XRP has traded sideways for several days, struggling to find momentum amid weak market conditions. The lack of bullish signals across the broader crypto sector has left the token consolidating near key support levels.

Adding pressure, investor participation, and profitability are all declining, hinting at potential downside risks.

XRP Investors Pull Back

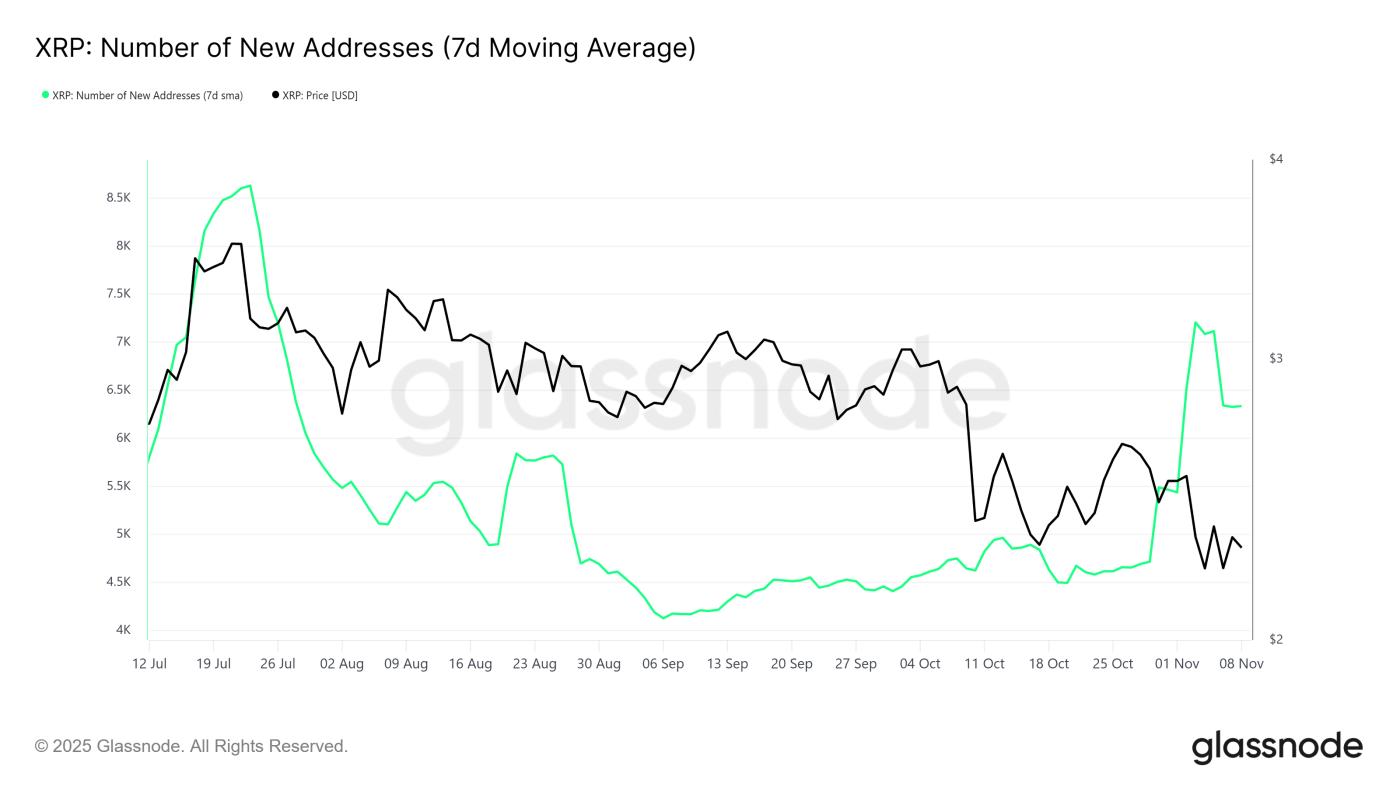

New XRP addresses have seen a noticeable drop, reflecting waning interest from fresh investors. Earlier this month, new wallet creation surged to a four-month high but has since fallen sharply to around 6,336. This cooling growth signals that new buyers see little incentive to invest in XRP at current levels.

