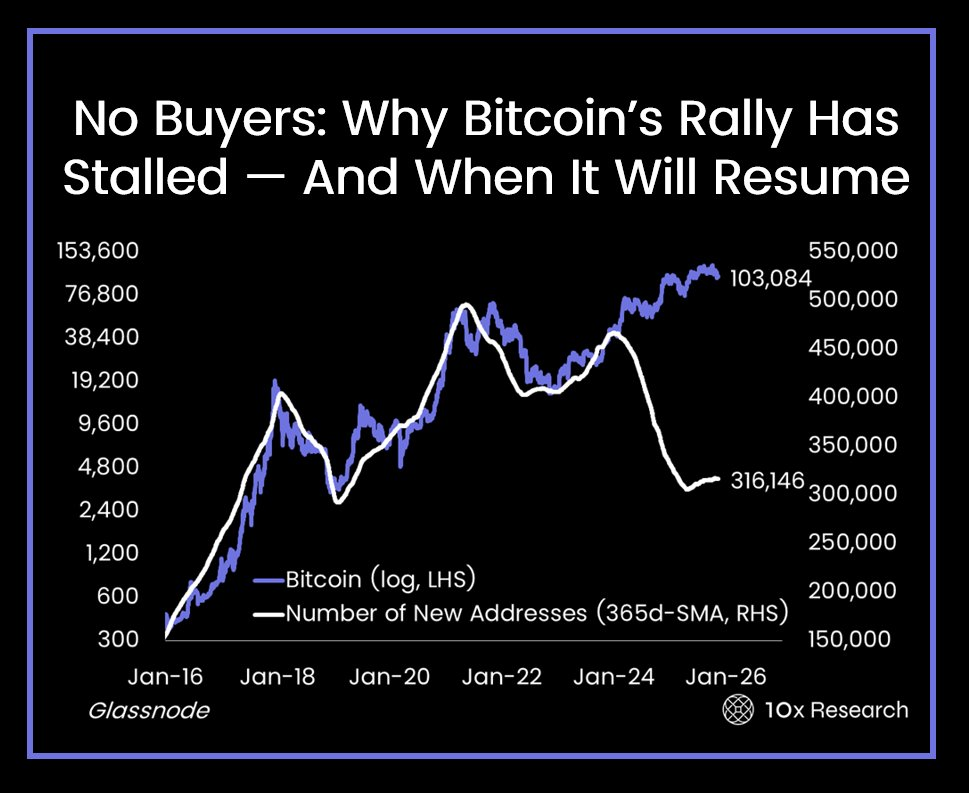

After reaching an all-time high of $126,200 on October 6, 2025, the Bitcoin market experienced a deep correction lasting over a month. As of mid-November, while the price of Bitcoin had stabilized above $100,000, it had fallen nearly 20% from its all-time high and consistently failed to break through the key resistance level of $106,000. In stark contrast to the S&P 500's strong performance, which is only 1% away from its all-time high, the upward momentum in the Bitcoin market has clearly weakened. This weakness is the result of three major factors: large-scale selling by long-term holders, a stronger dollar suppressing demand for risk assets, and changes in market structure.

Long-term holders take profits.

Between October and November 2025, the Bitcoin market experienced a massive sell-off led by long-term holders. According to Markus Thielen, head of 10x Research, long-term Bitcoin holders sold approximately 400,000 Bitcoins, worth about $45 billion, in the past month.

This large-scale sell-off has severely imbalanced the market supply and demand, becoming a significant obstacle to Bitcoin's price increase. On-chain data clearly reveals this trend. CryptoQuant data shows that in the past month, long-term Bitcoin holders have sold over 320,000 BTC, reflecting weak market confidence and liquidity pressure. These sell-offs mainly came from cryptocurrencies held for 6 to 12 months, indicating large-scale profit-taking since mid-July.

Long-term holders' selling behavior is closely correlated with Bitcoin's price movements. Glassnode analysts point out that when Bitcoin breaks through the psychological threshold of $100,000, the volume of selling by long-term holders increases significantly. This group, which includes early adopters, whale, and long-term staunch supporters, is not engaging in panic selling, but rather reducing risk and shifting funds to other high-performing sectors, such as AI and tech stocks.

Selling pressure from long-term holders may continue into next spring.

Thielen warned that during the 2021-2022 bear market, large holders sold over 1 million Bitcoins in nearly a year, and a similar scale could be repeated. "If it's at a similar pace, we could see this continue for another six months." He didn't predict a catastrophic crash but believes there's room for further declines, stating, "$85,000 is my biggest downside target."

A stronger dollar and macroeconomic constraints

US Dollar Index (left, red) and Bitcoin/USD (right). Data source: TradingView

The strong performance of the US dollar index has significantly suppressed risk assets such as Bitcoin. When investors worry that persistent inflation will lead to stagnant economic growth (a situation often referred to as stagflation), the local currency typically weakens because monetary expansion becomes inevitable.

Recently, the US dollar index has surged past 106, reaching a new high for the year, putting downward pressure on dollar-denominated assets. A stronger dollar typically leads to tighter global liquidity, causing capital to flow back to the US and creating a drain on high-risk assets such as Bitcoin.

A strong US dollar and Bitcoin prices have a long-term, stable negative correlation. A weak dollar and high risk appetite are favorable for Bitcoin, while a strong dollar and low risk sentiment are detrimental. This relationship was particularly evident in the market performance of the second half of 2025, although there were brief periods of positive correlation between the US dollar index and Bitcoin prices during that time.

The Federal Reserve's monetary policy direction remains a key variable influencing the US dollar index. The market widely expects the Fed to cut interest rates in October and December, a expectation largely priced in. If the Fed's easing cycle materializes, it could boost risk sentiment by the end of the fourth quarter, but this positive effect has not yet translated into strength in Bitcoin. Macroeconomic uncertainty further exacerbates the problem of insufficient demand in the Bitcoin market.

Bitcoin is currently trading below the cost base for short-term holders (around $106,100) and is struggling to maintain above $110,000. This weakness contrasts sharply with the rise in global risk assets due to the US government's reopening, highlighting the lack of internal momentum in crypto assets.

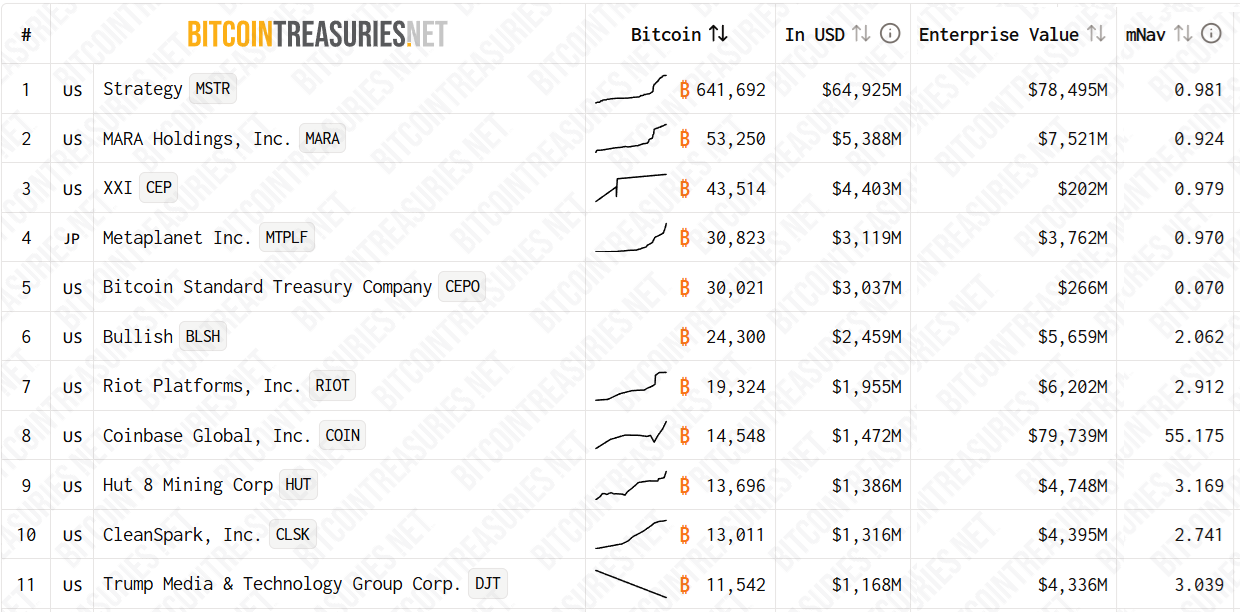

Bitcoin reserve strategy company. Source: BitcoinTreasuries.Net

Bitcoin reserve strategy company. Source: BitcoinTreasuries.Net

Market structure changes and capital rotation

The intrinsic structure of the Bitcoin market is undergoing significant changes, with the expanding influence of the derivatives market and the rotation of funds into other asset classes jointly constraining the rise in Bitcoin prices.

Derivatives markets dominate price discovery

A major structural change in the Bitcoin market in 2025 will occur in the derivatives sector.

Bitcoin options open interest has hit an all-time high and continues to grow. This shift has altered investor behavior, with investors no longer directly selling spot Bitcoin but instead using options to hedge risk or bet on volatility. While this shift has alleviated direct selling pressure in the spot market, it has also amplified short-term volatility. Now, every significant move triggers hedging by traders, exacerbating intraday price fluctuations. The market is entering a new phase where price movements are driven more by derivatives positions than by long-term beliefs, indicating that Bitcoin has become a fully financialized macro asset.

ETF inflows dried up

The performance of spot Bitcoin ETFs, an important source of new funds in the market, has been lackluster.

Despite a broad rally in U.S. stocks on Monday, U.S.-listed Bitcoin ETFs saw only a net inflow of $1 million, a stark contrast to the hundreds of millions of dollars that had flowed in during previous periods. Ten Bitcoin spot ETFs have experienced net outflows exceeding $1.3 billion in November, with BlackRock's IBIT seeing a single-day outflow of $400 million, and Ethereum spot ETFs also experiencing outflows of nearly $400 million. Institutional demand has slowed significantly, and the lack of new funds makes it difficult for the market to absorb the supply pressure from long-term holders selling off their holdings.

Privacy coins and alternative assets divert funds

As market funds seek new avenues, privacy coins have become a new focus of capital rotation. Over the past 30 days, Zcash's price has surged 99%, followed closely by Decred's 74% increase, significantly outperforming Bitcoin and other mainstream cryptocurrencies. This sharp rise in privacy-focused tokens reflects a shift in market risk appetite, with some funds potentially seeking above-average returns beyond Bitcoin. This diversion of funds further weakens Bitcoin's buying power, making it difficult for it to mount a sustained upward surge.

Technical analysis shows that $99,000-$102,000 is a key structural support level. A break below this level could open the way for a drop to $86,000 or even lower to $82,000 (aligned with the 100-week moving average). Currently, Bitcoin's price is still trading below the 3,650-day moving average (currently near $110,000), a level widely considered a critical threshold for any sustained upward movement by analysts.

The market is in the process of recalibration rather than a crash. Once the macro environment turns favorable again, Bitcoin is expected to once again become the preferred high-beta safe-haven asset in the global market.