Arbitrum's timeboost auctions have leveled out around $10k per day in additional REV, just two weeks after launch

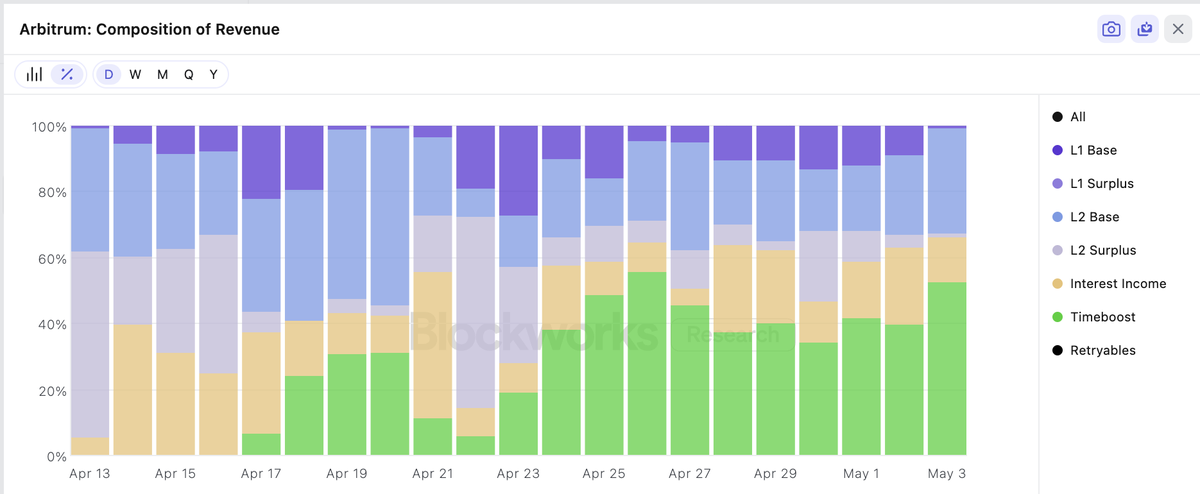

Timeboost now accounts for ~45% of Arbitrum's total revenue

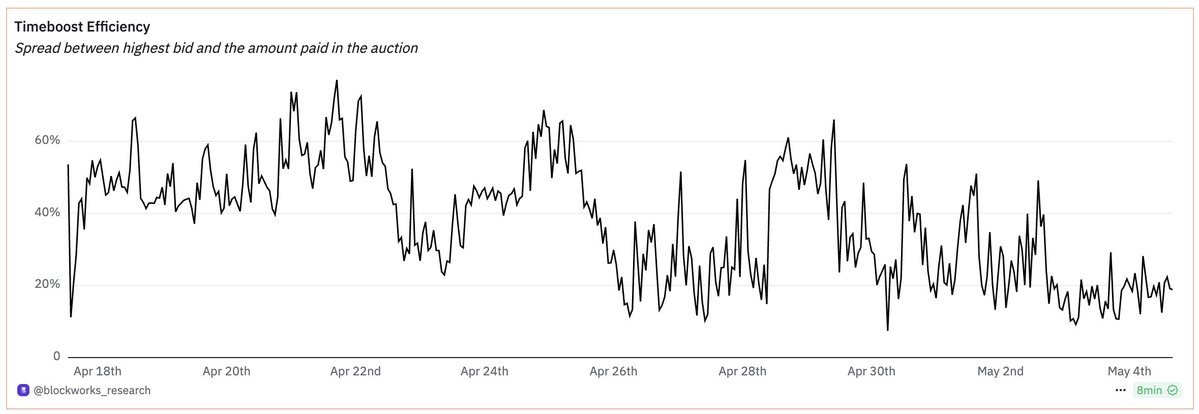

Timeboost auctions have also become significantly more efficient, with the spread between the first and second bids now hovering around 20%, down from 60% last week

A low spread (near 0%) indicates more of the fair market value of the express lane is captured by the auction

