What the market has truly lost is not confidence, but the calculability of the future. The danger of this non-farm payrolls report lies not in the data itself, but in its destruction of the sense of predictable patterns. It wasn't bad enough to salvage expectations of interest rate cuts. Nor was it good enough to justify current risk asset prices. This is the most troublesome situation for the Federal Reserve. Ultimately, US stocks closed higher, with tech stocks managing a modest gain. The only remaining macroeconomic headwind this year is Japan's interest rate hike. The Fed candidate will be announced soon, and the new Fed chair will undoubtedly be aligned with Trump. The period before Christmas, when liquidity is at its worst and institutions begin their annual portfolio adjustments, should be the turning point. In recent weeks, there have been frequent reports of US stock tokenization, and with gradually improving infrastructure, a foundation for development has been laid. This is the narrative we should be closely monitoring next.

This article is machine translated

Show original

链研社

@NB

12-16

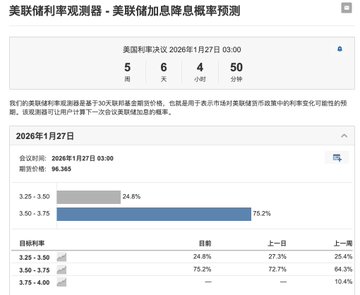

今晚的数据公布了,现在美国经济像个生了重病的人,但股市却在开香槟,因为大家确信医生(美联储)马上要加大药量(降息)了。

1. 10月的就业人数天坑 x.com/lianyanshe/sta…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content