II. The First Three Industrial Revolutions

Dr. Xiao Feng cited the research findings of a Nobel laureate in economics: "The industrial revolution had to wait for a financial revolution." This Nobel laureate believed that all industrial revolutions relied on the support of new financial service models in order to promote, develop and expand the new industrial revolution. Conversely, without the support of a financial revolution, the industrial revolution in human society may not have been successful. Similarly, another economist further pointed out that each industrial revolution is a superposition of an energy revolution, an industrial revolution and a financial revolution, in which the financial revolution is often the prerequisite.

His research findings cover the first three industrial revolutions, and now we have entered the fourth industrial revolution - the era of intelligence and digitalization. Let's first review the previous three industrial revolutions:

The First Industrial Revolution (1760s-1840s) was marked by the steam engine, occurring in Britain. The British government debt system and joint-stock banks provided financing channels for railways and factories, greatly improving productivity.

Douglass North pointed out in "The Rise of the Western World" (1973) that before the industrial revolution, Britain achieved institutional innovations such as government debt system, improvement of the banking system, property rights protection, and reduction of transaction costs, providing a capital accumulation and risk-sharing mechanism for technological breakthroughs (such as the steam engine and textile machinery). He believed that "the industrial revolution had to wait for the financial revolution" was a summary of this stage.

The Second Industrial Revolution (late 19th century to early 20th century) was represented by electricity and wireless communication, occurring in the United States. The development of the US financial system (such as investment banks and stock markets) in capital aggregation was the prerequisite for technological innovation, providing channels for large-scale corporate financing. For example, the construction of railways required a large amount of long-term investment, and the US attracted domestic and foreign capital through the issuance of railway bonds and stocks, with investment banks (such as J.P. Morgan) playing a key role in integrating dispersed capital.

The Third Industrial Revolution (late 20th century to early 21st century) was marked by computers, code and the Internet, also emerging in the United States. At that time, the Silicon Valley venture capital model (such as Sequoia Capital and KPCB) became the core financing mechanism for the Third Industrial Revolution. VCs provided early-stage funding for high-risk, high-return start-up tech companies (such as Apple, Microsoft, Google) through equity investment. For example, from 1970 to 2000, US VC investment increased from a few hundred million dollars per year to the hundreds of billions, directly driving the commercialization of semiconductor, software and Internet technology.

On this basis, the NASDAQ stock market established in 1971, with low thresholds, high liquidity and inclusiveness for tech companies, became the main channel for tech companies to go public and raise funds. For example, Microsoft (IPO in 1986) and Amazon (IPO in 1997) obtained expansion capital through IPOs. At the same time, tools such as stock options and employee stock ownership plans (ESOPs) attracted talents to join innovative companies, linking human capital with financial capital.

III. The Fourth Industrial Revolution

If the fourth financial revolution based on Bit is already in place, then according to the argument that "the industrial revolution had to wait for a financial revolution", we are actually looking for where the fourth industrial revolution will be born.

The "Fourth Industrial Revolution" was first officially proposed by Germans in 2013, the core idea of which is to use information technology for the manufacturing sector, thereby changing traditional standardized, large-scale production, and establishing a highly flexible, intelligent industrial production model. However, simply limiting intelligent information technology to the industrial field obviously has not truly recognized the far-reaching impact of the technological revolution represented by AI and Bit on human civilization.

3.1 Cathie Wood's View on the Technological Revolution

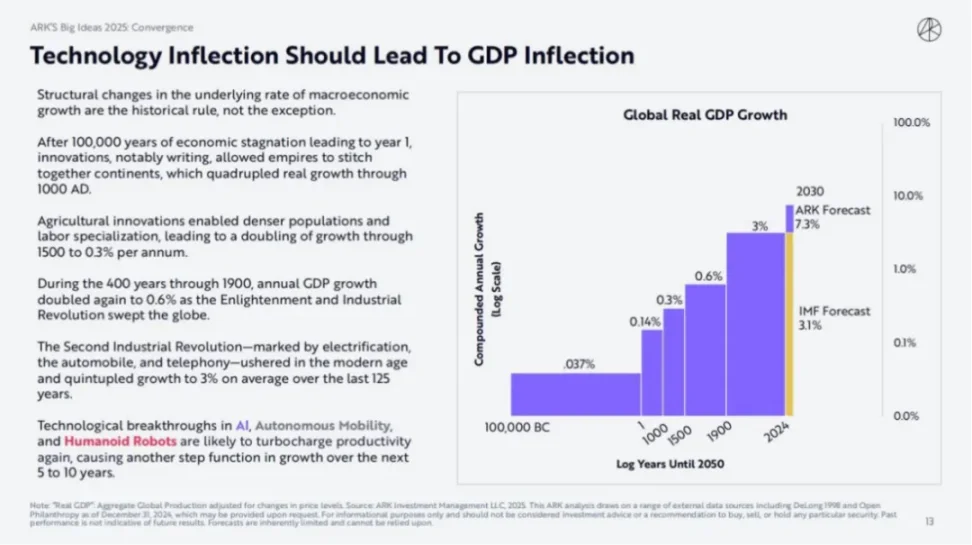

Cathie Wood, known as the "Queen of Tech Investing", released the ARK Invest "Big Ideas 2025" report at the beginning of the year, stating that although the International Monetary Fund (IMF) forecasts global economic growth to be 3.1% by 2030, she believes that the annual economic growth rate at that time should exceed 10%!

ARK Invest believes that changes in macroeconomic growth are in line with historical patterns, presenting a phenomenon of step-by-step leaps, and each leap is brought about by major technological changes.

Since the beginning of human history, the economy has been stagnant for 100,000 years, and innovation (especially writing) has enabled empires to connect all continents, doubling the actual growth rate in 1000 AD. Subsequently, agricultural innovation led to increased population density and labor specialization, causing the growth rate to double again in 1500, reaching 0.3% per year.

Subsequently, the First Industrial Revolution swept the globe, bringing human economic growth to an average of 0.6% per year. The Second Industrial Revolution, marked by electrification, automobiles and telephones, ushered in modernization, allowing humanity to increase its economic growth rate fivefold over the past 125 years, reaching an average of 3%.

Without a new technological revolution, the IMF's forecast is likely to be correct, but Cathie Wood believes that breakthroughs in areas such as AI, Bit, and smart robots may again increase productivity, representing a major technological revolution, and could drive economic growth to another level in the next 5 to 10 years.

www.ark-invest.com/big-ideas-2025

3.2 AI Reconstructs the Spatial Dimension of Human Economic Activities

I fully agree with the two logics Cathie Wood mentioned:

1) Each technological revolution will take the economic growth rate to a new level;

2) AI is a major technological revolution.

This should not be controversial in 2025, so what I want to express is:

Each technological or industrial revolution essentially reconstructs the spatial dimension of human economic activities by breaking through the original physical or institutional boundaries and creating a completely new value exchange domain. This "expansion of economic space" is not simply an expansion of geographical scope, but a transformation of the technology-economic paradigm, achieving an upgrade in the way production factors are combined, the boundaries of value creation, and the system of transaction rules.

For example, in the First Industrial Revolution, the use of steam engines shifted production from home workshops to factories, and railways and steamships expanded the scope of trade, allowing raw materials and goods to be transported across regions. This was indeed an expansion of geographical space, but the essence was to incorporate surface resources and colonies into a single capitalist production network. The Second Industrial Revolution, with electricity and internal combustion engines, led to urbanization and the rise of multinational companies, and economic activities were no longer limited to the local, but to the national or even global scale. The information technology of the Third Industrial Revolution, especially the Internet, created a virtual economic space of network, enabling e-commerce, digital services, and completely breaking geographical constraints. The Fourth Industrial Revolution may involve AI, Bit, and the Internet of Things, further integrating the boundaries of the physical and digital spaces, or even encompassing the economic activities of the silicon-based world of AI agents.

The greatest value of AI lies in embodied intelligence and spatial intelligence, which requires a large number of physical robots as well as virtual AI agents. Investor Wang Chao previously mentioned that if the future is a society composed of millions of AI agents, Cryoto may be a relatively feasible solution for agent-to-agent interaction and machine-to-machine interaction.

Cathie Wood stated that AI agents will change people's logic of searching and shopping, and be carried by digital wallets; digital wallets can further integrate traditional banking financial services such as savings, lending, insurance, investment, and consumption, and through the innovative paradigm of AI agents, can move the value chain of downstream platforms' global e-commerce and digital consumption upstream.

