Written by: Token Dispatch, Thejaswini M A

Translated by: Block unicorn

Preface

A tweet. 69 minutes. $17 million. And then chaos. What happened next with Base's official account caused the entire crypto community to question "content tokens", insider trading, and the responsibilities of various platforms.

Three mysterious wallets somehow precisely knew when to buy and earned a profit of $666,000, while thousands of retail traders suffered heavy losses.

Base claimed this was just a harmless "chain culture" experiment - but on-chain evidence revealed a more complex truth. Is this a new frontier for creator monetization, or just a pump and dump under a new name?

In today's in-depth analysis, we will dissect the most controversial "non-token token" release event in the crypto space from multiple angles.

Event Progression

On a very ordinary Wednesday afternoon, Base - Coinbase's Ethereum Layer 2 network - posted a seemingly harmless tweet: "Base is open to everyone."

What happened next is a perfect case study of evolving etiquette in the cryptocurrency field, with a frustratingly blurry line between experimentation and irresponsibility.

60 seconds after the initial tweet, Base added a link to a Zora post in the comments, with content identical to the tweet. For the uninitiated, Zora is a "chain-based social protocol" that automatically converts any content posted on its network into a tradable token. By posting some clever content, people can buy and sell tokens of your wisdom.

Base's leadership might have thought this was a harmless "chain culture" experiment. What the crypto community saw was entirely different: a meme token worth $17 million appearing out of thin air, bearing the name of one of the most well-known brands in crypto.

The story becomes interesting - and complex - from here.

The market's reaction was exactly as you would expect when a major Layer 2 network "launches" a token:

Market cap soared from 0 to $17 million in just 69 minutes

Then crashed nearly 90% (dropping below $2 million)

Recovered somewhat in the next few hours, reaching up to $20 million

Stabilized around $8-10 million at the time of writing

To observers, this looked very much like a classic pump and dump. For Base, this was a practical lesson in the law of unintended consequences.

