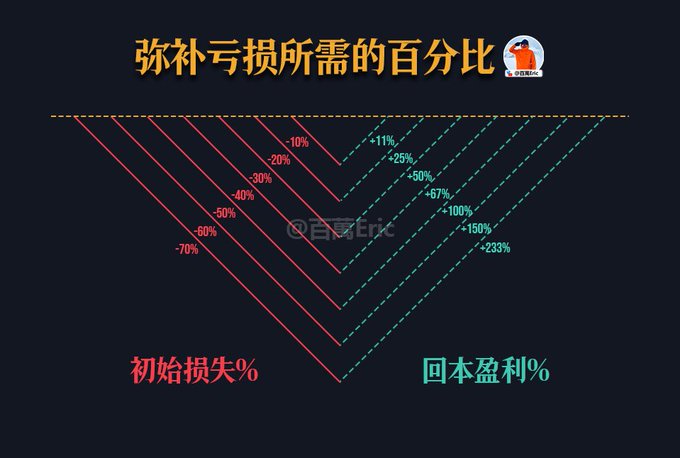

In trading, losses and profits are never symmetrical. If you lose 10%, you need to earn 11% to recoup your investment. If the loss is 50%, then the profit must be 100%; Once you lose 70%, you need to increase your losses by 233% to make up for it. This illustrates one thing: the greater the loss, the exponentially higher the rate of return required to recoup the investment, and it is almost impossible to recover it with one or two operations (in other words, if you want to recoup the investment quickly, you will fall into the vicious circle of going all-in with a heavy All In). Real risk management is not to wait until the loss is huge before trying to make up for it, but to resolutely stop the loss when the loss is controllable and control the account curve within a repairable range. In other words, the key to a trader's survival is not to recover losses through magical operations, but to prevent losses from getting out of control from the beginning.

This article is machine translated

Show original

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content