In today's cryptocurrency field, stablecoins have become an indispensable key element. Their unique value is not only reflected in the medium function of crypto asset trading but also demonstrates revolutionary potential in traditional financial scenarios such as cross-border payment settlements. The latest industry data shows that as of April 9, 2025, the global stablecoin circulation market value has risen to $236.7 billion. Top asset management institutions including BlackRock and Fidelity, as well as sovereign economic entities like the EU and Singapore, are accelerating their layout in the stablecoin track. USDC stablecoin issuer Circle has recently formally submitted its prospectus to the US SEC, expected to list on NASDAQ with a valuation of $5-7 billion, which has become a microcosm of the industry's robust development.

What exactly is a stablecoin? Why can stablecoins maintain their value?

What is different between stablecoins and other cryptocurrencies?

What is the purpose of stablecoins? Why do we need stablecoins?

What are the mainstream stablecoins in the current market? What are the differences between different stablecoins?

The Crypto Salad legal team has been deeply involved in the cryptocurrency industry for many years, with rich experience in handling complex cross-border compliance issues in the crypto industry. They will combine industry research and team practical experience to sort out and answer these questions from a professional lawyer's perspective.

II. What are the main stablecoins in the market, and what are the differences between them?

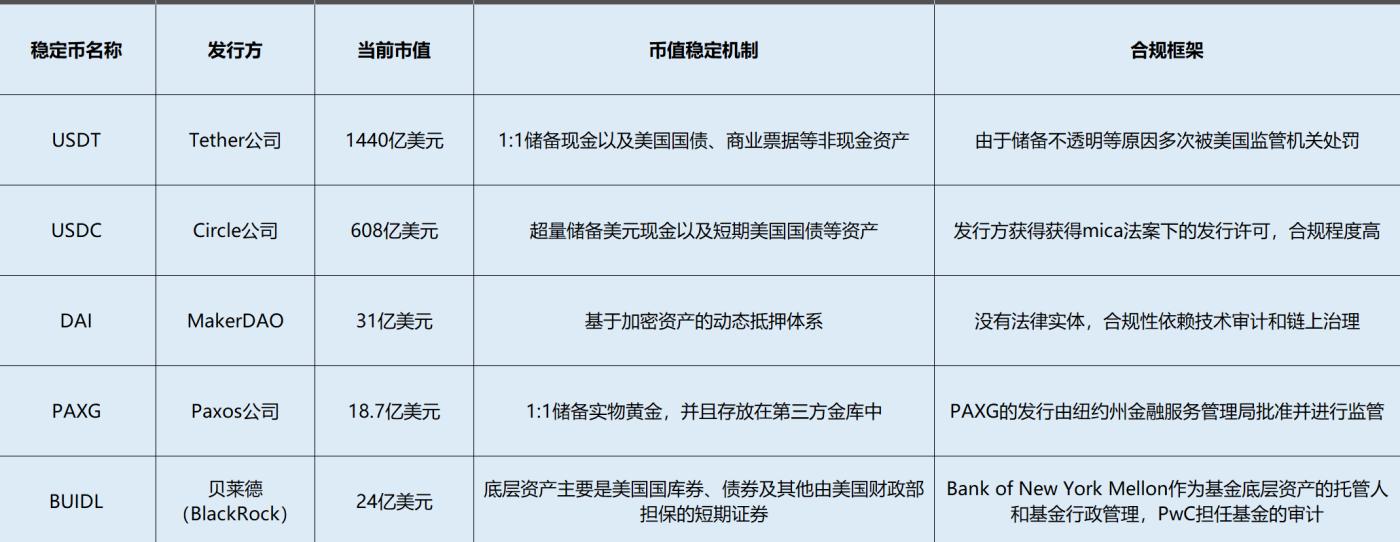

Currently, mainstream stablecoins in the market can be categorized based on their collateralized asset types: fiat-backed stablecoins, crypto-backed stablecoins, asset-backed stablecoins, and algorithmic stablecoins. Next, the author will analyze the mainstream stablecoins from three perspectives: market capitalization, price stability mechanism, and regulatory compliance.

The above image compares different types of stablecoins

(I) Fiat-Pegged Stablecoins

Fiat-pegged stablecoins are those supported by fiat currency or equivalent cash. Currently, USDC and USDT dominate the market, with a combined circulation market value of over $200 billion, accounting for more than 85% of the total stablecoin market liquidity.

1. USDC

Basic Information: USDC is issued and operated by Circle, with a current circulation market value of around $60 billion.

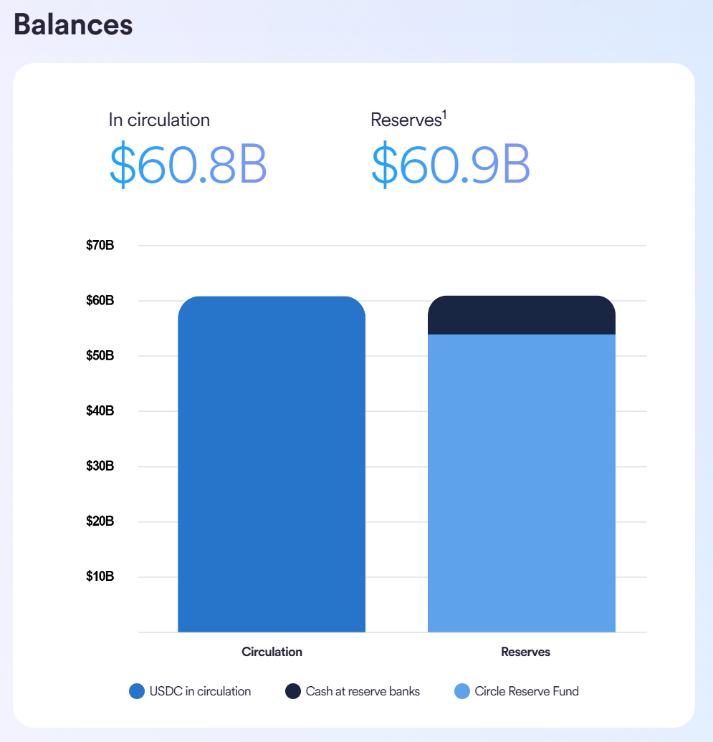

Price Stability Mechanism: Circle maintains USDC's stability through over-reserved US dollar cash and short-term US Treasury assets. "Over-reserved" means the reserve asset value will always be slightly higher than USDC's circulation market value, further ensuring price stability. The stablecoin reserves are subject to monthly audit reports by third-party auditor Deloitte.

(The above image shows the reserve situation disclosed on Circle's official website)

Regulatory Framework: Circle is a licensed remittance institution regulated by US state laws. The company is registered with FinCEN and holds Money Transmission Licenses (MTL) in multiple US states. Circle's regulated subsidiary became the first stablecoin issuer to commit to the Value-Related Crypto Assets (VRCA) requirements by the Ontario Securities Commission (OSC) and Canadian Securities Administrators (CSA) in 2024. This allows USDC to be publicly traded on Canadian crypto asset trading platforms. In 2024, Circle, as a leading digital payment platform, received issuance authorization for its stablecoins USDC and EURC under the EU MiCA regulation, making USDC the first mainstream stablecoin compliant with EU MiCA requirements.

The brilliance of this over-collateralization mechanism lies in: It preserves the decentralized nature of crypto assets while solving the centralized trust issue of traditional stablecoins through a mathematical model, ultimately achieving decentralized stablecoin issuance.

Compliance Framework: After research, the Crypto Shalei team found that unlike Circle and Tether, MakerDAO is not a traditional commercial entity, but a decentralized autonomous organization (DAO) built on the Ethereum blockchain. The stability of DAI does not rely on the credit endorsement of a centralized institution, but is mainly maintained through an algorithmically driven dynamic collateralization system and community consensus. While this design technically achieves the ideal of decentralization, it also brings unique regulatory challenges. Due to the lack of a clear legal entity, DAI's compliance is difficult to assess through traditional financial regulatory frameworks, with its transparency depending more on technical audits and internal governance rather than external legal constraints.

(III) Stablecoins Pegged to Physical Assets

1. PAXG

Basic Information: PAXG is a gold stablecoin issued by Paxos. As of March 2025, PAXG's market value is approximately $1.87 billion, accounting for 76% of the gold stablecoin market.

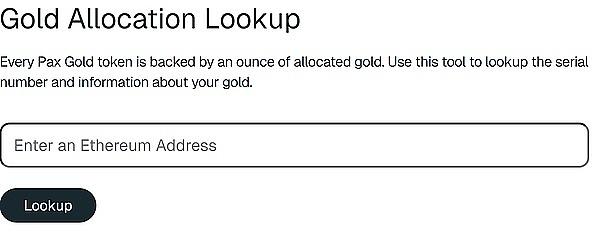

Value Stability Mechanism: PAXG's gold physical reserves are custodied by the Paxos Trust Company. These gold bars are safely stored in vaults like Brink. Third-party audit firms review and disclose the gold reserves monthly to verify that the gold reserves match the token supply. Moreover, PAXG holders can redeem a certain number of tokens for the corresponding physical gold. Through this legal framework design, Paxos can ensure that one PAXG token is equivalent to a London standard delivery gold bar of one troy ounce, with its value directly linked to the real-time market gold price. Token holders can check their physical gold serial number, value, and other physical characteristics by entering their Ethereum wallet address in the PAXG query tool.

Essentially, PAXG is an RWA (Real World Asset) project based on physical gold assets. Unlike mainstream stablecoins, its underlying asset gold has higher price volatility than cash or short-term government bonds typically used by stablecoins, thus differing in positioning. However, as gold has long been recognized by the market as a hedge asset during economic uncertainty, its underlying asset characteristics give PAXG certain stablecoin attributes, hence its inclusion in the stablecoin discussion.

(The above image is a screenshot of the gold reserve query page on the Paxos official website)

Compliance Framework: PAXG is approved and regulated by the New York State Department of Financial Services. The issuer, Paxos, holds gold reserves through a trust company, thereby achieving complete isolation of gold reserves from the issuer's assets, ensuring the independence and adequacy of corresponding gold reserves.

In addition to PAXG, BUIDL (BlackRock USD Institutional Digital Liquidity Fund) issued by the world's largest asset management company, BlackRock, has been particularly outstanding in recent years. Currently, BUIDL's total market value has exceeded $2.4 billion, becoming an important member of the stablecoin market. BUIDL provides a digital asset that combines liquidity and yield for institutional and individual investors through an innovative tokenized fund design.

The underlying assets of this token include U.S. Treasury bills, bonds, and other short-term securities guaranteed by the U.S. Treasury, ensuring the stability of its token value. The project also designed a comprehensive compliance framework. Bank of New York Mellon serves as the custodian and fund administrator of the underlying assets, ensuring the safety and transparency of the underlying assets; PwC acts as the fund's auditor, auditing the fund's financial condition and operations, enhancing the fund's transparency and credibility.

(IV) Algorithm-Based Stablecoins

Algorithmic stablecoins are a type of stablecoin that maintains its value pegged to a reference currency (usually the U.S. dollar) through complex smart contract algorithms. Unlike traditional collateralized stablecoins, algorithmic stablecoins do not rely on reserves of fiat or cryptocurrencies, but instead solely regulate their supply and demand to achieve price stability.

Since the stability of algorithmic stablecoins heavily depends on algorithm design and market conditions, extreme market volatility or malicious attacks on the stabilization algorithm can easily cause them to lose their peg to the reference currency. In May 2022, during the notorious "UST, Luna crash," the algorithmic stablecoin UST lost its peg due to a malicious attack on its stabilization algorithm, causing its price to plummet to zero. This black swan event not only caused hundreds of billions of dollars in crypto assets to vanish but also exposed fatal flaws in algorithmic stablecoins, including algorithmic mechanism vulnerabilities, market liquidity dependence, and risk isolation mechanisms. It completely destroyed the trust foundation for algorithmic stablecoins in the crypto market. In the post-crisis era, regulatory agencies have listed such projects as high-risk areas, and investors generally avoid related cryptocurrencies, directly causing the algorithmic stablecoin track to fall into long-term dormancy.

III. Crypto Shalei Interpretation

The Crypto Shalei team believes that the value foundation of stablecoins is built on a dual support:

First, the underlying physical or digital assets as a guarantee,

Second, market consensus-driven liquidity and trust mechanisms

Consensus determines the usage range and liquidity of stablecoins, while the adequacy of reserve assets is directly related to the stablecoin's risk resistance. The dynamic balance between the two constitutes the core stability of the stablecoin system.

However, the "stability" attribute of stablecoins is not absolute. The stability of stablecoins is essentially the result of a dynamic balance, not a static absolute guarantee. When market consensus for stablecoins fractures or reserve assets encounter systemic risks, they may face price volatility or even de-pegging risks. Recent stablecoin de-pegging incidents have also confirmed this view. To address potential extreme risks faced by stablecoins and protect the legitimate rights of stablecoin holders, related regulatory frameworks and technical guarantee mechanisms still need further development and improvement.

The Crypto Shalei team will continue to update the introduction and analysis of stablecoin regulatory frameworks worldwide, so stay tuned.

Special Statement: This represents only the personal view of the author and does not constitute legal consultation or legal advice for specific matters.