Over the past week and even before, Bitcoin prices have been showing a worrying pattern. US trading sessions have led to sharp declines in Bitcoin, while Asian markets have consistently bought into the dips, showing a clear regional divergence.

New reports allege that the government may have orchestrated sell-offs that took place during US trading sessions as part of its broader investment strategy.

US Acquisition Rumors Hit MicroStrategy as Bitcoin Drops to $85,000

Bitcoin’s recent price decline has revealed a clear Chia in trading, with US sessions leading the sell-off while Asian traders continue to buy into the dip. BeInCrypto reported that US trading sessions have become the weakest time for Bitcoin prices.

According to Bitcoin pioneer Max Keiser, the US government may be targeting MicroStrategy (MSTR) and Coinbase (COIN), potentially taking advantage of Bitcoin's sharp sell-off in November .

While there is no evidence to support these claims, speculation has been rife, with some suggesting that this interest led to the government regulating the recent Bitcoin sell-off below $90,000.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

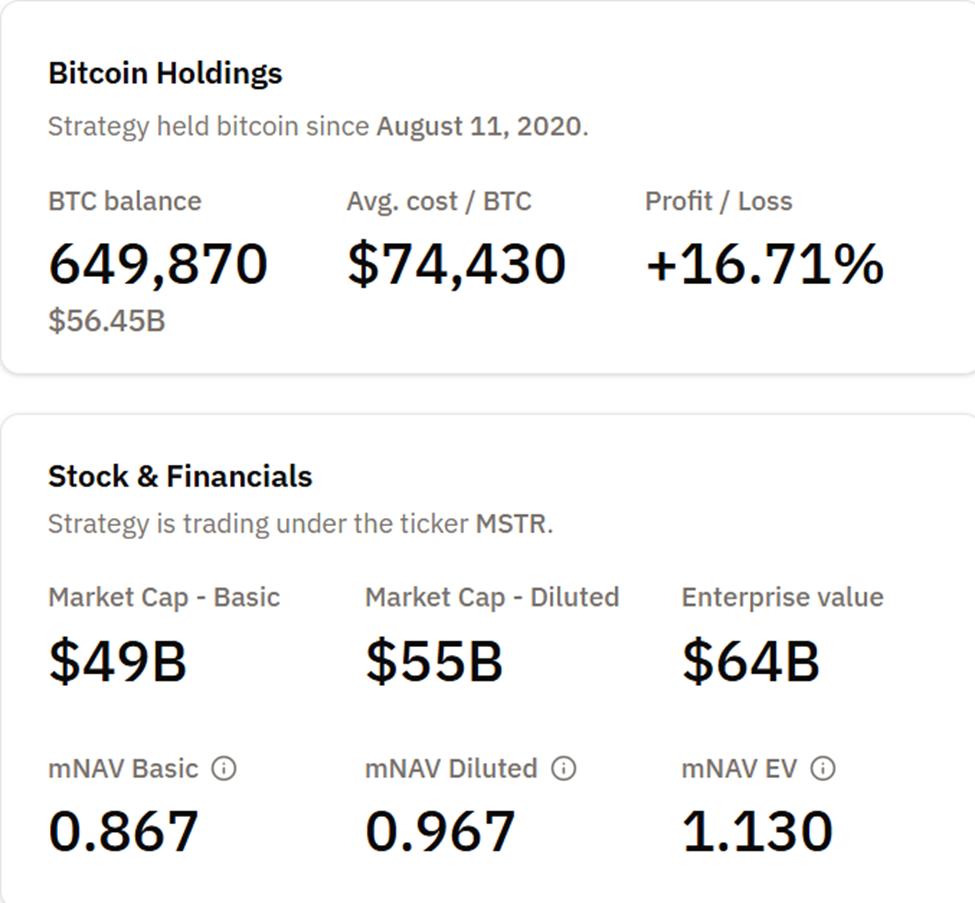

Bitcoin (BTC) Price Performance. Source: BeInCryptoAllegedly, US government officials wanted MicroStrategy's market value to be close to its net asset value (mNAV) of 1.0 and thus engineered a Bitcoin price dump to compress the differential.

