Some funds have already preemptively entered the market, and the whole world is waiting for tonight's non-farm payroll data. The current market consensus is: November Non-Farm Payrolls: 50,000 (Wall Street forecast range: 20,000 to 130,000) Unemployment Rate: 4.5% (potentially the highest since 2021) Private Sector: 50,000 Wages: Month-on-month growth of 0.3%, year-on-year slowing to 3.6% Since the second half of this year, the US job market has been lackluster, with only a few sectors like healthcare showing growth. Furthermore, the US government shutdown lasted 43 days, resulting in over 140,000 federal employees accepting buyouts, directly dragging down net job losses by approximately 80,000 in October and November. Therefore, the market has reached a delicate consensus: as long as it doesn't collapse, a slightly weaker performance is acceptable. In short, all the suspense hinges on 9:30 PM Beijing time. Let's wait and see. #FederalReserve #NonFarmPayrolls

This article is machine translated

Show original

Followin 华语 - 热点风向标

@followin_io_zh

12-15

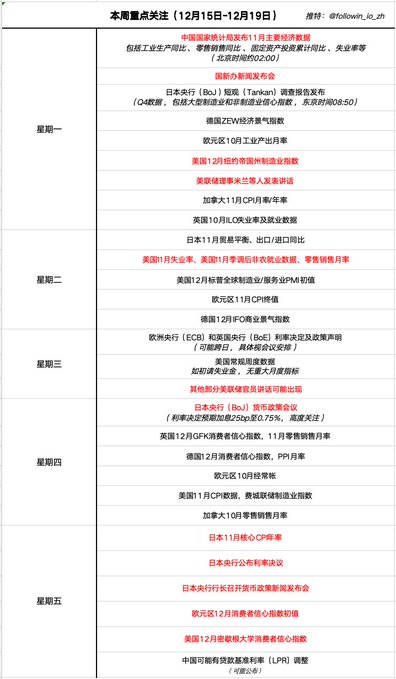

🚨 本周宏观日程密集,行情风险性极高

1️⃣日本央行(BOJ)

12月19日BOJ公布利率决定,市场定价91%-98%概率上调25基点至0.75%,结束自2024年以来的暂停。

作为美国国债最大持有者,此举被视为“免费资金”终结信号,可能引发日元套利交易快速解体,导致全球债券、外汇和权益市场波动。

✨观点分歧:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content