This article is machine translated

Show original

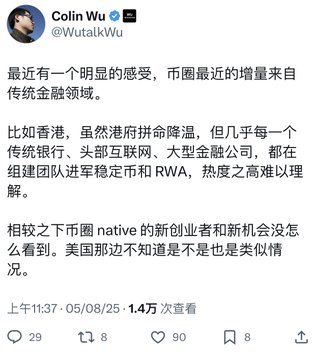

Reflecting on the sentiments of @divine_economy and @WutalkWu regarding the lack of innovation in crypto applications, here's a bold thought I've been considering: The blockchain technology we once anticipated would integrate with various scenarios like gaming, social media, e-commerce, and even offline businesses to drive true innovation and value creation, may not actually exist.

The largest future application scenarios for blockchain technology, token economics, and crypto assets are not the expected crypto-native innovative applications, but rather from two specific scenarios:

First, traditional Web2 businesses rapidly migrating to the chain, with equity and tokens converging, allowing tokens to enjoy real business revenues and corresponding rights. Only businesses creating genuine value can enable a positive token economic cycle; otherwise, token economics remains in a vacuum.

Second, AI using crypto currency to incentivize other bots, agents, and even humans to complete tasks becomes natural. Smart contracts, distributed ledgers, and tokens will become the primary interaction mediums between agents, agents and bots, and bots with each other. From this perspective, Crypto might be preparing for a highly digitalized future society.

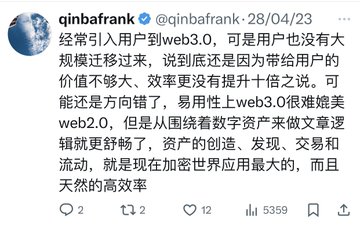

In the mobile internet venture capital domain, there was a concept of tenfold efficiency improvement: users only migrate when efficiency increases tenfold. In the crypto industry, the true tenfold efficiency improvement has been in asset issuance, trading, and liquidity - naturally high-efficiency areas, as seen in the rise of on-chain transactions and stablecoin development. This essentially represents a new capital paradigm, where higher capital asset mobility brings greater capital efficiency.

This aligns with SEC Chair Atkins' May remarks about tokenized securities potentially reshaping the securities market, including issuance, trading, holding, and usage. On-chain securities could automate dividend distribution via smart contracts and enhance capital formation by transforming illiquid assets into tradable investment opportunities.

Beyond innovations around asset issuance, trading, and liquidity, efforts to implement blockchain technology in specific business scenarios might have been fundamentally misguided from the start.

qinbafrank

@qinbafrank

08-03

From SEC Chairman Paul Atkins' speech on Thursday evening, looking at the driving forces for the industry in the second half of the year and the next one to two years, the theme of the speech was "Making the U.S. the Crypto Capital of the World." The most important part of

Overall, I agree. Currently, these two areas are seeing the fastest breakthroughs and the highest degree of compatibility.

If these two areas take off in the future, social gaming and e-commerce may be partially involved, but integration seems difficult at this point.

I feel that if the on-chain business matures in the future, game e-commerce and social networking may also be utilized. However, the main focus will still be game e-commerce and social networking, not encryption itself. The previous encryption game social networking may have gone astray from the beginning.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content