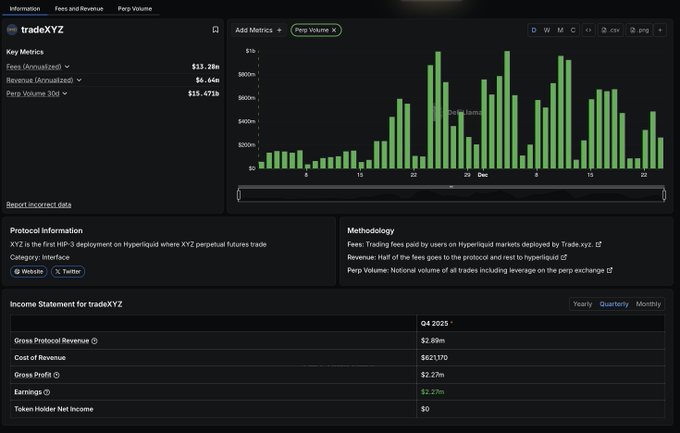

Watching Theses 2026 on DeFi: Perps & Equity Perps, Prediction Markets, Stablecoin Yield w/ @MessariCrypto Alumni. Top narrative: equity perps. The thesis: Equity perps are hitting an inflection point where the infrastructure is finally good enough (60-70% complete) that novelty alone drives adoption. The numbers back this up - @tradexyz reached $6B volume and became the 8th largest perp DEX by open interest after just one month of launching equity markets. Why this works: • Crypto natives want higher leverage on familiar assets (stocks > memecoins when returns compress) • TradFi retail wants cleaner directional exposure than 0DTE options provide • 24/7 trading with no brokerage accounts needed is genuinely novel • Onchain platforms have structural regulatory advantages over traditional exchanges The critical insight: This isn't just a crypto trend. It's where ALL trading is heading - people want more asymmetric returns. Perps deliver clean levered exposure better than short-dated options. But the skepticism is valid: • Perp DEXes were the ONLY DeFi metric that wasn't "down only" in 2025 • Hyperliquid already proved product-market fit for crypto perps • The question is whether equity perps expand the TAM or just fragment existing volume Prediction: Equity perps will be bigger than anyone expects (like stablecoins and prediction markets before them), but 2026 is the execution year - whoever gets from 60% to 80% product completeness first captures the market.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content