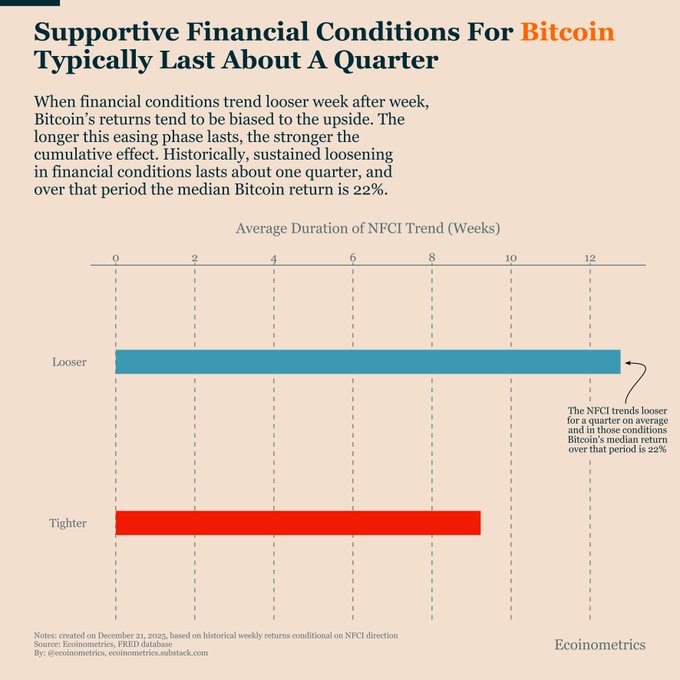

When financial conditions, as measured by the National Financial Conditions Index (NFCI), trend looser week after week, Bitcoin’s returns tend to be biased to the upside.

The weekly effect is modest, but duration matters. Historically, easing phases last about one quarter, and over that period the median Bitcoin return is around 22%.

The NFCI has recently started trending lower again, indicating that financial conditions are easing.

Supportive financial conditions alone are not enough. Even during easing phases, Bitcoin still posts negative returns about 25% of the time.

That’s why it’s important to watch whether ETF flows also turn supportive. Macro tailwinds reinforced by sustained inflows are the winning formula for Bitcoin’s recovery.

Follow @ecoinometrics for more data-driven insights on Bitcoin and macro.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content