This article is machine translated

Show original

CPI Decline: A Deep-Rooted Problem

Questioning of the November CPI data has begun. Firstly, there are concerns about the accuracy of the Labor Department's statistics. Secondly, the prolonged US government shutdown in November impacted the economy and consumption.

However, the decline in US consumption cannot be determined solely by November's data!

┈┈➤ Consumer Confidence Index

Both the Conference Board's Consumer Confidence Index and the University of Michigan's Consumer Confidence Index show a decline in consumer confidence.

┈┈➤ University of Michigan Consumer Confidence Index

The University of Michigan's data is often somewhat alarmist.

The University of Michigan's Consumer Confidence Index suggests that current US consumer confidence is similar to that of the 2008 subprime mortgage crisis.

┈┈➤ Conference Board Consumer Confidence Index

The Conference Board's Consumer Confidence Index is relatively more authoritative.

The Conference Board is a globally renowned independent, non-profit economic and business research organization founded in 1916. The Conference Board's data collection activities are unaffected by government shutdowns.

The Conference Board's Consumer Confidence Index shows:

In the short term, US consumer confidence is projected to continue declining from July to November 2025.

This indicates that the interest rate cuts in September and October failed to boost consumer confidence.

In the long term, consumer confidence declined sharply in 2020 due to the pandemic, but was boosted by the Federal Reserve's QE and near-zero interest rates. However, since June 2021, US consumer confidence has generally continued to decline.

This demonstrates that the Federal Reserve's QE and low interest rates, followed by rate hikes, merely postponed the economic impact of the pandemic; the negative economic impact of the pandemic cannot be completely painless.

┈┈➤Media Misleading Information

Note that you should not be misled by the media.

Media discussions about rising used car and housing prices and declining CPI are misleading. As long as the CPI is greater than 0, prices are still rising, just at a slower rate.

Prices of other goods and services may rise only slightly or even fall; after weighted averaging, the CPI will still show a downward trend.

The author, also confused by the media's motives, interprets the dot plot as an indication of an impending interest rate cut, which is absurd.

┈┈➤Labor Department Statistics

As someone with an intermediate statistics certificate and some understanding of statistical activities, the author knows that domestic statistical work follows a set procedure.

The US Department of Labor likely operates similarly; they can't simply fabricate data. At most, there's some margin of error in sampling and statistical calculations.

Therefore, even after removing errors, the CPI may still be declining.

┈┈➤In Conclusion

Declining consumer confidence is a common conclusion from both indicators, and their statistics are unaffected by the US government shutdown.

Therefore, even after removing the impact of the US government shutdown, the CPI may still be declining.

The deceptive nature of the annual CPI rate is that it compares prices to the same period last year. Therefore, a decline in the CPI could be due to higher prices in November of last year.

However, the monthly CPI rate is a month-on-month figure, comparing each month to the previous month, making the monthly rate potentially more convincing.

In his previous article, Brother Bee estimated the average monthly rates of both composite and core CPI, and they were both very low. Therefore, even after adjusting for the Labor Department's statistical errors, the CPI is likely still declining.

This situation didn't arise overnight; weak employment, economic downturn, and declining consumption are not determined by the November data alone!

Essentially, these are all impacts of the pandemic, only the Federal Reserve's unlimited QE and extremely low interest rates have delayed their effects.

TVBee

@blockTVBee

12-18

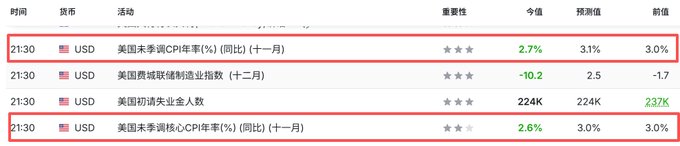

11月CPI数据明显利多

┈┈➤CPI年率明显低于预期

果然CPI年率率和工资一样,低于预期

CPI年率:预期3.7%,实际2.7%。

核心CPI年率:差别大感人肺腑3.0%,实际2.6%。

都远小于预期。

┈┈➤10~11月平均CPI月率也很低 x.com/blockTVBee/sta…

The Federal Reserve is expected to cut interest rates in March or April.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content