“The US is XEM at investing billions of dollars in MSTR and they need mNAV to be at 1 before it makes sense to invest, so they created a crash on Bitcoin,” Teddy, a popular user on X (Twitter), wrote .

Mike Alfred names officials like President Donald Trump, Treasury Secretary Scott Bessent , and allies, citing a multi-step plan to bolster Bitcoin, MSTR, and stablecoins while simultaneously defunding JP Morgan, the Fed, and the US banking system to protect American citizens.

Again, there are no official statements or legal filings to support these claims. No representatives from the US Treasury, the White House, or regulatory agencies have addressed or confirmed these rumors.

“The government XEM this as a decisive battle,” Alfred noted .

MicroStrategy's metrics risk outweighs outside noise

Several real-world factors have influenced the recent price movement . Strategy Inc. is facing the potential impact of MSCI’s proposed exclusion of companies with more than 50% of their assets in Bitcoin or similar cryptocurrencies from its index . If passed, the policy could trigger as much as $8.8 billion in passive Capital withdrawals from the stock.

At the same time, changes in the Fed's stance on rate cuts and volatility in the bond market have put pressure on riskier investments, leading to an increasing market decline.

Michael Saylor, CEO of MicroStrategy, rejected efforts to reclassify his company as a fund or a trust , emphasizing its ongoing software and treasury operations.

With the MSCI decision in January 2026 looming, the company continues to face real-world business challenges that have nothing to do with online conspiracy theories.

Speculation on X ties Bitcoin's decline to imaginary government hoarding schemes, including:

- Claims that the government would “step in and buy MicroStrategy,” creating a “safeguard.”

- Theories that the Bitcoin price dump allows the US to reach its hypothetical 1 million BTC storage target.

- Claims that MicroStrategy could be a long-term “honey trap” leading to asset forfeiture.

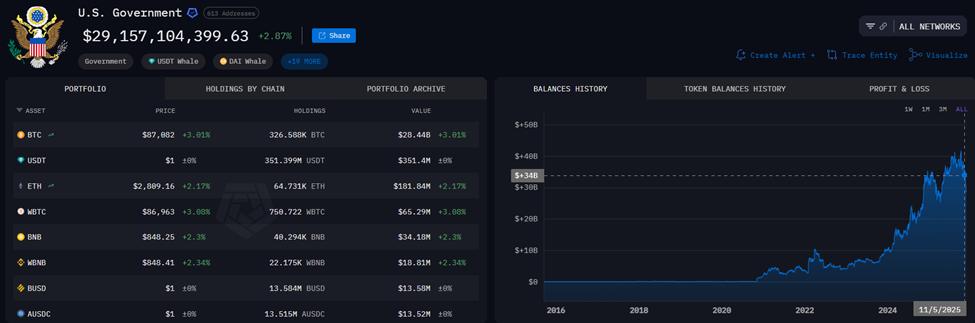

Blockchain data shows the US government holds more than 326,000 BTC from previous seizures, fueling ongoing speculation.

US government Bitcoin. Source: Arkham Intelligence

US government Bitcoin. Source: Arkham IntelligenceMicroStrategy, whose balance sheet is largely Bitcoin, has fallen more than 60% from its peak, pushing its mNAV below 1 on November 23.

MicroStrategy mNAV. Source: Bitcoin Treasures

MicroStrategy mNAV. Source: Bitcoin TreasuresEven without evidence of a government proposal, these rumors highlight some important facts:

- MicroStrategy's value remains closely tied to Bitcoin's volatility.

- Assessing index eligibility may significantly impact the liquidation of $MSTR.

- Social media-driven narratives can influence sentiment during periods of high volatility.

While these are still just speculations from some of the industry's biggest voices, the timing of these posts, as Bitcoin is experiencing its biggest weekly price drop of 2025, could increase the spread.