Overnight, crypto asset custody giant BitGo officially submitted an initial public offering (IPO ) application to the U.S. Securities and Exchange Commission (SEC), planning to be listed on the New York Stock Exchange under the stock code "BTGO".

This move quickly attracted widespread market attention. Not only was BitGo another crypto company vying for the mainstream capital markets, but more importantly, it was poised to become the "first crypto custody company."

BitGo's business evolution path

As a long-established Web3 infrastructure service provider with over a decade of experience, BitGo's IPO wasn't a whim, but rather a natural progression of institutionalization. Founded in 2013, the company initially focused on providing multi-signature wallet and private key management services, primarily serving early Bitcoin adopters and developers. However, with the development of the crypto market, and particularly the increasing involvement of institutional capital, the company's business focus has shifted upwards, evolving into a full-stack infrastructure platform integrating custody, clearing, API services, and security and compliance.

Its core businesses currently include:

Qualified Custody: Provides institutions with secure storage solutions that meet regulatory requirements, using multi-signature technology and cold storage to ensure asset security.

Self-hosted wallet: supports users to manage their own assets, covering a variety of cryptocurrencies.

Liquidity Solutions: Provide lending, trading and settlement services to meet the needs of institutional and high-net-worth clients.

Infrastructure as a Service (IaaS): Provides technical support for the blockchain ecosystem, including APIs and wallet infrastructure.

According to company disclosures, as of June 30, 2025, BitGo served over 4,600 institutional clients and 1.1 million users in over 100 countries, with nearly $100 billion in assets under custody. The company also partners with traditional financial institutions such as Goldman Sachs to provide crypto custody services, further solidifying its position at the intersection of traditional finance and the crypto world.

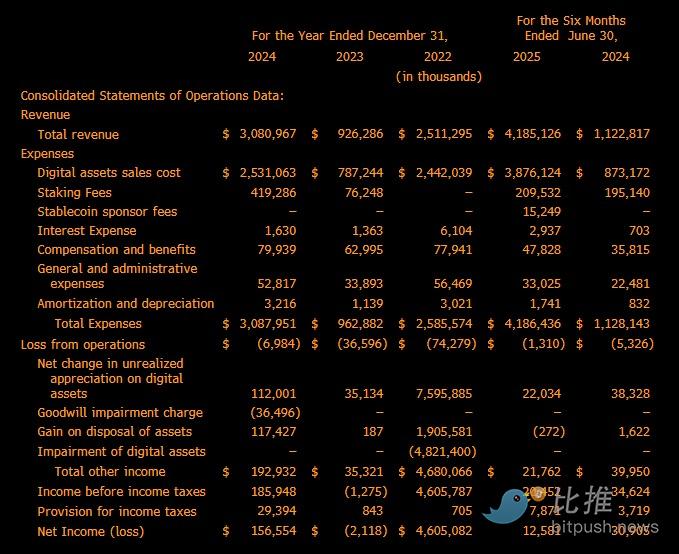

Revenues soar, profits under pressure: The growth trade-off under capital structure

According to data disclosed in the prospectus, BitGo's revenue in the first half of 2025 reached US$4.19 billion, a nearly fourfold increase compared to the same period last year. This growth rate far exceeds the industry average and highlights its leading position in the "institutional custody" market.

However, the profit picture is not optimistic: net profit for the same period was US$12.6 million, a year-on-year decline of nearly 60%. On the surface, this is a contradictory structure, but in reality it reflects the inevitable trade-offs that an infrastructure company must make during a period of rapid expansion.

On the one hand, the company needs to continue investing in "asset-heavy" areas such as technical security, compliance audits, human resources operations, and cross-border licensing. On the other hand, rapid revenue growth is forcing the company to accelerate its global expansion. This high-investment, low-profit financial structure may squeeze profitability in the short term, but in the long term, it lays the foundation for subsequent scale and branding.

BitGo has clearly chosen a path of "profit for share," which is a strategic choice that all infrastructure companies must face in their early stages.

Is BitGo the first crypto custodian?

Among the currently listed crypto companies, although companies such as Coinbase , Bakkt (BKKT) and Galaxy Digital (GLXY) also provide custody-related services, "custody" is more of a part of their huge business system rather than their core business.

Coinbase (direct listing on Nasdaq in 2021): Its valuation once reached $86 billion, with over $200 billion in assets under custody, but its core business is retail trading.

Bakkt (SPAC listing in 2021): valued at US$2.1 billion, it relies on the Intercontinental Exchange (ICE) to provide custody services and is positioned as a bridge between traditional finance and encryption.

Galaxy Digital (listed on TSX in 2018, listed on Nasdaq in 2025): valued at US$2.8 billion, provides asset management and custody services, but custody is not its core business.

In contrast, BitGo focuses on custody and infrastructure, with a purer business model, free from the distraction of an exchange business. If successfully listed, BitGo will become the first publicly traded company centered around crypto custody, setting a benchmark for the industry and potentially inspiring private custody companies like Anchorage and Fireblocks to accelerate their IPOs.

Although BitGo leads in business maturity and capital movements, the competition in the crypto custody sector has already entered deep waters.

Fireblocks is a strong challenger, leveraging its superior wallet API technology and multi-party computation (MPC) capabilities to establish a broad customer base among exchanges and fintech companies. Anchorage, through its acquisition of a US national trust company license, has further strengthened its compliance and policy advantages. While Coinbase Custody is a subsidiary of Coinbase, leveraging its traffic and brand, it also holds a leading position in ETF custody.

Compared to these competitors, BitGo's differentiated advantages primarily lie in its "neutral platform" positioning and its "high-net-worth client base." It doesn't rely on exchange traffic or tie itself to a specific chain or protocol, allowing it to serve as a backend service provider for multiple platforms. This "non-competitive" stance actually makes it more resilient within the ecosystem.

Industry Outlook

BitGo's IPO is not an isolated event, but a node event in the commercialization process of the entire encryption infrastructure.

As traditional funds like sovereign funds, insurance companies, and family offices increasingly embrace digital assets, the demand for "compliant, secure, and auditable" custody services is growing. This not only raises the bar for the industry but also creates a long-term, stable market space for service providers like BitGo.

In the future, crypto custody is likely to evolve into an API-centric service network, integrating payment, clearing, risk management, KYC, and auditing functions, becoming the "backend of a bank" for the Web3 financial world. On this path, the fastest and longest-running projects won't necessarily be those with the most on-chain assets, but rather those custodians who can provide stable underlying services for the entire system.

If Coinbase's IPO in 2021 marked the beginning of the "era of exchanges," then BitGo's IPO can be seen as the starting point of the "era of compliant custody." Whether it can deliver satisfactory results in the capital markets will also provide an important window into the commercialization prospects of crypto infrastructure.

Author: seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush