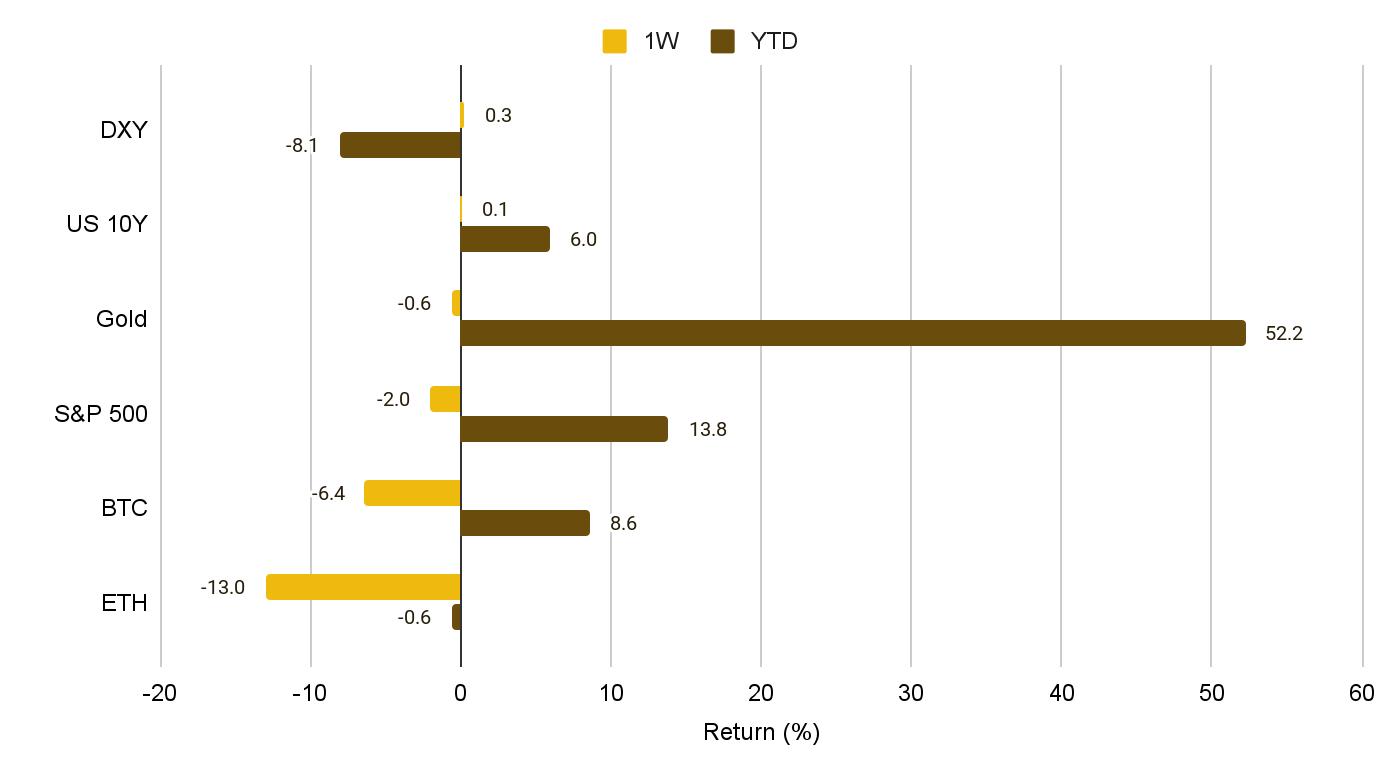

Global financial markets experienced a chill this week due to a strong spread of risk aversion. Bitcoin fell by more than 6% in a single week, and the S&P 500 also dropped by 2%. According to TokenPost Research, this decline is not only due to a contraction in investor sentiment, but also a "compound shock" caused by record-breaking leverage liquidations and conflicts with external macroeconomic variables.

■ "Technical adjustments triggered by deleveraging"

The cryptocurrency market saw liquidations exceeding $1 billion for two consecutive days. Experts pointed out that excessive leverage triggered the sharp short-term decline. "When market uncertainty increases, positions built on debt are the first to collapse. A drop in collateral value triggers a chain reaction of liquidations, creating a vicious cycle that drives down prices."

However, TokenPost Research diagnosed this decline as a "technical correction." The analysis suggests that the fundamental value of cryptocurrency technology or its market structure remains undamaged.

■ "Although $1 trillion has evaporated, liquidity has not disappeared."