Such a decline in participation can weaken liquidity and stall price recovery. Without an influx of new capital, the demand needed to push XRP higher may be missing. If this trend continues, the altcoin could remain rangebound.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP New Addresses. Source: Glassnode

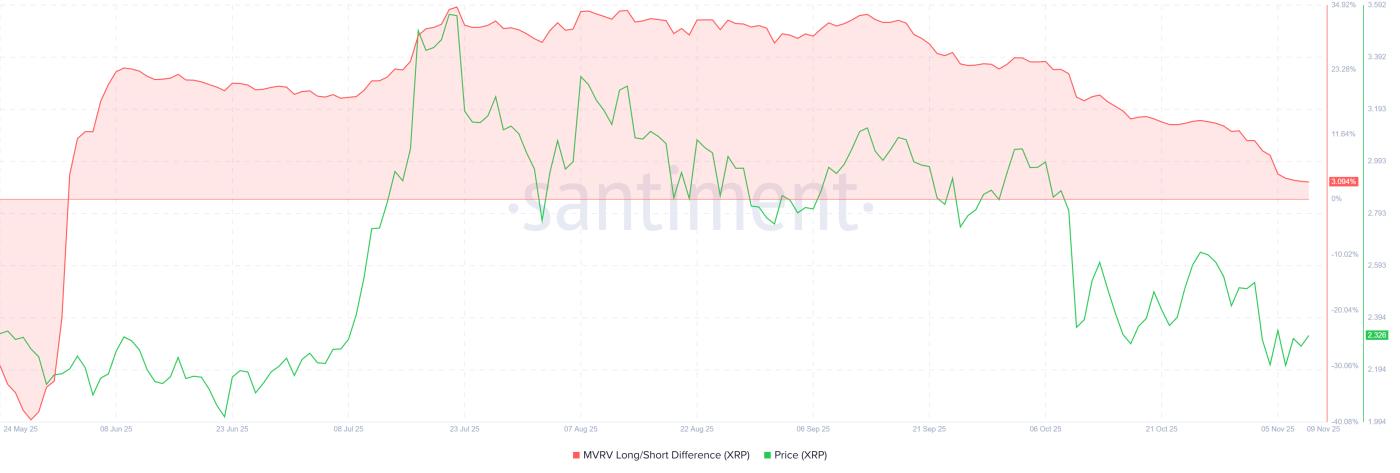

XRP New Addresses. Source: GlassnodeThe MVRV Long/Short Difference currently sits near 3%, reflecting shrinking profits for long-term holders (LTH). Historically, positive readings indicate healthy profitability, while declining values point to eroding gains. The recent dip suggests that even experienced investors are seeing lower returns from their holdings.

If long-term holders start realizing profits or exiting positions, this could add selling pressure to XRP’s price. Sustained declines in the MVRV ratio often coincide with reduced confidence, increasing the likelihood of minor corrections.

XRP MVRV Long/Short Difference. Source: Santiment

XRP MVRV Long/Short Difference. Source: SantimentXRP Price May Need A Push

XRP is trading at $2.32, holding above the crucial $2.28 support level. The altcoin has made multiple attempts to breach $2.36 but has struggled to sustain momentum amid weak investor participation.

Given the current on-chain and technical setup, XRP could continue consolidating between $2.28 and $2.13 if selling pressure grows. A break below $2.13 would reinforce the bearish outlook and delay recovery.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingViewHowever, if investor confidence improves and inflows strengthen, XRP could successfully flip $2.36 into support. This move would open the path toward $2.45 or even $2.52, signaling renewed bullish sentiment and invalidating the current bearish thesis.