Crypto Black Friday’s record liquidations erased $19 billion in positions, exposing transparency gaps between centralized and decentralized venues. As Binance stumbled, Hyperliquid held firm, making the 10.10 crash crypto’s biggest stress test since FTX.

The crash and Binance’s recent listing controversy underscored one growing theme: the cost of centralization and the appeal of open systems.

The Crash That Shook Trust

Latest Update

Bloomberg reported that Hyperliquid processed over $10 billion of the $19 billion in liquidations while Binance suffered outages and refunded users. The DEX maintained 100% uptime, proving its resilience during extreme volatility.

Background Context

Bitwise CIO Matt Hougan noted that blockchains “passed the stress test,” highlighting that DeFi venues like Hyperliquid, Uniswap, and Aave stayed operational while Binance had to compensate the traders. His conclusion: decentralization preserved market integrity as leveraged traders collapsed.

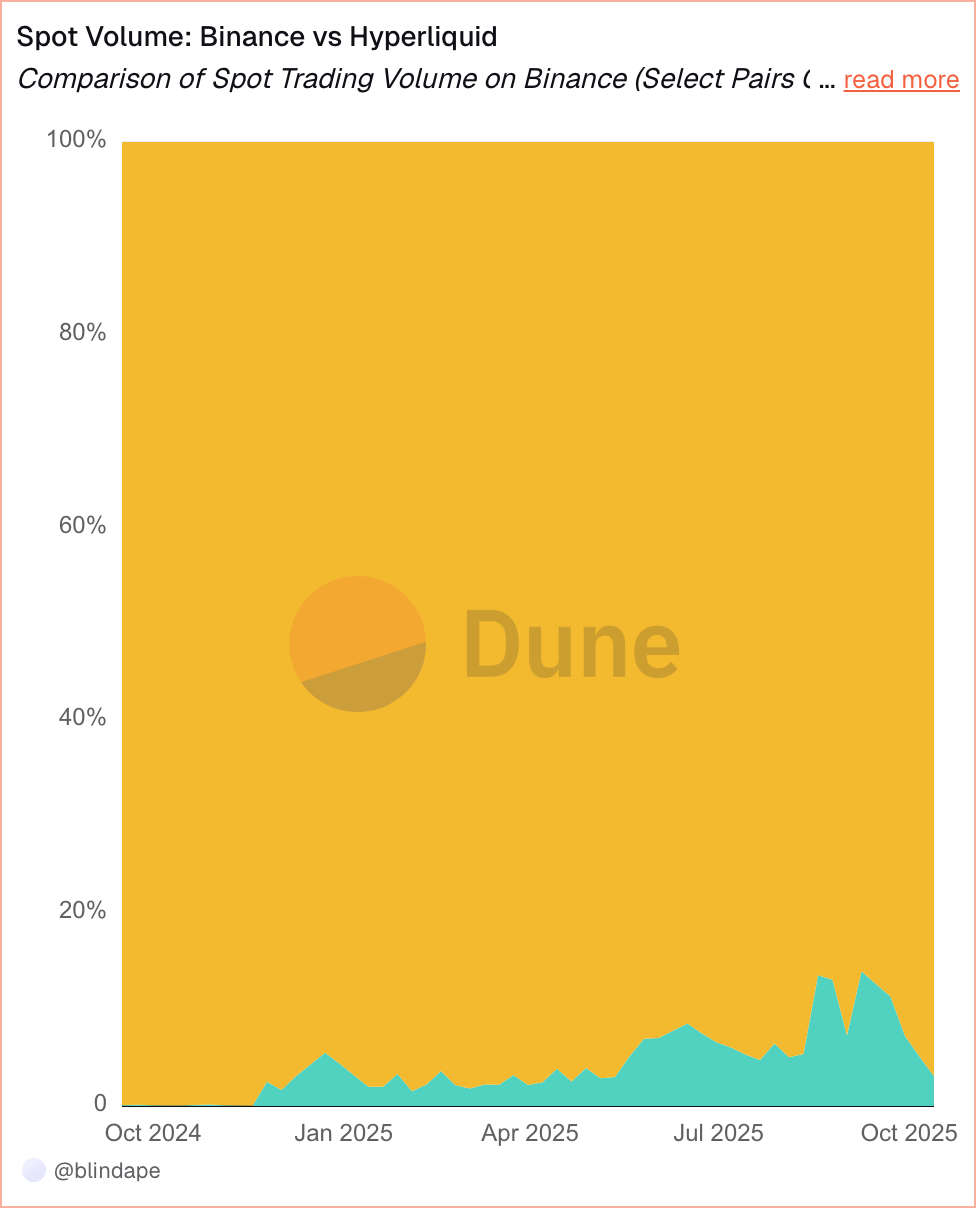

Dune data shows Binance dominates spot volume, while Hyperliquid’s share remains under 10% despite steady growth through mid-2025. The same trust gap that surfaced during the crash soon reappeared in a different form — the listing fee debate.

Binance Faces the Listing Backlash

Deeper Analysis

Limitless Labs’ CEO alleged that Binance demanded 9% of the token supply and multimillion-dollar deposits for listings. Binance denied it, citing refundable deposits, and defended its Alpha program. The fairness debate erupted as CEX trust hit new lows.

Behind the Scenes

CZ argued exchanges follow different models and said, “If you dislike fees, build your own zero-fee platform.” Hyperliquid replied that on its network, “there is no listing fee, department, or gatekeepers.” Spot deployment is permissionless: any project can launch a token by paying gas in HYPE and earn up to half of trading fees on their pairs.

DEX and AMM have already ensured free listing, exchange, and liquidity for any asset

— Hayden Adams 🦄 (@haydenzadams) October 15, 2025

If a project is willing to pay high listing fees it’s for marketing, not market structure

Proud of the role we played in making this a reality

Uniswap founder Hayden Adams argued that DEXs and AMMs already offer free listing and liquidity—if projects still pay CEX fees, it’s purely for marketing.

Hyperliquid Emerges as the On-Chain Contender

Essential Facts

| Platform | Sept 2025 Volume | Market Cap |

|---|---|---|

| Hyperliquid | ≈ $200 B | ≈ $13.2 B |

| Aster | ≈ $20 B | ≈ $2.5 B |

| dYdX | ≈ $7 B monthly | $1.5 T cumulative |

Looking Forward

VanEck confirmed Hyperliquid captured 35% of blockchain fee revenue in July. Circle added native USDC to the chain, and Eyenovia launched a validator and HYPE treasury. HIP-3 enabled permissionless perps, letting builders create futures markets for any asset.

Grayscale reported that DEXs have become price-competitive with CEXs, citing Hyperliquid as 2025’s breakout. It projects that DEXs could dominate the long tail of assets where transparency and community governance matter most.

Hyperliquid’s edge lies in efficiency. A ten-engineer team runs a venue rivaling Binance’s 7,000 staff and $500M marketing spend. The DEX turns savings into token value and liquidity rewards by cutting listing bureaucracy and ads. VanEck calls this “profit without marketing spend”—a moat no centralized player can copy.