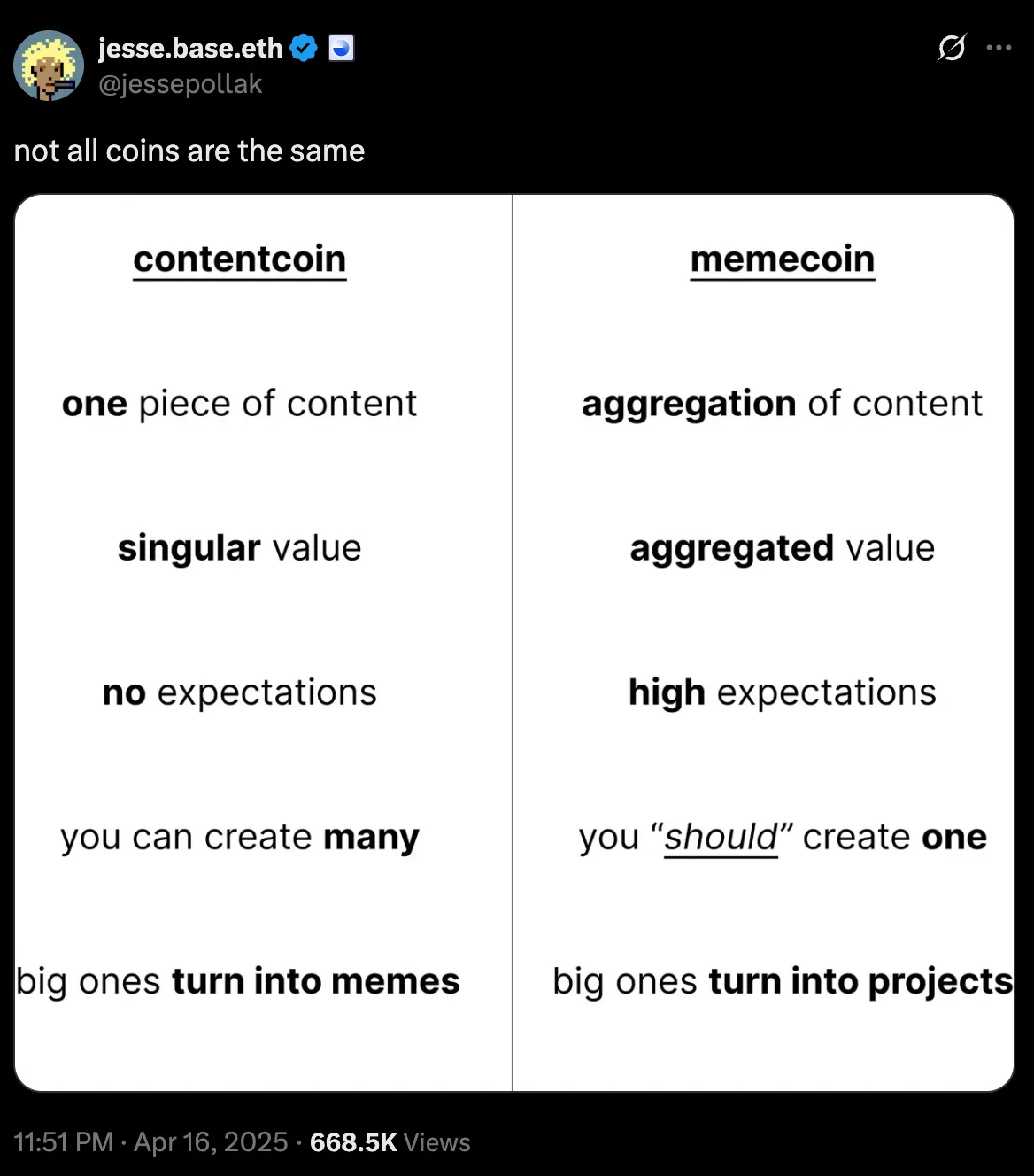

For thousands of retail traders who bought at the peak, this was an expensive educational lesson about the difference between "content tokens" and "meme tokens" - a distinction that means nothing to those who just lost money.

Base's founder Jesse Pollack tweeted.

Frustratingly, the answer seems to be "it's complicated".

This ambiguity is both the biggest advantage and the most enduring weakness of the crypto field. The field develops rapidly because the threshold for experimentation is extremely low. But the same freedom also creates an environment where chaotic events like "content tokens" frequently occur.

Just being associated with Base/Coinbase is enough to drive millions of dollars into a token with no utility, no roadmap, and no future.

This is not unique to Base—we have seen similar phenomena involving tokens allegedly related to Solana, Bitcoin, and almost all other mainstream crypto projects.

This influence comes with responsibility. Base's core mission—"building a global on-chain economy that fosters innovation, creativity, and freedom"—is commendable. Their technological innovations are impressive. Their growth data (900,000 daily active addresses, $2.4 billion total value locked) shows reasonable development potential.

This makes this meme token mishap all the more puzzling. Base does not need to chase short-term wins or social media hype. They are building something truly meaningful in the long term.

Given that Base just released an ambitious second-quarter roadmap, the defense of the "content token" seems particularly hollow. The plan outlines impressive technological innovations such as Flashblocks (reducing block time to 200 milliseconds), Base Appchains (third-layer chains for specific applications), and enhanced privacy features.

Base's serious technological ambitions stand in stark contrast to this seemingly casual attempt at tokenizing a social media post, making it hard to ignore.

The line between innovation and irresponsibility may be blurry, but the ability to successfully navigate this line is the difference between truly transformative projects and interesting but ultimately failed experiments.

In the crypto field, as in life, good intentions are not enough to solve problems. "Base is open to everyone" is a good slogan—but only if "everyone" includes retail traders who do not understand the difference between meme tokens and content tokens, who should not become collateral damage in "on-chain culture" experiments.