Approximately $540 million worth of leveraged positions were liquidated in the cryptocurrency market over the past 24 hours.

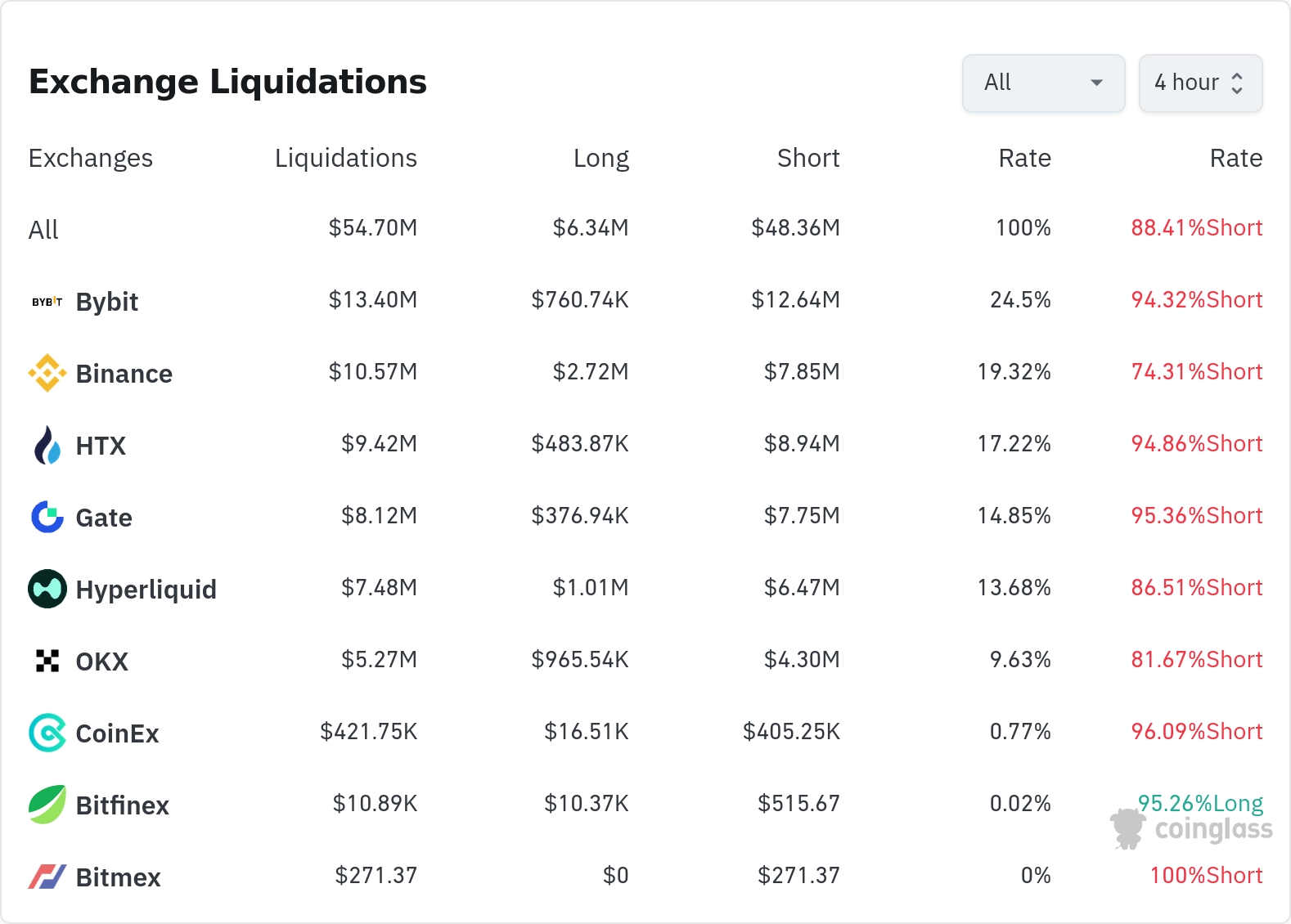

According to currently aggregated data, short positions account for the majority of liquidated positions, with the short liquidation rate reaching over 80% on major exchanges.

Bybit saw the most position liquidations over the past four hours, with a total of $13.4 million liquidated. Short positions accounted for an overwhelming 94.32% of this liquidation.

The second-highest number of liquidations occurred on Binance, with $10.57 million worth of positions liquidated, of which short positions accounted for 74.31%.

Liquidations of $9.42 million and $8.12 million occurred on HTX and Gate exchanges, respectively, with both exchanges showing a very high short position liquidation rate of over 94%.

Notably, Bitfinex had an overwhelmingly high long position liquidation rate of 95.26%, unlike other exchanges.

