Bitcoin’s recent dip below $100,000 tested investor nerves and market conviction. Yet, the largest cryptocurrency quickly rebounded, reaffirming its new psychological floor.

Analysts across the board agree that, despite short-term turbulence, the structural trend for Bitcoin remains intact and potentially bullish. Most analysts view the US government shutdown as a significant constraint on prices in the current market.

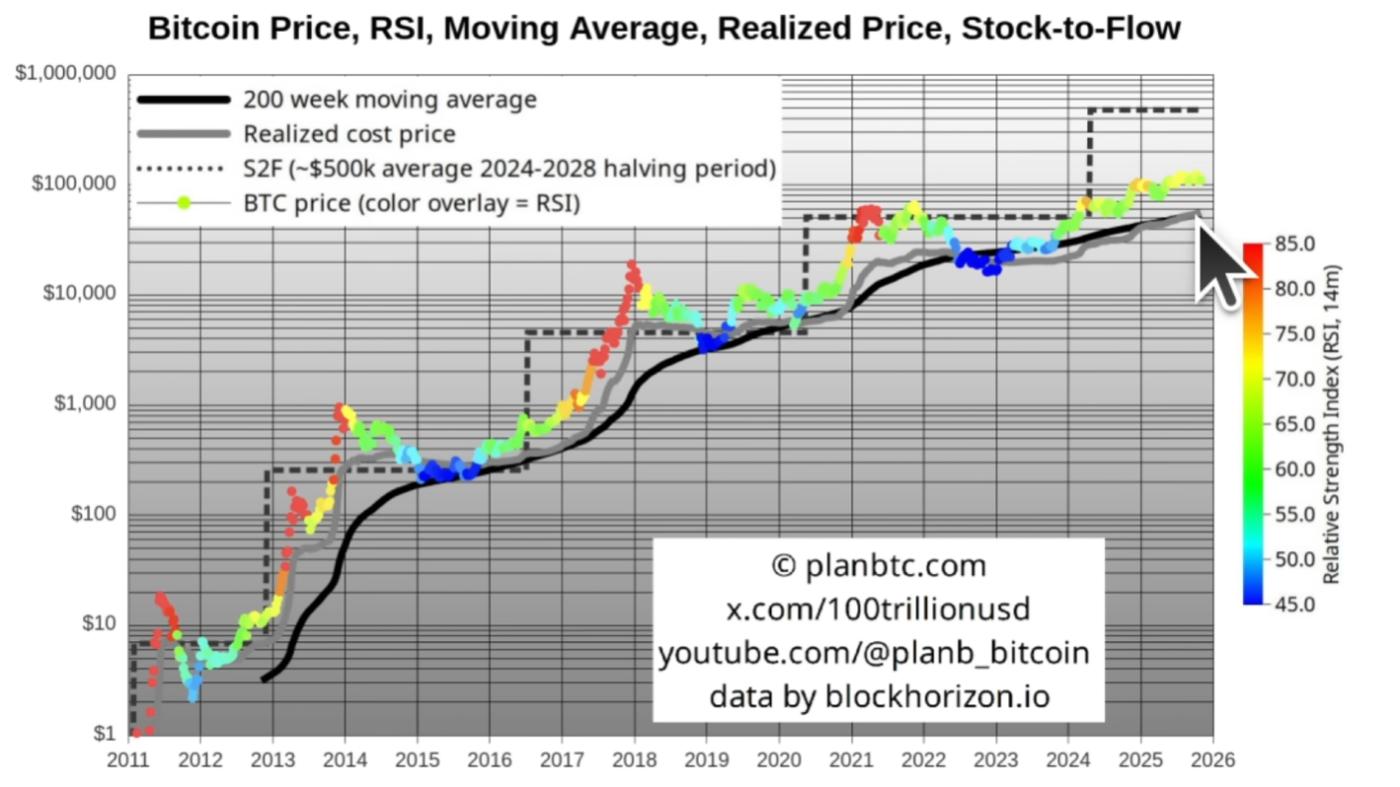

PlanB: Mid-Cycle, Not Mania

PlanB, creator of the Stock-to-Flow (S2F) model, sees the correction as a mid-cycle pause. His data shows Bitcoin has held above $100,000 for six consecutive months. This is a major shift from resistance to support.

Bitcoin Technical Indicators Chart. Source: Youtube/PlanB

Bitcoin Technical Indicators Chart. Source: Youtube/PlanBHe argues that the market hasn’t reached euphoria yet, with the RSI still around 66. This is well below the overheated 80+ levels of past cycle tops.

“Without that mania phase,” he notes, “we’re likely not at the final top.”

PlanB expects the next major leg higher could target the $250,000–$500,000 range, provided Bitcoin continues diverging from its realized price — a hallmark of ongoing bull markets.

Arthur Hayes: Stealth QE Ahead

Arthur Hayes connects Bitcoin’s short-term weakness to tightening US dollar liquidity. Since the US debt ceiling was raised in July, the Treasury General Account (TGA) has swelled, draining liquidity from markets.

Hayes notes this dynamic caused both Bitcoin and dollar liquidity indices to drop in tandem.

However, he predicts the coming reversal — once the US government reopens and spends down its TGA balance — will mark the start of “stealth QE.”

The Fed, he argues, will indirectly inject liquidity through the Standing Repo Facility, expanding its balance sheet without officially calling it quantitative easing.

In his words: “When the Fed starts cashing the checks of politicians, Bitcoin will rise.”

Raoul Pal: The Liquidity Flood Lies Ahead

Raoul Pal’s liquidity model paints a similar picture. His Global Macro Investor (GMI) Liquidity Index — tracking global money supply and credit — remains in a long-term uptrend.Pal calls the current phase a “Window of Pain,” where liquidity tightness and investor fear test conviction. But he expects a sharp reversal soon.

Treasury spending will inject $250–350 billion into markets, quantitative tightening will end, and rate cuts will follow.

As liquidity expands globally — from the US to China and Japan — Pal says, “When this number goes up, all numbers go up.”

The Outlook: Accumulation Before Expansion

Across models, the consensus is clear: Bitcoin has weathered its liquidity-driven correction. Large holders are buying, technical support has held, and the macro setup points toward renewed liquidity expansion.Short-term volatility may persist as fiscal and monetary gears realign, but structurally, the next phase favors gradual recovery and accumulation.If liquidity indicators begin to rise again in Q1 2026, both Hayes and Pal suggest the next Bitcoin rally could unfold from the same foundation it just survived — the $100,000 crash test.

Additionally, CryptoQuant data indicates that large Bitcoin holders — wallets holding 1,000 to 10,000 BTC — added approximately 29,600 BTC over the past week, valued at roughly $3 billion.

Their collective balance rose to 3.504 million BTC. This marked the first major accumulation phase since September.

This buying spree occurred as retail sentiment plunged and ETFs recorded $2 billion in outflows.Analysts interpret this divergence as a sign that institutional players are quietly reloading, strengthening Bitcoin’s support zone near $100,000.