Similarly, I also believe that programmable cryptocurrencies based on Bit smart contracts are capable of facilitating value flows in the silicon-based civilization of AI, and can be carried by Web3 digital wallets. This means that the Fourth Industrial Revolution must be based on new finance based on Bit, otherwise it will degenerate into the old concept of traditional finance reducing costs and improving efficiency.

IV. The Token Economy Engine

The UK relied on the credit and bond markets to support the first industrial revolution, the US relied on investment banks and capital markets to support the second industrial revolution, and the third industrial revolution was supported by venture capital (VC) and the emerging Nasdaq stock market in Silicon Valley, USA. So, does the fourth industrial revolution not need a new financial model?

As Dr. Xiao Feng said:

Many people are reluctant to admit that blockchain is the infrastructure supporting the fourth industrial revolution, so we often mention "consortium chains" or "non-currency blockchains". But the practice of the past decade has proved that most of these attempts do not work. We must bravely admit that the core entry point of blockchain as a tool for adjusting production relations is finance. If there is no financial demand, we do not even need blockchain. This means that when humanity enters the fourth industrial revolution and innovates the digital and intelligent production relations, a new financial revolution is indispensable. Otherwise, all of this may not happen or cannot succeed.

Clearly, the new financial model based on blockchain is already in place, and the token economy engine on top of it has already started roaring.

Although the classification of tokens can have many types, from Dr. Xiao Feng's initial three-token model to the five types of tokens today, and the recent seven-token type framework given by a16z, and although it is said that "Online is New Onchain", and all assets will be tokenized on-chain, I believe that the function-based tokens (Utility Tokens) that are combined with the functional rights of the project network are the key to leading the crypto market. If other token types are all upgrades and transformations, then functional tokens can be an innovation.

In 2023, Dr. Xiao Feng delivered a closing speech on the "Three-Token Model of Web3 Applications" at the Hong Kong Web3 Carnival, and I also wrote an article in July 2023 on "Value Capture and Compliance Progress, Exploration of the Application of the Three-Token Model in China" on the discussion of functional tokens, which still seems very applicable.

Dr. Xiao Feng's closing speech at the 2023 Hong Kong Web3 Carnival

Web3 based on blockchain networks is an economic model based on a value network (stakeholder capitalism), emphasizing data credibility, data sovereignty and value interconnection. Under the premise that all value can be tokenized, value not only includes ownership, but more importantly, the right of use.

The right of use is non-exclusive, has multiple sharing properties, can be authorized and licensed multiple times, and can even achieve open source, CC0 infinite circulation, which is conducive to the participation and value sharing of ordinary users. The core of the use right system is stakeholder capitalism, and the original organizational form may not be suitable, and the decentralized autonomous organization (DAO) based on open source organizations and non-profit organizations is naturally in line with stakeholder capitalism, becoming the main organizational form of the new economic model of Web3.

Under the use right system, all participants in the decentralized organization participate as stakeholders, make their own contributions, and share the value of the organization. In this context, the shareholder ownership represented by the shareholders of centralized projects has no meaning, and the real value is the use right of the project.

The use right cannot be securitized, but it can be tokenized. Combining blockchain distributed ledger technology, the use right can be standardized and fractioned in the form of Tokens, which is related to the interests of each participant in the project network, and this token is called a Utility Token.

In this new economic model of Web3, the token is essentially the carrier of value, and only by deeply understanding the essence of the token's value can the optimal economic model be designed for Web3 applications, realize multi-layered growth flywheel, and achieve incentives for all participants.

The New Economy of Web3 and Tokenization

The New Economy of Web3 and Tokenization

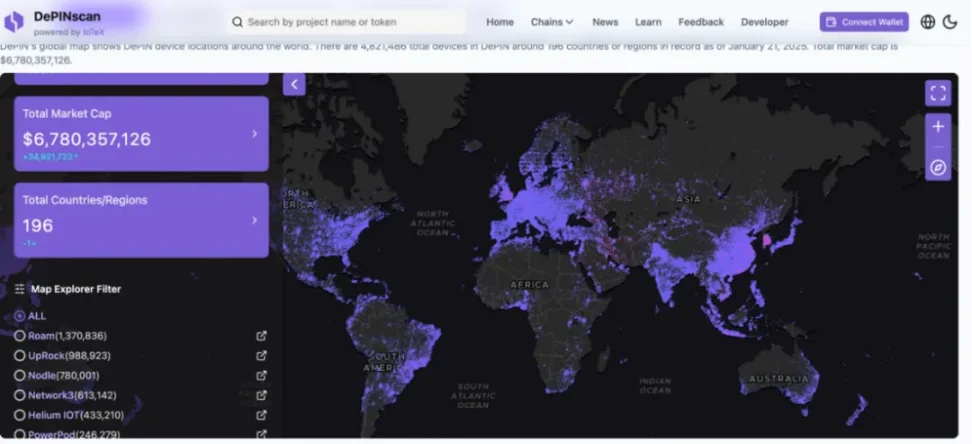

Let's look at a vivid case of the token economy engine - the Web3 decentralized telecom operator Roam. This project can truly solve the pain points that are difficult to solve in the Web2 scenario through the way of Web3, and can be said to be a typical example of Web3 moving from virtuality to reality.

Roam is committed to building a global open wireless network to ensure that humans and smart devices can achieve free, seamless and secure network connectivity whether stationary or mobile. Compared to the geographical limitations and homogenization of traditional telecom operators, Roam, with the inherent globalization advantages of blockchain, has built a decentralized communication network based on the OpenRoaming™ Wi-Fi framework, while also accessing eSIM services, to create a global open and free wireless network.

In just over two years of construction, Roam now has 1,729,536 nodes in 190 countries worldwide, 2,349,778 app users, and performs 500,000 network authentication activities per day, already becoming the world's largest decentralized wireless network. In addition, Roam users can also get free eSIM data when building and verifying Wi-Fi nodes, making Roam a telecom service provider that can adopt the Internet operating model.

depinscan.io/projects/roam

Globally, although traditional Wi-Fi still accounts for over 70% of data traffic, its outdated infrastructure and privacy data security issues have limited its potential. To address these challenges, Roam has collaborated with the Wi-Fi Alliance and the Wireless Broadband Alliance (WBA) to build a decentralized communication network by combining traditional OpenRoaming™ technology and Web3 DID+VC technology. This not only reduces the high upfront cost of global network construction, but also achieves seamless login and end-to-end encryption similar to cellular networks.

Roam encourages users to participate in network co-construction through the Roam App, sharing Wi-Fi nodes or upgrading to more secure and convenient OpenRoaming™ Wi-Fi. Users not only can enjoy seamless connectivity among 4 million OpenRoaming™ hotspots globally, but also can find Roam's self-built network nodes in remote areas like Siberia and northern Canada, greatly expanding the network coverage and improving the user experience.

Roam has driven the rapid development of decentralized networks through global free access with Wi-Fi+eSIM and diversified project network incentive mechanisms. The ideal nation of Network State needs to be built on communication networks, and Web3 decentralized telecom operators like Roam may become the digital foundation of the ideal nation.

Combining the narrative of the fourth industrial revolution, projects like Roam can obviously become the communication infrastructure of the AI silicon-based civilization, and can also bring the speed of the Internet to the global transmission of value. This new economic model of Web3 that has sprung up in 2 years can be said to be a disruption of the traditional economic model of Web2, and the token economy engine is crucial.

V. In Conclusion

As Professor Yang Peifang said: "Looking back on human history, the Chinese nation once dominated the agricultural civilization era with agriculture, sericulture and a vague holistic philosophical view; Europe and the United States dominated the industrial civilization era with mechanical power and a precise reductionist philosophical view."

So in this fourth industrial revolution, although the tide of anti-globalization has been caused by geopolitical factors, we will still be pulled together by the unified ledger of blockchain, and you will find that the world is really flat. As a book says: "We wanted to fly across the ocean, but we invented Zoom."

In this parallel global market, we can ignite global momentum through the token economy engine, we can achieve instant global value transmission through the blockchain settlement network, we can achieve global financial inclusion and financial equality through the new financial infrastructure, and of course there is much more that can be done and many more things that need to be done.