standard answer to the above question. In fact, it is related to the common thinking and value choices of all Web3 market participants on the direction of industry development. The valuable legacy left by Satoshi Nakamoto to the crypto world is not only cold code, but also a set of profound philosophical thoughts on how to build trust and promote collaboration in a decentralized network. Binance hopes to be an active practitioner of this idea - the platform should not play the role of "God's hand", but should become a "mirror" of community consensus, and ultimately build a more open, transparent, and community-governed crypto ecosystem through technological innovation and mechanism optimization.

As former U.S. Federal Reserve Chairman Alan Greenspan said, "The art of effective regulation is to convince the market that you will never abuse your power." Binance continues to iterate and improve its coin listing mechanism, moving towards this goal: the platform strives to replace the centralized authority in the traditional model with higher transparency, and to rebuild market trust with broader community participation. Although the road ahead is long and full of challenges, Binance firmly believes that when the voting rights of BNB token holders and the code contribution of the project development team become key factors affecting the decision to launch the project, a truly decentralized "promised land" will gradually come to the crypto world.

Chapter 3 BNB Chain Technical Blueprint: Building a High-Performance, Low-Cost Blockchain Infrastructure

The BNB token is not only the value carrier of the Binance ecosystem, but also the key link connecting developers, users and investors, and is the core infrastructure supporting Binance's decentralized vision.

In February 2025, BNB Chain officially released its comprehensive technology development roadmap, with the vision of "Code-driven Moon Landing Plan", which opened the prelude to a new round of technological innovation. This technical blueprint, praised by the community as the "light-year roadmap", is far more valuable than a simple stacking of a series of performance parameters. It also contains deep thinking and forward-looking layout on the nature and future development direction of blockchain technology - how to build the underlying infrastructure that can carry human commercial civilization to the stars and the sea under the framework of decentralized network?

1. Break through the bottleneck of transaction performance and lower the threshold for users to use

- Sub-second block confirmation speed: Through the deep optimization of the underlying technical architecture, BNB Chain plans to significantly reduce the block confirmation time from the current 3 seconds to sub-second 0.8 seconds. The transaction processing speed will be increased exponentially, and the daily transaction throughput is expected to break through the performance bottleneck of the existing blockchain network, clearing the way for large-scale commercial applications. This is not only a simple improvement in technical parameters, but also a strong response to the traditional industry perception that "decentralized networks are difficult to balance efficiency and performance", proving that decentralization and high performance are not irreconcilable contradictions.

- Revolutionary reduction in fuel costs: By introducing innovative technologies such as the Megafuel solution, BNB Chain is expected to significantly reduce transaction gas fees, and plans to fully support users to use mainstream stablecoins such as USDT to pay gas fees. This change will effectively lower the threshold for users to use blockchain applications, greatly improve user experience, and lay the foundation for the large-scale popularization and application of blockchain technology.

2. Continuously iterate user security and transaction experience

- New generation of smart wallets: Based on the EIP-7702 standard, BNB Chain is actively developing a new generation of smart wallet solutions. The new wallet will no longer be just a simple storage tool for private keys, but will transform the traditional complex private key management process into a more convenient and secure "silky" user experience by integrating cutting-edge technologies such as biometrics and social recovery. In the future, the key of a blockchain wallet may no longer be an obscure string of characters, but will become the "genetic code" for users to safely enter the Web3 world.

- Forward-looking MEV protection shield: In order to effectively deal with the increasingly severe risk of miner extractable value (MEV) attacks, BNB Chain plans to deeply improve the existing block voting mechanism and greatly reduce the living space of malicious transactions such as "sandwich attacks" through technical means. This is not only a simple technical defense measure, but also a powerful defense of the spirit of "transaction fairness" of decentralized networks - in an ideal decentralized world, every user transaction should enjoy equal and transparent sunshine.

While actively innovating underlying technologies, BNB Chain has also keenly captured the trend of the times in which artificial intelligence (AI) technology is accelerating, and has begun to proactively plan for the deep integration of blockchain and AI technologies, striving to seize the initiative in the next wave of technological change.

3. Build the foundation of data democratization and release the value of data elements

- DataDAOs decentralized data governance: Based on the BSC high-performance network and Greenfield decentralized storage infrastructure, BNB Chain is actively building a decentralized data governance platform DataDAOs, aiming to truly return data ownership and control to users. In the future, every user will have the opportunity to become a participant and beneficiary of AI model training. The browsing behavior data and content creation data generated by users on a daily basis can all be converted into "nutrients" for training and optimizing AI models, and data ownership will never be lost.

- Trusted Execution Environment (TEEs) Technology Application: BNB Chain plans to actively introduce Trusted Execution Environments (TEEs) technology to build a secure, reliable, and tamper-proof operating environment for various AI agents and smart contracts, laying a solid foundation for the development of smarter and more complex decentralized applications (DApps) on the blockchain network.

4. Create a developer-friendly ecosystem to enable the explosion of innovative Web3 applications

- AI-assisted smart contract development tools: BNB Chain is actively developing AI-assisted code development tools such as AI Code Copilot, which aims to use artificial intelligence technology to understand developers' Chinese programming needs, generate high-quality Solidity code, significantly lower the threshold for smart contract development, and effectively eliminate the language and technical barriers for traditional Web2 developers to enter the Web3 field.

- SDK developer toolkit evolution: The new generation of SDK developer toolkit will greatly simplify the development, testing and deployment process of DApp, and is expected to shorten the DApp development cycle from weeks to hours, allowing developers' innovative ideas to be implemented faster and quickly brought to market.

- EVM compatibility and ecological siphon effect: BNB Chain will continue to maintain a high degree of compatibility with the Ethereum Virtual Machine (EVM), and continuously improve its own network performance, with lower gas fees and higher transaction speeds, to continue to attract developers and high-quality projects in the Ethereum ecosystem to migrate to the BNB Chain ecosystem. Market data shows that among all EVM-compatible chains, BNB Chain has ranked first in transaction volume in the past 30 days, and its average daily fee income has surpassed the Ethereum mainnet. The cumulative transaction volume of leading decentralized exchanges such as PancakeSwap has also exceeded the 1 trillion US dollar mark. The above data not only confirms BNB Chain's leading position in the DeFi field, but also reflects its powerful ecological siphon effect and the potential subversion of the community governance model on the traditional financial order.

It is worth noting that in hot market areas such as Meme Coin, Binance not only pays attention to the fluctuations of short-term market sentiment, but also focuses on guiding the Meme Coin project to transform in a direction with more practical value. By actively organizing and participating in the "Meme Season" theme activities, Binance continues to strengthen its in-depth interaction with the Meme Coin community, guide developers to explore the innovative combination of Meme culture and blockchain technology, and promote the Meme Coin project to gradually evolve from a simple emotional value carrier to a direction with more application scenarios and practical value. Thanks to the above-mentioned active guidance and ecological support strategies, the proportion of Meme Coin transactions in the overall transaction volume of BNB Chain has jumped significantly from 15% to 32%, and the diversification and market appeal of the BNB Chain ecosystem have been significantly enhanced.

Chapter 4: Consolidating market trust: Binance and the community’s two-way journey

At a critical time when the overall trust in the crypto industry is facing severe challenges, Binance has proactively chosen to use "extreme transparency" as a breakthrough and important tool to consolidate market trust.

Building an "Anti-Corruption Watchtower": Binance publicly announced the establishment of a "Sunshine Whistleblower Fund" with a total amount of up to US$5 million, aiming to encourage internal employees and the public to actively supervise the platform's operations, and promised to synchronize internal audit reports to regulatory agencies such as the US Department of Justice, and actively accept external supervision.

Strengthening the information disclosure obligations of project parties: Binance plans to require all online projects to disclose project development progress on a monthly basis in the future. For projects that fail to complete the development roadmap as planned, the platform will automatically include them in the "project observation list" to continuously improve project information transparency and reduce user investment risks.

