Introduction: The Paradigm Significance of Apollo's Strategic Investment

On April 8, 2025, Apollo Global Management, a global alternative asset management giant with over $700 billion in assets under management, announced leading a new round of financing for Plume Network, marking a strategic-level recognition of blockchain-enabled real-world assets (RWA) by traditional financial giants. As a top institution focused on managing low-liquidity assets such as real estate, infrastructure, and art, Apollo's entry not only endorses and injects resources into Plume but also reveals its ambition to transform traditional asset management models through on-chain liquidity.

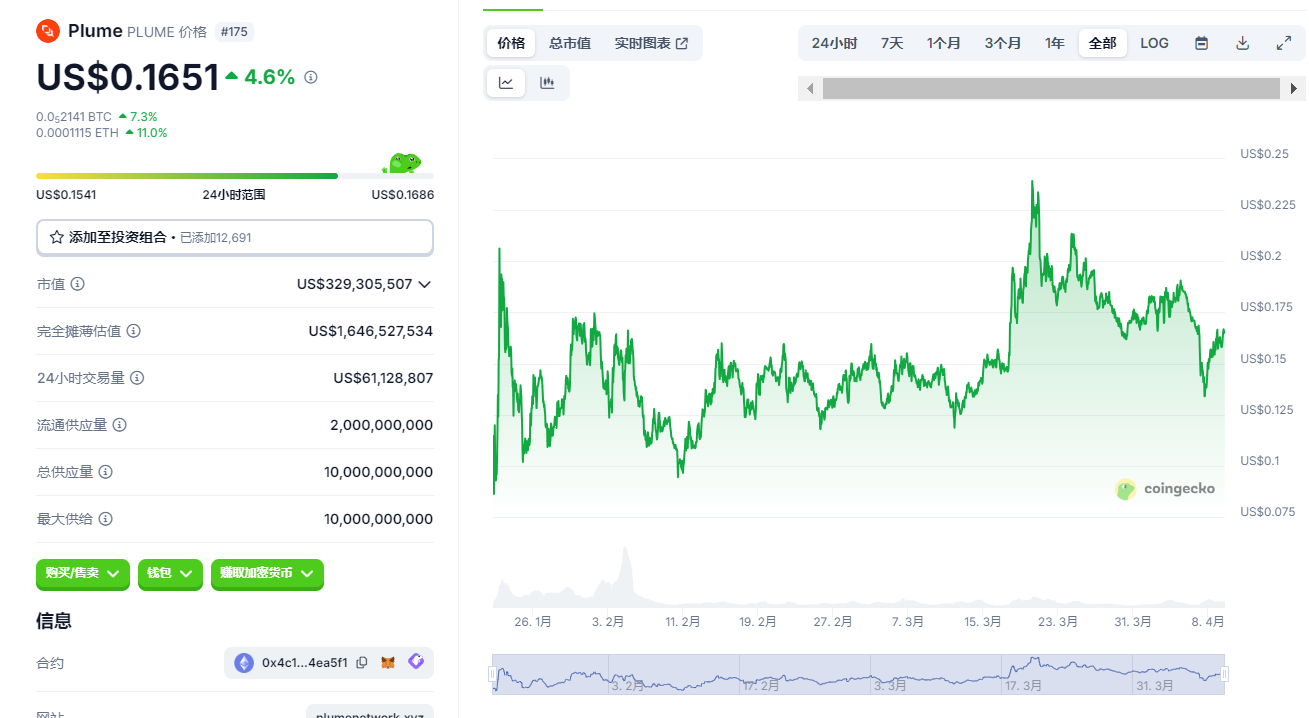

Currently, the PLUME token is priced at $0.16, with a circulating market cap of $330 million and a total market cap of $1.6 billion, still showing a significant valuation gap compared to competitors like Ondo (FDV $8.5 billion) and Mantra (FDV $12.5 billion). This article will systematically deconstruct Plume's value logic and future potential from dimensions such as team background, technical architecture, ecosystem layout, and capital trends.

I. Team Background: The "Golden Triangle" of Crypto Native and Traditional Asset Management

Plume's core team presents a rare composite background, combining crypto infrastructure development, institutional-level compliance operations, and top-tier capital operations, forming a "iron triangle" architecture supporting the RWA track:

- Chris Yin (CEO) - Product and Capital Dual Operator

- Former Executive Director at Scale Venture Partners and Product Vice President at Rainforest, deeply involved in early investments in star projects like Coinbase and Chainalysis, skilled at bridging technical product and institutional capital needs. His traditional venture capital background provides critical support for Plume's compliance path and resource integration.

- Eugene Shen (CTO) - DeFi Infrastructure Architect

- Former senior software engineer at dYdX, leading the underlying architecture development of derivatives protocols. His academic training in engineering physics gives him strong implementation capabilities in technological innovations like modular blockchain and account abstraction. Plume's core components such as smart wallets and data highways are led by his technical team.

