The altcoin Derivative market in the last week of September showed a clear imbalance between the total cumulative volume of Longing and Short positions. This imbalance was due to the fact that more than $200 billion in market Capital was wiped out, causing many altcoins to fall in price.

In this context, short-term traders show strong bearish sentiment as the possibility of Short liquidation spikes.

1. Ethereum (ETH)

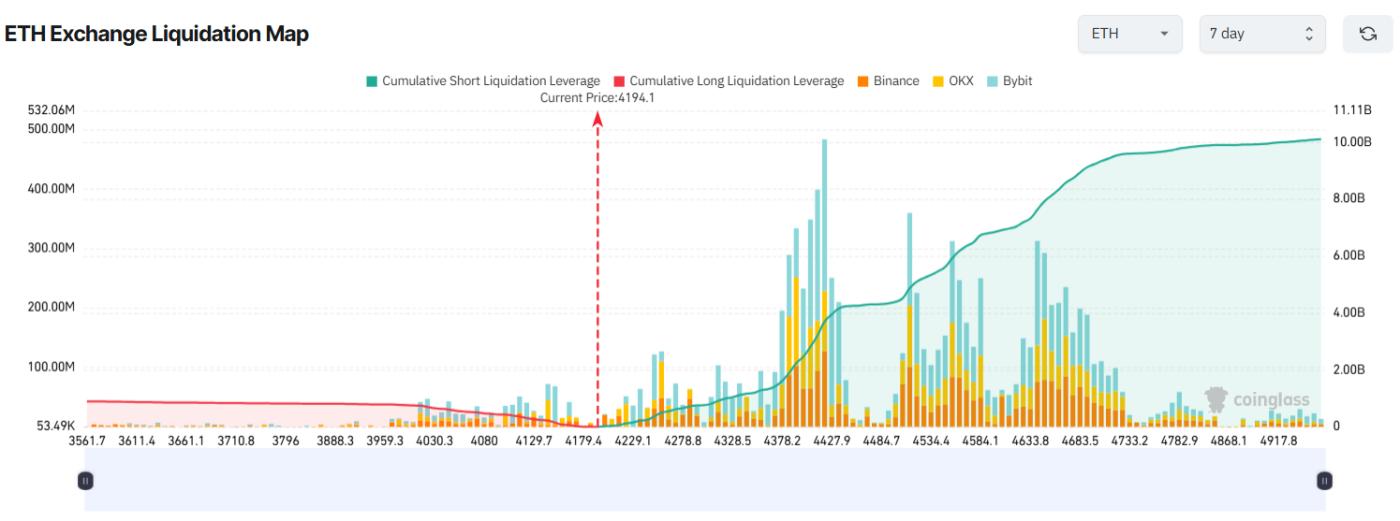

Ethereum faces the largest potential liquidation volume among altcoins in the last week of September. The 7-day liquidation map shows that traders are allocating more Capital and leverage to Short positions, pushing Ethereum's potential liquidation volume into the billions of dollars.

ETH Liquidation Map. Source: Coinglass

ETH Liquidation Map. Source: CoinglassAt the time of writing, ETH price is down more than 5%, sliding from above $4,400 to below $4,200.

If ETH recovers to $4,500 this week, cumulative Short could reach $4.5 billion. If positive news helps ETH recover recent losses and climb above $4,900, cumulative Short could approach $10 billion.

On the other hand, total Longing liquidations could reach $900 million if ETH drops further to $3,560 this week.

Traders have solid reasons to increase their Short positions. A recent BeInCrypto report shows that the number of profitable ETH addresses is at an All-Time-High, while Ethereum whales are starting to take profits at historic levels.

However, the drop in ETH prices could spark new demand. ETH accumulation shows no signs of slowing down. This demand could encourage institutions and companies to buy, fueling a recovery that could liquidate Short positions.

2. Solana (SOL)

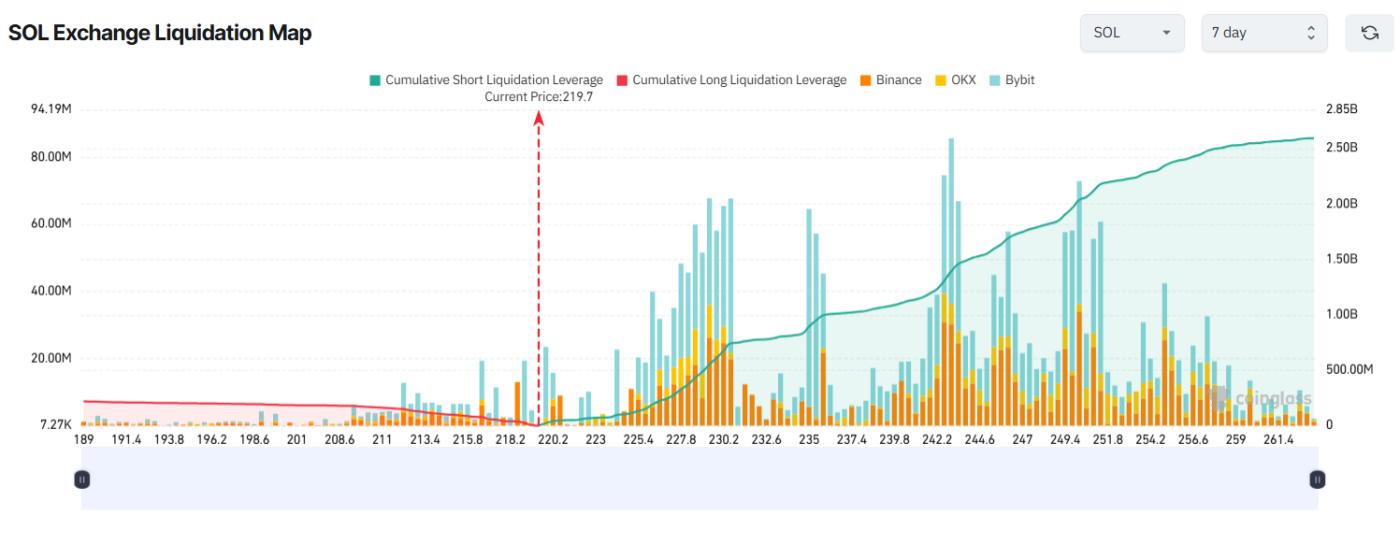

Solana ranks second in potential liquidation volume this week.

Today's more than 7% price drop has fueled overwhelming bearish sentiment among Derivative traders. As a result, total potential Short liquidations far exceed Longing liquidations.

SOL Liquidation Map. Source: Coinglass

SOL Liquidation Map. Source: CoinglassThe 7-day liquidation map shows that if SOL rallies to $250 this week, more than $2.5 billion worth of Short positions could be liquidated. Conversely, if SOL falls below $190, about $215 million in Longing positions could be liquidated.

Just days ago, the SEC approved the Grayscale Digital Large Cap Fund (GDLC), the first multi-asset cryptocurrency ETP, which includes BTC, ETH, XRP, SOL , and ADA. The SEC also approved common listing standards for ETFs. These developments are a strong boon for SOL .

If today's sell-off subsides and these positive factors continue to influence the market, SOL price could recover , putting Short positions at serious risk.

3. Avantis (AVNT)

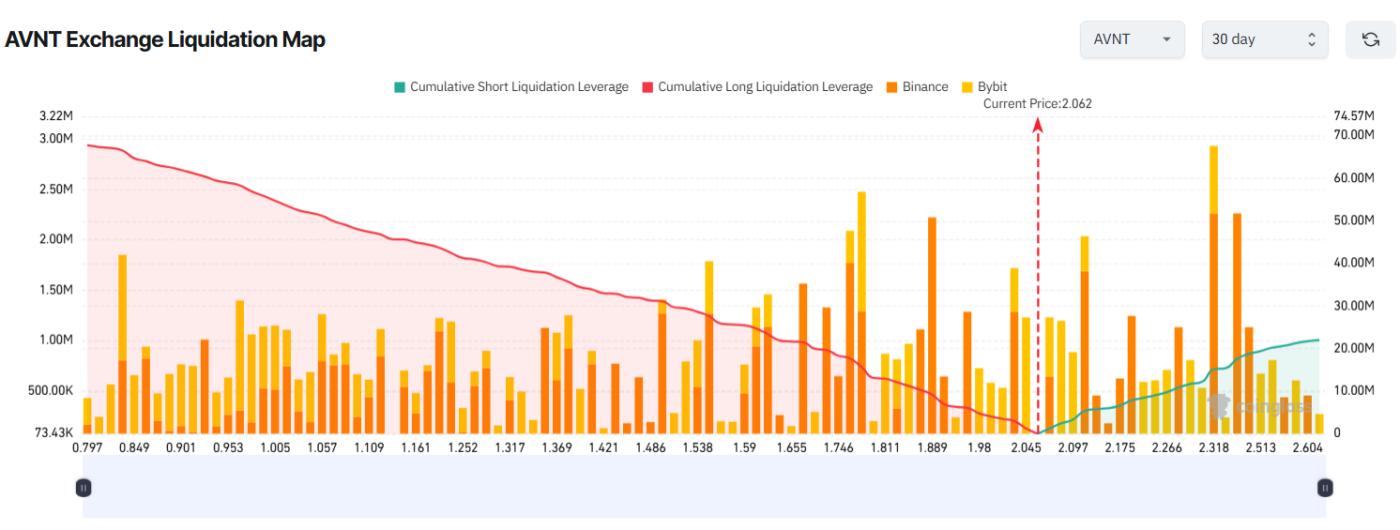

While AVNT doesn’t have the potential to liquidate billions like Ethereum or Solana, its popularity puts it on this list. According to CoinMarketCap Trending, Avantis is currently at the top of the market’s attention.

Interest in AVNT comes from its simultaneous listing on three major exchanges: Upbit, Bithumb , and Binance. Its price increased by more than 600% in September.

Derivative traders continue to bet on further price increases, as shown by the dominance of potential Longing liquidations.

AVNT liquidation map. Source: Coinglass

AVNT liquidation map. Source: CoinglassThe liquidation map shows that if AVNT corrects to $1, about $60 million in Longing positions could be liquidated. Conversely, if AVNT recovers to $2.6, more than $21 million in Short positions could be liquidated.

Early investors are currently sitting on a large profit on such an explosive altcoin. Many will likely take profits early. on-chain data confirms that an AVNT whale took profits today with profits exceeding 700%. If this profit-taking spreads, Longing positions will face significant risk.

The market entered the final week of September with large liquidation losses. A recent report by BeInCrypto highlighted some of the reasons for this outcome.

“In the last 24 hours, 387,148 traders were liquidated. Total liquidations reached $1.67 billion,” Coinglass reported .

These numbers are likely to remain high in the coming days as volatility in late September becomes increasingly unpredictable.