The crypto market ushered in the largest liquidation in history. In the early morning of October 11, many crypto investors who woke up from their dreams thought they had misjudged the market.

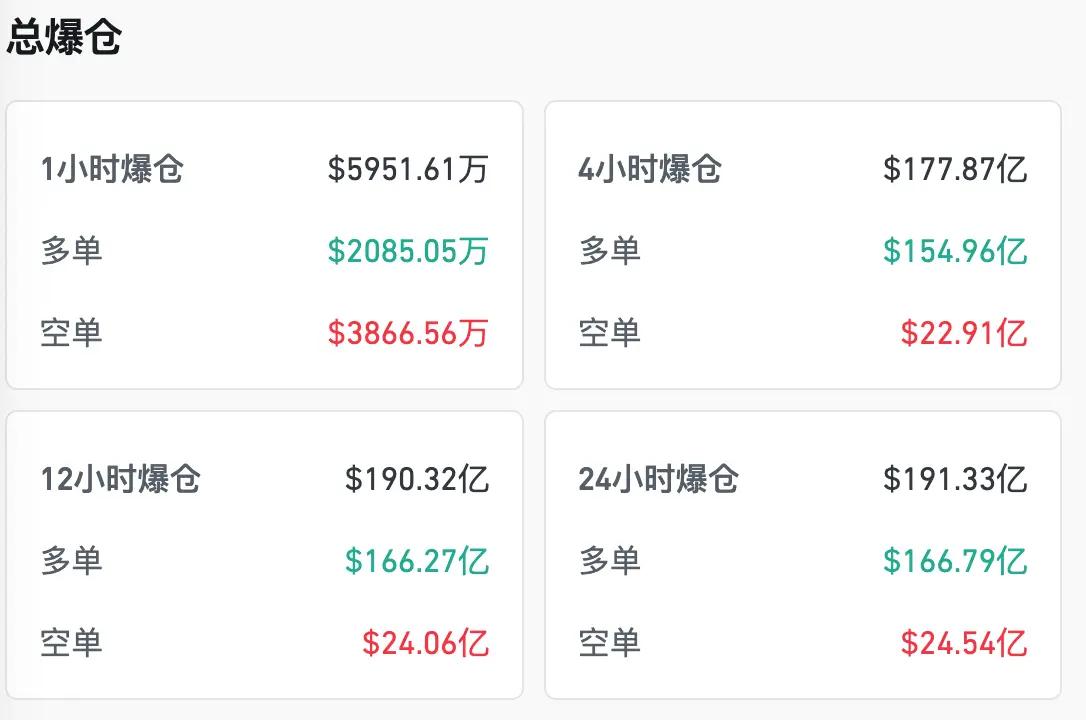

Coinglass data shows that as of 8:00 on the 11th, the 24-hour liquidation amount reached US$19.1 billion, and 1.62 million people worldwide were liquidated. The largest single liquidation order occurred in Hyperliquid - ETH-USDT, worth US$203 million.

The crypto market is in turmoil.

