After DeepSeek R1, Sam Altman will give you GPT-4.5 and CoT process, which will enhance your Deep Research. This is not because of their conscience or because they have become good people, but because the small whale has been here.

Under AI empowerment, the pillars of platform capitalism are cracking, giving small teams and individual developers a chance to raid big companies. With the successive impacts of Hyperliquid and PumpFun, Binance has begun to seriously address token listings, build BSC meme ecology, and respect the basic human rights of retail investors in Binance Wallet.

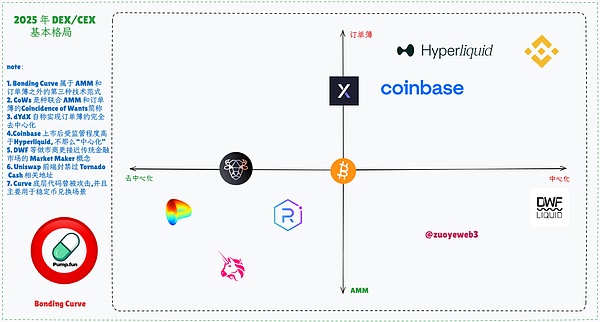

However, the situation is not entirely the same. The Bonding Curve that Pump Fun relies on is not a new paradigm. During the 2020 DeFi Summer, Order Book, AMM (Automated Market Maker), and Bonding Curve were competing with each other. Ultimately, AMM became the preferred choice for DEX, while Order Book retreated to CEX and Perp DEX, hibernating in the crowd.

To date, the entire history of blockchain is the history of trading platforms.

Contrary to stereotypes, in spot trading scenarios, CoWs combined with AMM and Order Book mechanisms introduce Solver operations to improve matching efficiency. Demand coincidence is more intentional. Contract trading products like dYdX and Hyperliquid's efficiency is more like a convergent evolution towards CEX.

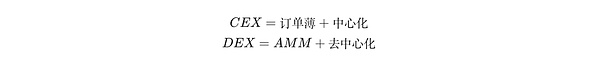

By 2025, measuring decentralization will be meaningless; trading efficiency will be the core, and the above formula can be rewritten in the following format:

It needs to be clarified that this mixes asset issuance models and asset issuance platforms, which are like the wave-particle duality of light, entangled bidirectionally and hard to separate.

For example, NFT, FT, and Memecoin are all asset issuance models, but different assets will also inspire new platforms, such as OpenSea and Blur, which are already tears of the era. This article mainly explores what the next asset platform will be.

Whether BSC is taking over the new meme wave or Base is launching another on-chain stock drama, it's essentially a transformation of asset issuance models. Instead of FOMO about specific tokens, it's better to focus on model changes.

After all,what we truly want to know is not how Binance is, but how Binance was formed and how to replace Binance.

Boarding Time Determines Industry Position

I miss the summer of 2020 so much, even more than the summer of 2018 when the wind started blowing.

Tracing back the entire history of trading platforms from the present, Binance in 2017 was indeed the child of the era. This has been recorded in the transition from crypto pioneers to old money by CZ, and will not be elaborated here.

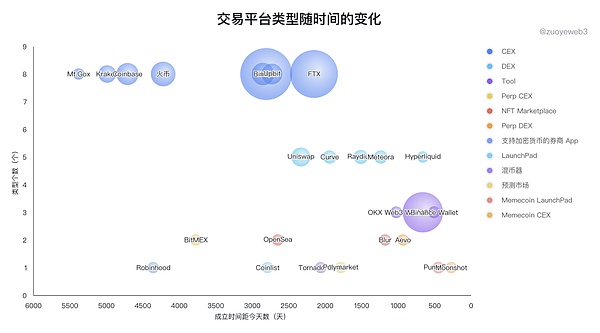

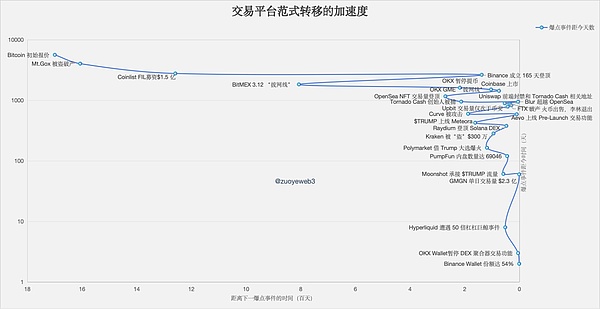

*Note: The horizontal axis represents the number of days since the establishment of each trading platform, and the bubble size represents current trading volume. FTX's is the previous average trading volume (mourning SBF for a second).

From the chart, we can see that CEX started earliest and is the most crowded track. From Mt.Gox starting to trade BTC in 2010 to the fall of FTX in 2022, with Binance claiming the throne, it has gone through 12 years of brutal competition. Today's compliance and equity participation are just boring intermissions.

However, Binance's establishment did not completely stop the trading platform competition. The 2020 DEX battle finally made on-chain trading more than just a gimmick, but a real business where LPs can profit. However, $UNI was a hasty response to SushiSwap, and did not unify the on-chain space like Binance.

FTX in 2022 was Binance's true crisis moment. The SEC's high-leverage regulation and money laundering accusations allowed the well-bred SBF to rampage with FTX, but the later story is already well-known, leaving only a sigh.

On-chain DEX has not flipped Binance in 2020/2022/2025. DEX spot trading volume accounts for at most 15% of CEX, seemingly an invisible heavenly tribulation.

Curve's large stablecoin exchanges, Ethereum and Solana DEX represented by Uniswap/Jupiter, and Memecoin represented by Pump Fun are the entire story of on-chain spot DEX. In 4 years, it's still too early to tell if AMM+Bonding Curve+Order Book has potential.

In comparison, DEX's biggest problem is the absence of an absolute market giant, unlike Binance's dominance. Driven by market efficiency, normally organized forces would defeat unorganized ones. I guess the reason might be that trading itself requires strong intermediary matching. The stronger the intermediary, the more centralized, but the lower the trading costs and higher the success rate.

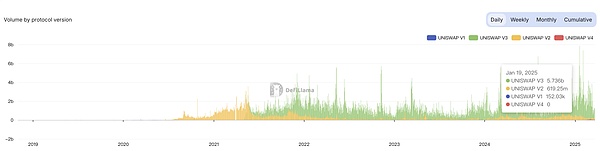

This is particularly evident in Perp DEX. Hyperliquid reaches up to 10% of Binance's daily trading volume, but multi-chain deployed Uniswap's daily trading volume is only $1.5 billion, with a recent high of $5.7 billion on January 19th for Uniswap V3, finally catching up with Binance's rumored annual fee profit.

The biggest problem with spot DEX and Perp DEX is that trading volume cannot increase. But the blame is not on Uniswap; the fragmentation of public chains and L2 is the real culprit. The crypto solution is chain abstraction, which is equivalent to re-walking the aggregation path of centralized exchanges, but under the name of decentralization - first split, then heal, repeatedly.

Of course, BitMEX and Aevo are more innovative. The former developed the perpetual contract product type, and the latter launched the Pre-launch (pre-market trading) mode. However, unfortunately, they were copied by other CEXs and ended up crushing the old pioneers.

OpenSea and Blur are typical examples of entering the wrong industry. The NFT market has been periodically falsified. Whether to issue tokens, list them, or do Rollup has lost its meaning for discussion.

We can draw a preliminary conclusion that no new players will emerge in CEX, especially in spot CEX. If you don't believe it, you can look at Backpack's experience. Even with FTX's spiritual continuation and Solana's orthodox backing, combining wallet/CEX is already futile.

As of now, the only trend in 2025 is the on-chain competition of exchanges, opening the proxy war of wallets, DEX, and meme. However, we need to understand why these elements and why it will be the exchange's home ground.

DeFi Cultural Renaissance

Before the universe, we are always children; before Binance, we are always leeks.

One day in the crypto world is a year in human world. Simply using trading platform establishment time and current trading volume is not enough to show the speed and brutality of paradigm shift. According to explosive events of each trading platform, we can more clearly outline its development path:On-chain - Off-chain - Back on-chain.

The initial on-chain ecology was completely centered around Bitcoin. P2P meant point-to-point trading, not microloans, but trading efficiency was obviously low. Ethereum 1.0 was born to make everything happen on-chain, including but not limited to trading and DeFi.

On-chain: Beyond Binance, Coinlist can participate in token public offerings;

Off-chain: Beyond the US and China, Upbit took 9.44% market share with a single country market;

Back on-chain: Beyond spot and contract, Polymarket proved the feasibility of on-chain prediction markets.

From Filecoin's sky-high $150 million fundraising on Coinlist in 2017 to the 2024 election prediction driven by Trump, the emergence of $TRUMP, and BTC strategic reserve motion, crypto has officially turned into the opposite of itself, becoming part of the established system, much like the development history of trading platforms.

From a narrative perspective, existing trading platforms can be roughly divided into four product styles:

Image description: Trading platform style classification Image source: @zuoyeweb3 It can be observed that platforms with Chinese backgrounds like Binance and OKX are hard to categorize, as they are hybrid innovating, copying and modifying, both on-chain and off-chain, hoping to build an all-in-one ecosystem like WeChat, thus doing spot and futures trading, having wallets and L1/L2, involving stablecoins, DeFi, financial management, and compliance licenses, while also laying out and controlling VC and market makers.

Beyond the established "greedy" product mindset, more importantly, the larger the platform, the less they can ignore tiny threats. BitMEX's network line disconnection to save the market in March 2020 led to its gradual demise; the more top-tier a platform is, the more they must watch the traffic effect of explosive events. Robinhood, as a brokerage platform, got involved in the GME and dogecoin controversy, and ultimately, being infamous is still being famous.

How BitMEX disappeared and how Robinhood emerged are questions that persistently exist, more worthy of contemplation than FTX's sudden rise and fall.

In other words, today's Binance is not the Binance of 2017, but a new Binance focusing on "diverting" BNB Chain and wallet ecosystem after regulation, just like OKX Wallet removing DEX aggregators to truly comply.

There's a further conclusion: as long as specific operations and strategies are followed, when reaching the critical point, the tipping point will arrive, and non-linear growth will become reality.

Now to answer why exchanges are the main players: on-chain competition is an inevitable move after exchanges have consumed existing market share. Hyperliquid's proactive attack brought about the prosperity of BNB Chain meme.

However, wallets are not new products, and L2 has been criticized for Ethereum, only exchanges have the capability to continue, and this proxy war still needs an audience - retail investors' attention.

DeFi becomes the focus again, and the meme craze is just a prelude to a larger-scale monetary offensive in the future.

Life Sustains on Negative Entropy, Trading Relies on Retail Investors

[The translation continues in this manner, maintaining the original structure and meaning while translating to English]