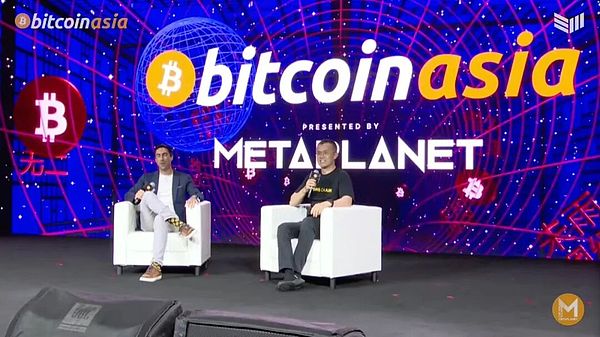

Many crypto enthusiasts have likely witnessed the recent speeches by CZ , at the University of Hong Kong and Bitcoin Asia 2025. From the dock in a Seattle federal courtroom to the podium at the Hong Kong conference, CZ's trajectory has been nothing short of dramatic. His appearance in Hong Kong coincided with a crucial juncture in the city's crypto regulation: the official implementation of the Stablecoin Ordinance, prompting tech giants like Ant and JD.com to rush into the stablecoin market. This article will provide an in-depth summary of CZ key speeches at the two Hong Kong conferences, connecting the dots between Hong Kong's "traditional experience + institutional innovation," exploring the bridge between traditional finance and on-chain value, and exploring potential compliance paths and opportunities for Web3 projects in the future.

1. What are the three major challenges and main themes of RWA?

RWAs have enormous potential and have been a hot topic recently. Kaisa Capital (00936.HK) saw its stock surge 250% today after announcing its strategic transformation and expansion into the tokenization of real-world assets (RWA). So, is RWA really that easy to implement? CZ previously outlined three major challenges in implementing RWAs in Hong Kong:

The first obstacle is liquidity. Real estate and collectibles inherently have low transaction frequencies. If tokenized on-chain, the order book depth is undoubtedly insufficient. Buyers are unable to purchase, and sellers are unable to sell, making it difficult for large funds to enter and exit the market. Without liquidity, tokenization loses its core value.

The second obstacle is regulatory complexity. Are tokenized assets securities or commodities? Who is responsible? The China Securities Regulatory Commission, the Commodity Futures Trading Commission, or some other agency? How can one obtain a license to operate this business? The nature of RWA assets is highly ambiguous. Is it a security or a commodity? The answer can be completely different in different countries and regions. This means that if an RWA business wants to go global, it may have to apply for a wide variety of licenses around the world. The compliance costs and difficulties are enormous, severely limiting the scalability of its business model. Currently, tokenized stock products haven't yet resolved the issue of linking to actual stock prices, making them unviable from a systemic perspective.

The third obstacle is flawed product mechanisms. Currently, some tokenized stock products are emerging on the market, but the price of the tokens often decouples from the underlying stock price, suggesting that the inherent arbitrage mechanism may be ineffective. A financial product that cannot self-correct its price through market forces is not a solid foundation.

Despite facing so many challenges, should RWAs be abandoned? CZ believes that this is something that must be done. Stocks and bonds with transparent profits are the core theme of RWAs. Currently, stablecoins are the most successful RWAs. Their underlying assets are real-world assets like the US dollar and US Treasury bonds. US Treasury bonds are the most liquid and standardized assets in the world. For an international financial center like Hong Kong, RWAs are even a strategic necessity. If you don't, others will, and you will be marginalized. Now is a golden window for the development of RWAs. It's time to overcome difficulties and seize opportunities. The Hong Kong government is also actively promoting them.

If a company plans to issue bonds through an RWA program, Lawyer Liu urges them to first consider two key questions: First, does your project meet the requirements for issuance? Will the brokerage firm sell the bonds? Furthermore, do the asset classification, valuation, and collateral arrangements meet the brokerage firm's standards? Second, are the costs and profit margins acceptable? It's important to note that some RWA bond issuance fees are now even higher than those of traditional IPOs, involving domestic and international lawyers, fund agency services, accounting and auditing, blockchain technology services, and brokerage fees. Besides the brokerage's service fee, calculated on a per-point basis based on the financing amount, and subsequent underwriting fees, other costs can reach no less than HK$5 million. These considerations must be fully considered during the project design phase, including the entire lifecycle of the project. If a company simply rushes in to boost its stock price and then exits midway, it will only end up with more losses than gains.