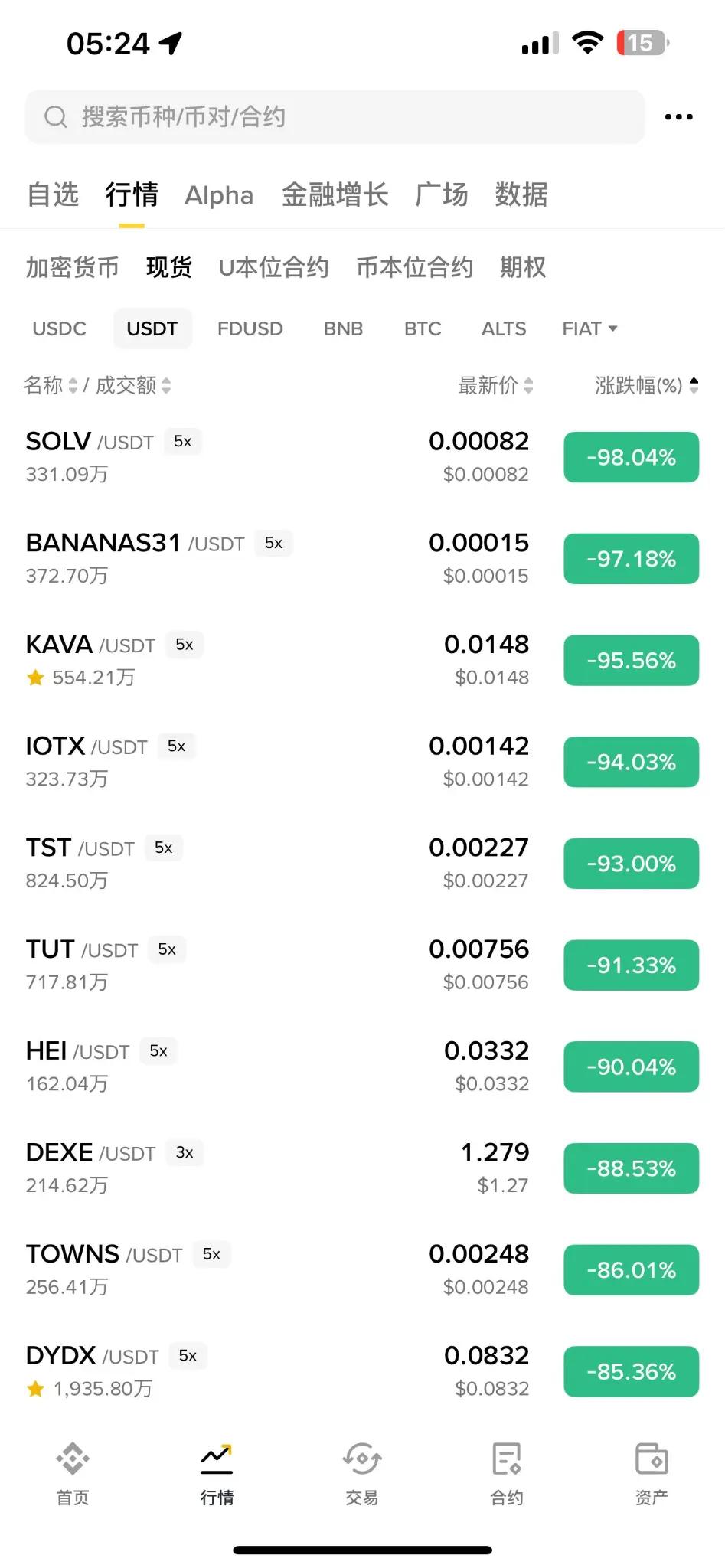

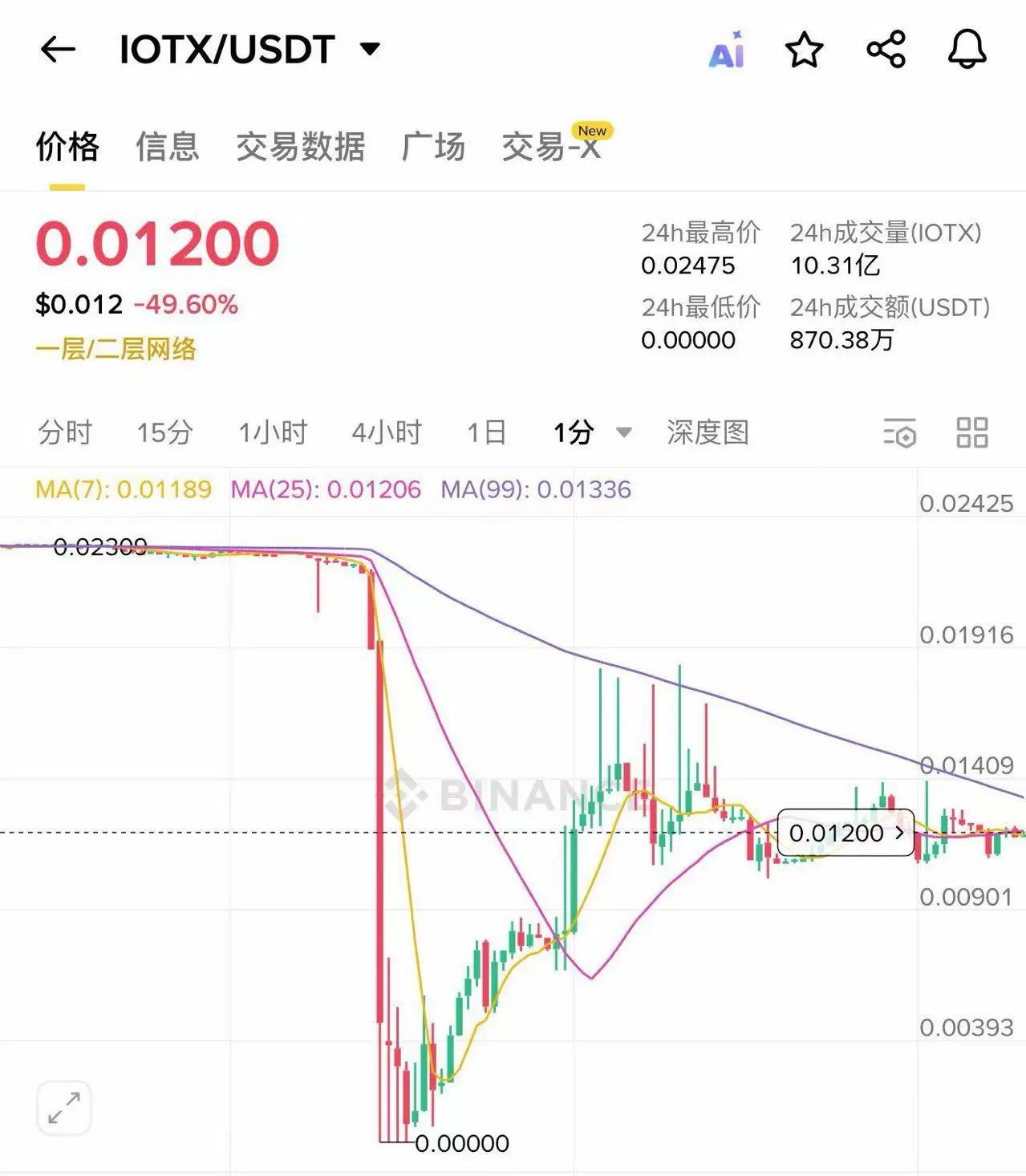

Behind these staggering margin calls, while Bitcoin and Ethereum have rebounded, dropping 7% and 11% in the past 24 hours, many Altcoin have plummeted to zero. Many crypto projects have seen declines exceeding 90%, and even wrapper tokens of mainstream coins, such as WBETH and BETH, have seen significant drops. The price of IOTX has even plummeted to zero. Stablecoins have also experienced depegging, with the USDE depegging to 0.62 before returning to its peg. Binance even experienced a downtime due to excessive traffic.

Trump's backtracking ignited the market

On the evening of October 10, Trump threatened to increase tariffs on China on his social platform, and at 5 a.m. on the 11th, he threatened to impose a 100% tariff, which directly triggered a series of declines in cryptocurrencies.

The sharp drop in Altcoin may be due to issues with market makers. According to crypto influencer @octopusycc, the sharp drop in Altcoin is entirely due to issues with active market makers, who are typically unable to adequately hedge.

According to their analysis, market makers have limited funds, and this limited capital leads to different liquidity provision for projects across Tier 0, Tier 1, Tier 2, Tier 3, and Tier 4. Tier 0 and Tier 1 projects receive the most funding, while other Tier 2 and Tier 3 projects receive a bit of support. Following the collapse of Jump, a large number of projects fell into the hands of active market makers. Therefore, when Trump decided to reimpose tariffs, there wasn't enough capital to backstop all projects. Consequently, only large projects could be guaranteed to be safe. Funds originally intended to support smaller projects were even diverted to larger Tier 0 and Tier 1 projects. This resulted in market makers simply not having enough funds to place orders when significant selling pressure emerged, leading to a lack of counterparties and a downward price movement.

The current crypto market's active market maker funding portion is approaching saturation, with a large amount of funds being placed on large projects. However, with so many projects launched this year, the market has been overloaded and unable to fully hedge. The market also lacks sufficient derivatives to supplement liquidity for hedging purposes.

Of course, dangers and opportunities coexist. Some have turned declines into opportunities. For example, short sellers were even stopped out of profits. Others, however, buy the dips the dips in mainstream and packaged tokens, seeking wealth and fortune amidst the dangers. One crypto influencer shared their own trading experience, earning $8 million in a short period of time by buy the dips in USDE and BETH.

Some are happy while others are sad. More investors and the entire crypto market are faced with the task of "post-disaster reconstruction."

The market teaches us two things. One is that investment is the art of risk control. The second is that as long as you don't leave the table, there will always be opportunities.