This article is machine translated

Show original

Ethereum Engine Reconstruction Discussion

Ethena Chooses Arbitrum Camp

Unichain, MakerDAO Old DeFi Are All Moving

Recent Week's Thoughts on DeFi

( - /9)🧵

1/ Let’s talk about ETH first. Vitalik proposed to use RISC-V to replace EVM as the long-term execution layer.

Try to explain it in as simple a way as possible:

(1) It can be roughly understood as changing the engine, the goal is to improve efficiency

(2) Coping with the massive computing consumption that may be faced in the future

(3) Breaking through the insurmountable performance ceiling under the EVM framework

(4) This change only occurs in the underlying execution engine

(5) Will not change Ethereum’s account model, contract calling method, etc.

(6)

2/ Ethena launches @convergeonchain and chooses the Arbitrum camp

This choice is quite unexpected to me, because there are many good players on OP Superchain, such as Unichain and Base, and Arbitrum is obviously at a disadvantage in the camp. Although Arbitrum Orbit and OP Superchain are both based on L2 expansion solutions, there are still some differences in design:

(1) Orbit allows developers to create dedicated Rollup or

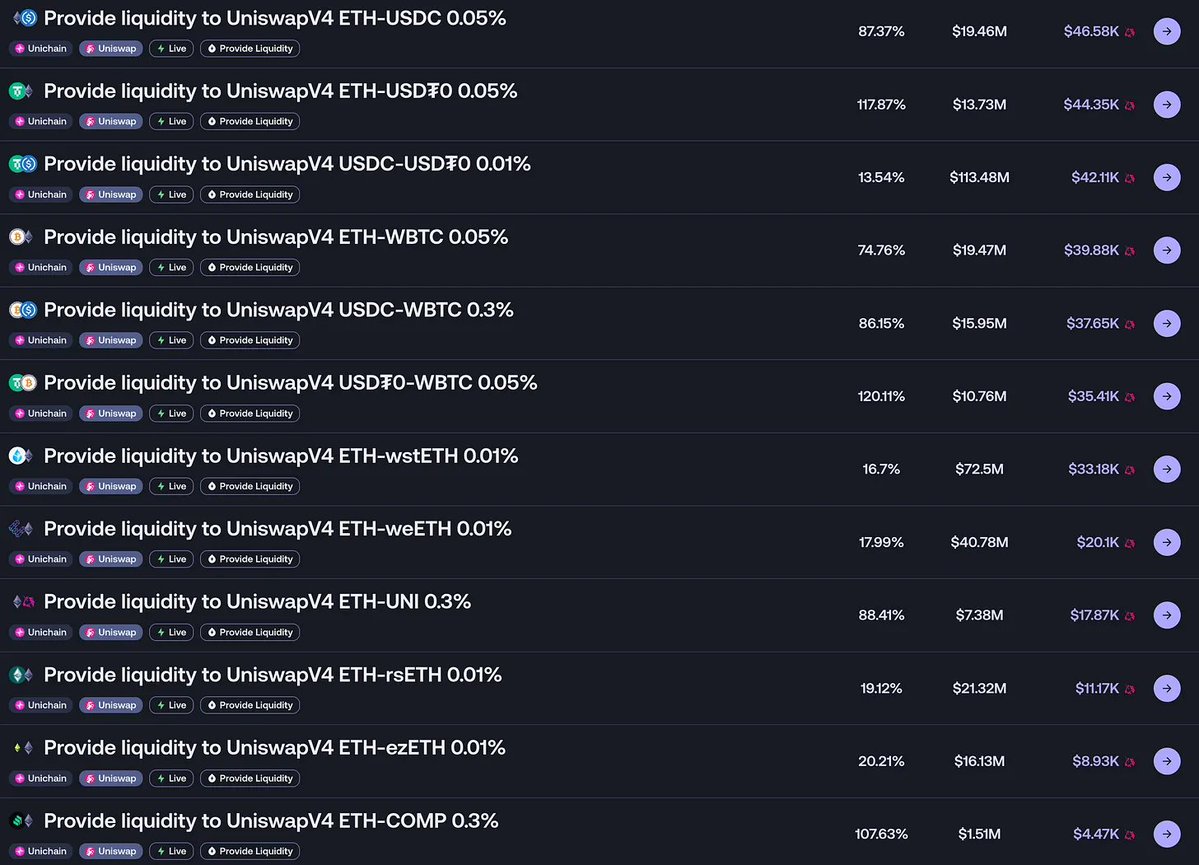

3/ Unichain Liquidity Mining

4/ Ripple's stablecoin RLUSD has entered the mainstream DeFi protocol

(1) Aave has added RLUSD to V3

(2) Curve Pool has deployed 53M liquidity

Stablecoins are really hot this year. It seems that there is a place for this track in every cycle. You can always find an angle. When there is non-compliance, algorithmic stablecoins perform well, and when the compliance environment is good, the big brothers also come out.

5/ @Optimism launches SuperStacks event to prepare for the upcoming Superchain interoperability feature

(1) April 16 to June 30, 2025

(2) Encourage users to participate in DeFi on Superchain and earn XP

(3) The protocol can also stack its own incentives

(4) OP officials said there will be no airdrop, it is just a social experiment

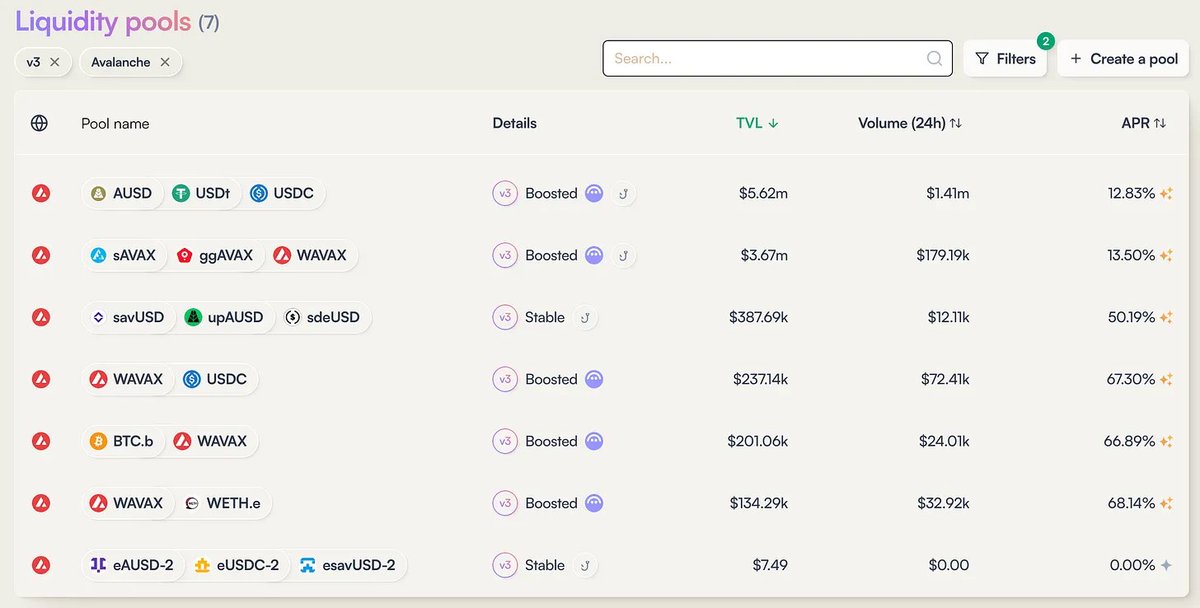

6/ @Balancer V3 is launched on Avalanche, accompanied by $AVAX incentives

The rewards are OK, but the capacity is average. BAL was previously delisted by Binance, but the protocol is still actively working, including cooperation with the ecosystem and updating and iterating. This old DeFi has not become a leader like Uniswap and Aave, and it does not have the coin issuance bonus of new DeFi, so it is very difficult to survive. We can only hope for a big explosion on the chain.

7/ Circle launches CPN network, targeting the global payment market

A compliant, seamless and programmable framework that brings together financial institutions to coordinate global payments through fiat currencies, USDC and other payment stablecoins. This network is designed to overcome the infrastructure barriers faced by stablecoins in mainstream payments, such as unclear compliance requirements, technical complexity and the problem of secure storage of digital cash.

8/ "Bridge" war

(1) GMX chooses LayerZero as the information transmission bridge for the multi-chain expansion plan

(2) a16z crypto purchased 55M worth of LayerZero tokens, locked for three years

(3) Wormhole released a future planning roadmap

Some thoughts:

9/ Spark (MakerDAO) deployed 50M funds to Maple

It is worth noting that this is the first time @sparkdotfi has deployed funds in the non-US Treasury field, but there is a limit of 100 million US dollars.

Who is Maple?

Maple focuses on connecting on-chain and off-chain to provide unsecured lending. Its main products include the main platform Maple Finance and the derivative platform Syrup:

(1)

Full article link:

Welcome to subscribe👏

cmdefi.substack.com/p/cmdefi-f...

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content