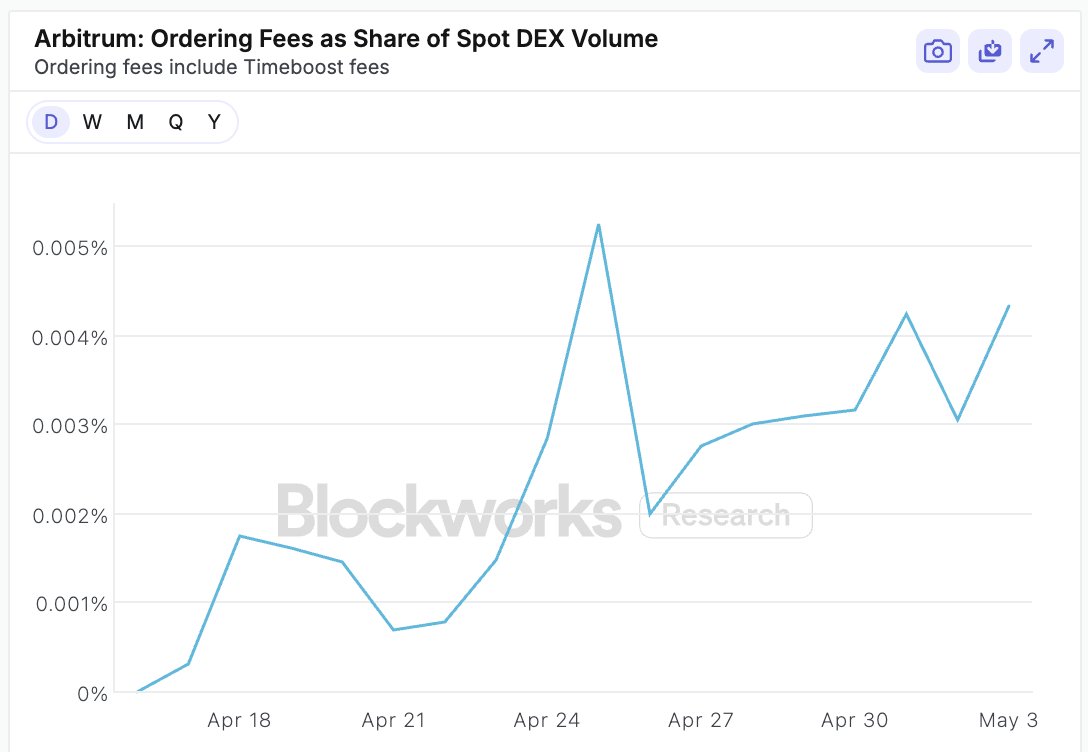

However, Arbitrum is capturing just 0.004% of value as a percentage of DEX volume on the chain

Given priority (prio fees/bundles/auctions) is generally related to dex activity, this metric can serve as an imperfect indicator of value capture efficiency

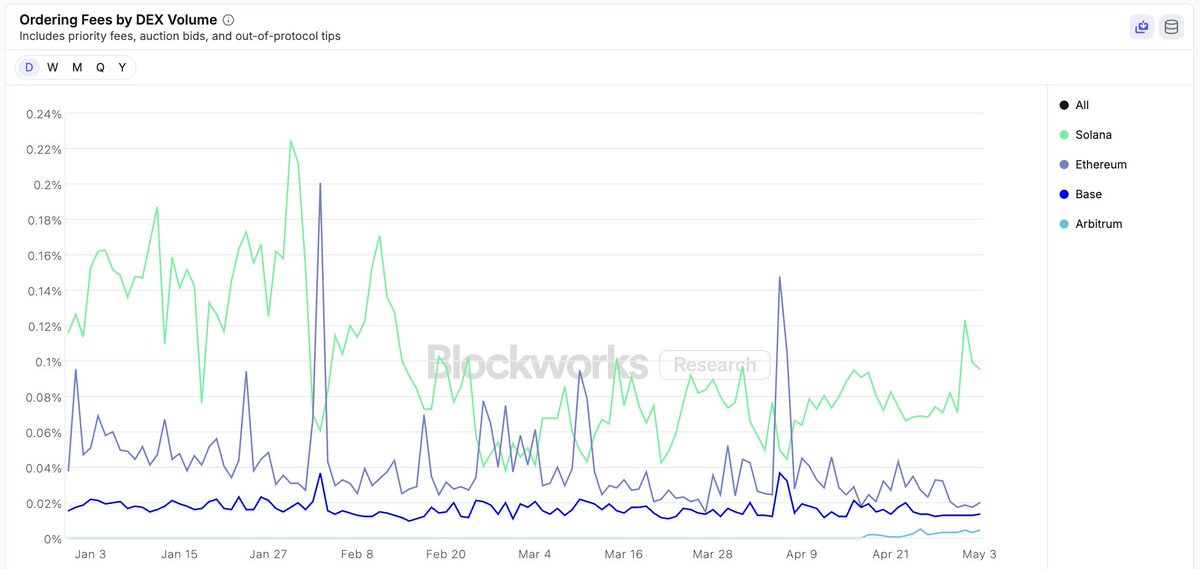

While imperfect, Arbitrum and Base are the closest you can get to isolating differences in the capture mechanism: priority ordered blocks vs timeboost 60s ownership slot

They have strong similarities in chain design (single sequencer/no front running) & activity (defi parity)

Arbitrum: 0.004%

Base: 0.013%

Which suggests ~3x more value can be captured

I would expect this gap to shrink given timeboost is still in its infancy

But the key question is: in equilibrium, how much do auction participants need to discount the future value of opportunities in the 60 second window?

Secondary marketplaces like Kairos from @gattacahq

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content