As markets reel from President Trump's tariff hike, Binance – the world's largest cryptocurrency exchange – is facing widespread outrage after users reported frozen accounts, failed stop-loss orders and sudden price drops that sent many coins to near zero.

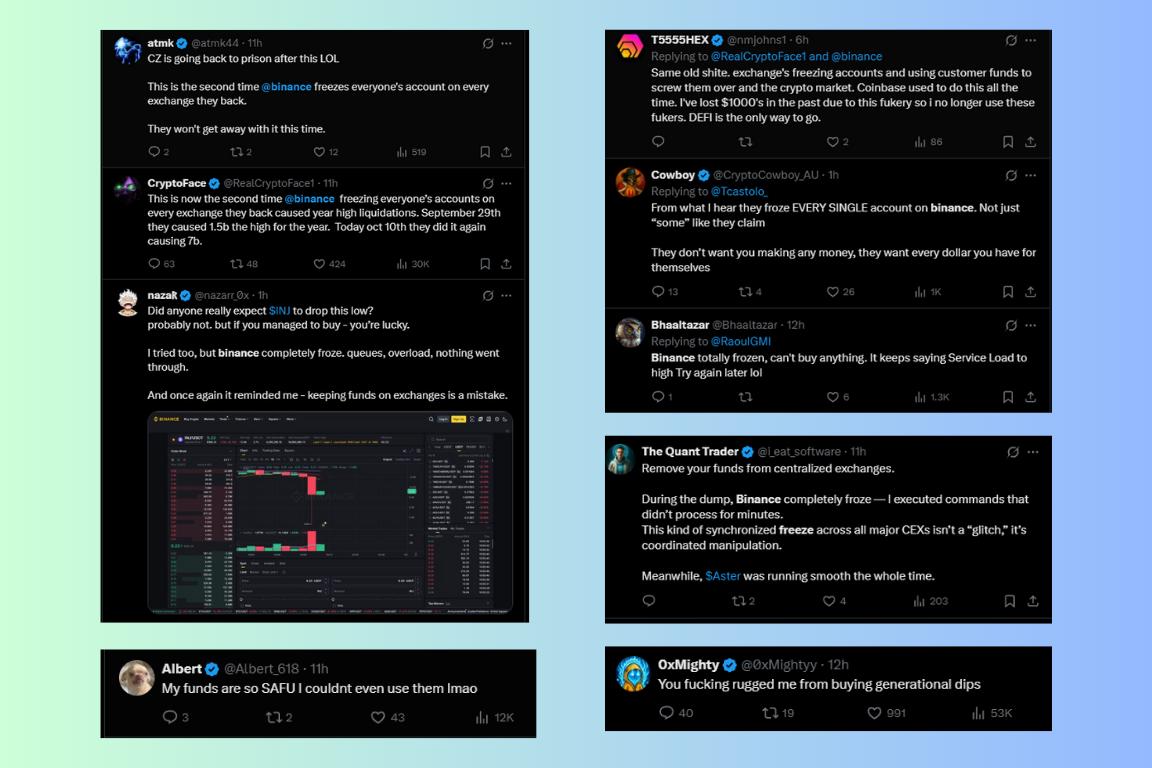

Social media exploded on Friday evening after traders claimed Binance's systems locked up in the biggest liquidation of the year.

Many altcoins drop to 0 on Binance

Coins like Enjin (ENJ) and Cosmos (ATOM) briefly dropped to $0.0000 and $0.001, respectively, before recovering.

Some traders reported being unable to close or protect positions as losses mounted.

Binance acknowledged the disruption, saying “heavy market activity” caused system delays and display issues, but assured users that “ funds are safe .”

However, users accused the exchange of market manipulation, claiming that the freeze allowed Binance to profit from the largest liquidation event in crypto history.

Some prominent traders accused Binance of disabling limit and stop loss functions at key times. Others said both long and short positions were liquidated while the Order Book was frozen.

Tweets described widespread system overload and users being unable to make transactions for several minutes.

Notably, Binance is not the only exchange experiencing outages and trading freezes. Coinbase and Robinhood have also reported similar issues.

Community Reacts Strongly to Binance After Yesterday's Crypto Market Crash

Community Reacts Strongly to Binance After Yesterday's Crypto Market CrashHowever, this is not the first time Binance has faced such allegations . Some traders compared it to a similar incident earlier this year, when the service suddenly stopped coinciding with large-scale liquidations.

Critics are now calling on regulators to investigate the exchange's internal controls, while retail investors are calling for withdrawals from centralized exchanges .

Binance’s outage likely exacerbated the fallout from Trump’s threat of 100% tariffs on China , which wiped $200 billion from the global cryptocurrency market earlier in the day.

A combination of geopolitical panic and technical failures turned a severe sell-off into a historic crash.

Binance says its systems are now back online, but users continue to report delayed withdrawals and frozen P2P trading. The company has not announced any compensation for traders affected by the sudden price crash.