2. Stablecoins can be used as “crypto tools”

Upgrade to "financial infrastructure"?

CZ called stablecoins "a new vehicle for currency internationalization ," arguing that they will shift from safe-haven assets to infrastructure for global payments and capital flows. He believes the US government deeply understands the value of stablecoins to the dollar's global strategic position. The vast majority of USDT users are now outside the US, essentially extending the dollar's influence globally. Stablecoins are tools for the globalization of underlying currencies, and every country should have its own stablecoin product. Interestingly, when the US enacted the Genius Act, it also proposed banning central bank digital currencies (CBDCs). This is because the US already has dollar-denominated stablecoins like USDT and USDC. For China, promoting the development of RMB or Hong Kong dollar stablecoins could provide a new Web3 channel for the RMB. While freely circulating blockchain assets pose challenges to foreign exchange controls, countries are actively exploring solutions, and Hong Kong is also leading the charge.

Regarding the challenges posed by stablecoins to foreign exchange controls, stablecoin trading is currently not permitted within China, and related cross-border capital flows remain subject to foreign exchange regulations. The system, exemplified by the "Notice of the State Administration of Foreign Exchange on Issues Concerning Foreign Exchange Administration of Overseas Investment, Financing, and Roundtrip Investment by Domestic Residents through Special Purpose Vehicles" (Document No. 37), remains the primary compliance path for domestic individuals and institutions to legally repatriate capital and earnings from overseas investments. However, we believe that SAFE may consider opening up policy loopholes for stablecoins in certain regulatory scenarios in the future, a step that China must take. This is a crucial step in responding to international competition and the development of the digital economy, and in avoiding marginalization in the global crypto and payment markets.

3. DAT will become traditional capital

A compliant bridge into Web3?

DATs (Digital Asset Treasury Companies) are listed or public entities that hold digital assets (primarily cryptocurrencies, stablecoins, tokenized real-world assets, etc.) as a core component of their balance sheets. They raise capital by issuing stocks, bonds, or similar instruments to gain exposure to crypto assets, thereby providing traditional investors with an indirect way to participate in the digital asset market. CZ strongly supports the DAT model , believing that the traditional stock market is far larger than the cryptocurrency market. This sector is much larger than the crypto. For the world's largest economies, the vast majority of assets are managed by institutions. Currently, these institutions have been unable to directly hold cryptocurrencies on a large scale until the advent of ETFs. However, DATs now offer more options. For entities that cannot directly purchase bitcoins, such as listed companies, state-owned enterprises, and central enterprises, they can gain indirect exposure to cryptocurrencies through stock purchases, opening a compliant entry point for large amounts of traditional capital into Web3. DATs can be understood as a channel and bridge connecting traditional finance and Web3. With more capital flowing in, the market will naturally become more stable.

CZ suggests that while your strategy can vary greatly within the DAT model, from simply holding Bitcoin to proactively managing your trades and even investing in entire ecosystem projects, a simpler strategy is often more reliable: clear positions, simple trading, and clear risk control. This is because bull markets can lead to numerous lawsuits. Lawyers advise: If your strategy is clear and you have professional support, the likelihood of being sued is much lower.

4. “AI+Web3”: Is it just hype or can it really be implemented?

CZ pointed out that most so-called "AI + Web3" projects currently on the market are mere hype, devoid of practical impact. While the integration of the two is still immature, it's by no means a mere concept and holds great promise for the future. He believes that programmable money is the foundation of everything: if money itself can be programmed to automatically trigger certain logic, it can greatly expand the role of AI in payments and value settlement. The ultimate development of AI ultimately depends on cryptocurrency. Because AI lacks identity cards and cannot perform know-your-customer (KYC) like humans, payments will inevitably rely on digital currencies and blockchains. In the future, interactions between AIs and between AIs and services will be both financial and non-financial. This type of machine-to-machine payment is likely to involve massive, high-frequency interactions and value settlements. Especially for very small micropayments, using cryptocurrency through APIs is the most convenient and efficient method, potentially triggering a thousand-fold increase in on-chain transaction volume.

