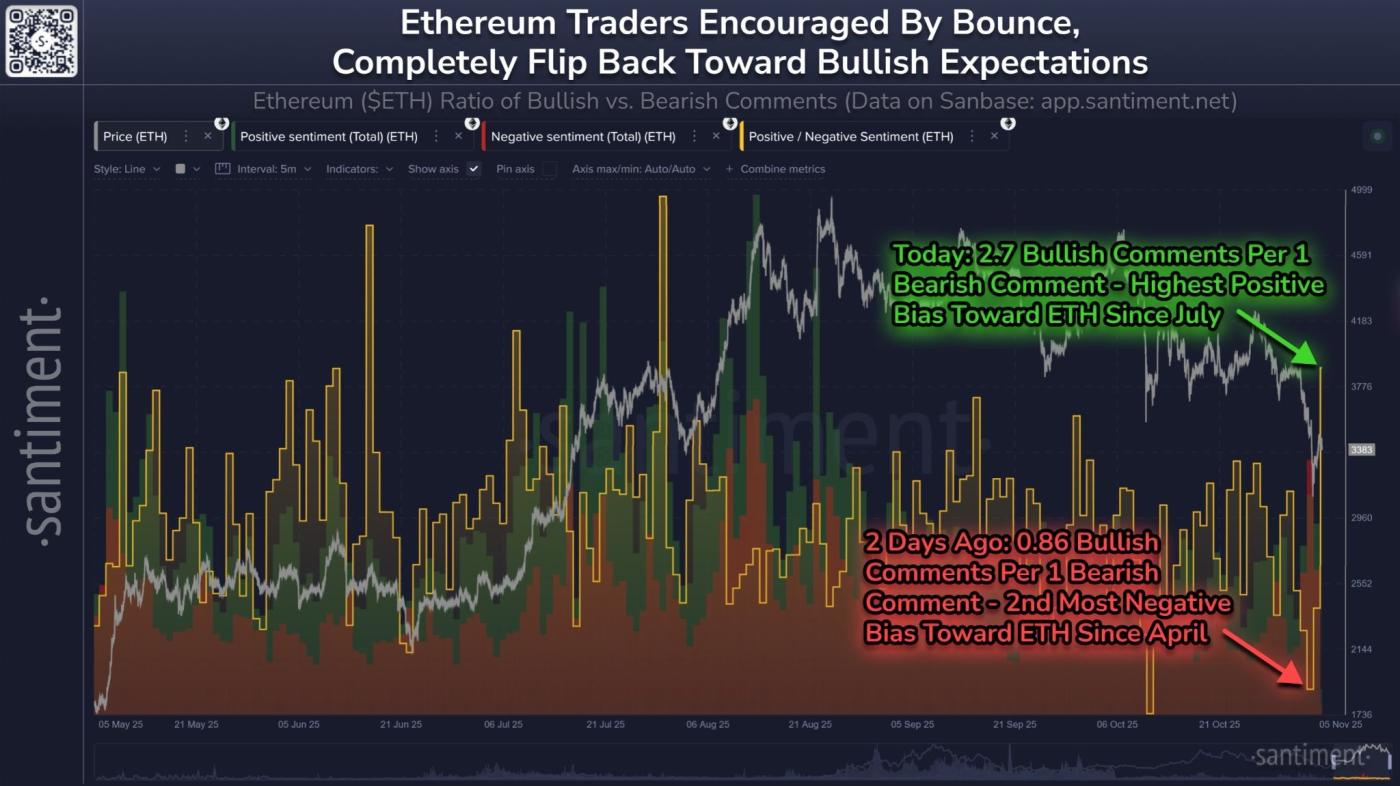

Santiment said that social media discussions about Ether have turned positive, although the Crypto Fear & Greed Index, which reflects overall market sentiment, remains at “Extreme Fear.”

Ether traders on social media are feeling more optimistic after the Token ’s price posted a slight bounce on Thursday — even as the rest of the crypto market remains on edge amid the sharp decline.

The surge in bullish comments online began as ETH prices neared $3,500 on Thursday, which traders XEM as a positive sign that the Token was regaining momentum, according to analytics platform Santiment in a post on X.

On Medium, Santiment recorded 2.7 bullish comments for every 1 bearish comment on Ether — the highest positive bias since July.

“Ethereum traders went from extremely bearish to extremely bullish very quickly,” Santiment said, adding that when ETH “almost recovered to $3,500 yesterday, the crowd took it as a sign that the asset was back on track.”

According to CoinGecko, Ether has been trading in the $3,251–$3,451 range over the past 24 hours and was at $3,323 on Friday morning.

FOMO can do more harm than good

However, Santiment argues that this heightened optimism could backfire, as “prices often move against crowd expectations.”

On Tuesday, the platform recorded an Medium of just 0.86 bullish comments for every bearish comment as Ether traded at $3,700 — the second-highest negative bias since April.

“Historically, we would like to see prolonged FUD like what Ether experienced on Tuesday,” Santiment said, adding that “the sell-off has helped fuel the rally over the past few days” and trader FOMO “could now cause this momentum to stall.”

Santiment noted that when traders “lower their expectations for ETH to quickly return to $4,000” and “when bullish sentiment cools off again, that’s the real buy signal.”

The rest of the crypto market remains fearful

The overall sentiment in the crypto market remains skewed toward fear, as the overall market continues to plunge — something analysts say is driven by US-China trade tensions and other macro factors.

The Crypto Fear & Greed Index recorded a reading of 24/100 on Friday, which corresponds to “Extreme Fear,” after maintaining a Medium “Fear” reading throughout the previous week.

The index plunged 50% on Tuesday to 21 points , its lowest in nearly seven months, after Bitcoin briefly fell below $106,000 for the first time in more than three weeks.

Meanwhile, Samson Mow — founder of Jan3, a Bitcoin infrastructure company — remains strongly bullish on X, arguing that Bitcoin's bull run hasn't really begun yet , and there's still a lot of room for growth ahead.