Cryptocurrency payment is accelerating, but what truly drives user adoption? What obstacles hinder its widespread use? To answer these questions, we delved into the Web3 PayFi ecosystem and released the "Unlocking PayFi: On-Chain Cryptocurrency Payment Adoption Report". Despite rising adoption rates, key challenges must be addressed to make cryptocurrency payments a seamless and reliable financial tool.

Background

As crypto assets continue to integrate into mainstream financial systems, understanding user motivations and concerns has become crucial. Our research deeply explored the core factors influencing cryptocurrency payment adoption—whether transaction speed and cost-effectiveness or concerns about security and usability. By analyzing user behaviors across different generations and regions, we revealed key trends shaping the future of cryptocurrency payments.

For example, emerging markets prioritize accessibility and low costs, using cryptocurrency as a tool to bypass traditional financial barriers; while users in developed markets focus more on financial independence and privacy, viewing cryptocurrency as an alternative to centralized banking systems. These insights provide valuable references for industry participants to optimize payment experiences, build trust, and accelerate global adoption.

This report is based on an online survey of 4,599 Bitget Wallet community respondents between February 7-11, 2025, covering Generation Z, Millennials, and Generation X users across multiple global regions, comprehensively presenting the evolution trajectory of cryptocurrency payments.

Key Insights

What Drives Cryptocurrency Payment Adoption?

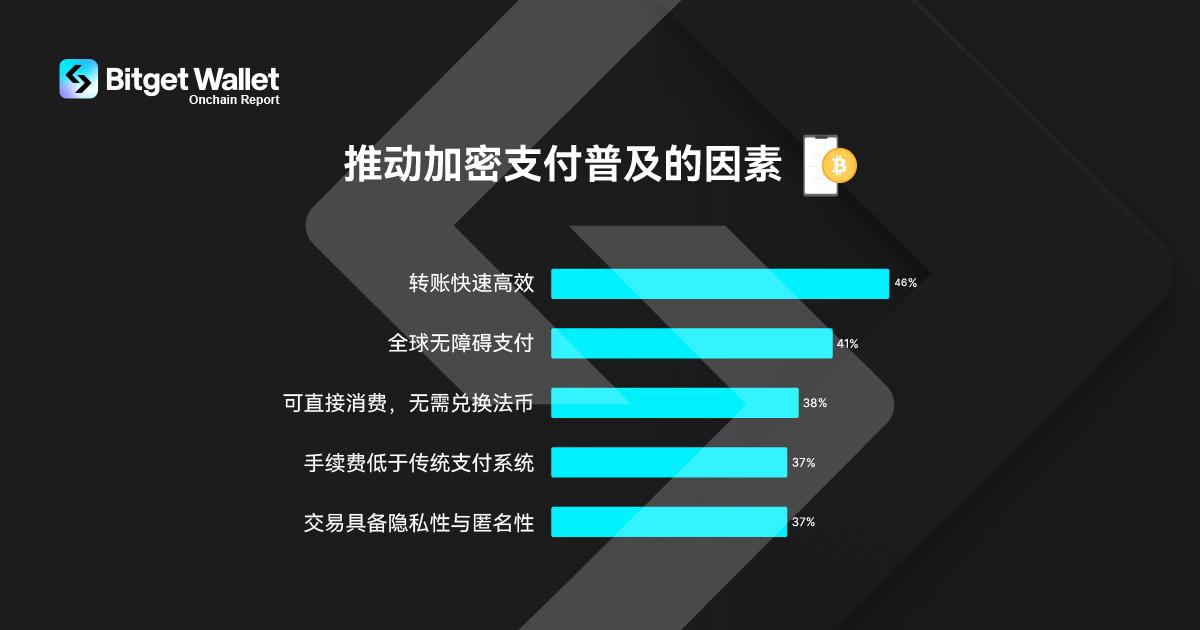

Speed is the primary driver of adoption, with 46% of respondents citing fast transactions as the main reason for using cryptocurrency payments. Global accessibility follows closely, with 41% of users valuing the seamlessness of cross-border transactions, especially in regions with weak banking infrastructure.

Cost savings are equally critical—37% of users choose cryptocurrency for lower transaction fees, and 31% appreciate its ability to avoid high exchange rate costs. Additionally, 32% of users view cryptocurrency as a financial independence tool, enabling transactions without bank dependence.

Beyond practical value, cryptocurrency is also seen as an investment. 33% of respondents view their held assets as potentially appreciating investments. Other users value the privacy protection (37%) and fund control (35%) offered by decentralized payments.

Regional differences further shape adoption patterns: emerging market users prioritize speed, accessibility, and low costs. Africa (52%) and Southeast Asia (51%) have the highest demand for fast transactions, while North American and Oceanian users (36%) emphasize smooth cross-border payments.

What Hinders Cryptocurrency Payment Adoption?

Despite growing user interest in cryptocurrency payments, multiple obstacles remain. Security concerns top the list, with 37% of users worried about hacking and fraud. Lack of legal protection (27%) and trusted payment service providers (23%) further exacerbate these concerns, keeping users hesitant about cryptocurrency transactions.

Price volatility remains a significant challenge. Approximately 35% of users believe token value fluctuations make payments unpredictable. Moreover, network congestion and high peak-period transaction fees undermine the cost advantages of on-chain payments.

Usability issues also pose a major barrier: the risk of irreversible transactions (34%) makes errors costly, while low merchant acceptance (31%) limits practical cryptocurrency applications. An additional 25% of respondents find wallet and address technical complexity reduces payment experience friendliness. Simplifying operational processes and expanding merchant support will be key to overcoming these bottlenecks.

Read the Complete 2025 PayFi Report for In-Depth Analysis and Regional Data

Bitget Wallet's PayFi Future Vision

At Bitget Wallet, we are committed to addressing cryptocurrency payment challenges and promoting more user-friendly, secure, and practical crypto payments. As part of Bitget Wallet's 2025 PayFi vision, we are launching smooth on-chain financial services that allow users to earn, send, and spend within a single platform.

Imagine a completely new financial ecosystem: you can stake stablecoins across multiple chains to earn passive income while maintaining full asset control, and directly purchase daily necessities or pay travel expenses with cryptocurrency without worrying about price fluctuations or complex operations. By combining DeFi earnings with real-world payments, we are transforming cryptocurrency from a speculative asset into a practical financial tool, enabling billions globally to enjoy digital financial convenience.

As we continue to innovate, we invite you to join this journey towards a new era where cryptocurrency payments are as seamless as traditional finance!

About Bitget Wallet

Bitget Wallet is Asia's largest and globally leading one-stop Web3 wallet, with over 60 million global users. Offering diverse wallet forms including seed phrase wallets, keyless MPC wallets, AA smart contract wallets, and supporting hardware wallet connections, it now supports over 100 mainstream public chains, hundreds of EVM chains, and over 500,000 cryptocurrency assets. As the best choice for users to discover new assets and capture opportunities in the Web3 domain, Bitget Wallet's product features cover Swap trading, smart market tracking, Launchpad, inscriptions, Non-Fungible Token & DApp, earning, and achieve free trading across 50+ chains by aggregating liquidity from hundreds of mainstream DEXs and cross-chain bridges. Bitget Wallet has established a systematic security system, providing a $300 million risk guarantee fund.

For more information, visit: Website | Twitter | Telegram | Discord