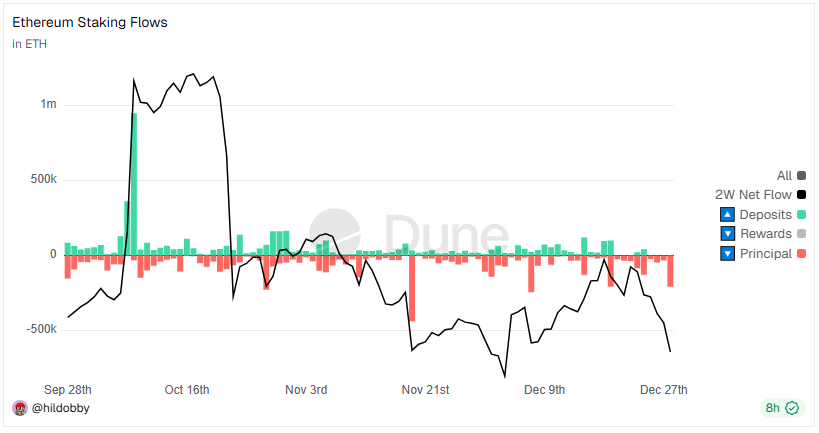

The Ethereum staking market continues to see weak inflows and withdrawals, with overall outflows gradually easing.

According to data from Dune Analytics (@hildobby), the total amount of staking deposited on the Ethereum network as of the reference point is 35,862,369, which is 28.87% of the total Ethereum circulation.

Furthermore, cumulative net staking inflow since the Shanghai upgrade has reached 14,187,346, while net inflow excluding rewards has reached 17,689,671. While inflows are slowing in the short term, the staking base is continuing to expand in the medium to long term.

From the 22nd to the 28th, a total of 67,586 ETH were newly deposited into the Ethereum staking market, continuing a limited inflow. ▲2,004 ETH on the 22nd ▲21,505 ETH on the 23rd ▲47,366 ETH on the 24th ▲703 ETH on the 25th ▲449 ETH on the 26th ▲302 ETH on the 27th ▲1,887 ETH on the 28th. After a peak of large-scale deposits on the 24th, the inflow strength rapidly weakened.

During the same period, compensation withdrawals totaled -17,369 ETH, and principal withdrawals totaled -563,867 ETH, demonstrating continued strong outflow pressure. Principal withdrawals were particularly concentrated on the 24th (-129,088 ETH) and the 28th (-208,920 ETH), increasing the weekly outflow.

The total weekly net change was -513,650 ETH. Despite new inflows, large-scale withdrawals exceeded this, continuing the net outflow trend in the staking market. In the short term, a withdrawal-driven correction appears likely.

Ethereum Staking Flow / Dune Analytics (@hildobby)

Over the past week, the Ethereum staking annual percentage rate (APR) has fluctuated between 2.83% and 3.12%, showing somewhat increased short-term volatility.

From December 23rd to 26th, it hovered around 2.84% to 2.85%, reaching a short-term high of 3.12% on the 27th. It then declined again to 2.83% on the 28th and remained at that level on the 29th. Overall, the rate quickly returned to a stable level after a brief surge during the week. While there was short-term volatility due to changes in staking demand, it's difficult to interpret this as a structural trend shift.

Staker Status

The current number of active validators stands at 983,783. There are 742,824 ETH waiting in the entry queue for new staking, with an estimated waiting time of approximately 12 days and 22 hours.

There are 355,447 ETH waiting in the exit queue for unstaking, with an estimated wait time of approximately 6 days and 4 hours. The average sweep delay (the time it takes for funds to be transferred to the withdrawal address after an exit) is 8.5 days.

Looking at the single staker rankings, ▲ Lido maintains the largest share of 24.3% by depositing 8,758,397 ETH.

Next, ▲Binance is in 2nd and 3rd place with 3,282,032 ETH (9.1%), and ▲EtherFi is in 2nd and 3rd place with 2,198,521 ETH (6.1%), respectively.

▲Coinbase followed with 1,912,380 ETH (5.3%), ▲Pigment with 1,494,528 ETH (4.2%), and ▲Kraken with 1,367,938 ETH (3.8%).

Next, ▲Block Daemon (892,722 ETH, 2.5%) ▲Everstake (679,328 ETH, 1.9%) ▲Kiln (599,334 ETH, 1.7%) ▲Rocket Pool (571,235 ETH, 1.6%) appeared in that order.

Over the past week, ▲EtherFi (+3%) showed an increase, while ▲Pigment (-5%) and ▲Coinbase (-4%) showed a decrease.

[Editor's Note] Ethereum transitioned to Proof-of-Stake (PoS) in September 2022, introducing a staking structure where users deposit 32 ETH to become validators and receive rewards. Withdrawal functionality was activated with the Shapela upgrade in April 2023. The emergence of liquidity staking platforms like Lido and RocketPool has enabled small-scale participation, and its practicality is expanding to include the liquidity of deposited assets and the use of DeFi. Staking trends are a key indicator of Ethereum's security and value creation structure. To understand this, we will examine ▲ deposit and withdrawal trends ▲ number of validators ▲ reward rates.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.