Author: GoMoon

Original title: Forgetting to sign a confidentiality agreement, Binance’s “hidden rules for listing coins ” were exposed, and the uproar broke out again.

Recently, Binance has been embroiled in one turmoil after another, and today the crypto circle is in an uproar again.

The reason is that Limitless founder CJ leaked an internal document allegedly from Binance on X, which involved the token ratio and funding conditions required for listing.

Listing fees have always been a sensitive and often taboo topic for centralized exchanges. This revelation quickly sparked heated discussion in the global community.

Binance responds: We do not charge listing fees, only margin

In response to external concerns, Binance immediately responded, stating:

"Binance will not profit from the coin listing process, and the platform does not charge listing fees. The so-called funds are only refundable deposits used to ensure user safety and project sustainability. Usually, they can be refunded within 1 to 2 years after the conditions are met." Binance also accused CJ's remarks of being "false and defamatory," emphasizing that it "obviously misled the public and harmed the fairness of Binance's coin listing process."

However, the community's reaction was mixed, with many believing that this interpretation indirectly acknowledged the authenticity of the document.

Exposed content: Binance spot listing requires surrendering 8% of token supply

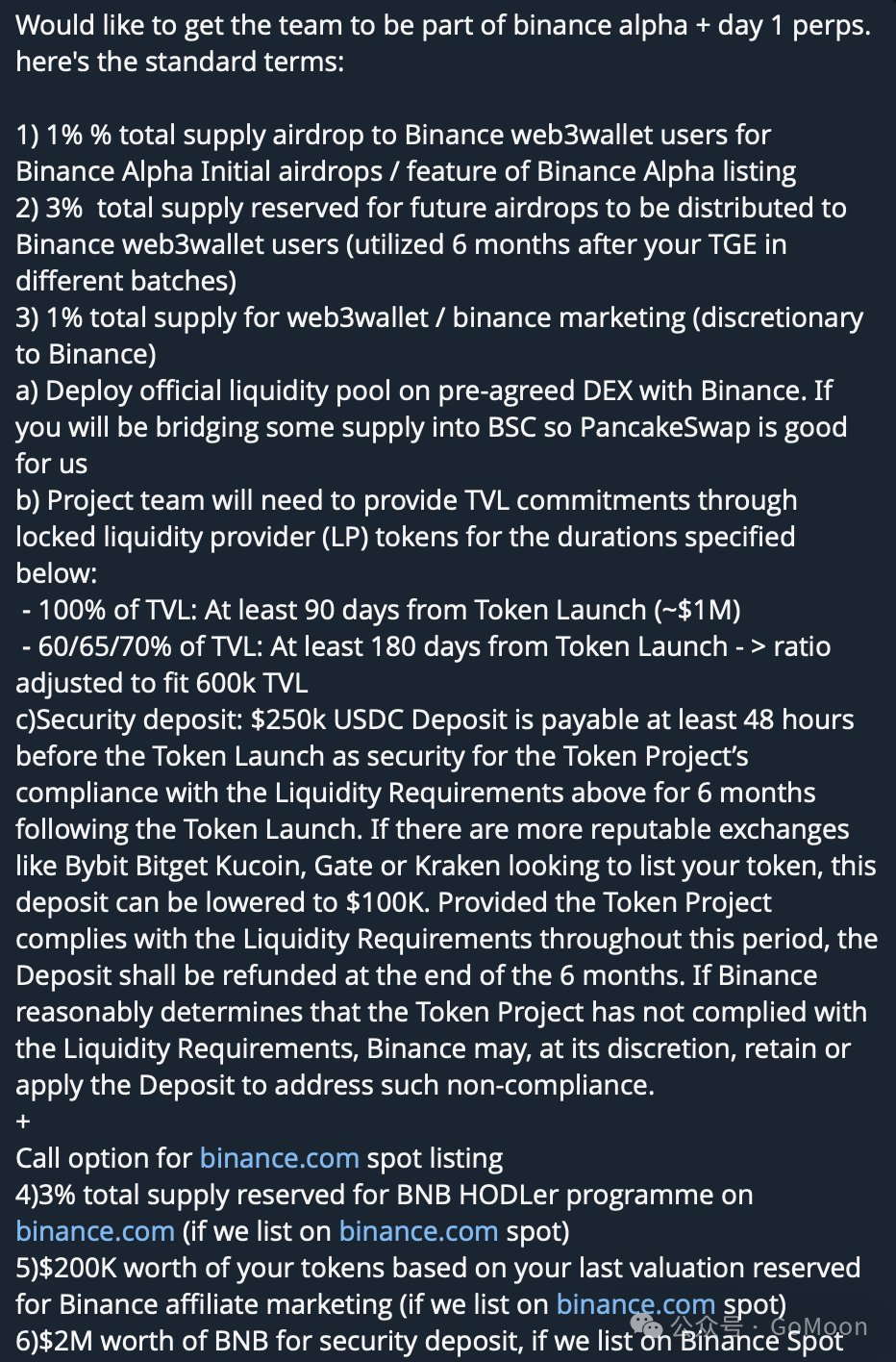

According to the document released by CJ, Binance will set different token and funding requirements based on the scope of cooperation that the project party hopes to have. The details are as follows

To participate only in Binance Alpha and perpetual contracts: you need to invest approximately $1.25 million (of which $250,000 is a refundable deposit); and hand over 5% of the total token supply.

If you wish to launch Alpha, perpetual contracts, and spot trading simultaneously: the cost will increase to $3.25 million (of which $2.25 million is refundable); you will need to provide an additional 8% of the token supply; and pay an additional $200,000 worth of token expenses.

The document also lists a series of specific conditions:

1% will be airdropped to Binance Web3 wallet users for the initial launch and Alpha campaigns;

3% will be airdropped in batches six months after the TGE (Token Generation Event);

1% is reserved for marketing and is at Binance's disposal;

Projects must deploy a liquidity pool on PancakeSwap and lock up at least $1 million in LP tokens for a period of 90–180 days.

A $250,000 security deposit is required, which is refundable after six months if liquidity meets the requirements;

If you plan to list on other major exchanges at the same time, the listing margin can be reduced to $100,000;

3% of tokens must be reserved for the BNB HODLer program;

$200,000 worth of tokens for Binance Affiliate marketing;

If you want to go online for spot trading, you will need to pay a BNB deposit equivalent to US$2 million.

CJ also added that, in comparison, Coinbase’s proposal focuses more on collaborative construction, such as building an application ecosystem with long-term value on the Base network, rather than simply “spending money to list coins.”

The absurd episode of "forgetting to sign a confidentiality agreement"

The drama of the incident is not over yet.

CJ posted a screenshot of being blocked by Binance founder CZ on X. CZ immediately responded:

"This guy is so attention-seeking. Honestly, I didn't even know who he was before he posted that fake picture. If I really wanted to block him, I could make it happen right now - but I choose to ignore it. Ignoring is the best response."

Not to be outdone, CJ countered:

“At least two people should have been fired in this incident. One was the coin listing person who was so excited when Kaito’s pre-sale exceeded its target by 200 times that he forgot to ask me to sign a non-disclosure agreement. The other was the Binance community editor who brought me traffic.”

This incident sparked contrasting reactions across different communities. Many in the Chinese-language community lambasted CJ for "ruining Limitless's chance of listing on Binance." However, Limitless's major investors—Collider partner Adam Benayoun and the 1confirmation Fund—publicly supported CJ, saying he had exposed the hidden rules of the coin issuance process and brought greater transparency to the industry.

This controversy not only puts Binance's listing mechanism in the spotlight but also reveals the power imbalance between projects and exchanges. In an industry constantly touted for "decentralization" and "transparency," when even the "cost of listing" requires leaks to be discussed, this is perhaps the most alarming reality.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush