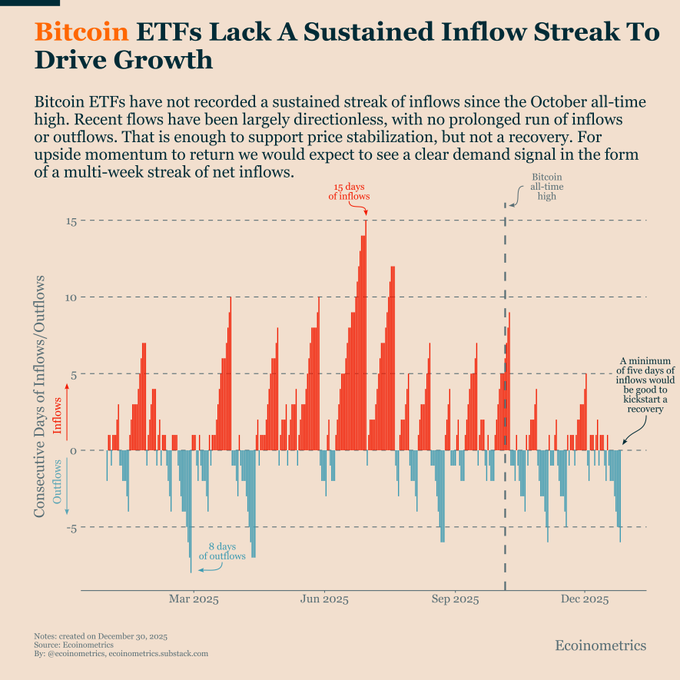

Bitcoin ETF flows still aren’t signaling a recovery.

Since the October all-time high, spot Bitcoin ETFs have failed to sustain a meaningful streak of net inflows. Flows have been largely choppy, with no prolonged run of demand.

That’s enough to support price stabilization, but

Stabilization and recovery are not the same thing.

A durable move higher usually requires persistent demand, something that shows up as a multi-week streak of net inflows. Until that happens, upside moves tend to be fragile and easily reversed.

This is why watching flows, not just price, matters.

Follow @ecoinometrics for more data-driven insights on Bitcoin and macro.

We cover this question, stabilization vs recovery, explicitly in the Bitcoin Market Monitor.

In the December edition, our probabilistic baseline pointed to consolidation rather than a breakout. So far, that’s played out, with Bitcoin unable to sustain a move above ~$95K.

The December issue is available to read here:

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content