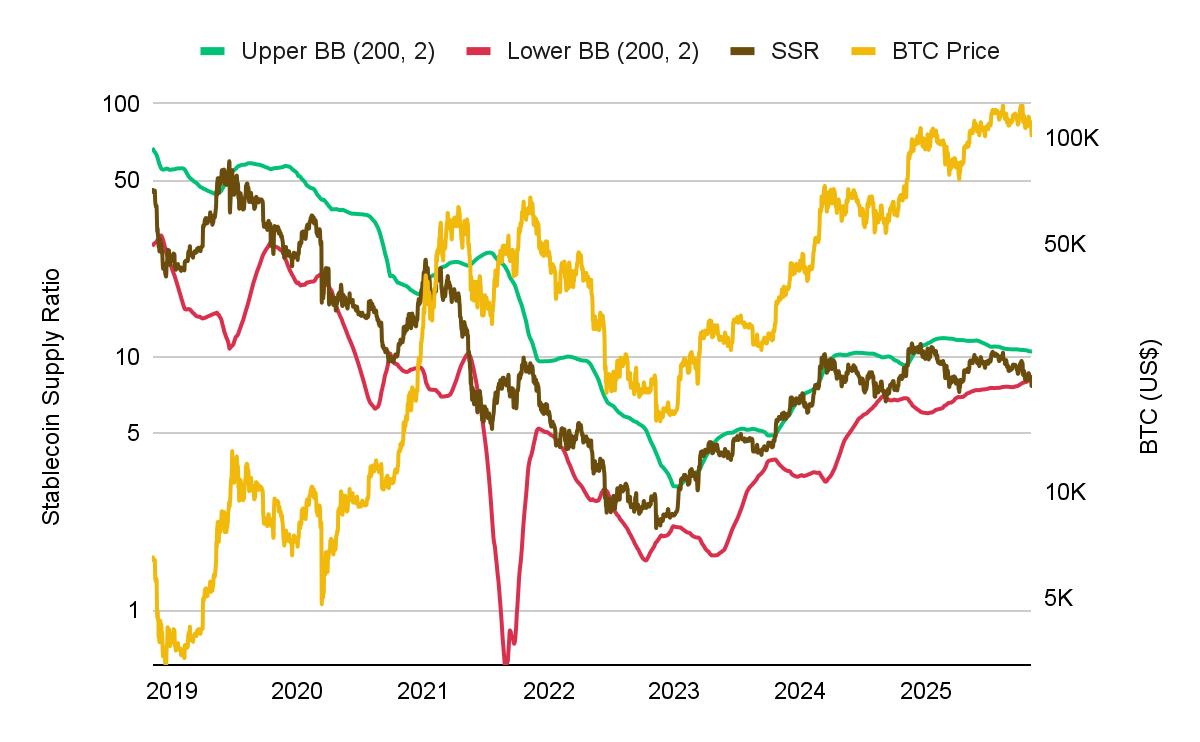

It is worth noting that the supply of stablecoins in the cryptocurrency market remained stable during the sharp decline.

Funds flowing out of volatile assets like Bitcoin haven't completely left the market; instead, they're holding on in stablecoins like USDT and USDC. The 'SSR' metric, reflecting this proportion, has recently dropped sharply, which TokenPost Research interprets as "indicating increased buying power within the market."

The analysis suggests that the "$1 trillion evaporation" in the market does not mean the funds have disappeared, but rather that they are in a latent state. Historically, after similar SSR compression phases, the market often shows signs of stabilization and rebound.

■ "Global macroeconomic uncertainty suppresses investment sentiment"

This adjustment is not only due to internal factors in the cryptocurrency market, but also compounded by external shocks. The 35th day of the US government shutdown has led to a halt in the release of major economic indicators, the Supreme Court hearings surrounding tariffs, and the possibility of Federal Reserve tightening have all exacerbated market anxiety. The policy vacuum, creating a "blind test of the economic situation," has been described as significantly increasing investor uncertainty.

■ "Focus on the market turning point in mid-November"

Experts believe that mid-November should be considered a watershed moment in the short term. If the shutdown ends and the backlog of key economic indicators are released, uncertainty is expected to ease. Conversely, if the situation becomes prolonged, market caution may increase further.

The cryptocurrency industry is closely watching key conferences next week in Texas, Berlin, and Amsterdam. In the absence of macroeconomic data, updates on technology, regulation, and projects are likely to have a greater impact on short-term market sentiment.

■ "The concentration of stablecoins may indicate a new investment trend"

TokenPost Research does not simply view this phenomenon as "defensive migration." The trend of liquidity concentrating on stablecoins may be a harbinger of future changes in asset allocation patterns or new investment strategies. If the tendency for funds to concentrate on specific stablecoin types or specific DeFi protocols intensifies, this could be interpreted as a signal of structural changes in the market.