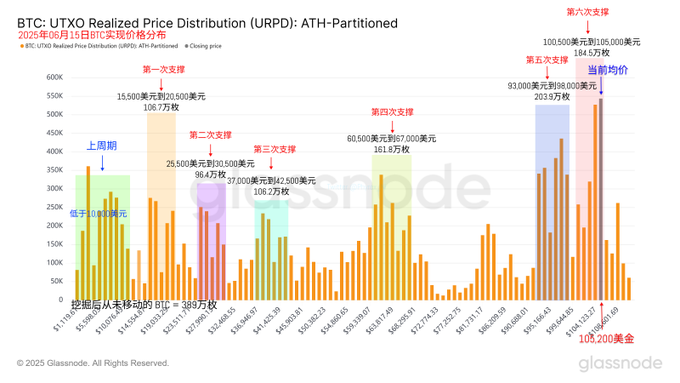

On Saturday, I almost "lay down" all day, having placed a long position at $102,000 since Friday, and then started to let it go. I am very unfamiliar with the war domain and unwilling to gamble on the outcome, so I just need to go long at the low point in my mind. If I get in, I start trading; if not, it means that $BTC is not sensitive to the Middle East issue. However, this price is only for the weekend, and I will probably cancel the order on Monday, mainly concerned about potential mixed emotions after the US stock market opens. Actually, occasionally lying flat also allows the body to relax. I woke up tonight and came to do my homework, seeing that @Trader_S18 was sick the other day, and today @Murphychen888 M brother is also not feeling well and needs to rest for a while. So combining work and rest is really important. Being in a tense state all day is very exhausting, and one must exercise regularly. Starting from Monday, I will resume swimming. The recent main direction is still driven by geopolitical conflicts in the Middle East, which I am not very familiar with, so I won't speak rashly. However, tonight's information has revealed that Israel is striking Iran's energy (oil) infrastructure, which may likely affect oil production supply and push up oil prices. We also discussed yesterday the impact of rising oil prices on US inflation. So when geopolitical conflicts occur, especially those that may affect US inflation or economy, they will cause fluctuations in dollar assets. The greater the impact, the higher the price volatility, so I am cautious during such times. Looking at Bitcoin data, although geopolitical conflicts have caused price fluctuations, investors' sentiment remains quite stable, with no significant changes. The turnover rate is also normal for a weekend, and most investors have not panicked. Support data remains unchanged, with $93,000 to $98,000 still very stable. $BTC is continuing to accumulate around $105,000, and no risks in the chip structure have been seen temporarily. However, on Sunday Beijing time, it is Trump's birthday, and some known gatherings will occur. I wonder if his birthday will bring any unexpected events. This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

This article is machine translated

Show original

Phyrex

@Phyrex_Ni

06-14

虽然今天风险市场整体表现不佳,但作业反而相对好写。相比昨天事件频发,今天的焦点相当集中,地缘冲突进入实质性阶段。战争一旦爆发,首先反应的往往是石油价格,因此我也推荐对于宏观不感兴趣的小伙伴,可以通过美油的价格波动来简单判断局势演变,虽不完全精准,但足以省下大量读新闻的时间。 x.com/Phyrex_Ni/stat…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content