Launch of the "Market Maker Transparency Index": In order to effectively prevent the risks of price manipulation and insider trading in the secondary market and effectively protect the legitimate rights and interests of ordinary trading users, Binance has innovatively launched the "Market Maker Transparency Index" mechanism, which aims to make the trading behavior of platform market makers transparent, publicize the real trading data of market makers to the market, and help users better understand the dynamics of market microstructure, and identify and prevent potential market manipulation risks in advance.

Binance hopes to enhance the credibility of the platform through the above series of "combination punch" transparency measures, and also hopes to build a more transparent and credible market environment with community users, and reshape the cornerstone of the healthy development of the industry. Binance knows that it is impossible to consolidate trust in the crypto world overnight, but as long as the platform and users can treat each other sincerely and work together, the industry will be able to get rid of the trust crisis and usher in a brighter future.

Chapter 5 Binance’s Future Development Vision: Focusing on Application Innovation and Community Governance

Looking ahead, Binance's strategic vision is not only to consolidate its leading position in the global crypto asset trading field, but also to become an active promoter and value contributor of the Web3 innovation wave. BNB Chain is expected to become the preferred platform for global Web3 developers and innovators, especially among Chinese developers with great potential and global developer groups, to build a more innovative, dynamic, open and inclusive Web3 innovation ecosystem.

1. Focus on the innovation explosion of Web3 application layer

Continuously optimize Web3 infrastructure: At the underlying technology level, we will continue to increase investment in the R&D of BNB Chain infrastructure. Through cutting-edge technological innovations such as Account Abstraction (AA) technology and Decentralized Identity (DID), we will continuously optimize BNB Chain's network performance and user experience, significantly lower the threshold for Web2 developers to enter the Web3 field, attract more traditional Internet developers and innovative forces to join the blockchain ecosystem, and jointly promote the prosperity and development of the Web3 application innovation ecosystem.

Proactively support innovative sub-sectors: At the application ecosystem level, Binance will not only focus on traditional hot tracks such as DeFi and GameFi, but also on innovative sub-sectors such as SocialFi and CreatFi that have greater explosive potential and are closer to the real needs of users. Binance will give full play to its global platform advantages and resource integration capabilities to provide more accurate resource docking and greater policy support for developers and innovation teams in the above-mentioned sub-sectors, give full play to the unique advantages of Asian developer groups in application innovation and model innovation, and set off a new wave of innovation in the Web3 application layer.

2. Promote deep community participation and realize the return of universal value

Actively listen to the voice of the community: At the platform governance level, Binance plans to hold various online and offline activities such as developer summits and community open days from time to time to actively collect opinions and suggestions from community users and developers on the future development of the platform. It will also gradually delegate platform governance rights to the community, explore a more decentralized community autonomy model, and achieve a deep binding of platform development with community interests.

Vigorously advocate long-term value: In terms of value orientation, Binance will not only focus on short-term market hotspots and traffic effects, but will also vigorously advocate long-term value, continue to reward and support high-quality project parties that do not chase short-term market hype but focus on long-term operations and technological innovation, and focus more on the long-term value creation and sustainable development potential of the project.

Conclusion

The development of the cryptocurrency market is a process full of challenges and changes. Binance is well aware that in the ever-evolving market environment, only by adhering to the original intention of the decentralized concept, continuing to innovate technology and optimize mechanisms, and establishing deeper and stronger trust with users and the community, can we lead the healthy development of the industry. Looking to the future, Binance is not only committed to the long-term value empowerment of BNB tokens, constantly improving and iterating the community co-governance coin listing mechanism, but also will consolidate market trust and give back to user expectations through transparency construction and compliance efforts.

Binance firmly believes that true decentralization is not an ideal country that can be achieved overnight, but a dynamic process of continuous evolution and improvement, which requires the joint construction and continuous investment of all market participants. On the road to the ideal state of Web3, Binance is willing to use technological innovation as an engine and user needs as a direction to seek a dynamic balance between compliance and innovation, market popularity and long-term value, centralization and decentralization, and constantly explore a more open, transparent, and community-driven crypto future.