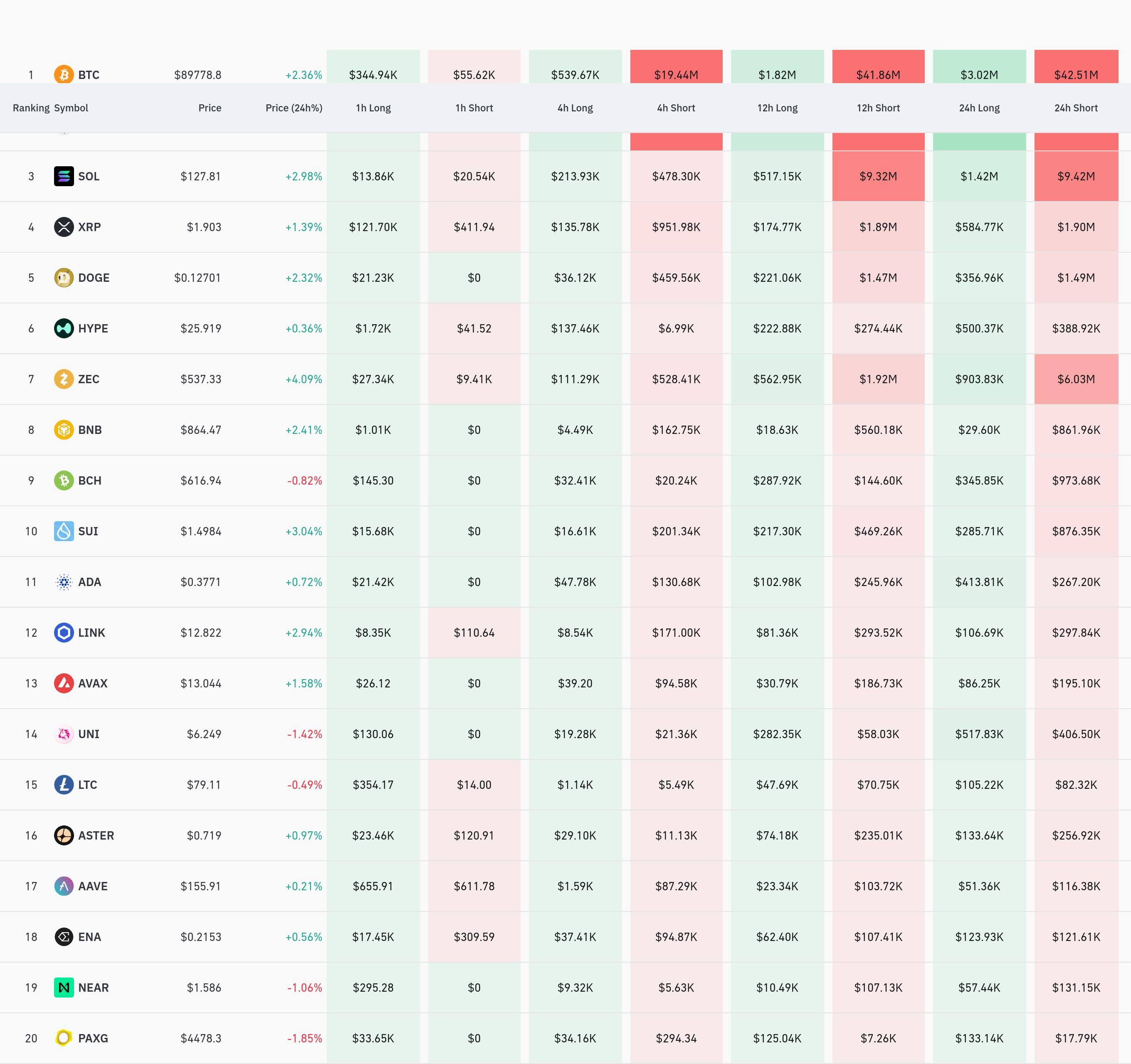

By coin, positions related to Bitcoin (BTC) and Ethereum (ETH) were liquidated the most. Bitcoin liquidations amounted to approximately $45.53 million, while Ethereum liquidations amounted to approximately $45.49 million, accounting for the majority of total liquidations.

Bitcoin is currently trading at $89,778.8, up 2.36% over the past 24 hours. Short positions were liquidated in Bitcoin over the past 24 hours, with $3.02 million in long positions and $42.51 million in short positions liquidated. Short positions were liquidated overwhelmingly.

Ethereum also showed a similar pattern, with short position liquidations accounting for the majority.

Solana (SOL) is trading at $127.81, up 2.98% over the past 24 hours, with approximately $10.82 million in liquidations. Short positions accounted for 87% of this, or $9.42 million.

ZEC (ZEC) rose 4.09% over the past 24 hours, trading at $537.33, leading to the liquidation of a total of $6.93 million in positions. A significant liquidation occurred in short positions, totaling $6.03 million.

In addition, significant liquidations occurred across various altcoins, with tokens like ZB and ZBT seeing liquidations of $6.98 million and $3.49 million, respectively.

What is particularly notable is that $3.4 million in liquidations also occurred in silver-related derivatives (flx:SILVER).

This massive liquidation demonstrates the significant impact on traders holding short positions as the recent cryptocurrency market rally intensifies. The continued rise of Bitcoin and Ethereum, in particular, appears to have led to a surge in short position liquidations.

Article Summary by TokenPost.ai

🔎 Market Interpretation: Over the past 24 hours, approximately $540 million in leveraged positions were liquidated in the cryptocurrency market. Short position liquidations were overwhelming (over 80%) due to rising prices of Bitcoin and Ethereum. Bitcoin rose 2.36% to $89,778, resulting in $45.53 million in liquidations, while Ethereum saw $45.49 million in liquidations. Bitfinex was the only exchange with a high long position liquidation ratio (95.26%).

💡 Strategy Point: The current market is experiencing a strengthening upward trend, so long positions may be more advantageous than short positions. However, the short liquidation rate of over 90% on exchanges like Bybit, HTX, and Gate suggests caution against excessive long positions. Bitfinex's counter-liquidation pattern, in particular, is noteworthy, as it reflects a different perspective from institutional investors.

📘 Glossary: Liquidation refers to the forced liquidation of a leveraged position when losses reach the margin level. A long position refers to a position purchased in anticipation of a price increase, while a short position refers to a position sold in anticipation of a price decrease.

TokenPost AI Notes

This article was summarized using a TokenPost.ai-based language model. Key points in the text may be omitted or inaccurate.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.