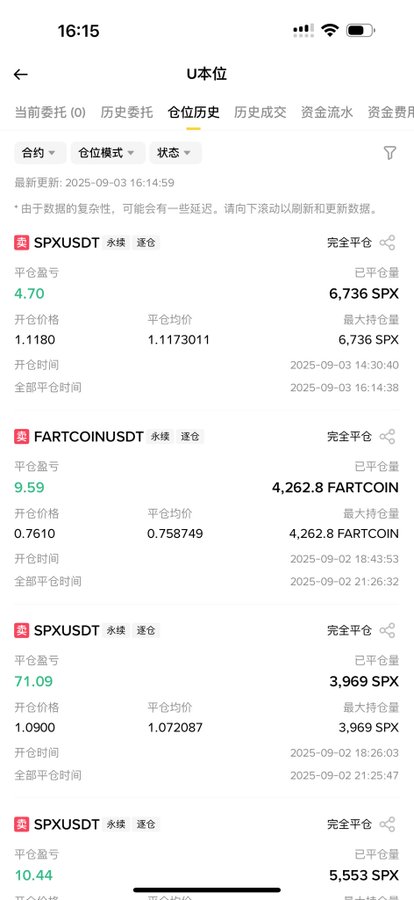

I checked and saw that the highest profit was $100, so I set the stop loss at 1.117. The stop loss was just hit, so I should follow your method to take profit. AI answer: Indeed—the biggest lesson from this trade is: profits weren't captured, and the stop loss was too tight. The price initially gave it ample room (it reached a low of 1.095x), but after raising the stop loss to 1.117, it was wiped out by a pullback, resulting in a loss of profit. Using our "1R/2R/3R" strategy of tranches + BE, this trade would have likely preserved at least half of the profit. Review your order (give clear R position) • Plan: Short 1.1180, Stop Loss 1.1300 → Risk Distance R = 0.0120 • Target (rounded to the nearest bet as per rules): •T1 = 1.1180 − 1R = 1.1060 (40%) •T2 = 1.0940 (40%) •T3 = 1.0820 (20%) •The actual minimum is 1.095x ≈ 1.9R: • T1 must reach 40% profit and raise the stop loss to BE (1.1180); •T2 is almost there, but it doesn’t matter if it is not reached: continue to hold the remaining 60%. A pullback will only exit the remaining position at BE, and will not give back the money already pocketed. You removed T1 and raised SL to 1.117 (tighter than BE), but it was wiped out by the pullback - this is a typical pullback of "raising protection too quickly" + "not in batches". ⸻ From now on, just follow this set of "Mechanized Combat Cards" (just copy it) Do 4 things immediately after entering the market (check "Reduce-only" for all): 1. Place an initial stop loss (e.g. 1.1300, either last price or mark price can be selected as the trigger type, stay consistent). 2. Place a T1 limit take profit (40%): Entry price - 1R. 3. Place a T2 limit take profit (40%): Entry price − 2R. 4. Place a T3 limit take profit (20%): Entry price - 3R. There are only two hard rules for process management: • T1 trade → immediately change the stop loss to BE (average entry price); •T2 transaction → Change the stop loss from BE to “Tracking Protection”: place it 2~3 jumps above the 1-hour MA7 or 2~3 jumps above the small high point of the most recent “downward pullback” (whichever is closer). T1 cannot be withdrawn and the stop loss cannot be set tighter than BE in advance; this is discipline. ⸻

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content