On October 6, asset management giant Grayscale announced the official launch of the first spot crypto ETF products supporting staking functions in the United States - Grayscale Ethereum Trust (ETHE) and Grayscale Ethereum Mini Trust (ETH).

This means that while investors maintain Ethereum exposure through traditional securities accounts, they can also automatically earn staking returns, without requiring any on-chain interaction. Grayscale also announced that its Solana product, GSOL, will also launch staking functionality, pending regulatory approval and transition to a formal ETF.

This move marks the official entry of the U.S. market into the "era of pledgeable crypto ETFs," which is a milestone in the process of monetizing digital assets.

The key breakthrough of ETH ETF: from price exposure to income asset

Since the Ethereum spot ETF was approved in the United States in 2024, its attractiveness has lagged behind that of the BTC ETF. The market generally points out that it lacks a core selling point compared to the Bitcoin ETF - staking income.

Looking at ETF funds, SoSoValue data shows that Bitcoin ETFs currently have a total net asset value of $164.5 billion, equivalent to 6.7% of its market capitalization. Ethereum ETFs lag behind with net assets of $30.5 billion, representing 5.6% of the cryptocurrency's valuation.

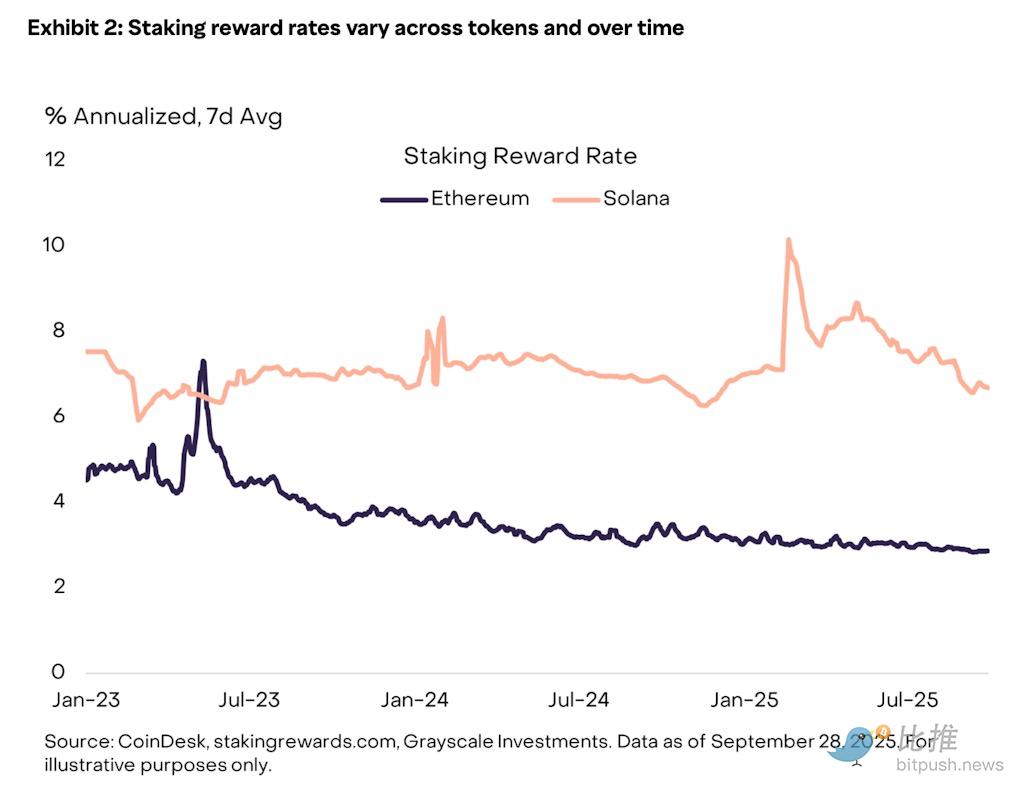

As a PoS network, Ethereum holders can obtain an annualized block reward of 3% to 5% by staking ETH. However, previous ETFs only provided price tracking functions and were unable to pass on staking income to investors.

Grayscale’s innovation fills this gap.

According to the company's announcement, ETHE will distribute staking returns as monthly dividends, while ETH and GSOL will have their returns added to their net asset value (NAV), allowing for compound growth. Grayscale Research Director Zach Pandl explained that this allows investors to "earn ETH network returns without additional effort, while enhancing liquidity and security."

Against the backdrop of the Federal Reserve embarking on a cycle of interest rate cuts and declining returns on traditional fixed-income assets, the "income attributes" of the ETH staking ETF stand out.

Institutional funds may usher in a new round of inflows

Grayscale currently manages over $8 billion in Ethereum assets, and the introduction of the staking function is generally seen by the industry as a key variable in enhancing the attractiveness of ETH.

Bitcoin's ETF mainly provides price speculation and long-term allocation functions, while ETH staking ETF has additional "cash flow" logic, similar to stock dividends or bond coupons.

This means that ETH is no longer just an "interest-free asset", but has evolved into a new type of investment product with the dual attributes of income and growth.

Huobi co-founder Du Jun ( @DujunX ) commented on the social platform:

"This is extremely positive for Ethereum! With reduced supply and increased demand, ETH staking increases the ETF's 'yield attribute,' similar to stock dividends, attracting more institutional and retail investors. Competitors like BlackRock will also follow suit, and we estimate that the new inflows into Ethereum ETFs will exceed $10 billion over the next year."

This view represents the consensus of many industry observers.

“By adding staking functionality, you can transform it from a passive investment vehicle into something that can generate income and yield,” Twinstake CEO Andrew Gibb said at a Blockworks roundtable. “I think it brings it closer to similar traditional products like bond ETFs or dividend-paying stocks.”

Nate Geraci, president of NovaDius Wealth Management, stated that while this is a positive development for those seeking exposure to ETH in traditional investment vehicles, the unlocking of staking won't necessarily lead to a significant increase in inflows. He stated, "In my opinion, the lack of a 2-3% yield isn't a major barrier to investors allocating to this asset class. Even so, this is still a significant milestone—it makes spot ETH ETFs more competitive than direct ETH ETFs."

As more institutions (such as BlackRock and Fidelity) are poised to launch ETFs with similar features, staking returns will become a standard feature in future ETH fund competition. On the capital side, the lock-up effect of staking will further reduce circulating supply, while new capital inflows will drive demand, providing structural support for ETH.

Long-term impact on the Ethereum ecosystem and crypto market

1. Strengthening ETH’s “digital economic bond” attributes

The introduction of staking returns transforms ETH from a "pure asset" into a "yielding asset," which will alter institutional pricing models. For traditional investors, ETH not only offers inflation hedging and network growth value, but also provides a stable cash flow return, making it more easily included in portfolio allocations for pension funds, sovereign funds, and other institutions.

2. Improve network security and decentralization

More funds participating in staking means an increase in the number of validating nodes on the Ethereum network, enhancing on-chain security. In the long term, the ETF staking mechanism will more closely bind institutional capital to the underlying operations of the blockchain, becoming a new channel for traditional finance to participate in decentralized network governance.

3. Promote the differentiation of ETH and BTC investment logic

The appeal of Bitcoin ETFs stems primarily from their "digital gold" attributes. However, the introduction of returns on ETH staking ETFs has led to a clear divergence in the investment logic between the two: BTC is more of a store of value asset, while ETH is more of a hybrid of "tech growth + income-generating assets." This will drive a reshaping of the market's valuation framework for both assets.

Potential risks

Although the launch of pledged ETFs is widely viewed as positive, the market also needs to pay attention to several potential issues:

Liquidity risk: If a large amount of ETH is locked and pledged, when redemption demand is concentrated, the fund may experience unlocking delays or discounts.

Node security and slashing risks: If a validator node is penalized (Slashing) due to operational errors, profits may be affected.

Concerns about centralization: If ETF holdings are concentrated in a few large verification service providers, it may lead to excessive concentration of on-chain governance rights.

As of press time, ETH is trading at $4,690, up 156% over the past six months. As more institutions join the competition, staking ETFs are expected to become an important standard in the future crypto asset market. When interest-bearing properties become the new pricing core, the current price may just be a starting point.

Author: Seed.eth

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush