Behind almost every narrative design and event , I end with a vision of Bankless: We can build a Web3 on-chain digital bank through stablecoin payment + on-chain finance, building almost all the services that traditional banks can provide, achieving financial inclusion and financial equality.

The starting point behind this grand vision extends beyond crypto-native applications like Crypto Consumer Apps, DeFi, and public blockchains; it can also include stablecoin payment companies, Fintech, and more. In short, a revolution in new digital banking has arrived.

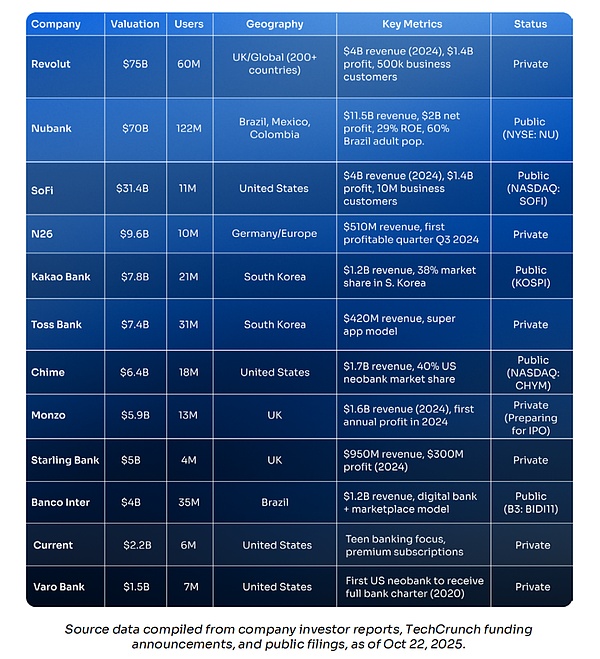

Traditional digital banking Fintech is still in its infancy. Nubank has a market capitalization of $72 billion and serves 122 million users in Latin America; Revolut is valued at $75 billion and has over 60 million customers worldwide; Chime, with a market capitalization of $11.6 billion upon its IPO in 2025, has 18 million accounts in the US alone. These "digitally native" banks prove that better, faster, and cheaper banking services can scale to hundreds of millions of users and generate billions of dollars in revenue—all without needing a single physical branch.

Crypto-native Web3 on-chain banks are emerging. Crypto users have long been using self-custody services, peer-to-peer transactions, and earning yields with stablecoins; the market is awakening. But for these digitally native ordinary people, crypto remains too complex and too dangerous. What they need is a bridge: a new type of Web3 bank—a familiar banking interface, but running on blockchain tracks, stablecoin accounts, and DeFi infrastructure.

Therefore, we have compiled the article MOIC Digital Onchain Neobanks & the LATAM Gold Rush to examine, from the perspective of traditional digital banks, how Web3 on-chain banks built on blockchain and stablecoin architecture will meet user needs and serve those who are not served by traditional financial services in the future.

Our focus will be on Latin America. Here, crypto has taken root, proving the potential of new-type banks, which are already native to stablecoins. Latin America possesses structural conditions such as currency crises, reliance on remittances, and financial exclusion, making Web3-based new-type banks not just "useful," but "essential." The region handles trillions of dollars in crypto transactions annually, with 50-90% of these being stablecoin payments rather than speculation. Argentina's 178% inflation rate fuels a thirst for dollar-denominated accounts; $160 billion in remittances flow through the region annually, only to be siphoned off by exorbitant fees; and 122 million people still lack bank accounts, yet everyone owns a smartphone.

https://www.moicdigital.com/neobanks-latam-report

I. Traditional Digital Banks

1.1 What is a digital bank (Neobank)?

Digital banks are “digitally native” financial institutions that operate solely through mobile apps and websites, without any physical branches. Traditional banks move their offline operations online, while digital banks are born in the cloud, designed from the ground up for smartphones. They typically partner with licensed banks to achieve regulatory compliance and deposit insurance, while offering a superior experience, lower fees, and faster speeds, allowing them to directly reach customers.

Five key characteristics defining digital banking:

Zero branches: All operations are completed on your mobile phone. Opening an account takes 5 minutes. No need to visit a branch. No business hours. 24/7 online customer service.

Zero paperwork: No need for piles of forms and notarized documents; Automated KYC: Take a picture of your ID and scan your face, and it's done in 10 minutes.

Ultra-low fees: Checking account is free, with no monthly fees and no minimum balance requirement.

Mobile-first: The app is not an "additional channel" like traditional banks, but the entire product itself.

User-centric: Traditional banks prioritize meeting institutional processes, while digital banks prioritize meeting user needs—spending categories, savings goals, investment opportunities, and cashback rewards are all built-in functions, not additional plugins.

Digital banking ≠ “Bank + App”

The difference lies in the underlying architecture. Traditional banks use a digital interface attached to a core system built on top of systems from decades ago; digital banks, on the other hand, are rewritten from day one with modern infrastructure prioritizing APIs, resulting in superior products, faster feature iterations, and lower operating costs.

It is this infrastructure that allows Nubank to serve a customer at an average monthly cost of only $1, while traditional Brazilian banks cost $15-20; it allows Revolut to open in new countries in a few weeks, while traditional banks take years; and it allows digital banks to acquire 80-90% of their new customers through word-of-mouth, while traditional banks have to spend hundreds of dollars to buy a single user.

1.2 Current Status of the Digital Banking Market

Digital banking has rapidly become the most valuable sector in fintech. While traditional banks have spent decades building branch networks and outdated systems, digital native challengers have already amassed hundreds of millions of customers, with market capitalizations approaching those of century-old institutions. Let the numbers speak for themselves:

Revolut has 60 million customers and a valuation of $75 billion.

Nubank has 122 million users and a market capitalization of $70 billion.

Chime's IPO grossed $11.6 billion.

These are no longer "startups," but financial behemoths: with annual trading volumes in the hundreds of billions and revenues in the tens of billions, many of which are consistently profitable. Their global footprint is as follows:

A young market, a rapid pace

This industry isn't ancient; the entire sector is only a little over ten years old, yet its combined market capitalization rivals that of century-old companies. Fifteen years ago, most of the players didn't even exist: Revolut was founded in 2015; N26, Chime, and Nubank were all founded in 2013.

Starting in 2023–2024, several companies began to turn a profit, proving that the model could be scaled; however, public listings came even later: Nubank IPO'd in December 2021, SoFi went public in the same year, and Chime didn't go public until 2025—the story has only just begun.

Latin American Superstars

Here's the key: Nubank, the digital bank with the most global customers, is headquartered in Latin America. It boasts 122 million users in Brazil, Mexico, and Colombia—more than Revolut and Chime combined. In just over a decade, it has grown from nothing to cover 60% of Brazil's adult population; its annual revenue is $11.5 billion, and its return on equity is 29%, making traditional banks envious.

Even Warren Buffett has made a bet: In 2021, Berkshire Hathaway invested $500 million in its pre-IPO round—the legendary investor rarely touches technology and fintech, but this time he made a rare move.

Imagine this: if Latin America can nurture a $70 billion digital bank using fiat currency accounts in a market with high inflation and financial exclusion, what would be the potential when Web3 on-chain digital banks bring stablecoin infrastructure, DeFi yields, and blockchain technology to the same group of people?

This is the gap we need to fill.

1.3 Unit Economics and Income Patterns

To understand the potential of on-chain digital banks in Web3, we must first understand how traditional digital banks make money and why their unit economics far surpass those of established banks.

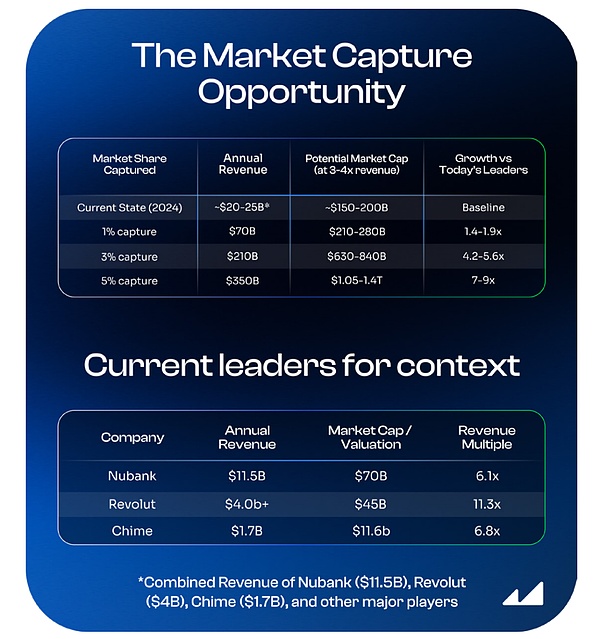

Traditional banking: $7 trillion in annual revenue baseline

First, consider the scale. According to McKinsey's "2024 World Banking Annual Review," the global banking industry generates approximately $7 trillion in annual revenue. Even the largest digital banks account for less than 1%. The opportunity lies not in replacing traditional banks overnight, but in capturing even just 3-5% of the market share over the next decade.

Let's do a simple calculation:

If digital banks capture 5% of global banking revenue, that would amount to $350 billion per year.

Based on current valuation multiples (most are 3-4 times revenue, with high-growth companies like Revolut commanding a higher premium);

The industry's total market capitalization will reach $1 to $1.4 trillion;

This would be 5–6 times the combined size of today’s leading digital banks, and Web3 on-chain digital banks are expected to capture a significant share of it.

1.4 Four Core Revenue Streams for Digital Banks

A. Credit card exchange fee sharing (Interchange)

For every transaction a customer makes, the merchant pays a 1-3% transaction fee. The card organization (Visa/Mastercard) takes a cut, and the remainder goes to the digital bank. This is the largest source of revenue (Chime derives approximately 70-90% of its revenue from this) .

B. Credit Products

Credit cards, personal loans, and BNPLs generate interest income. Traditional banks derive 50-60% of their revenue from lending; digital banks first attract deposits and issue cards, then enter the lending market after establishing trust and data.

Nubank's loan balance in Q3 2024 was approximately US$21 billion, with an ROE as high as 30%, far exceeding the average of 15-18% for traditional banks, due to its targeting of underserved populations and strict risk control.

C. Premium Subscription

For a monthly fee of $10–$45, users can unlock benefits such as airport lounge access, better exchange rates, and encrypted trading. Revolut Premium and Nubank Ultravioleta, among others, rely on this to generate high-margin, predictable recurring revenue.

D. Forex and Cryptocurrency Spreads

Currency and crypto trading are subject to spreads. Revolut supports 80+ cryptocurrencies, and its wealth/crypto revenue saw strong growth in 2024; in Latin America, clients continue to exchange volatile local currencies for USD or stablecoins, with particularly lucrative spread profits.

Traditional digital banks have demonstrated with superior unit economics that a purely digital banking model can scale to hundreds of millions of users and generate billions of dollars in revenue.

So what would happen if "crypto-native" was written into our genes from day one?

II. The Era of Web3 On-Chain Digital Banking Arrives

Digital banking is the ultimate destination for cryptocurrencies. This vision can bring the on-chain world to the masses. Every Real-World Asset Tokenization (RWA), every token, every decentralized finance (DeFi) product, every investment vault, every Layer 1 or Layer 2 public chain—everything on-chain needs a distribution channel. A new wave of digital banks is connecting all these points.

Digital banks have disrupted traditional banks with "digitalization"; Web3 on-chain digital banks will once again disrupt digital banks with blockchain and stablecoins.

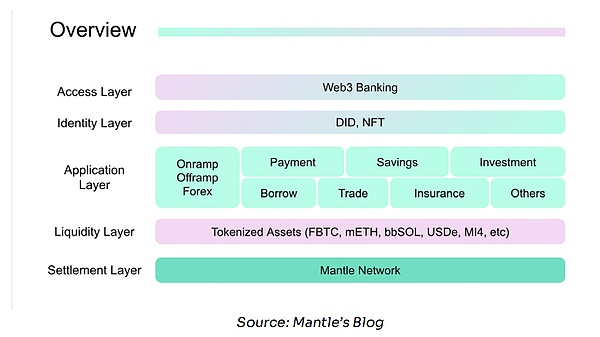

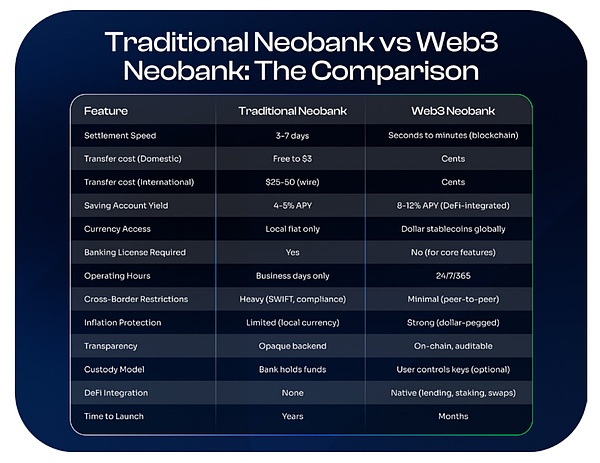

This is not as simple as adding a "crypto trading" label to an existing bank app. Web3 on-chain digital banking is a complete reconstruction based on the native blockchain architecture.

2.1 What Makes Web3 On-Chain Digital Banks Different? — UR: A Real-World Example

Backed by Mantle's multi-billion dollar treasury, UR, launching in June 2025, is a Web3 on-chain digital bank. Users can open Swiss IBAN accounts, supporting USD, CHF, EUR, CNY, JPY, SGD, and HKD, with a 1:1 deposit reserve, and global spending via Mastercard debit cards. All accounts are provided by licensed Swiss financial institutions, but the core system integrates tokenized deposits and NFT identities.

The key lies in the underlying infrastructure: UR is deeply integrated with Mantle Network (Ethereum L2) and its native products—mETH (liquidity staking token) and MI4 (tokenized money market fund). Therefore, UR can provide traditional banking services (IBAN, debit cards, fiat currency) while simultaneously allowing users to earn on-chain rewards and DeFi opportunities.

This is the core difference: traditional digital banks have only a single-layer banking architecture; Web3 on-chain digital banks break down the layers, with the settlement layer connected to global blockchains, the liquidity layer connecting to tokenized fund pools and DeFi protocols, and the experience layer retaining the familiar banking interface.

Users don't need to understand Mantle or mETH; they only see: "Annualized return on USD deposits XYZ%", "Euro to USD conversion in seconds". The blockchain infrastructure exists invisibly, yet it supports a superior economics.

Bank cards are distribution channels; accounts are infrastructure. We believe that successful digital banks should be "account-first": creating regulated, registered multi-currency accounts that connect to the traditional financial system, enabling on-chain USD to be used for payroll, bill payments, and to build credit history over time. We firmly believe this is the path to building successful digital banks that blur the lines between fiat and cryptocurrency.

— Neo Liat BengUR, Chief Operating Officer

Now, let's break down the four core differences that make this architecture so powerful:

A. Blockchain financial infrastructure

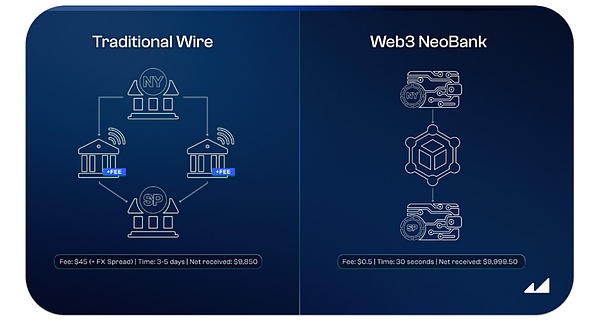

Traditional digital banks are still operating on the old financial track. When you transfer money using Revolut or Nubank, the money has to go through systems such as ACH (US) and SEPA (Europe), and the settlement takes 3-7 business days; wire transfers are a bit slower, but each transaction costs $25-50; SWIFT cross-border transfers are even more outrageous, starting at 5 days, with intermediary banks taking a cut at each level.

Web3 on-chain digital banks settle transactions directly using the blockchain. Sending USDC to the other side of the world takes only seconds to minutes, with fees of less than $1 (even less than $0.10 for high-efficiency chains like Solana and Plasma). No weekends, no holidays, no intermediaries, and no delays.

Real-world example: Transferring $10,000 from New York to São Paulo

Traditional wire transfer: Fee of US$45, arrival time 3-5 days, intermediary bank + exchange rate difference, actual amount received US$9,850.

Web3 On-Chain Digital Bank (USDC): Transaction fee of $0.50, funds arrive in 30 seconds, actual receipt of $9,999.50.

This isn't just theory; millions of users are already using stablecoins for cross-border remittances because it's cheap and fast.

B. Stablecoin Account

Traditional digital banks only offer local currency accounts (Brazilian Real, Mexican Peso, Argentine Peso). If you want dollar assets, you either need to open a US bank account or get ripped off by high exchange rate differentials at local banks.

Web3's on-chain digital bank directly provides stablecoin accounts (USDC, USDT), allowing anyone, anywhere, to own USD-denominated assets with a single click. No US bank, local residency, or credit history is required; simply download the app to deposit USD on the blockchain.

In Latin America, it's a matter of survival: when the local currency depreciates by more than 50% annually (Argentina, Venezuela), holding US dollars is not speculation, but "survival."

C. DeFi Integration

Traditional digital banks offer savings account interest rates linked to central bank policies. In the United States, the annualized interest rate (APY) for high-yield savings accounts is 4–5%, in line with the Federal Reserve's interest rate; in Brazil, Nubank offers rates approximately equal to 100% of the CDI (Brazilian Interbank Rate of Deposit), with a current nominal APY of 10–11%.

However, Brazilian users face a trap: with an inflation rate of 4-6%, the real continues to suffer from political and exchange rate fluctuations (depreciating by more than 15% against the US dollar in 2024). What seems like a 10% return in real may actually result in a negative return when converted to US dollars—interest is earned, but purchasing power is lost.

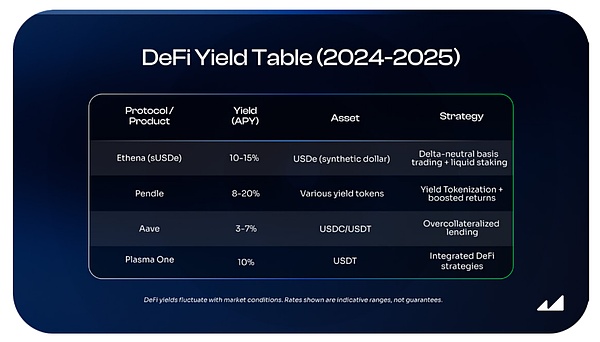

Web3 on-chain digital banks directly integrate DeFi protocols, allowing users to earn interest on USD stablecoins while hedging against inflation and devaluation. Sources of income include:

Over-collateralized lending: Lending USDC/USDT to borrowers with a collateral ratio of ≥150%.

Liquidity Market Making: Providing liquidity for stablecoin trading pairs on DEXs

On-chain vaults: Professional asset managers run strategies such as Delta-Neutral on-chain.

Staking Rewards: Earn validator rewards by holding staked liquidity tokens.

Tokenization of earnings: Platforms like Pendle allow future earnings to be split into tokens for trading and leverage.

Comparison: Chase offers 0.01% APY for regular savings, while Nubank offers 10% APY, but its currency depreciates by 15%. For Brazilian users, earning 12% APY with USD stablecoins through Ethena is far superior to earning 10% with the Real, despite its annual depreciation.

While these returns come with smart contract risks and are not FDIC insured; DeFi protocols are vulnerable to attack; Ethena's delta-neutral strategy relies on the proper functioning of the derivatives market; and Pendle's high returns require a deep understanding of the fixed-income market, the context dictates the choice. In the following countries:

Triple-digit inflation (Argentina: 178%)

Strict foreign exchange controls (Venezuela)

Banking system turmoil (Lebanon, Türkiye, Nigeria)

Political instability triggers capital flight

DeFi risks are often considered "safer" than those of local banks. Those who have experienced government-frozen accounts (Argentina in 2001, Brazil in 1990) or their local currency depreciating by 90% overnight may find "smart contract risks" relatively controllable.

For hundreds of millions of people worldwide, this is a choice that requires no hesitation.

D. No license required

Traditional digital banks must first obtain a banking license, pass regulatory approval, cooperate with licensed banks to provide FDIC insurance, sign card issuance agreements with Visa/Mastercard, and comply with dozens of local financial regulations—before even making their first deal, they have already spent several years and burned through millions of dollars on legal and compliance matters.

Web3 on-chain digital banks' core products (stablecoin accounts, DeFi yields, peer-to-peer transfers) can be launched directly without a permission:

Allow users to hold USDC

Earn revenue by integrating with Aave

On-chain transfer

None of these require a banking license. Development and deployment can be completed in weeks to months. Although Web3 on-chain digital banks still require licenses and partners to perform the following: debit/credit card (Visa/Mastercard card issuance); fiat currency deposits and withdrawals; KYC/AML compliance (licensed suppliers required), the core product of stablecoin + DeFi can be launched immediately, with card and fiat currency channels to be added later. The entry barrier has been drastically lowered, and the listing cycle has been significantly shortened.

This is why Web3 on-chain digital banks saw an explosive increase in launches in 2025:

Infrastructure is mature → Demand has been validated → Regulatory framework is in place (GENIUS Act)

The builders can now proceed at full speed.

2.2 Why "Now" is Key

A. Shifting Landscape of the Crypto Market

In the past few years, the crypto community has always talked about "using blockchain to serve the unbanked population," but that was just a beautiful vision—wallets were difficult to use, gas fees skyrocketed, regulators were hostile, and the user experience was terrible, so it was simply not going to be implemented.

In 2025, the situation will have completely changed:

Stablecoins have matured: market capitalization exceeds $200 billion, stability has been proven, and regulatory frameworks have been established.

Fast and cheap networks: Solana, Base, Plasma, Mantle offer thousands of TPS with fees below 1 cent.

A revolutionary change in experience: Account abstraction, social recovery, embedded wallets—using a crypto wallet is as simple as using Venmo.

Clear regulations: The US GENIUS Act and the EU MiCA have been enacted.

Plug-and-play infrastructure: Circle/Tether API, Fireblocks hosting, Plaid account opening – no need to reinvent the wheel.

The puzzle pieces are all in place, and the market is truly ready.

B. Regulation: The window of opportunity is now.

For years, the biggest obstacle to on-chain digital banking in Web3 has not been technology, but regulation. Stablecoins have long existed in a "gray area," with banks refusing to cooperate, venture capitalists adopting a wait-and-see approach, and entrepreneurs forced to work offshore.

On July 18, 2025, everything changed. US President Trump signed the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, marking the first time the US had established a comprehensive federal-level regulatory framework for stablecoins.

The biggest "existential risk" for institutional funds has been removed—banks can confidently partner with stablecoins, and digital banks can boldly integrate USDC/USDT.

The gates have opened. The first batch of compliant players includes: Circle (USDC), Tether (USDT), PayPal (PYUSD), and Paxos (USDP).

The United States is not an isolated case. The European Union's Crypto Asset Market Regulation (MiCA), which came into effect in 2024, also provides clear guidance, allowing EURC, EURT, and other cryptocurrencies that comply with MiCA to circulate freely in its 27 member states.

As a result, the world's two largest economies have reached a regulatory consensus on stablecoins.

C. Stablecoin market capitalization explodes

Regulatory clarity directly ignites the market: the global stablecoin market capitalization reached $150 billion in 2024 and is projected to exceed $250 billion in 2025.

According to Visa's adjusted data, stablecoin annual transaction volume exceeded $5 trillion in 2024, approaching Visa's $14 trillion. People are using it in real economic activities: remittances; savings; daily payments; and cross-border trade.

This is no longer just "crypto hype," but a new settlement layer for global commerce. This is a truly "practical application."

The window has been opened.

2025–2026 is the golden period for entering the Web3 on-chain digital banking market:

Clear regulation

Stablecoins are worth $250 billion and continue to grow.

Mature infrastructure

Institutional capital inflow

User needs were validated.

Early adopters who act now can gain a first-mover advantage before traditional digital banks complete their encryption integration and large technology companies enter the market. The starting gun has been fired—Latin America is a goldmine.

2.3 New Narratives Ignited by Plasma

The concept of digital banking is not new, and projects have been emerging for years, but it has remained lukewarm. It wasn't until 2025, after a series of regulatory victories, that a landmark event ignited the market—on September 25th, the Plasma blockchain and its flagship digital banking product, Plasma One, were officially launched.

This is seen as the "iPhone moment" for on-chain digital banking in Web3: the convergence of infrastructure, regulation, capital, and user experience finally makes the vision of scaling feasible.

Funding Path: From Seed to $396 Million

$3.5 million seed round (2024): Led by Bitfinex, to build USDT infrastructure on Bitcoin and expand stablecoin reach.

$20 million Series A funding (February 2025): Led by Framework Ventures, to launch Plasma's proprietary blockchain.

The token public offering raised $373 million (7 times oversubscribed): The market voted with its funds, snapping up on-chain tokens.

Plasma is strategically backed by Tether, which also serves as its core liquidity provider. On-chain USDT transfers are completely free of charge, directly subsidized by the Plasma network. The world's most widely used stablecoin (with a market capitalization exceeding $180 billion) can circulate on-chain at zero cost—this is the next generation of banking infrastructure. When the world's largest stablecoin issuer personally supports Web3 on-chain digital banking infrastructure, this is no longer an experiment, but a formal declaration of the future.

The impact on Latin America is enormous. Stablecoins have become the mainstream of crypto trading in the region (accounting for 50-90% of trading volume in major markets). Today, these transactions not only offer instant settlement and zero fees, but also come with substantial returns.

The project went live on September 25, 2025, and the data speaks for itself:

Day 1:

$2 billion USDT liquidity injected in one go

Stablecoin deposits offer 10%+ annualized return (Plasma One)

USDT transfers have zero fees.

Early adopters get 4% cashback on debit card spending.

20 days later (October 15th)

Total value locked (TVL) surpassed $5 billion, 2.5 times that of the first day.

Leading DeFi protocols such as Aave, Pendle, Balancer, Fluid, Veda, Neutrl, and Euler have all been deployed.

This is a real-time product-market fit.

A. Narrative Spreads Like Wildfire

Plasma's launch not only ignited its own fervor but also thrust the entire "Web3 on-chain digital banking" sector into the spotlight. Projects that had been quietly developing for months or even years were suddenly labeled "the next Plasma," becoming the hottest targets in the crypto market. Announcements followed in quick succession:

RedotPay: Plasma announced a $47 million Series A funding round the day after its launch, bringing its valuation to over $1 billion. Coinbase Ventures, Galaxy Digital, and Vertex Ventures jointly invested, making a precise timing.

Tria: Completed a $12 million pre-seed and strategic round in October.

Twitter KOLs, VC analysts, and fintech media outlets began publishing articles on the topic of "Web3 on-chain digital banking" almost simultaneously. What was once a niche sector instantly became the hottest narrative in Q4 2025.

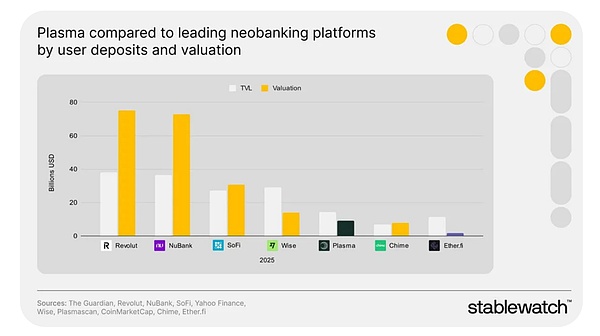

B. Valuation Gap

Despite the current hype, the valuations of Web3 on-chain digital banks remain significantly lower than those of traditional players. A recent Stablewatch report compares Plasma, EtherFi, and traditional digital banks by TVL and market capitalization:

Traditional digital banks

Nubank: Valued at $70 billion, with 122 million users.

Revolut: Valued at $75 billion, with 60 million users.

SoFi: Valuation of $31.4 billion, 18 million users

Web3 on-chain digital banking

Plasma: Valuation of approximately $3-4 billion (Plasma token XPL represents both the L1 public chain and the Plasma One digital bank; valuation includes an infrastructure premium).

EtherFi: Valuation approximately $600 million – $1 billion

If Web3 on-chain digital banks can capture a mere 5-10% market share from their Web2 counterparts, the upside potential would be 10-30 times based on current valuations.

C. Open Ecosystem: Everyone Has a Place

Plasma CEO Lucid recently stated regarding the network vision that although Plasma has created Plasma One, it welcomes more projects to enter the market and dominate their own territories—"The track is big enough to accommodate many winners." The digital banking narrative extends far beyond Plasma.

While Plasma One is our own flagship digital bank, Plasma is actively recruiting more teams to build digital banks on the platform.

“We don’t consider other digital banks as competitors. The world is too vast and diverse for a single product to win the entire market. Look at how Revolut, Monzo, and Starling have each built a huge user base in the UK, and how Nubank, Tonik, and Kuda have thrived in their respective regions with very different models. Financial services accessibility is a global issue that cannot be solved by a single app.”

Our goal is to shift the global financial system from a traditional model to a higher-quality one. This means not only building a distinctive and powerful product ourselves, but also empowering others to expand horizontally across different regions and use cases. Freelancers in Kenya, small businesses in Turkey, and retail users in Indonesia have vastly different functionalities they require.

Plasma provides developers with best-in-class payment infrastructure, ample liquidity, user resource access, and a permissionless system—where users can freely switch between various digital banks built on Plasma (including Plasma One). We also provide financial, operational, and funding support to help these digital banks grow faster.

Looking back at Web2, we see that Nubank conquered Latin America, Revolut swept across Europe, and Chime dominated the US. Different regions, user habits, and regulatory environments ultimately led to a win-win situation. Web3 on-chain digital banks will likely replicate this path: multiple players vying for dominance, each occupying a specific vertical market or geographical territory.

2.4 The Web3 on-chain digital banking ecosystem is booming

Following Lucid's open philosophy, we have compiled a list of the major players in Web3 on-chain digital banking. The entire chain includes 70+ projects. Due to functional overlap, a "spectrum" approach is used instead of a rigid classification (the diagram only lists 34 projects for readability; the retail/card sector is the most crowded).

Spectral quadrants:

Retail (Part 1): Targeting the general public, not institutions

Institution (below): B2B Digital Banking Solution

Payments and spending (left): Focusing on everyday expenses, such as encrypted cards or payment infrastructure.

Savings/Investment (right): Focusing on capital appreciation and DeFi yields

Now, let's take a closer look at four representative projects and see how they stand out in the field: EtherFi, Plasma, UR, and Neobankless, which deserves special mention—its alpha version has already attracted more than 5,000 users in Brazil.

A. Plasma

With its infrastructure-level advantages and top-tier backing, most importantly, its close ties with Tether, Plasma One boasts deep liquidity, a complete ecosystem around the entire chain, and high yields, making it the leader among "native stablecoins." Zero transaction fees for USDT and $2 billion in liquidity on its first day clearly demonstrate its competitive advantage.

B. EtherFi

Ultimate DeFi native experience. At the peak of the "restaking" narrative, the team rapidly attracted funds through liquidity restaking, causing TVL to surge. They then expanded their business into digital banking while retaining their DeFi DNA. Targeting both retail and institutional clients, they offer the highest returns in the market (11-15% APY including token incentives), making them highly attractive to crypto natives.

If you're new to DeFi, you might think EtherFi was born to be a large-scale on-chain digital bank for Web3. That's not the case—it started as a "liquidity restaking" protocol and completely dominated that narrative in 2023–2024.

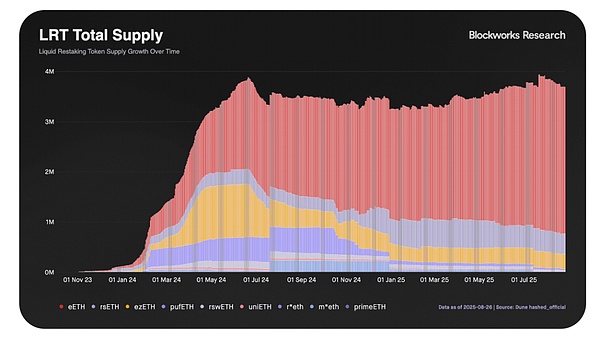

As the restaking frenzy subsided, EtherFi remained the only major LRT protocol retaining a significant amount of TVL. Blockworks Research's chart clearly illustrates this:

Why does it stand firm while others collapse? EtherFi leverages its strengths: seamlessly transferring billions of TVL and infrastructure accumulated during the restaking era to the Web3 on-chain digital banking sector, creating a moat that new entrants cannot replicate. Key differentiator: retaining users with "real value".

Deep liquidity. As the largest LRT, eETH has real liquidity across various DeFi protocols—it's tradable, can be used as collateral, and can accumulate yield. Smaller protocols can't do this.

Delivering new value quickly. Instead of sitting back and collecting eETH management fees, EtherFi continuously launches new products, giving users "a reason to stay."

EtherFi's three-piece product suite creates a closed loop of earning interest on consumption. You deposit eligible assets like eETH into a collateralized vault, and use your EtherFi card for everyday spending (bills, groceries, subscriptions, etc.). Your collateralized assets continue to earn returns; you can spend without selling your tokens, profiting from price increases, and earning up to 3% cashback on purchases. You can also repay your debts directly with stablecoins or other crypto assets.

① Stake. Deposit ETH, BTC, or USD to earn returns. eETH alone has locked up over $6 billion, which is the foundation of this business.

② Liquid. Automated strategy vault, which distributes ETH, BTC, and USD to multiple protocols to earn higher returns, greatly increasing TVL stickiness.

③ Cash – It puts EtherFi in the "digital banking" arena. A non-custodial, DeFi-native credit card:

In just a few months since its launch, the data has been quite impressive: cumulative spending of over 77 million US dollars; cashback of over 3.6 million US dollars; number of transactions of over 930,000; and number of cards issued of over 32,000; and this is just the beginning.

C. UR

A Swiss-compliant multi-currency account with a Mastercard debit card, directly connected to traditional clearing networks such as SWIFT, SEPA, and SIC. Backed by the Mantle blockchain and access to resources from the world's top exchange, Bybit, it precisely addresses the pain points of businesses and high-net-worth individuals who "need both traditional banking functions and Web3 underlying infrastructure."

D. Neobankless

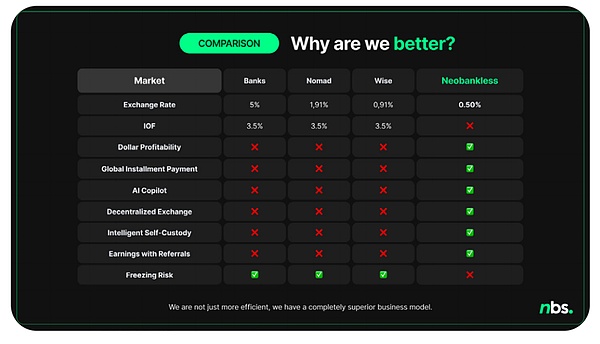

Neobankless targets the Brazilian market, encapsulating Web3 revenue within a Web2 experience—something no other international player has yet achieved. The pain point: the Brazilian Real is volatile and experiences high inflation, making Brazilians reluctant to hold their local currency; however, buying USD using platforms like Nomad and Wise incurs high fees, even with a user-friendly experience.

solution:

The underlying Solana chain is downplayed, yet users "cannot see" it: PIX is instantly converted to Brazilian Real, and USDC arrives in the account in seconds.

DeFi yields are abstracted as "high-interest dollar savings," and users don't need to know anything about blockchain.

Differentiation:

Other services only offer debit cards, but Neobankless directly provides credit cards.

Users' money continues to sit in their accounts earning dollar returns, which are then used for spending to boost their credit limits.

Credit limit = total value of collateral assets in the account, allowing for flexible coexistence of savings and overdrafts, something traditional banks cannot replicate.

Support for installment payments – a necessity in emerging markets such as Brazil.

Large purchases can be split into monthly payments, but are still priced in US dollars to avoid currency devaluation.

In short: With real deposits, dollar interest, credit card withdrawals, and installment options, Neobankless has made "stablecoin native" a digital bank that locals are truly willing to use.

Market validation:

The limited beta version has attracted over 2,000 users, with the platform's cumulative transaction volume exceeding 1.5 million reais, and over 3,000 people on the waiting list.

Zero budget, 100% organic growth. Visa's new credit card is about to be launched, directly competing with Brazil's two major dollar gateway giants, Wise (valued at $10 billion) and Nomad (valued at $363 million).

III. Crypto Gold Rush in Latin America: The Untapped Gold Mine

Before we begin, let me quote a post from Harj Taggar, Managing Partner of Y Combinator, from a few weeks ago:

“If you’re building a Web3 on-chain digital bank but you’re ignoring Latin America, you’re missing out on the biggest opportunity in the entire sector.”

Now, let's delve deeper into this "Latin American Alpha".

3.1 Current Status of Encryption Usage in Latin America

Latin America isn't just "crypto curious," it's "crypto native." The region has processed more crypto transactions than the whole of Europe, and stablecoins are the absolute mainstream—not for speculation, but as savings accounts, remittance channels, and inflation hedges.

According to Chainalysis's "Latin America Crypto Adoption Report 2025," the total volume of crypto transactions in Latin America reached $1.5 trillion between July 2022 and June 2025, representing a year-on-year growth of 42.5%. For reference, this figure is larger than the entire GDP of developed countries such as Sweden, Norway, and Austria.

From the perspective of "value reception", Brazil leads with $318.8 billion, accounting for nearly one-third of total activity in Latin America, followed by Argentina, Mexico, Venezuela and Colombia.

A. Stablecoins are king, not speculation.

Key Insight: The core of Latin American crypto activity isn't betting on Bitcoin's rise, but rather using stablecoins as a means of saving and paying for US dollars. In major Latin American markets, 50–90% of crypto transactions are in stablecoins. When Argentinians or Venezuelans "buy coin," they're not betting on Bitcoin doubling in value, but rather grabbing USDT in case their own currency collapses.

Hardcore data:

Argentina: 50% of crypto purchases are stablecoins

The national cryptocurrency penetration rate is nearly 20%, the highest in Latin America. Annual inflation is 178%, and the peso is projected to depreciate by another 51.6% against the US dollar in 2024. Ordinary people without US bank accounts can only rely on USDT/USDC to maintain their purchasing power.

Bitso exchange: 46% of purchases are stablecoins.

Bitso covers Mexico, Brazil, Argentina, and Colombia. Platform data shows that 46% of the funds used for buying go directly to USDT/USDC, rather than BTC/ETH.

Brazil: Over 90% of cryptocurrency flows are to stablecoins.

Chainalysis points out that Brazilian users have an extreme preference for using stablecoins for savings and transfers. With a mature domestic digital infrastructure (PIX processes 420 billion transactions annually), users have no barrier to entry for "digital money" and simply want to exchange "Real" for "US Dollars".

B. Why choose stablecoins? Because the local currency is collapsing.

The rise of stablecoins is a rational response to economic realities:

Inflation Nightmare:

Argentina: 178% (2024)

Venezuela: Hyperinflation (over 1000%)

Currency devaluation:

Argentine Peso: Depreciated 51.6% against the US dollar in 12 months.

Brazilian Real: Expected to depreciate by over 15% against the US dollar in 2024.

Venezuelan Bolivar: Now almost worthless

When your salary shrinks by 15-50% annually, holding US dollars is no longer an option, but a necessity for survival.

3.2 How Digital Banks Can Fit into the Latin American Market

If you were to design the market best suited for digital banking disruption, you would picture it as Latin America:

A large unbanked population is eager to access financial services.

The local currency depreciates in real time, and purchasing power evaporates instantly.

Banking oligopolies enjoy a monopoly and collect exorbitant rents.

With mature mobile infrastructure, any smartphone can become a service point.

Traditional digital banks have already validated this argument with Nubank; Web3 on-chain digital banks take it a step further—integrating stablecoin settlement, DeFi yields, and cross-border instant transfer networks, achieving a disruptive breakthrough.

Latin America will be a region where cryptocurrency-driven digital banking flourishes. We've already seen institutions like Lemon, Nubank, and Bitso leading the way. Today, on-chain infrastructure makes launching digital banks easier than ever, and I expect dozens of strong players to emerge over the next five years—driving financial inclusion to the last mile and transforming the traditional financial industry.

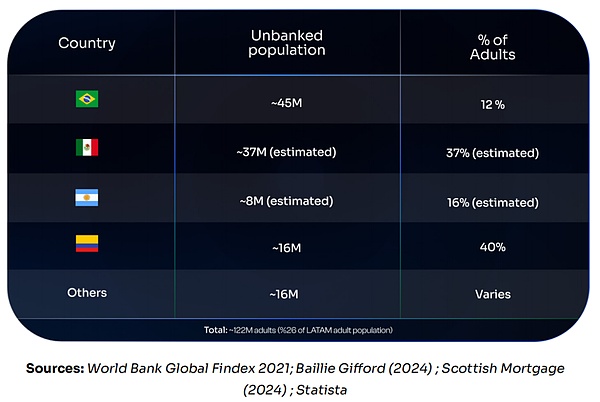

A. The Unbanked Crisis: 122 Million People Left Out

In Latin America, 122 million people (26% of the region's total population) do not have bank accounts. This is not a small minority; it is almost equivalent to the entire population of Mexico. It's not that they don't need banking services, but rather that traditional banks are unwilling to provide them or set prohibitively high barriers to entry.

Why do so many people not have bank accounts?

Minimum balance requirements exclude low-income individuals.

Documentation barriers (proof of address, employer's letter, tax ID number)

Geographical exclusion (no outlets in rural areas, slums, and informal settlements)

Distrust of institutions – a historical memory of years of banking crises, frozen accounts, and confiscation of currency.

Web3 on-chain digital banks solve all of this instantly: zero minimum balance, zero physical branches, zero proof of employment—all you need is a smartphone and a passport photo to complete KYC in 10 minutes. Download the app, deposit funds through a local payment channel (or directly deposit stablecoins), and you can open a USD-denominated account, enjoy returns, and receive a debit card.

Nubank captured 60% of Brazilian adults with its "accessible banking" model; Web3 on-chain digital banks can replicate this miracle and sweep across Latin America by making "dollar banks" equally accessible and low-cost.

B. The Nightmare of Inflation: Watching Money Turn into Paper

Argentina's 178% inflation rate in 2024 means that if you receive 100,000 pesos in January, by December, that same amount will buy you less than 40% of what it did at the beginning of the year. Your salary will either remain the same or fail to keep pace with inflation. Rent is rising, weekly grocery expenses are increasing, and various bills are constantly climbing.

Worse still is the long-term nature of this inflation: Argentina's average annual inflation rate has reached 66.9% over the past decade. This is not a one-year crisis, but a continuous erosion of purchasing power. In 2018, Venezuela experienced hyperinflation exceeding 65,000%, rendering its currency virtually worthless.

Even "stable" countries were not immune: Brazil's average annual inflation rate of 5.9% over a decade meant that 100 reais would lose approximately 45% of its value within ten years. In contrast, the average annual inflation rate in the United States during the same period was 2.5%.

When a country's currency depreciates so rapidly, the only sensible course of action is to immediately exchange it for US dollars.

C. Banking oligopoly

The Latin American banking system is dominated by oligopolies who extract monopoly rents, essentially "taming" their clients. In Brazil, for example, just five banks (Itaú, Bradesco, Banco do Brasil, Santander, and Caixa) control 92% of the credit market, charging the following fees:

Overdraft fees: 300-400% annualized

Credit card interest: 400%+ per annum

Basic checking accounts also incur account management fees.

Domestic wire transfers will incur additional transfer fees.

Digital banks have disrupted this landscape. Nubank introduced free checks, zero fees, and transparent pricing, and now 60% of Brazilian adults have a Nubank account.

Web3 on-chain digital banking could bring the same revolution to the whole of Latin America:

USDT transfers with zero fees

No minimum balance, no account management fee

Savings annualized return of 10%+

Foreign exchange spreads are lower than the bank's spot exchange rate.

Cross-border transfers arrive instantly for less than $1, while bank wire transfers cost $25-$50.

Oligopolies survive solely on regulatory moats and inertia, while Web3 on-chain digital banks bypass both.

D. Mature mobile infrastructure

This is the advantage of infrastructure: smartphone penetration in Latin America has reached 80%, and 88% of users conduct financial transactions via mobile phones. This means:

No need to set up physical outlets

No need to teach users what mobile banking is anymore

The channel is ready to use and can reach users instantly.

Young population, digital native

Brazil's PIX processes 42 billion transactions annually—instant, free, and peer-to-peer—and has made digital money transfers a habit for over 100 million Brazilians. If on-chain digital banks on the Web3 blockchain can offer a user experience as seamless as PIX, coupled with the yields of Web3 and the advantages of stablecoins, Brazilians will trust stablecoins that circulate in the same way as they trust the Real.