- Teddy Pornprinya (CBO) - Ecosystem Expansion "Crypto Diplomat"

- Former Business Development Director at Binance and Business Expansion Head at Coinbase, who facilitated listings and ecosystem collaborations for multiple billion-dollar projects. His industry connections have quickly built a cooperation network covering 180+ projects including BlackRock, Ondo, and Brevan Howard.

Team Core Capability Tags: Compliance Gene (Traditional Asset Management Experience) + Technical Accumulation (DeFi Protocol Development) + Ecosystem Resources (Exchange and Institutional Network), forming a perfect combination to promote large-scale RWA implementation.

II. Financing Map: The "Triple Bet" Logic of Top Institutions

Plume's financing journey is a microcosm of RWA track capital deployment, presenting a clear path of penetration from crypto-native funds to traditional asset management giants:

Deep Logic of Capital Deployment:

- Haun Ventures (founded by a16z former partner): Betting on Plume as the "Coinbase of RWA", building a one-stop platform for asset issuance and trading;

- Brevan Howard: Leveraging Plume's compliance engine to migrate its over $20 billion credit asset portfolio on-chain;

- Apollo: Activating secondary market trading for alternative assets like real estate and art through Plume's liquidity protocol, solving the traditional asset management "exit difficulty" pain point.

It's worth noting that Apollo's entry may bring two types of resource synergies:

- Asset Side: Tokenizing its $700 billion alternative assets (such as commercial real estate REITs, private credit) through Plume Arc engine;

- Liquidity Side: Constructing cross-chain asset pools by bridging data with partners like JPMorgan and Blackstone through Plume Nexus.

III. Product Matrix: Building RWA Infrastructure's "Triple Moat"

Plume embeds compliance, asset issuance, and liquidity into the protocol layer through a modular architecture, forming core competitiveness different from generic public chains:

1. Arc Engine: Compliance Asset Issuance "Assembly Line"

- Technical Characteristics: Adopting ERC-3643 token standard, with built-in KYC/AML verification, custodian interface, legal entity binding modules, allowing issuers to customize compliance rules (such as geographic restrictions, investor certification);

- Case Implementation: Assisted Mercado Bitcoin in putting 40 million USD of Brazilian consumer credit and corporate bonds on-chain, reducing issuance cycle from months to 72 hours;

2. Smart Wallet: Key Entry Point for Lowering RWA Usage Threshold

- Account Abstraction Innovation: Integrated at the native protocol layer, users can directly manage complex operations like tokenized asset pledging and yield farming using EOA addresses, without relying on third-party contracts;

- Compliance Integration: Embedded whitelist mechanism and on-chain arbitration module, meeting institutional clients' needs for permission control and dispute resolution;

3. Nexus Data Bridge: "Value Highway" Connecting DeFi and TradFi

- Real-time On-chain Data: Using TLSNotary technology to verify off-chain data sources (such as real estate valuation reports, carbon emission indicators), providing trusted input for RWA pricing;

- Application Scenarios: Supporting new on-chain financial products like weather derivatives and luxury goods index futures, expanding RWAFi boundaries;

Moat Effect: The synergy of these three creates a closed-loop ecosystem for Plume, from asset issuance (Arc) → user interaction (smart wallet) → liquidity enhancement (Nexus), building a "flywheel effect" in the RWA track.

IV. PLUME Token Value Analysis: Underestimated Track Leader?

As of April 9, 2025, the PLUME token's FDV is $1.6 billion, with a circulating market cap of $330 million, showing a significant undervaluation compared to track competitors:

Upside Potential Breakdown:

- Valuation Repair Space: If reaching Ondo's FDV level, PLUME has a 430% upside potential;

- Ecosystem Growth Dividend: After mainnet launch, $8 billion tokenized asset injection (real estate, private credit, etc.) will directly boost PLUME demand through Gas consumption;

- Listing Expectation Catalyst: Binance investment institution YZi Labs has already deployed, combined with Apollo's positive news, listing expectations are heating up;

- Staking Economic Model: Currently only 20% of tokens are circulating, with the remaining 80% to be released over 7 years, lower deflationary pressure compared to similar projects;

Risk Warnings:

- Regulatory Uncertainty: Policy risks from US SEC's classification of RWA assets;

- Ecosystem Expansion Speed: Potential slower-than-expected on-chain progress for assets from 180 partner projects;

V. Conclusion: The Next Stop of the RWA Revolution

Apollo's entry marks a key turning point for the RWA track, moving from "crypto-native experiment" to "traditional asset management standard". With its compliance engine, modular architecture, and top-tier resource network, Plume is becoming the core hub connecting trillion-dollar alternative assets with on-chain liquidity.

For the PLUME token, the current valuation has not fully reflected its ecosystem expansion potential and the strategic resource injection from Apollo. If the asset issuance scale breaks through hundreds of billions of dollars after mainnet launch as expected, PLUME may replicate Ondo's market value growth trajectory in 2024, becoming the next ten-fold target in the RWA track.

BlockBeats Perspective: The explosion of RWA is not a short-term narrative, but a lasting revolution that reshapes global asset liquidity. As a core piece of the infrastructure layer, Plume is worth adding to the long-term observation list.