Meteora is stirring up the Solana community with a controversial proposal: allocating 3% of the TGE fund to JUP holders, not in regular Token but in Liquidity Position NFTs.

This new approach promises to create deep liquidation for MET from day one, but also raises questions about fairness and centralization risk. Is this a wise move to bridge the two communities, or will it spark a long-running debate?

Allocate 3% to JUP Staker

As BeInCrypto reported , Meteora is preparing for a TGE in October. The platform has made one of the most notable community proposals ahead of MET’s TGE.

According to the plan, the project plans to allocate 3% of the TGE fund to Jupiter JUP holders in the form of Liquidity Position NFTs. Specifically, Meteora will use this 3% to create MET liquidation in a Single-Sided DAMM V2 pool, then allocate positions to Jupiter holders based on holding period, quantity, and voting activity.

The goal is to create MET/ USDC liquidation upon listing without immediately adding MET to the circulating supply. The proposal also emphasizes that “no additional Token will be added to circulation as a result of this proposal.” This is a “liquidity- liquidation” approach rather than paying directly in Token.

Meteora co-leader Soju has published a public calculation to visualize the scale. According to Soju, there are currently about 600 million JUP held. A 3% allocation would be equivalent to 30 million MET tokens. This equates to about 0.05 MET for every JUP held.

“I think this makes sense,” Soju Chia .

A user on X did some calculations and came up with a similar figure of ~0.05035 MET/JUP depending on the FDV assumption. The reward per JUP is small but when aggregated together it can be a significant incentive to convert users into MET LP .

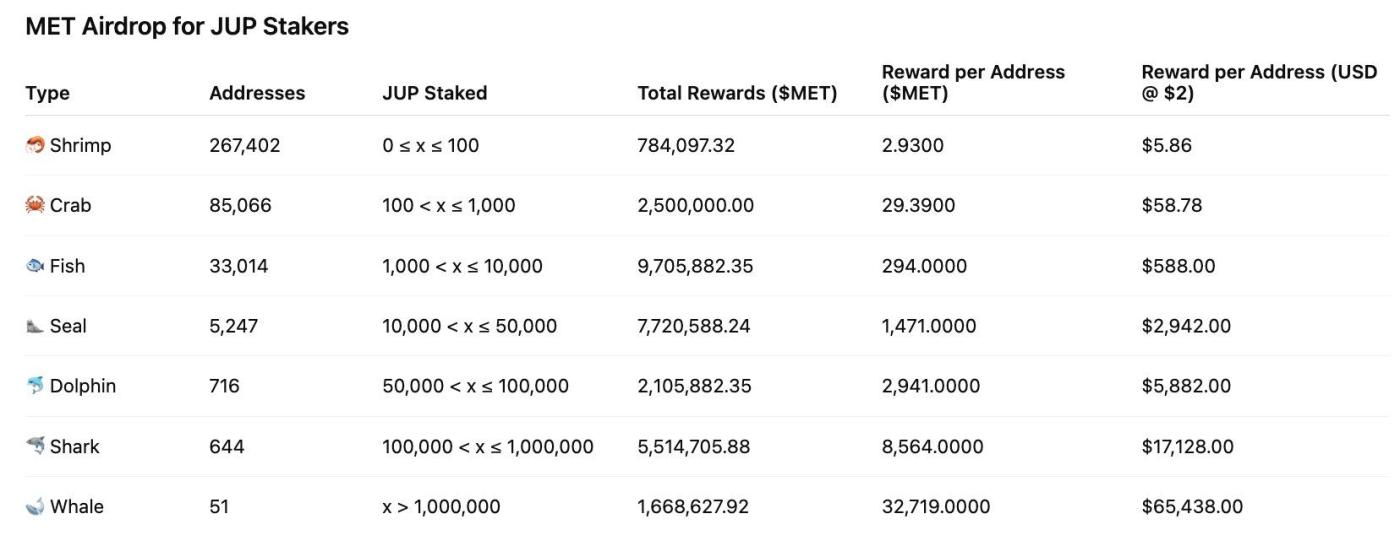

MET Airdrop to JUP holders. Source: fabiano

MET Airdrop to JUP holders. Source: fabianoAdvantages & Disadvantages

Meteora's proposal has clear benefits over other projects that reward users via Airdrop. It recognizes Jupiter's Vai in the Solana ecosystem, helps create MET/ USDC liquidation at TGE, and reduces immediate selling pressure because the initial reward is a liquidation position rather than a freely tradable Token . With careful engineering (timed distribution, tied to NFTs, limited withdrawals), this could be an effective bridge between the two communities.

However, there are still significant risks. The community has raised concerns about fairness: why are JUP holders getting the majority ? Could an “LP Army” or large wallets take a disproportionate share of the rewards? What will the circulating supply be at the TGE immediately? Previous allocation drafts have mentioned a maximum of 25% for TGE liquidation/fund, so the initial total circulating supply remains an important transparency question.

“Hard to argue about 'fairness' when JUP gave up 5% for Meteora (via mercurial shareholders). LP army deserves more -> LP Army will take a significant portion of all future emissions (ongoing LM rewards), and still own 20% (8% + 5% + 2% + 3% + 2%) of total supply at TGE,” Soju notes .

Based on previous Airdrop events, the Meteora team needs to be transparent about tokenomics, disclose the LP Non-Fungible Token redemption/vesting mechanism, set a cap per address, and XEM additional incentives for MET holders. If done poorly, centralized distribution and subsequent selling pressure could devalue the TGE.