Our RMB, USD, and HKD are not programmable. Projects are already underway in this direction: In September, Google launched the Agent Payments Protocol (AP2), which allows AI agents to use programmable currencies like stablecoins to execute automated payments in agent-to-agent or agent-to-service scenarios. The true catalyst for achieving these goals is the development of AI itself. AI computing power requires astronomical amounts of funding, which will drive the AI industry to embrace Web3, such as through tokenization for financing, or even towards more open and public models. In the future, everyone may have hundreds of AI agents performing various tasks behind the scenes, spurring massive micropayments. This model is impossible under traditional financial models, but can be easily supported by Web3. This poses significant legal challenges. First, when AI agents engage in erroneous transactions, fraudulent attacks, or authorization abuse, who bears liability? The protocol designer, the entity to which the agent belongs, or the user? Second, there are gaps in regulatory and privacy compliance requirements, such as whether transaction audits, payment chain transparency, and anti-money laundering (AML) and counter-terrorist financing (CFT) mechanisms are embedded in the system. Finally, as on-chain transaction volumes are likely to surge, issues of cybersecurity, tax compliance, cross-border payments, and data sovereignty will also be brought to the forefront.

5. Institutionalization and clear supervision: a benefit or a shackle?

A common debate in the crypto right now is: should governments and institutions enter the market? Extreme decentralization advocates and "Bitcoin purists" are firmly opposed. However, CZ speech at the conference offered a completely different answer—it's a good thing. CZ stated bluntly: The involvement of governments and large institutions will bring in capital, nodes, credibility, and, more importantly, application scenarios. Once a country begins to establish a "national strategic reserve of crypto assets ," oversight will be essential, rules will become clearer, and the market will be more stable. Bitcoin's performance in 2025 already partially reflects this trend. At the beginning of the year, everyone praised the UAE for being ahead of the curve, but now the US has clearly accelerated its pace. On August 29th, CZ saw that the US Commodity Futures Trading Commission (CFTC) was preparing to release draft regulations on the registration of foreign exchange companies (FBOTs). This would provide non-US exchanges with a compliant path to allow US users to participate. He lamented that he had once been imprisoned for trade protectionism, but he remains an advocate for economic globalization. Blockchain technology can easily achieve economic globalization, so old laws need to be updated to keep pace with globalization.

While the US is accelerating, Hong Kong, following the implementation of the Stablecoin Ordinance, is striving to establish itself as a "new frontier" for compliance through legislation, licensing, and regulatory guidance. Standard Chartered (Hong Kong), Animoca, and HKT have jointly established Anchorpoint to apply for a stablecoin issuance license. This signals that licensing and application scenarios will be the key themes of the next round of competition. This means that the crypto industry is no longer just a game for a small circle, but a battleground for large institutions and real capital. Interestingly, Trump's second son, Eric Trump, made a high-profile stand for Bitcoin at the closing keynote of Bitcoin Asia 2025, publicly predicting that Bitcoin will reach $1 million in the future and praising China's role in the development of cryptocurrencies. Meanwhile, a senior official and legislator of the Hong Kong Securities and Futures Commission temporarily withdrew from the speaking list to avoid interacting with Eric, further demonstrating the intertwining of crypto, geopolitics, and politics. In today's era of heightened political sensitivity, companies and individuals must be more cautious and compliant in their public statements and marketing.

Institutionalization means a massive influx of traditional capital, and the crypto industry will no longer be a niche market. While regulation raises the bar, the influx of capital will boost the overall market's liquidity and scale. How can compliance red lines be reconciled with the speed of business? On a practical level , the Hong Kong authorities have reminded the market: as of August 1st, when the Stablecoin Ordinance came into effect, no entity has yet been licensed; the initial batch of licensees is expected to be issued in early 2026. At the same time, the HKMA emphasizes the importance of "early application, early communication, and thorough preparation ," emphasizing prudent communication to avoid creating unrealistic expectations. Therefore, for Web3 entrepreneurs who want to succeed, don't even think about skirting the rules. Institutional capital requires audits, custody, and KYC, and will not invest in "black box" projects. If you still cling to the mindset of "running away when regulation arrives," you will have nothing to gain from the future growth market.