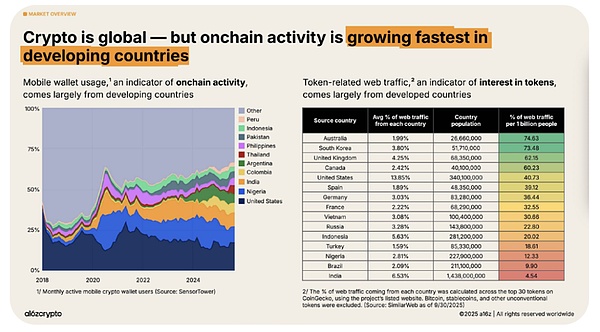

This "mobile-first" financial behavior is not unique to Latin America. a16z points out that mobile usage rates in developing countries are highly correlated with on-chain activity—the infrastructure is already in place, just waiting to be ignited.

E. Remittance dependency

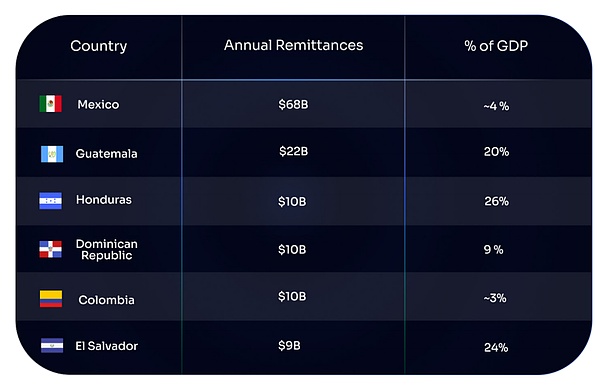

Latin America receives over $160 billion in remittances annually, almost all of which come from workers in the United States. For many countries, this amount ranges from 4% to 26% of their GDP: Haiti 26%, Honduras 17%, El Salvador 15%, Guatemala 14%, Nicaragua 11%, and even Mexico 4%.

However, traditional channels still bleed money: the average fee is 6.35%, and the highest fee from banks is 12.66%. If someone sends $500 from the United States to Mexico every month, $32-63 will be deducted from each transaction, and the net cost per year will be $380-760, which is equivalent to the local minimum wage.

Web3 on-chain digital banks use stablecoin channels to reduce the cost of the same transaction to less than $1: The remitter buys USDT in the US → the money is sent to the recipient's Web3 account in Mexico in seconds → the recipient can directly use the debit card for spending, or exchange it for pesos with one click for cash withdrawal.

With an annual transaction volume of $163 billion and an average fee rate of 6%, traditional institutions collect $9.8 billion in fees annually. If a company could capture 5% of the market share, it could generate over $8 billion in annual transaction volume. Moreover, the cost of acquiring and operating a single customer is far lower than that of Western Union or MoneyGram, giving it an overwhelming advantage in terms of unit economics.

F. Nubank: The viability of the Latin American model has been validated by its $70 billion market capitalization.

The "massive unbanked population, inflation crisis, banking oligopoly, and mobile infrastructure" mentioned above sound like theories, but are they really feasible? Just look at Nubank. Founded in São Paulo in 2013, Nubank started from scratch and has now become the world's largest digital bank in terms of customer base, with a market value of $70 billion, entirely supported by its Latin American users.

Growth trajectory: 0 → 122 million users

Total customers: 122 million (more than Revolut and Chime combined)

Brazil has 107.3 million households, covering 60% of the adult population.

Mexico 10 million+

Colombia 2.5 million

Financial performance:

Revenue of $11.5 billion in 2024

Net profit of $2 billion

Return on equity (ROE) of 29% – a figure that most traditional banks worldwide can only dream of.

With an efficiency ratio of 29.9%, you can earn $1 in income for every $0.30 spent.

In comparison, JPMorgan Chase, widely recognized as having the best-performing business, has an ROE of only 17%. Nubank's 29% ROE in emerging markets is truly phenomenal.

3.3 Latin America Gold Rush Operation Manual

Recognizing an opportunity is one thing; being able to seize it is another.

Most Web3 projects rush into Latin America with a "globally uniform" strategy, English-first content, and zero understanding of local payment habits and user behavior, only to complain about stagnant adoption rates. To succeed in Latin America, you need to move quickly, spend your money wisely, and deeply localize. The playbook below provides the answers.

A. Brazil-first landing strategy

The reason for choosing Brazil was not because it was simple, but because it offered the best risk-reward ratio.

Why choose Brazil?

Largest scale: 215 million people, Nubank has verified 107 million digital banking users, and the lowest education cost.

Best infrastructure: PIX processes 42 billion instant transfers annually, and users are already used to "instant" digital payments.

The clearest regulation: The Central Bank of Brazil (BCB) is building a complete regulatory framework for crypto, which will be implemented in 2025-2026, allowing it to secure its position in advance.

Cryptocurrency trading volume is the largest: annual transaction volume of US$318.8 billion, accounting for 31% of the total in Latin America.

Brazil's approach: Integrating with PIX on launch day one is a hard condition with no room for negotiation; partnering with local exchanges such as Mercado Bitcoin (detailed later); offering BRL to USDC exchange with transparent rates; and building the product in Portuguese from day one, rather than fixing it afterward.

Nubank has proven this approach works: they focused solely on Brazil for years before expanding into Mexico and Colombia. This focus enabled them to capture 60% of Brazil's adult population. First, dominate one market, then consider regional expansion.

B. Achieve distribution through CEX partnerships

Most Web3 builders have overlooked a crucial insight: in Latin America, access to cryptocurrencies is almost entirely monopolized by centralized exchanges, and the disparities are enormous.

Chainalysis data shows that 64% of on-chain activity in Latin America occurs on centralized exchanges (CEXs), second only to the Middle East and North Africa (66%), and far exceeding North America (49%) and Europe (53%). Why do CEXs dominate this market?

Fiat currency entry: Users must exchange their local currencies (BRL, MXN, ARS) for crypto assets.

Brand Trust: Mercado Bitcoin and Ripio were founded as early as 2013, and SatoshiTango was launched in 2014, accumulating user reputation over the years.

Local customer service: Portuguese/Spanish support, dispute mediation, and all necessary licenses and compliance requirements.

Payment channels: PIX, SPEI, bank transfer, and cash deposit are all built-in, allowing for one-stop completion.

Regional leading platform

Mercado Bitcoin: Brazil's largest and most recognized brand.

Bitso: 8 million users, Mexico's leading cryptocurrency exchange; previous data showed 46% of its users purchased stablecoins.

Ripio: Covering all of Latin America, with strong cross-border business.

Wenia: Launched by Bancolombia, Colombia's largest bank, with a strong local presence.